Get the free IRS Unveils Draft Form 1099-DA for Crypto Tax Reporting

Get, Create, Make and Sign irs unveils draft form

How to edit irs unveils draft form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs unveils draft form

How to fill out irs unveils draft form

Who needs irs unveils draft form?

IRS unveils draft form: A comprehensive guide for taxpayers

Understanding the IRS draft form

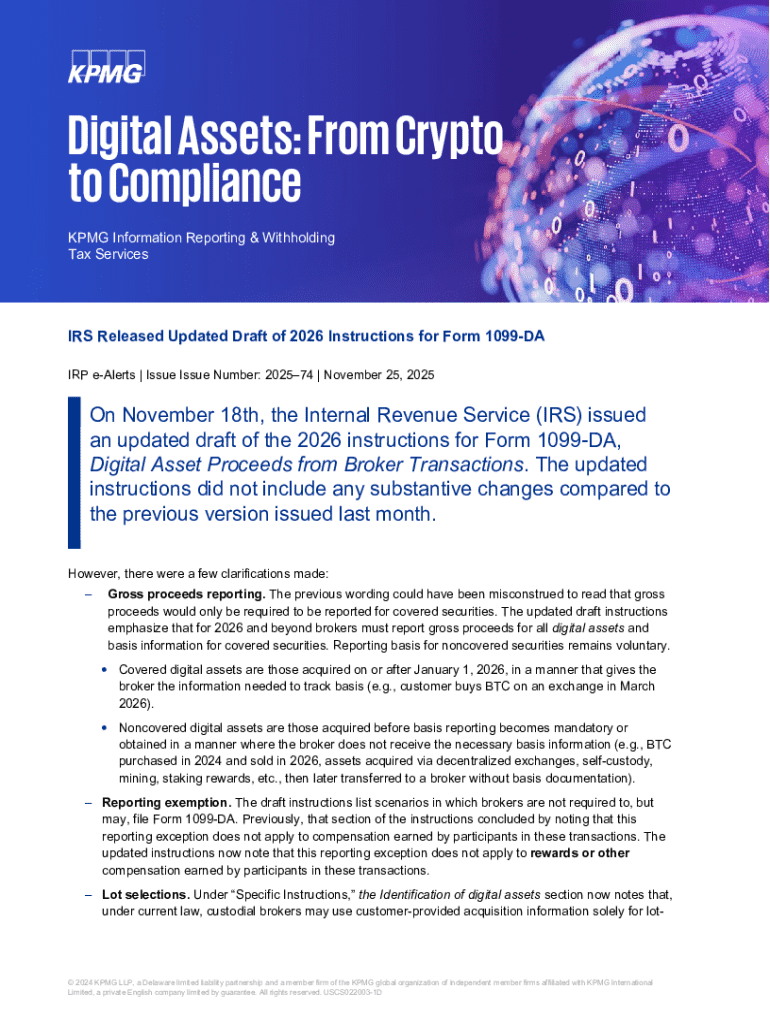

The IRS has recently unveiled a draft form, a crucial tool for the upcoming tax season. This draft form serves as a preliminary version that taxpayers and tax professionals can review before the final version is released. Understanding its purpose and importance is essential for successful tax filing.

A key difference between draft forms and final forms lies in their purpose. While final forms are the definitive documents used for submission, draft forms allow for feedback and can be adjusted for clarity and accuracy. This iterative process helps ensure compliance and reduces the risk of errors for taxpayers.

Recent updates to the IRS draft form can significantly affect taxpayers. For instance, changes may pertain to the information required, adjustments in calculations, or new compliance regulations that taxpayers need to adhere to. Understanding these updates is vital to avoid potential complications during the filing process.

How to access the IRS draft form

Accessing the IRS draft form is straightforward. First, navigate to the IRS website, which offers a user-friendly interface to search for forms. The site has a dedicated section for tax forms, where you can locate the draft form by its specific number.

The draft form is typically available in various formats, such as PDF for download or online fillable forms. When downloading, ensure that your device is compatible with PDF viewer applications to avoid any issues in viewing or filling out the form.

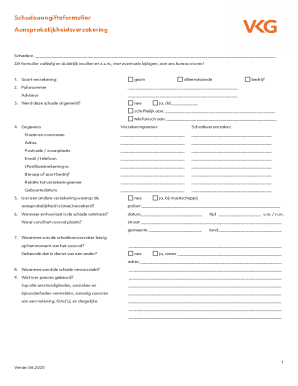

Filling out the IRS draft form

When it comes to completing the draft form, accuracy is key. Each section of the draft form should be filled out meticulously to ensure compliance and prevent potential delays in processing. Review each area thoroughly, noting any specific instructions outlined on the form.

Using pdfFiller can significantly enhance your experience while filling out the draft form. This platform offers features that simplify the process, such as interactive tools for error checking and suggestions for common fields, allowing users to navigate the form with ease.

eSigning and sharing the draft form

Once you have completed the IRS draft form, you may wish to eSign it for added convenience and security. E-signatures are increasingly popular due to their efficiency and legal acceptance. To add an e-signature using pdfFiller, follow these steps: start by clicking on the e-signature button, select or create your signature, and place it securely on the document.

Sharing the completed draft form can be handled effectively through pdfFiller's secure sharing options. You can send it via email or through a shared link, ensuring that the sensitive tax information remains protected. Best practices include encrypting documents and sharing only with trusted parties.

Collaborating on the draft form

For teams needing to collaborate on the IRS draft form, pdfFiller offers multi-user collaboration features that enable several people to work on the document simultaneously. This facilitates feedback and corrections from team members, streamlining the workflow and ensuring that everyone is on the same page.

While collaboration can be efficient, certain situations may call for seeking professional help. Consulting a tax professional can provide insights into complex areas of the draft form, ensuring compliance with IRS regulations and potentially uncovering tax-saving opportunities.

Managing your completed forms

Once you’ve filled out the IRS draft form, organizing and storing it effectively is paramount. Utilizing pdfFiller’s document management features can help. Best practices involve categorizing documents by tax year and securely storing them in digital formats to facilitate easy access during future filings.

As tax compliance is an evolving landscape, it's essential to keep track of changes in IRS forms. Subscribing to the IRS newsletter or following them on social media can help taxpayers stay informed about updates that could affect their filing process.

Advice from the experts

Tax professionals often emphasize the importance of attention to detail when filling out draft forms. Common pitfalls include misreporting income or misunderstanding the requirements, which can lead to filing delays. Precise and timely submissions are crucial to avoiding penalties.

User testimonials regarding pdfFiller often highlight its intuitive interface and efficiency in handling draft forms, indicating a strong preference for cloud-based solutions in managing tax documents.

Frequently asked questions (FAQs)

Many taxpayers have questions regarding the IRS draft form, particularly around filing deadlines and submission requirements. It's common to wonder about the timeline for receiving updates or the significance of inputting specific data.

For troubleshooting pdfFiller-related issues, many users report that checking help forums and FAQs can lead to quick resolutions for common problems, such as file compatibility and sharing functionalities.

Current news and updates

Staying informed about IRS forms and regulations is critical for taxpayers. Regularly checking the IRS website and subscribing to updates can enhance compliance. These resources are pivotal in keeping taxpayers aware of changes that may impact their filings.

Future trends in tax filing may indicate a push towards more digital solutions with increasing reliance on technology partnerships. As taxpayer needs evolve, the IRS may adapt forms to streamline the digital filing process.

We're here to help

For any further questions or support, pdfFiller provides reliable customer service options. Users can contact pdfFiller directly through the platform for assistance or explore the chat feature for quick queries. This commitment to customer support ensures users feel empowered while completing their tax documents.

Engaging with user communities can further enhance knowledge sharing, helping taxpayers navigate their responsibilities in a collaborative environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs unveils draft form directly from Gmail?

How do I complete irs unveils draft form on an iOS device?

How do I fill out irs unveils draft form on an Android device?

What is irs unveils draft form?

Who is required to file irs unveils draft form?

How to fill out irs unveils draft form?

What is the purpose of irs unveils draft form?

What information must be reported on irs unveils draft form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.