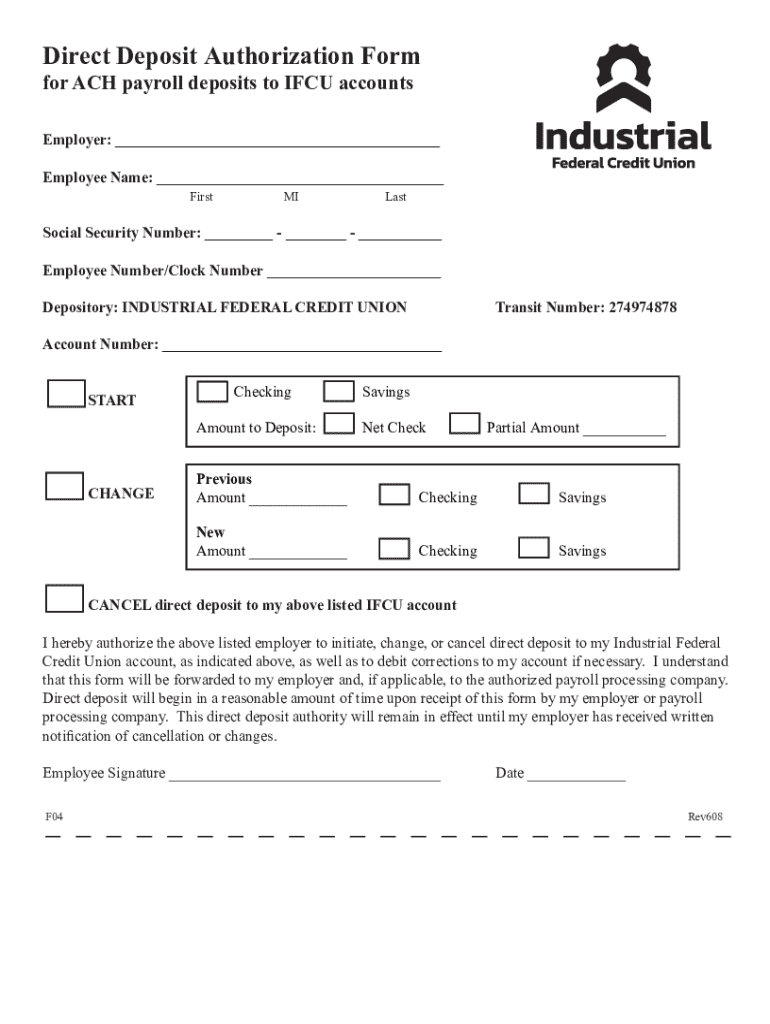

Get the free for ACH payroll deposits to IFCU accounts

Get, Create, Make and Sign for ach payroll deposits

How to edit for ach payroll deposits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for ach payroll deposits

How to fill out for ach payroll deposits

Who needs for ach payroll deposits?

A comprehensive guide to the ACH payroll deposits form

Understanding ACH payroll deposits

ACH payroll deposits, or Automated Clearing House payroll deposits, provide a secure and efficient method for transferring employee wages directly into their bank accounts. This system eliminates the need for paper checks which can be time-consuming and prone to errors.

Both employers and employees benefit from ACH payroll deposits. For employers, it streamlines the payroll process, reduces the administrative burden, and minimizes costs associated with printing checks and postage. Employees enjoy the convenience of instantaneous access to their funds, reducing the risk of lost or stolen checks.

The importance of the ACH payroll deposits form

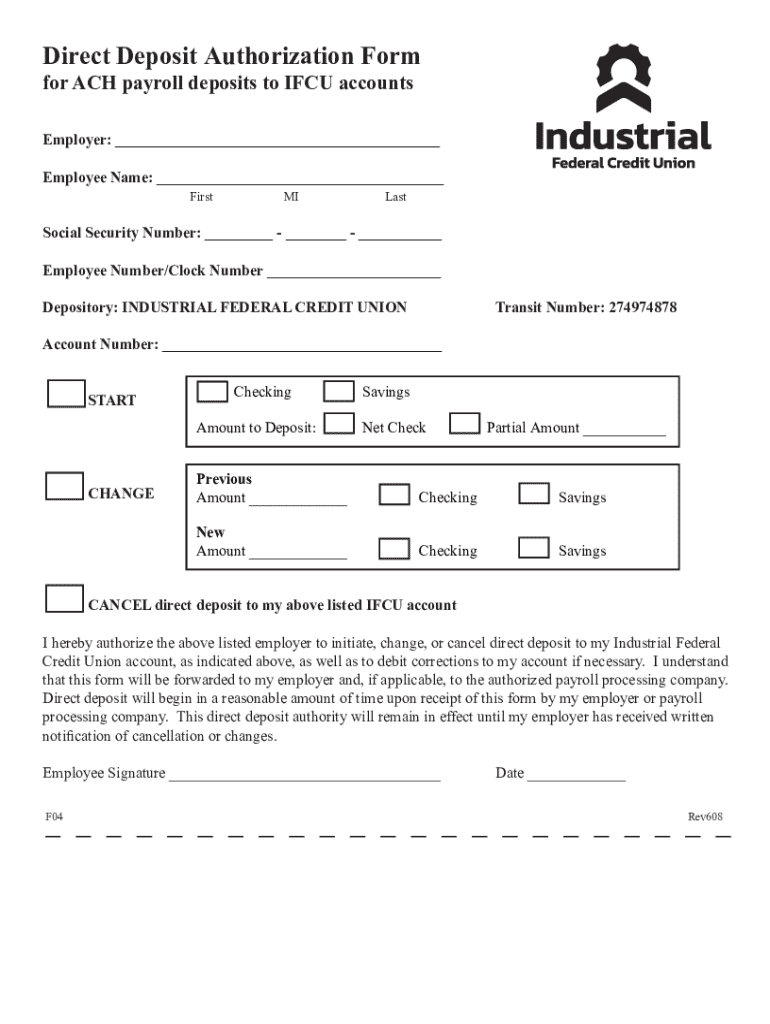

Filling out the ACH payroll deposits form is crucial for initiating direct deposits. This form acts as a formal authorization that allows employers to deposit wages directly into an employee's bank account. By providing essential information such as banking details and personal identification, the form ensures that payroll processing is both accurate and efficient.

Streamlining payroll processes not only enhances employee satisfaction but also reduces the time spent on payroll administration, ultimately leading to increased productivity for businesses. Ensuring the form is completed accurately is vital to prevent delays or errors in pay distribution.

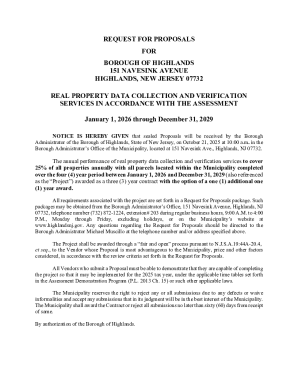

Getting started with the ACH payroll deposits form

Before diving into filling out the ACH payroll deposits form, it's essential to determine if you are eligible to use it. Typically, any employee receiving wages directly from an employer, whether full-time or part-time, should use this form. Organizations may also have distinct criteria, such as being willing to offer direct deposit to their workers.

Once eligibility is confirmed, gather all necessary information before starting. You'll need your personal details which include your name, address, and Social Security Number. Additionally, prepare your banking information, specifically your account number and the routing number of your bank. Having this information ready will facilitate a smoother form-filling process.

Step-by-step instructions to fill out the ACH payroll deposits form

To access the ACH payroll deposits form, you can directly visit pdfFiller, where you can find the form in both printable and fillable formats. This form is user-friendly and designed to be filled out easily. Make sure to access it online, as it offers built-in tools for efficient completion.

Now, let’s break down the sections of the form for better understanding.

After completing the form, it’s essential to review your inputs for any inaccuracies. Double-checking your entries will assist in avoiding potential payment errors, which can cause delays in your salary deposits.

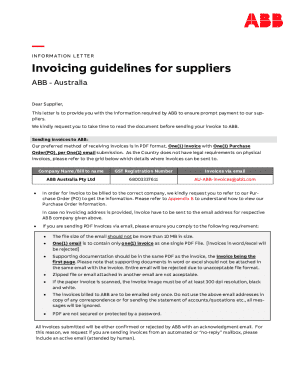

Editing and customizing your form with pdfFiller

One of the standout features of pdfFiller is its editing tools that allow for easy customization of your form. Utilize the interactive tools available on the platform to add or modify information as needed. This can streamline the process if you have to make adjustments to your form.

Additionally, digital signatures can be integrated seamlessly. Using pdfFiller, you can follow a simple step-by-step process to eSign your ACH payroll deposits form. The benefit of electronic signatures streamlines document handling and ensures all transactions are promptly completed.

Submitting the ACH payroll deposits form

Once you've completed and reviewed your ACH payroll deposits form, the next step is submission. Depending on your employer’s protocols, the form can typically be submitted via email or physical delivery to your payroll department.

Post-submission, it's important to know what to expect. Employers usually process submissions promptly, and you may receive a confirmation email outlining the setup of your direct deposit. Tracking the status of your direct deposit setup is manageable; often, payroll departments will communicate updates effectively.

Key FAQs about ACH payroll deposits

This section addresses frequently asked questions surrounding ACH payroll deposits. First, consider if ACH direct deposit is the right choice for you. While benefits such as convenience and instant access to funds are great, you should also consider if you are comfortable with digital transactions.

Next, understand the ACH network's functioning. It is a secure payment processing system that handles electronic transfers, making it a reliable method for payroll transactions. Additionally, knowing the differences between payment methods, such as checks or direct deposits, can expand your understanding of financial management.

Conclusion

Maintaining your ACH payroll setup requires regular monitoring to ensure that your banking details remain current, especially if you change your banking institution or account. Utilizing pdfFiller’s capabilities allows for smooth document management, allowing you to edit, eSign, and keep track of all necessary forms.

Leveraging pdfFiller ensures that you can manage your payroll documents efficiently from anywhere, highlighting the benefits of utilizing this cloud-based platform for your financial transactions and documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get for ach payroll deposits?

How can I fill out for ach payroll deposits on an iOS device?

Can I edit for ach payroll deposits on an Android device?

What is for ACH payroll deposits?

Who is required to file for ACH payroll deposits?

How to fill out for ACH payroll deposits?

What is the purpose of for ACH payroll deposits?

What information must be reported on for ACH payroll deposits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.