Get the free Nebraska Form 1065N (Nebraska Return of Partnership ...

Get, Create, Make and Sign nebraska form 1065n nebraska

Editing nebraska form 1065n nebraska online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska form 1065n nebraska

How to fill out nebraska form 1065n nebraska

Who needs nebraska form 1065n nebraska?

Nebraska Form 1065N: A Comprehensive Guide

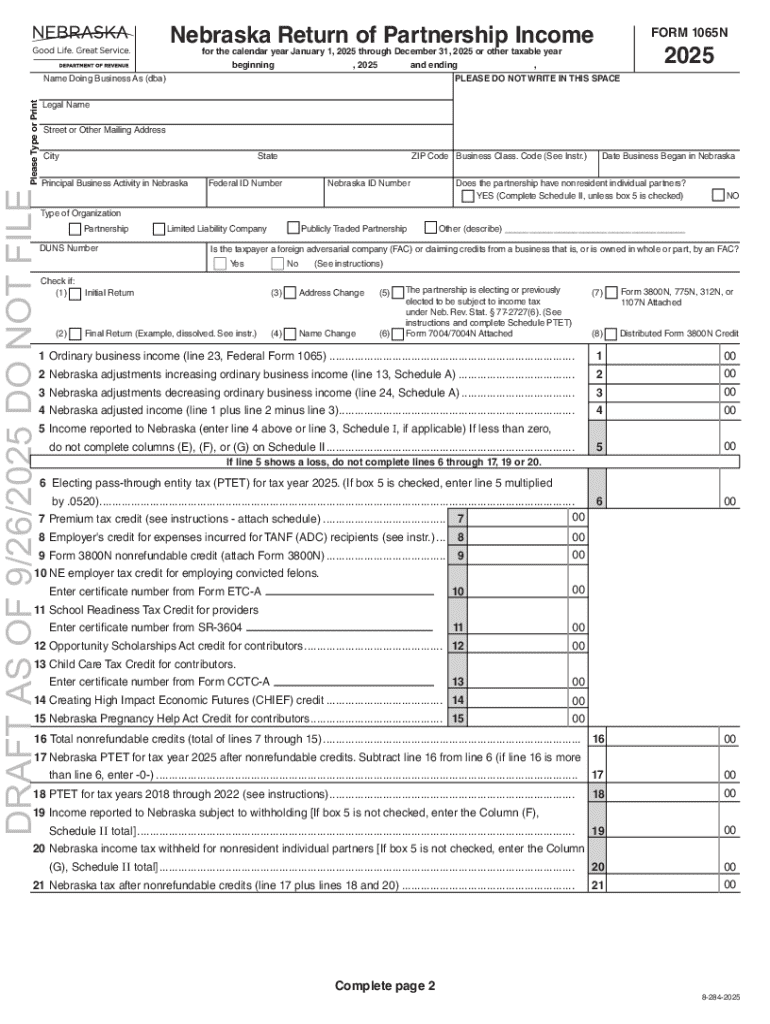

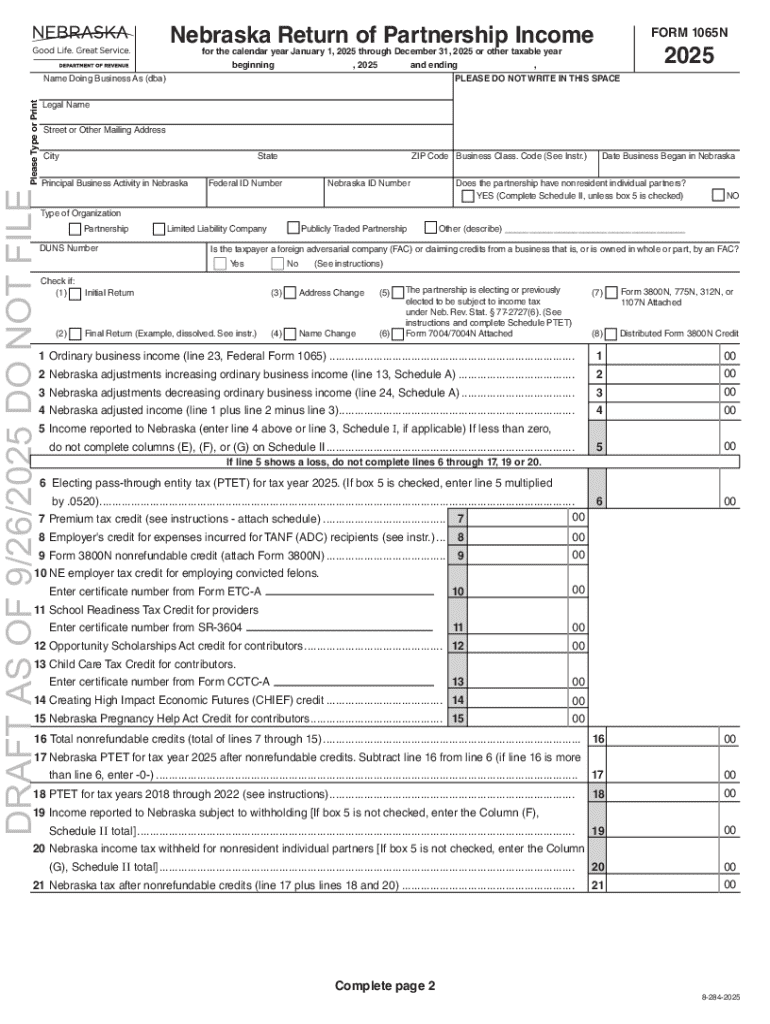

Overview of Nebraska Form 1065N

Nebraska Form 1065N is a crucial document for partnerships operating within the state, specifically designed to report the income, deductions, and credits of the partnership to the Nebraska Department of Revenue. This form ensures that partnerships comply with the state's tax regulations and accurately report their financial activities. Filing Form 1065N is essential for tax reporting as it provides clarity on how the partnership’s income is distributed among its partners.

For partnerships in Nebraska, Form 1065N serves not only as a tax document but also as a tool for transparency among partners concerning their earnings. This filing generally occurs annually, with a deadline aligned closely with federal filing dates, typically on the 15th day of the third month after the end of the fiscal year for the partnership.

Eligibility requirements for filing Form 1065N

All partnerships doing business in Nebraska are required to file Form 1065N. This includes general partnerships, limited partnerships, and limited liability companies that are taxed as partnerships. However, partnerships that have no income or activity during the tax year might not be required to file. It's essential for partnerships to evaluate their specific circumstances to determine if they meet the filing obligations.

Key exemptions may include partnerships that have made the election to be taxed as a corporation or entities that operate solely within the state without any reportable income. Additionally, partnerships should remain mindful of the regulations governing business activities in Nebraska and any changes that could impact their tax obligations.

Step-by-step instructions for completing Nebraska Form 1065N

Completing Nebraska Form 1065N involves several key sections that gather important data about the partnership's operations and finances. The first section requires basic information such as the partnership name, address, and the principal business activity. Clear and accurate information here sets the stage for the rest of the form.

Following this, Section 2 focuses on the partnership’s income and deductions. Here, partnerships must report total income along with any deductible expenses, including operating costs, salaries, and any other adjustments necessary as per Nebraska's tax guidelines. Partners should ensure all income is accurately reported to avoid penalties.

Section 3 looks into partner information, detailing each partner's share of income, loss, and capital. It’s crucial to correctly allocate shares according to each partner's agreement, particularly in cases of special allocations that might arise due to varying responsibilities or contributions.

Finally, in Section 4, partnerships need to account for specific Nebraska tax adjustments, considering local tax implications that may differ from federal requirements. Understanding these nuances is vital for compliance and accurate reporting.

How to access and fill out Nebraska Form 1065N using pdfFiller

Accessing Nebraska Form 1065N through pdfFiller is user-friendly. To begin, users can go to the pdfFiller website, search for the form, and open it. pdfFiller provides an interactive PDF platform to fill out the document with ease, ensuring that all necessary fields are accurately completed.

The editing features of pdfFiller enhance the process significantly. Users can utilize text editing tools for any section, ensuring clarity and accuracy. Pre-fill options are particularly helpful for commonly used information, minimizing repetitive input and saving time during the completion of Form 1065N.

Adding eSignatures through pdfFiller is straightforward and vital for compliance. The eSignature feature allows partners to sign the document electronically, streamlining the submission process while ensuring that signatures are legally binding. This feature is particularly advantageous for partnerships where multiple signatures are required.

Common mistakes to avoid when filing Form 1065N

Several common pitfalls may arise while filing Form 1065N. One of the most significant mistakes is missing critical information, such as partner details or financial summaries. Omissions can result in delays, penalties, or a rejected filing, which could complicate tax obligations further.

Another frequent error involves incorrect calculations regarding partner shares. Partnerships must ensure proper distribution of income and deductions according to each partner's share of the business. Failure to do so can lead to inaccurate tax liabilities and potential audits.

Finally, overlooking tax adjustments specific to Nebraska can lead to mismatched filings. Each partnership should review local regulations closely to ensure full compliance and that all adjustments are accurately reflected in their final submission.

Filing Nebraska Form 1065N: Submission options

Partnerships in Nebraska have several submission options for filing Form 1065N. The simplest method is online filing through pdfFiller, which offers a seamless platform for submitting the completed form directly to the Nebraska Department of Revenue. This method provides immediate confirmation of submission, allowing peace of mind for the filer.

For those opting to mail the form, it’s advisable to send it via certified mail for tracking purposes. Additional paperwork, such as Schedules K-1N for each partner, must accompany the submission to ensure accurate reporting of each partner's income and deductions.

Post-filing: What to expect after submitting Form 1065N

After submitting Nebraska Form 1065N, partnerships can expect to receive a confirmation of receipt from the state within a few weeks. This acknowledgment serves as reassurance that the state has received the document and is in the process of review. However, partnerships should remain vigilant, as the state may initiate audits if discrepancies or red flags are detected.

Remaining organized and keeping accurate records post-filing is essential for partnerships. They must be prepared to answer queries from the Nebraska Department of Revenue and provide any additional documentation if required. Maintaining good records not only aids in audits but also prepares partnerships for future filings.

Resources for Nebraska tax filings and Form 1065N

Partnerships can find valuable resources related to Nebraska tax filings and Form 1065N through the official Nebraska Department of Revenue website. This site features comprehensive guides, updates on regulations, and essential contact information for further assistance. Additionally, partnerships should review the frequently asked questions regarding Nebraska tax forms to clarify common uncertainties.

Useful links are available for download and review of supplemental documents, including the Return of Partnership Income Booklet, which provides in-depth guidance on completing the form. Engaging with these materials can enhance understanding and ensure accurate tax reporting.

Testimonials: Users sharing their Nebraska Form 1065N experience with pdfFiller

Users of pdfFiller have shared positive experiences regarding their filing of Nebraska Form 1065N, emphasizing the platform's ease of use. Through efficient document management, many have praised how pdfFiller assists in organizing necessary forms and streamlining the filing process, making tax season significantly less stressful.

Success stories illustrate the benefits of cloud-based document management where partnerships can access necessary documents anywhere, anytime. Users attribute seamless collaboration within teams, which is crucial when discussing financials that require accurate and timely reporting.

Exploring other related Nebraska tax forms

Beyond Form 1065N, various other tax forms are pertinent to Nebraska taxpayers seeking compliance with state regulations. Forms related to individual income tax, corporation taxes, and specific deductions all play critical roles in an individual or partnership’s overall tax strategy.

Using pdfFiller simplifies not just the submission of Form 1065N, but also the management of all Nebraska tax forms. The platform’s capability to host multiple document types ensures partnerships can handle all their tax-related needs in one convenient location, promoting efficiency and accuracy.

Contact information for support on Nebraska Form 1065N

For any questions or concerns regarding Nebraska Form 1065N, partnerships can reach out to the Nebraska Department of Revenue directly. Their contact information is available on their official website, where users can find guidance on specific filing inquiries or other related tax matters.

Additionally, pdfFiller provides extensive support for users needing assistance with completing or managing their forms. Their customer service team is available to resolve any issues and ensure users can file their documents with confidence and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nebraska form 1065n nebraska in Chrome?

Can I sign the nebraska form 1065n nebraska electronically in Chrome?

Can I create an eSignature for the nebraska form 1065n nebraska in Gmail?

What is Nebraska Form 1065N Nebraska?

Who is required to file Nebraska Form 1065N Nebraska?

How to fill out Nebraska Form 1065N Nebraska?

What is the purpose of Nebraska Form 1065N Nebraska?

What information must be reported on Nebraska Form 1065N Nebraska?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.