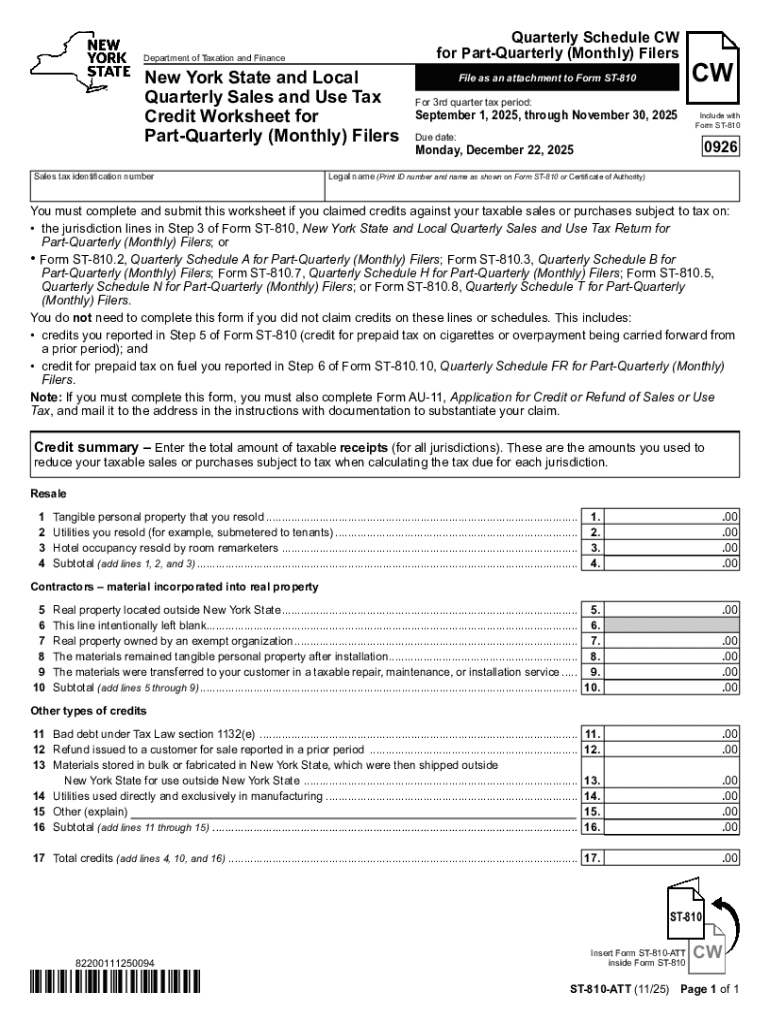

Get the free Form ST-810-ATT New York State and Local Quarterly Sales and Use Tax Credit Workshee...

Get, Create, Make and Sign form st-810-att new york

How to edit form st-810-att new york online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form st-810-att new york

How to fill out form st-810-att new york

Who needs form st-810-att new york?

Comprehensive Guide to Form ST-810-ATT: A Key Document for New Yorkers

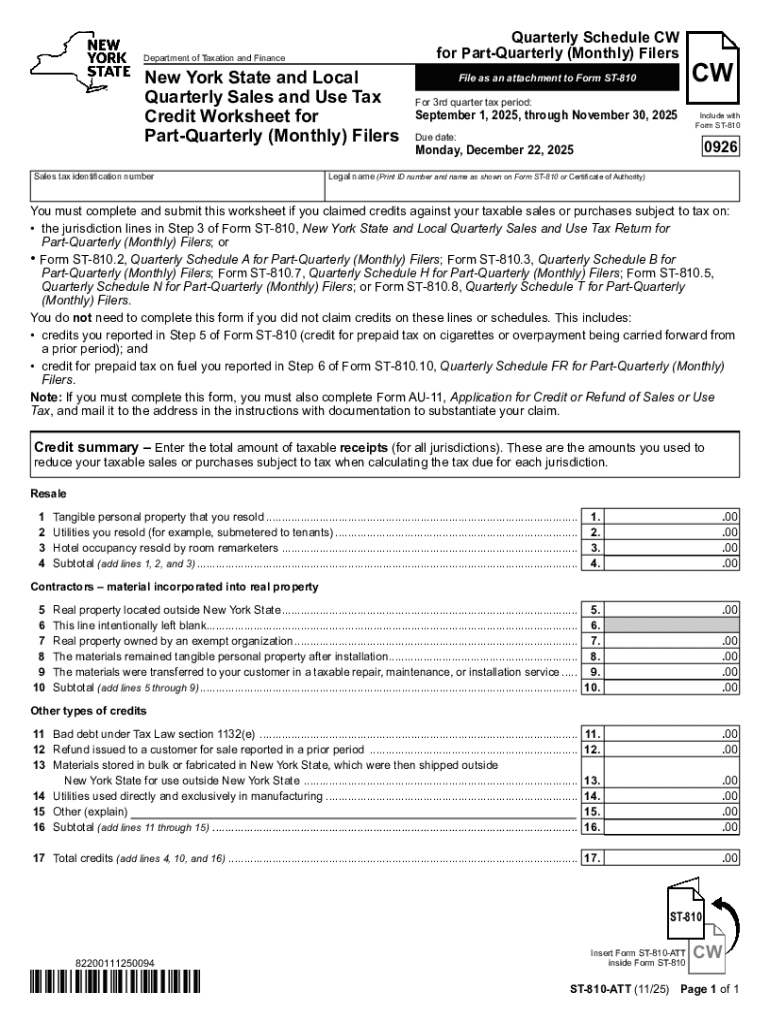

Understanding the ST-810-ATT form

The ST-810-ATT form is a crucial document in New York State, primarily utilized for claiming certain exemptions related to sales tax. This accompanying form is specifically designed for those entities and individuals who need to substantiate their claims for tax exemptions. By accurately completing this form, applicants can ensure that they remain compliant with state tax regulations while potentially saving money.

The importance of the ST-810-ATT form extends beyond mere compliance; it serves as a vital tool for businesses to manage costs effectively. Whether you are a small business owner or managing a larger organization, understanding this form will empower you to optimize your tax strategies, thereby enhancing your financial health.

Who needs to use the ST-810-ATT form?

Eligibility to file the ST-810-ATT form extends to a variety of individuals and organizations. This includes but is not limited to nonprofit organizations, government entities, and businesses that qualify for tax exemptions. It is pertinent for users to assess their specific situation to determine if they meet the criteria for this form.

Key components of the ST-810-ATT form

The ST-810-ATT form comprises several critical sections, each requiring careful attention. Key components include identification details of the claimant, information regarding the purchased items, and the specific exemption category being claimed. Each section plays a vital role in validating the claimed exemption.

Filling out the form accurately is paramount. Common mistakes often stem from incomplete information or misinterpretation of exemption categories. Users should thoroughly review each field to prevent such errors, ensuring that the information provided is precise and complete.

Step-by-step guide to completing the ST-810-ATT form

To successfully complete the ST-810-ATT form, start by gathering all necessary documents related to the transaction. This may include receipts, proof of nonprofit status, or any previous exemption certificates you hold.

Ensuring that you provide any additional documentation when required can enhance the legitimacy of your claim. Always cross-reference completed sections with your gathered documents for consistency.

Digital solutions for managing the ST-810-ATT form

In an increasingly digital world, managing forms like the ST-810-ATT online can save time and alleviate stress. Using platforms such as pdfFiller facilitates seamless document management, allowing users to access their forms from anywhere. This cloud-based solution not only enhances accessibility but also allows for easier collaboration among team members.

Interactive features of pdfFiller enable users to edit, eSign, and collaborate on the ST-810-ATT effortlessly. The platform simplifies the process of form-filling, ensuring that all submissions are compliant with New York tax regulations and are completed accurately. Users can navigate easily through tools that guide them in providing necessary information, making real-time adjustments as needed.

Submitting the ST-810-ATT form

Once the ST-810-ATT form is filled out and verified, the next step is submission. Users have the option to submit their forms online through the New York State Department of Taxation and Finance’s website or by mailing a paper copy to the appropriate office. It’s important to be aware of deadlines to avoid any penalties associated with late submissions.

After submission, users should expect a processing period during which the state will review the exemption claims. Follow-up actions, if required, may include providing additional documentation or clarifications regarding the submission.

Frequently asked questions (FAQs)

Here are some common inquiries surrounding the ST-810-ATT form. Many users often ask about their eligibility criteria, the details required for accurate submissions, and what to do after the form has been submitted. Addressing these questions can alleviate concerns and streamline the filing process.

In the event of submission issues, users are advised to double-check the information against the form's requirements and consult the New York State Department of Taxation and Finance for assistance.

Additional support and resources

Finding help with the ST-810-ATT form is crucial for ensuring correct and efficient processing. The New York State Department of Taxation and Finance provides contacts and hotlines for direct assistance, guiding users through their challenges.

Moreover, pdfFiller offers an array of online tools dedicated to ST-810-ATT management, elevating user experience by providing tailored support for form-filing.

Connecting with our community

Engagement within the user community can provide valuable insights regarding the ST-810-ATT. By sharing experiences and best practices with peers, users can gain additional knowledge on navigation issues and best practices.

Feedback from users on their experiences with the ST-810-ATT form can help enhance the tools available at pdfFiller, ultimately benefiting future users seeking assistance with this important document.

Versioning and compliance reminder

It is imperative for users to remain updated with any changes to the ST-810-ATT form, as tax regulations can evolve. Regular checks for updates should be done annually or bi-annually to guarantee compliance with state requirements.

pdfFiller provides specific features designed to ensure users remain compliant with New York regulations. By utilizing these up-to-date tools, users can enhance their efficiency and accuracy in managing essential documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form st-810-att new york on an iOS device?

How do I edit form st-810-att new york on an Android device?

How do I fill out form st-810-att new york on an Android device?

What is form st-810-att new york?

Who is required to file form st-810-att new york?

How to fill out form st-810-att new york?

What is the purpose of form st-810-att new york?

What information must be reported on form st-810-att new york?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.