Get the free IFCUTop Credit Union Loans & Accounts

Get, Create, Make and Sign ifcutop credit union loans

Editing ifcutop credit union loans online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ifcutop credit union loans

How to fill out ifcutop credit union loans

Who needs ifcutop credit union loans?

Navigating the IFcuTop Credit Union Loans Form: A Comprehensive Guide

Understanding the IFcuTop Credit Union Loans

IFcuTop Credit Union offers a range of loan products tailored to meet the specific needs of its members. Credit union loans serve to provide financial support for various purposes, including personal needs, vehicle purchases, and home financing. Unlike traditional banks, credit unions are not-for-profit organizations, often leading to more competitive interest rates and lower fees.

The primary purpose of credit union loans is to assist members in achieving their financial goals while fostering a sense of community ownership. Loans from IFcuTop can help you navigate life’s financial hurdles without the high-pressure tactics sometimes associated with for-profit lenders.

Types of loans offered by IFcuTop

IFcuTop offers several types of loans designed to cater to different financial needs. Each type comes with its own eligibility criteria and conditions, making it essential to understand the options available.

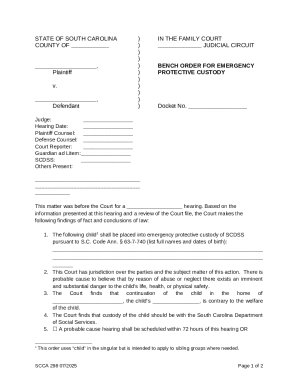

The IFcuTop Credit Union Loans Form: A Comprehensive Look

The IFcuTop Credit Union loans form is a critical step in the lending process, capturing vital information needed to assess your application. Completing this form accurately ensures a smooth and efficient processing experience.

Key information typically required includes personal details, income verification, and the loan amount requested. This form acts as a bridge between you and the loan approval process, making it imperative to understand its components.

Step-by-step guide to completing the IFcuTop Credit Union loans form

Filling out the IFcuTop Credit Union loans form can seem daunting, but with proper preparation, it can be straightforward. Start by gathering all necessary documentation to support your application.

Key personal and financial details to prepare include your identification, proof of income, employment details, and any existing financial commitments.

To avoid common pitfalls, ensure that all information is accurate and up-to-date and double-check for any errors before submitting your application.

Managing your loan application

After submitting your application, the next step is understanding what happens behind the scenes. Typically, the loan approval process takes a few days, during which IFcuTop representatives will review your application.

Clear communication with the credit union is essential. Expect email or phone contact updates on your loan status, especially if additional information is required.

Interactive tools and resources

IFcuTop Credit Union provides several interactive tools to help members make informed financial decisions. One of the most helpful resources is the loan calculator, which allows applicants to estimate their monthly payments based on the loan amount, interest rate, and loan term.

Additionally, a comprehensive FAQ section addresses common questions about the loan process, helping to clarify any uncertainties and ensuring that members are well-prepared.

Enhancing your financial literacy with IFcuTop

IFcuTop emphasizes the importance of financial education. The credit union regularly hosts workshops and seminars tailored to improving members' financial literacy, covering key topics from budgeting to debt management.

These programs build knowledge and confidence, equipping members with the skills necessary to manage their finances effectively over the long term.

User experiences and testimonials

Reading real-life success stories from IFcuTop members can inspire confidence in potential borrowers. Many borrowers have achieved significant milestones through their loan experience, from purchasing their first car to financing their home.

These testimonials highlight the positive outcomes of loans while emphasizing IFcuTop's commitment to community impact, showing how each loan contributes to local growth.

Final insights on IFcuTop Credit Union loans

As the lending landscape evolves, IFcuTop continues to explore new loan offerings and policies that can better serve its members’ needs. Anticipated developments may include more flexible loan terms or increased support for first-time borrowers.

Choosing IFcuTop for your lending needs means selecting a community-focused organization that prioritizes member relations, competitive rates, and educational resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ifcutop credit union loans to be eSigned by others?

How do I execute ifcutop credit union loans online?

How do I edit ifcutop credit union loans online?

What is ifcutop credit union loans?

Who is required to file ifcutop credit union loans?

How to fill out ifcutop credit union loans?

What is the purpose of ifcutop credit union loans?

What information must be reported on ifcutop credit union loans?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.