Get the free small business budget template excel Forms

Get, Create, Make and Sign small business budget template

How to edit small business budget template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small business budget template

How to fill out small business budget template

Who needs small business budget template?

Comprehensive Guide to Small Business Budget Template Form

Overview of small business budgeting

A solid budgeting framework is essential for small businesses to thrive. It not only helps maintain financial discipline but also plays a crucial role in strategic decision-making. With a concise budget, business owners can easily track income and expenses, making informed choices that impact daily operations and long-term growth. Utilizing a small business budget template form can simplify this intricate process, allowing for better organization and clarity in financial planning.

Having a budget in place is also pivotal for assessing a business’s financial health. It serves as a roadmap for resource allocation, ensuring that funds are directed toward profitable avenues while limiting unnecessary expenditures. This structured approach fosters a proactive mindset, guiding entrepreneurs to anticipate changes in cash flow, adjust spending accordingly, and ultimately, enhance profitability.

Exploring the small business budget template form

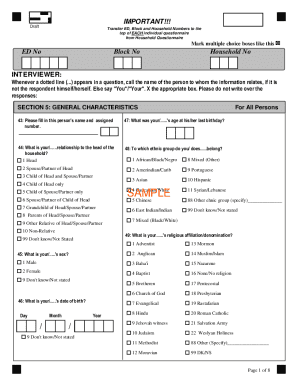

A small business budget template form is a pre-designed document that aids businesses in tracking their financials accurately. Its primary purpose is to streamline the budgeting process by providing structured fields for entering critical financial data. These templates typically include categories for income, fixed costs, variable expenses, and projected profits, creating a comprehensive overview of a business’s financial landscape.

The key components of a comprehensive small business budget include income projections, which outline expected revenues from various sources, and expense categorization, which breaks costs into fixed (e.g., rent, salaries) and variable (e.g., marketing, supplies) expenses. Understanding profit margins—both gross and net—is also critical, as it allows a business owner to assess profitability and make informed decisions based on their financial standing.

Benefits of using the PDFfiller small business budget template

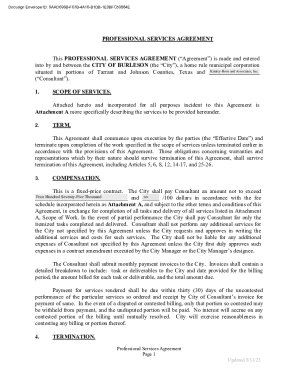

PDFfiller offers a robust small business budget template that enhances budgeting efficiency through cloud-based accessibility. This means both teams and individual users can access their budget templates from anywhere, at any time, promoting flexibility and collaboration. The platform’s editing features enable users to make changes easily, ensuring that the budget remains accurate and up-to-date, which is crucial in a rapidly changing market environment.

Additionally, PDFfiller provides seamless collaboration capabilities. Teams can work together in real-time, making it easier to invite feedback and suggestions regarding budget deadlines and expense management. The integrated e-signature feature simplifies the process of obtaining approvals, while version control ensures that users can track changes and maintain the integrity of their documents, resulting in less confusion and a more organized budgeting process.

Step-by-step guide to creating your small business budget

Creating an effective small business budget can be a straightforward process, particularly with a template provided by PDFfiller. Here’s a detailed step-by-step guide:

Customizing your small business budget template

Customization is crucial when working with budget templates, as different businesses have unique financial needs. With PDFfiller, users can navigate various editing options to tailor their budget forms to specific requirements. This may involve adding specific fields relevant to your business or adjusting existing categories to better align with your overall financial strategy.

Incorporating colors and branding elements into your budget template not only improves visual appeal but also standardizes financial documents across your organization. A professional look can promote internal consistency and foster a sense of professionalism when sharing with stakeholders, ensuring that financial matters are handled with utmost care and attention to detail.

Collaborating and sharing your budget form

Collaboration is a key element of effective budgeting, and PDFfiller facilitates seamless teamwork throughout the budgeting process. Users can easily invite team members to review and edit the budget template, gathering input before finalizing the document. This collective effort can lead to more accurate budgeting by incorporating diverse insights and enhancing the decision-making process.

Sharing the budget securely with stakeholders is equally important. PDFfiller allows for easy sharing through secure links or direct access to the document, ensuring sensitive financial information remains protected. Additionally, tracking changes made by different users helps maintain document integrity, allowing for accountability in budget management and input.

Using advanced functionalities in PDFfiller for budget management

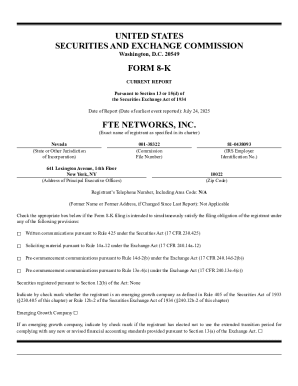

PDFfiller provides advanced functionalities that can significantly enhance your budget management process. One of the standout features includes the ability to integrate budget forms with other financial tools your business might be using, enabling a more streamlined approach to financial analysis and reporting.

Moreover, users can automate reminders for periodic budget reviews and updates, keeping financial matters dynamic and responsive to business changes. Generating budget reports through PDFfiller for stakeholders allows for effective communication of your financial status, ensuring transparency and fostering trust among partners and investors.

Common mistakes to avoid while budgeting

Budgeting is not without its pitfalls, and being aware of common mistakes can help business owners avoid financial missteps. One major error is underestimating expenses or overestimating income, which can lead to cash flow problems down the line. It's crucial to base projections on realistic assessments rather than optimistic expectations.

Additionally, failing to review and adjust the budget periodically can result in outdated figures that no longer reflect current economic conditions. Ignoring seasonal fluctuations in revenue is another mistake that can skew financial forecasts—being mindful of industry-specific patterns ensures better preparedness for fluctuations in income.

Real-life success stories

Many businesses have successfully utilized small business budget templates to improve their financial management. For instance, a local coffee shop implemented a budget plan that allowed them to allocate resources more efficiently. By using a structured budget template, the owner could identify underperforming expense categories and make informed decisions about where to cut costs, resulting in a 15% increase in profit margins over the year.

Another case involved a tech startup that used a small business budget template to scale operations. By carefully tracking income and categorizing expenses, they were able to streamline their development costs and reallocate funds into their marketing strategy. This approach led to rapid business growth and a successful series of funding rounds—demonstrating the pivotal role a small business budget template can play in navigating financial challenges and opportunities.

FAQs about small business budgeting using PDFfiller

Feedback and continuous improvement

Gathering feedback from team members regarding budgeting challenges is a critical component for continuous improvement. Conducting periodic reviews with your team can help identify pain points and obstacles encountered during the budgeting process. It ensures that everyone is on the same page regarding financial goals, and enables businesses to create a more agile and responsive budgeting process.

Implementing strategies based on this feedback allows for the refinement of the budgeting process year over year. By analyzing what works and what doesn’t, businesses can evolve their financial strategies, ensuring that budgeting remains a key driver of organizational success.

Conclusion on maintaining a sustainable budget with PDFfiller

Adopting a structured small business budget template from PDFfiller offers users a streamlined way to foster budgeting success. By taking advantage of cloud-based tools for editing, collaboration, and document management, businesses can ensure that they remain financially proficient in an ever-changing environment. The essence of a sustainable budget lies in proactive management and an adaptability mindset to learn from financial performance, making it an invaluable resource for all small businesses.

Encouraging a culture of ongoing budget reviews and real-time adaptations to market fluctuations will empower small business owners to navigate their financial landscape confidently. With the right tools and mindset, small businesses can harness their full potential, ensuring long-term success and profitability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit small business budget template online?

How can I edit small business budget template on a smartphone?

How can I fill out small business budget template on an iOS device?

What is small business budget template?

Who is required to file small business budget template?

How to fill out small business budget template?

What is the purpose of small business budget template?

What information must be reported on small business budget template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.