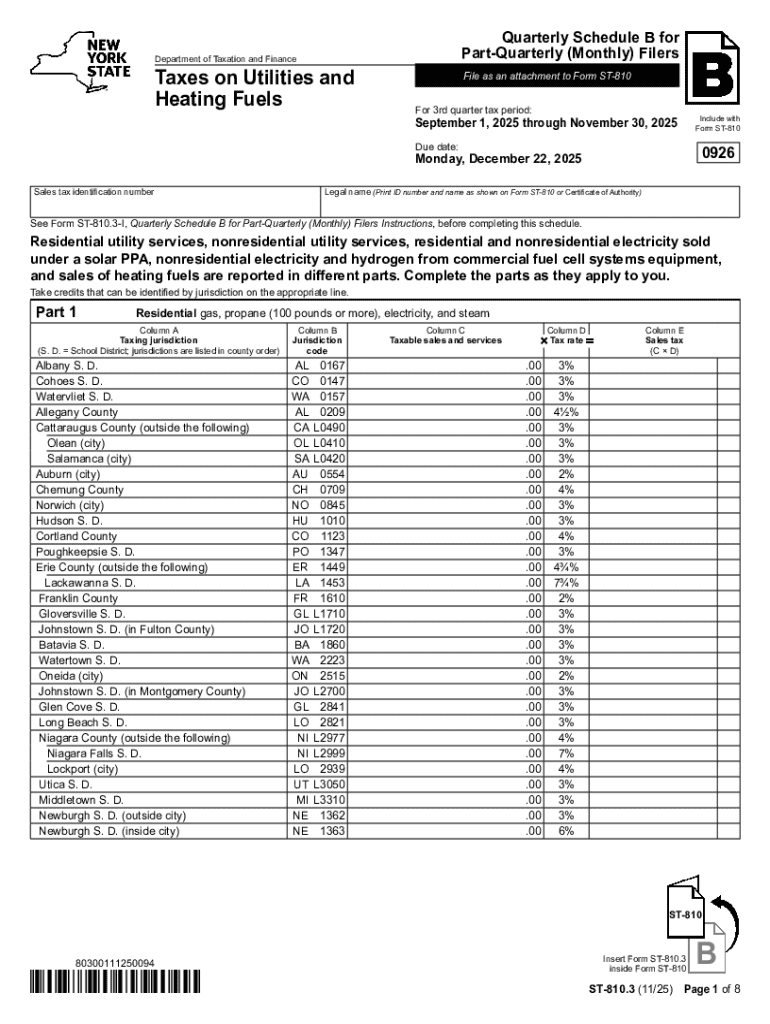

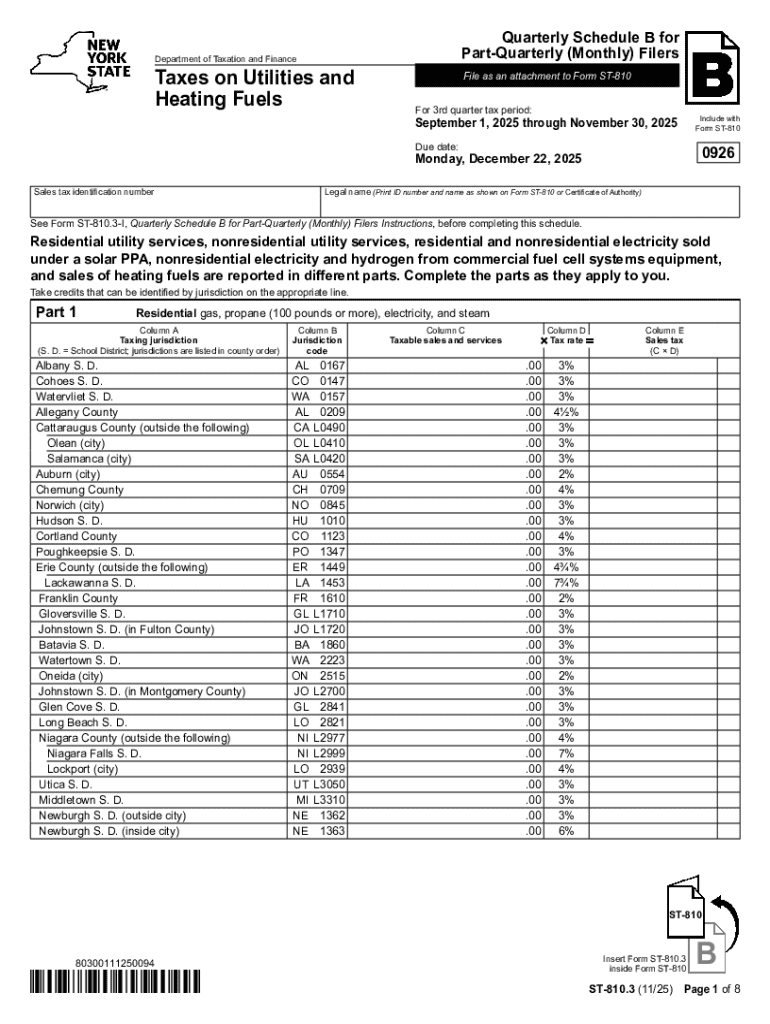

Get the free Form ST-810.3 Taxes on Utility and Heating Fuels - Quarterly Schedule B for Part-Qua...

Get, Create, Make and Sign form st-8103 taxes on

How to edit form st-8103 taxes on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form st-8103 taxes on

How to fill out form st-8103 taxes on

Who needs form st-8103 taxes on?

How to Handle Taxes on Form ST-8103

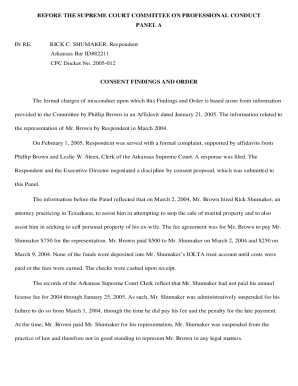

Understanding Form ST-8103

Form ST-8103 serves as a critical tool for taxpayers in specific circumstances, primarily dealing with state tax obligations. This form is essential for reporting the deferred sales tax on goods or services purchased that are taxable under state law. Understanding its nuances can be pivotal for accurate and compliant tax reporting.

Taxpayers utilize ST-8103 to indicate amounts that are due to a taxing authority. Issues such as failing to file or misreporting can lead to penalties or interest, emphasizing the importance of understanding this form.

Who needs to file Form ST-8103?

Eligibility to file Form ST-8103 hinges on various factors, including having applicable sales taxes due from purchases. Typically, individuals or businesses that engage in taxable purchases but do not pay sales tax at point of sale are required to file.

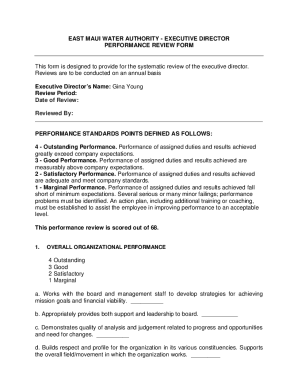

Preparing to fill out Form ST-8103

Before starting, collect necessary documentation to complete Form ST-8103 efficiently. Key documents include previous tax returns, receipts of the purchases, and any correspondence from tax authorities regarding sales tax liabilities.

Familiarize yourself with terms used within the form. Common terms include 'sales tax,' 'deferred taxes,' and 'exempt purchases.' Keeping a glossary handy may help clarify these concepts and prevent errors.

To minimize mistakes, be aware of common pitfalls. For instance, underreporting taxable purchases or failing to include supporting documents can delay processing. Double-check figures and ensure comprehensive documentation.

Step-by-step instructions for completing Form ST-8103

Accessing Form ST-8103 can be done via state tax authority websites, most commonly available in both printable and fillable PDF formats. Utilizing a digital form can simplify the process significantly. Begin filling out the form by entering your personal information accurately.

Next, report income and deductions. Be thorough in documenting any sales tax you owe. Sections typically include personal identification, total income, tax deductions, and declarations of tax responsibility.

To enhance efficiency, work in a quiet space, free from distractions. Utilize a checklist to ensure you have addressed all required sections and documents before submission.

Managing your Form ST-8103 after completion

After filling out Form ST-8103, eSigning the document can streamline the submission process. For eSigning, consider using pdfFiller to electronically sign your form, which offers an efficient method of handling digital documentation. Once signed, decide whether to submit electronically or mail your form.

Tracking submissions is important to ensure your form has been processed. If submitting electronically through pdfFiller, you can utilize built-in tracking features. For mail submissions, retain proof of mailing for your records.

In the event of mistakes or questions from the IRS, respond promptly and thoroughly. Providing additional documentation can aid in clarifying any issues that arise.

Interactive tools and resources on pdfFiller

Leveraging pdfFiller’s capabilities can make the process of handling Form ST-8103 even easier. If you need to revise your form, pdfFiller allows users to edit their forms after initial completion, ensuring your information remains current and accurate.

Collaboration tools within pdfFiller facilitate teamwork when completing forms. Whether multiple parties need to contribute or you need feedback on your form, these features enhance the efficiency of filling out tax documents.

Frequently asked questions about Form ST-8103

Many taxpayers often have questions when navigating Form ST-8103. Concerns regarding eligibility often surface. Remember, anyone who defers sales taxes through specific purchases should complete this form to remain compliant with tax laws. Filing deadlines vary significantly, and knowing your jurisdiction's deadlines is crucial.

Some may wonder about the consequences of misreporting or failing to submit. The best approach is to file accurately and timely to avoid penalties - addressing errors quickly can mitigate repercussions.

Best practices for future tax filings

Efficient record keeping underpins successful tax filing. Retain all documentation, including receipts and past filings, to streamline future processes. A good habit is to organize these records annually, ensuring they are easily accessible when tax season arrives.

Planning for future tax obligations is equally crucial, as regulations may shift each year. Stay updated with changes in sales tax laws in your state and nationwide to identify any factors that may impact your overall tax reporting.

Utilizing comprehensive document management solutions can save time and streamline tax-related processes. The more organized you are with your documents, the smoother your future filings will be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form st-8103 taxes on?

How do I make changes in form st-8103 taxes on?

How do I edit form st-8103 taxes on on an iOS device?

What is form st-8103 taxes on?

Who is required to file form st-8103 taxes on?

How to fill out form st-8103 taxes on?

What is the purpose of form st-8103 taxes on?

What information must be reported on form st-8103 taxes on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.