Get the free Voluntary benefits: A guide for your first-time enrollees

Get, Create, Make and Sign voluntary benefits a guide

How to edit voluntary benefits a guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out voluntary benefits a guide

How to fill out voluntary benefits a guide

Who needs voluntary benefits a guide?

Voluntary benefits: A guide form

Understanding voluntary benefits

Voluntary benefits refer to additional insurance or financial products that employees can choose to enhance their overall benefits package. Unlike traditional benefits, voluntary benefits are typically employee-funded and come in a wide array of options tailored to fit specific needs. In today’s workforce, employers recognize the importance of voluntarily offered benefits in fostering a supportive work environment, promoting financial well-being, and enhancing the overall employee experience.

As businesses strive to attract and retain top talent, offering a robust portfolio of voluntary benefits can be a significant differentiator. Employees increasingly look for personalized benefits that suit their individual circumstances, and these options can extend far beyond standard health insurance, making them an invaluable component of any employment package.

Participating in voluntary benefits

Both employees and employers can greatly benefit from the implementation of voluntary benefits. For employees, these options empower them to select products that address their personal health and financial security needs. They can choose coverage that directly relates to their life circumstances, such as family health needs, future planning, or unexpected expenses. This level of choice is a compelling motivator for job satisfaction and engagement.

On the employer side, providing voluntary benefits can contribute to improved employee relations, higher retention rates, and an enhanced reputation as a desirable workplace. Additionally, when employees feel that their needs are being met through a comprehensive benefits package, they are more likely to expend greater effort and loyalty to the organization.

Advantages of offering voluntary benefits

The advantages of offering voluntary benefits extend to both employees and employers. Employees find value in having personalized choices that can significantly contribute to their financial and emotional well-being. This flexibility can lead to improved workplace morale, as individuals feel that their unique situations are acknowledged and accommodated.

Employers benefit by experiencing increased employee engagement and loyalty. When workers perceive that their employer genuinely cares about their welfare, this fosters greater dedication to the organization. Moreover, a competitive benefits package makes it easier for businesses to attract top talent as they set themselves apart from competitors.

Case studies from various organizations illustrate how implementing a voluntary benefits program led to greater satisfaction among staff and decreased turnover. Many companies employing strategies tailored to meet employee needs have observed significant positive shifts in their workplace culture.

Busting the myths about voluntary benefits

Despite their clear benefits, several misconceptions persist about voluntary benefits. A common myth is that small businesses cannot afford these additional offerings. However, with the availability of pay-as-you-go models and various insurance products, many small and medium-sized enterprises can find cost-effective solutions to enhance their benefits packages.

Another misconception is that employees do not understand how voluntary benefits work. While education is critical, companies can support their teams by providing clear information and resources to guide them through the choices available. Engaging recruitment events and workshops can be valuable tools to enhance understanding and interest.

The essentials of choosing the right voluntary benefits

Selecting the right voluntary benefits requires a thorough understanding of employee needs. Conducting surveys and feedback sessions can provide invaluable insights into what employees truly value and require in their benefits package. Furthermore, analyzing demographic information can help employers identify the types of products that may be most beneficial to their workforce.

In addition to assessing employee preferences, it’s crucial to evaluate potential benefits providers. Key factors to consider include the company’s reputation, the range of coverage options available, and their customer service track record. Utilizing tools like pdfFiller can streamline this evaluation process by providing easy management of documentation related to different providers.

Interactive tools for managing voluntary benefits

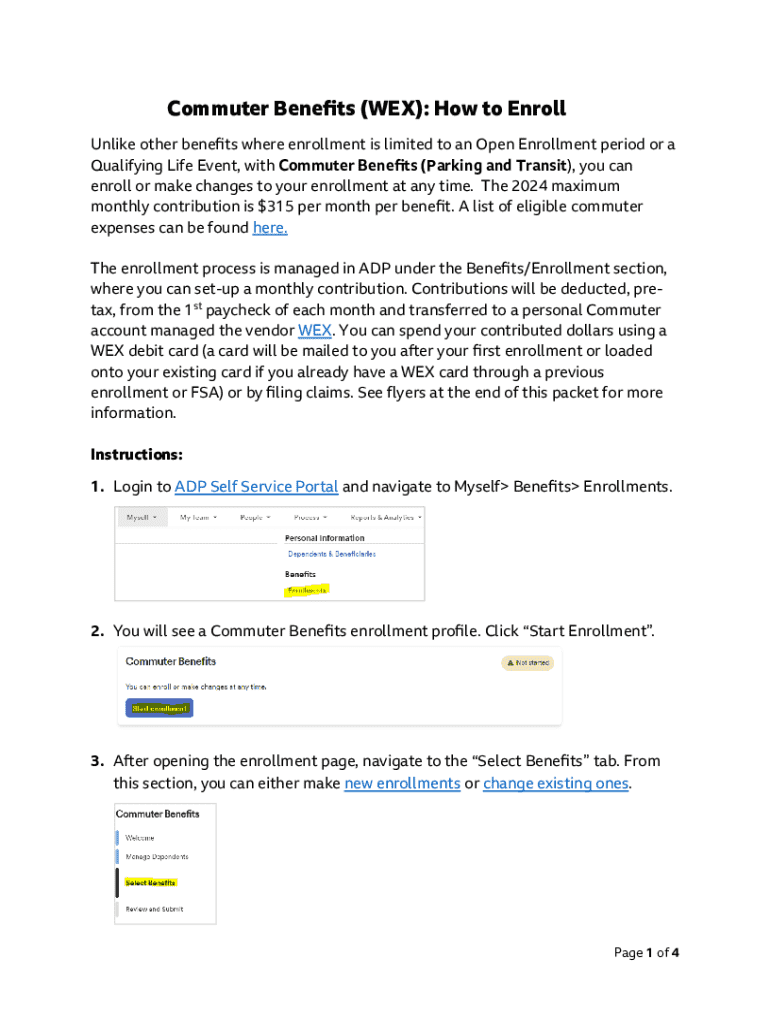

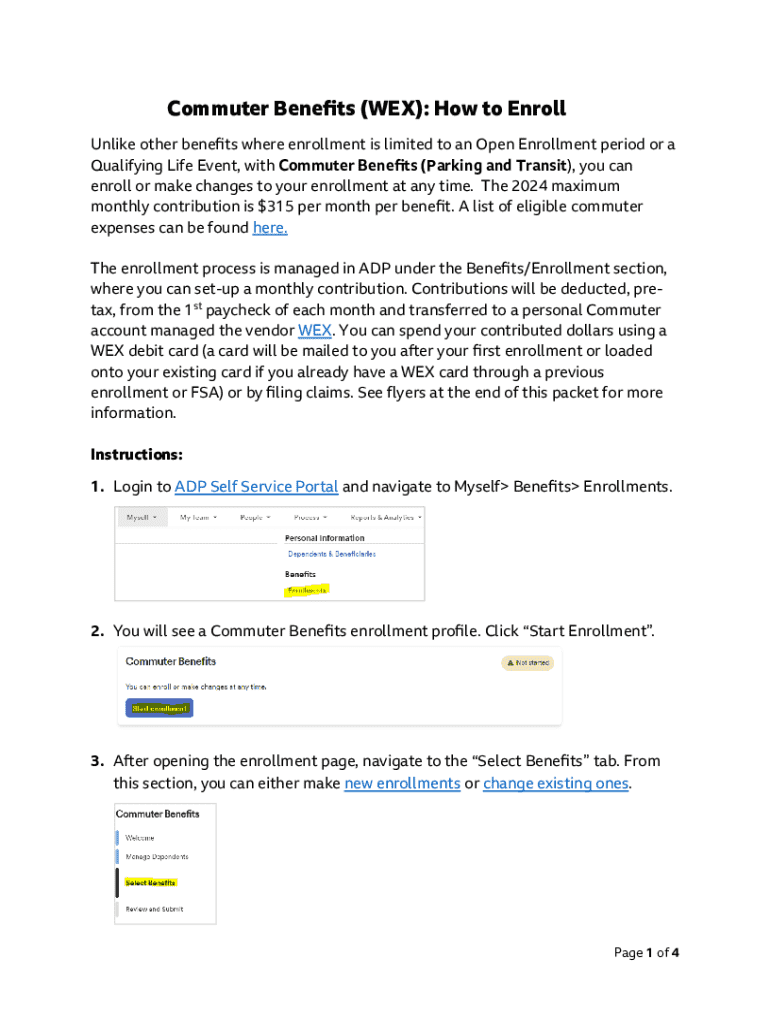

Managing voluntary benefits effectively can be complex, but using tools like pdfFiller simplifies the process immensely. This platform allows for easy editing of forms related to voluntary benefits, enabling users to fill out necessary documents quickly and efficiently. With a step-by-step guide available, employees can navigate filling out and submitting their enrollment forms with confidence.

Additionally, pdfFiller supports eSigning documents securely, ensuring that all interactions are both safe and efficient. Collaboration with teams on benefits-related paperwork is seamless, allowing for real-time feedback and adjustments, which ultimately contributes to a smoother experience for employees.

Managing deadlines and document life cycles is made simpler with pdfFiller's comprehensive tracking options, ensuring no important details are overlooked.

Frequently asked questions about voluntary benefits

The landscape of voluntary benefits can elicit many questions from employees. An increasingly common query is, 'What happens if I change jobs?' Generally, many of these benefits can be retained, or transitioned to a new employer, but clear communication from both parties is essential to navigate this effectively. Understanding the tax implications of such benefits is also crucial; many voluntary benefits are subject to taxation, so employees should be encouraged to seek guidance to ascertain how this may affect their overall finances.

Another area of inquiry often centers on form completion. Specifically, employees may wonder, 'How do I complete the enrollment form?' This is where platforms like pdfFiller play an invaluable role; by providing an easy-to-follow guide, employees can complete their forms with minimal hassle. Additionally, seeking assistance with voluntary benefits is always encouraged, ensuring all employees feel well-equipped to make informed decisions.

Utilizing technology for benefits management

Incorporating technology, particularly cloud-based platforms, enhances the administration of voluntary benefits programs. A centralized document management system allows for easy access to all necessary benefits paperwork from any location, making it convenient for both employers and employees. The ability to integrate with existing HR software streamlines processes, making it easier to manage communications around benefits efficiently.

Security and compliance are crucial components of benefits management. Protecting sensitive employee data from breaches is paramount, and utilizing reputable platforms with strong security measures is essential to maintain confidentiality and regulatory compliance when handling employee information.

Maintaining an updated benefits program

To keep a benefits program relevant, regular reviews and updates are necessary. Employees' needs can change over time, whether due to shifts in demographics or evolving market trends. By revisiting benefit offerings annually, organizations can ensure that they provide the most relevant and desirable options to their workforce.

Establishing a feedback mechanism fosters an ongoing dialogue between management and employees, providing insights into which benefits are performing well and which ones need reassessment. Engaging employees in this process not only enhances transparency but also builds a collaborative culture around benefits management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit voluntary benefits a guide from Google Drive?

How can I send voluntary benefits a guide to be eSigned by others?

How do I edit voluntary benefits a guide straight from my smartphone?

What is voluntary benefits a guide?

Who is required to file voluntary benefits a guide?

How to fill out voluntary benefits a guide?

What is the purpose of voluntary benefits a guide?

What information must be reported on voluntary benefits a guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.