Get the free Form ST-810.3 Taxes on Utility and Heating Fuels - Quarterly Schedule B for Part-Qua...

Get, Create, Make and Sign form st-8103 taxes on

Editing form st-8103 taxes on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form st-8103 taxes on

How to fill out form st-8103 taxes on

Who needs form st-8103 taxes on?

Form ST-8103: Taxes on Form – A Comprehensive Guide

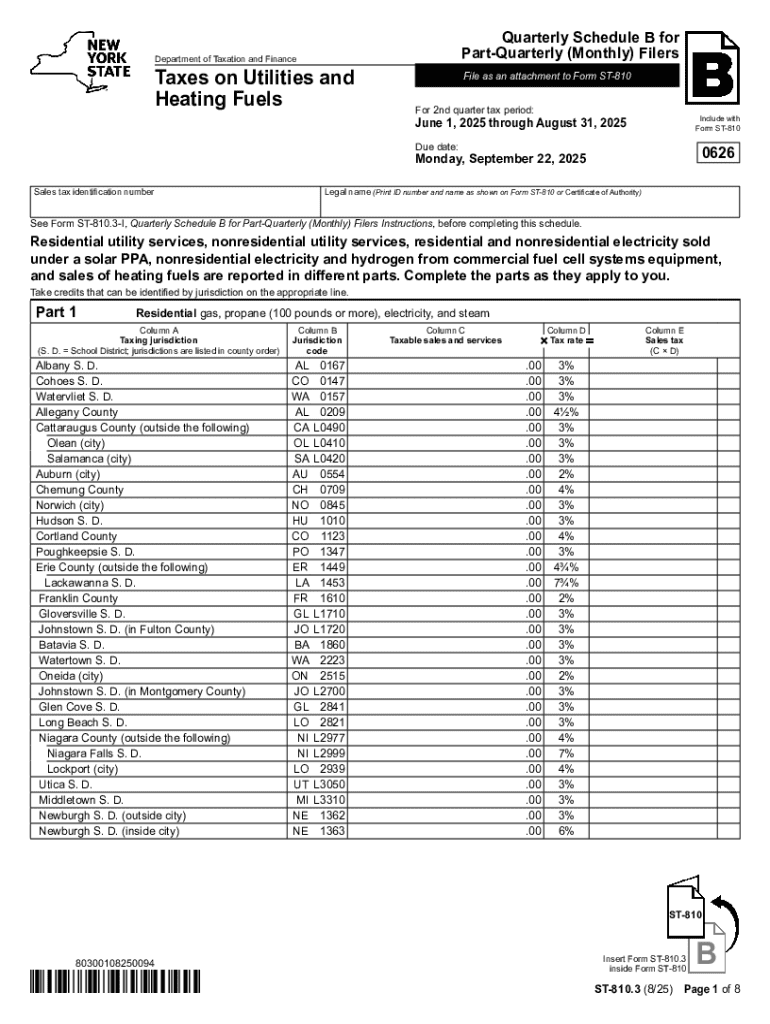

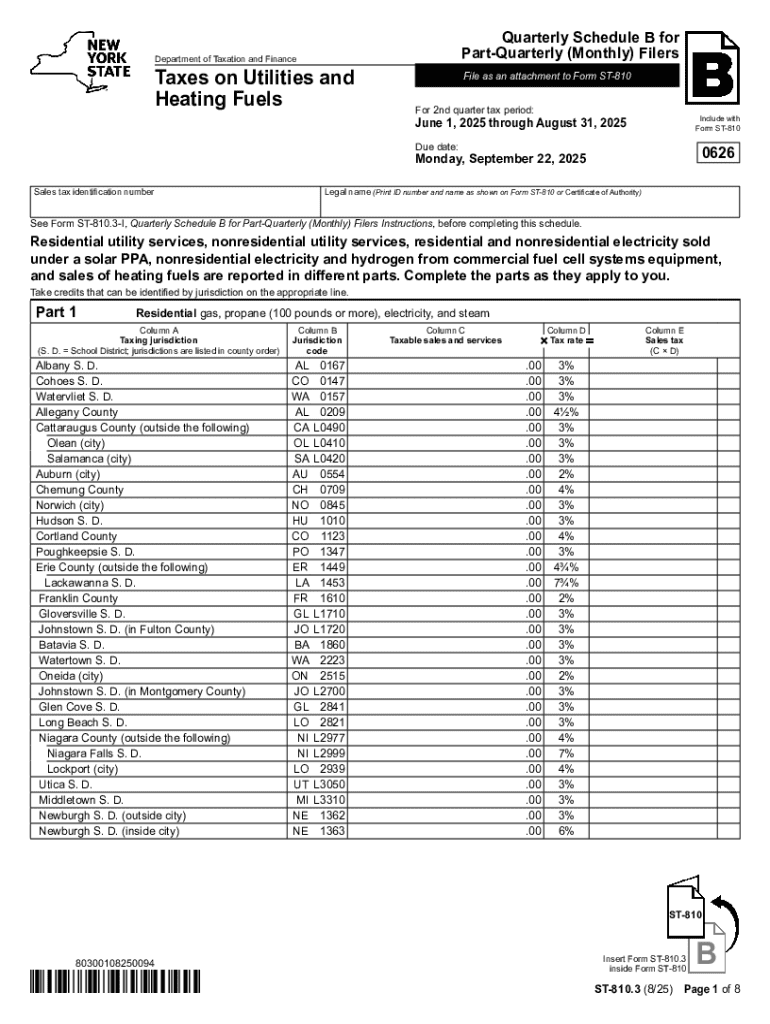

Understanding Form ST-8103

Form ST-8103, officially known as the Application for Extension of Time to File Sales and Use Tax Return, serves a vital role in tax compliance for individuals and businesses. Its primary purpose is to allow taxpayers to request an extension for filing their sales and use tax returns. Accurate completion of this form is important to avoid unnecessary penalties and ensure smooth processing with tax authorities.

The importance of accurate completion cannot be understated; any errors or omissions may lead to delays in processing or even fines. This guide focuses on helping you navigate this form effectively so you can meet your tax obligations on time and avoid complications.

Who needs to use Form ST-8103?

Form ST-8103 is targeted primarily at business owners and individuals engaged in taxable sales, purchases, or use of goods or services. This includes retail businesses, wholesalers, and those providing services that fall under sales tax regulations.

Specific scenarios where Form ST-8103 is applicable include when businesses unexpectedly require additional time to collect and report taxes due to various factors, such as sudden changes in the business structure or accounting software difficulties.

Key deadlines and submission guidelines

Filing deadlines for Form ST-8103 are typically aligned with the sales and use tax return due dates. Generally, businesses are required to submit this form at least a week before the tax return deadlines to ensure the request for an extension is processed in time.

Preparing to complete Form ST-8103

Before diving into filling out Form ST-8103, it's essential to gather necessary documents and information. Having everything ready can reduce frustration and ensure no critical details are overlooked.

A checklist for required documents includes your business's tax identification number, sales data for the relevant period, and any supporting documentation indicating the need for an extension. Proper documentation creates a smoother filing experience.

Understanding tax implications

Understanding the tax implications related to Form ST-8103 is crucial. The form primarily serves to extend the time for filing, not for extending payment deadlines unless explicitly stated. It's a common misconception that filing for an extension delays payment obligations, but that is not the case.

Step-by-step instructions for filling out Form ST-8103

Accessing Form ST-8103 is straightforward as it is available for download on pdfFiller. This platform provides a user-friendly interface for both downloading and filling out forms electronically.

Section-by-section breakdown

Personal information

Begin by filling in your name, address, and contact information accurately. Ensure that all details match those in your official filings to avoid confusion.

Tax information

In this section, report your income, applicable deductions, and any credits that can influence your tax obligation. Use precise figures to facilitate an efficient review process.

Payment information

Indicate the method of payment intended for any taxes owed. This can include check, bank draft, or electronic bank transfers, depending on your preference.

Signature section

Ensure you sign and date the form in the required section. This confirms the authenticity of the submission, and electronic signatures are permissible when using platforms like pdfFiller.

Tips for editing and managing Form ST-8103 on pdfFiller

Using pdfFiller helps to streamline the completion of Form ST-8103. The platform offers several editing features that allow users to fill in text, add signatures, and manage documents effectively.

Collaboration is easier too; team members can be invited to review the form, enabling efficient management of document versions. This feature is especially beneficial for businesses with multiple stakeholders involved in tax submissions.

eSigning your completed form

Once the form is complete, eSigning is simple within pdfFiller. Follow the platform instructions to add your electronic signature securely. As electronic signatures hold the same legal weight as handwritten ones, compliance standards are maintained.

Common mistakes to avoid when filing Form ST-8103

When completing Form ST-8103, several frequent errors can occur. For instance, miscalculating taxable sales or failing to include supporting documentation can lead to complications.

Double-checking your work is essential. Key areas to review include your tax identification numbers and totals reported. Small inaccuracies can lead to delays or additional scrutiny from tax authorities.

Troubleshooting and FAQs

Frequently asked questions about Form ST-8103 often revolve around filing procedures and deadlines. Examples include inquiries about how long extensions last or whether electronic submission is acceptable.

If you're facing difficulties or have specific questions, contacting the support team at pdfFiller is advised. Prepare details about your issue to expedite assistance.

Additional tools and resources for Form ST-8103

To aid in the completion of Form ST-8103, various interactive tools and calculators are available through pdfFiller that help simplify tax calculations. These tools are designed to prevent miscalculations and ensure your filings are accurate.

Additionally, related forms and templates may be needed for a comprehensive tax filing. Familiarizing yourself with these can better prepare you for the entire process beyond just Form ST-8103.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form st-8103 taxes on from Google Drive?

How do I edit form st-8103 taxes on on an Android device?

How do I fill out form st-8103 taxes on on an Android device?

What is form st-8103 taxes on?

Who is required to file form st-8103 taxes on?

How to fill out form st-8103 taxes on?

What is the purpose of form st-8103 taxes on?

What information must be reported on form st-8103 taxes on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.