Get the free Valuation Appeal Form Cr20 - Fill Out and Sign Printable ...

Get, Create, Make and Sign valuation appeal form cr20

How to edit valuation appeal form cr20 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out valuation appeal form cr20

How to fill out valuation appeal form cr20

Who needs valuation appeal form cr20?

Valuation Appeal Form CR20 Form: A Comprehensive Guide

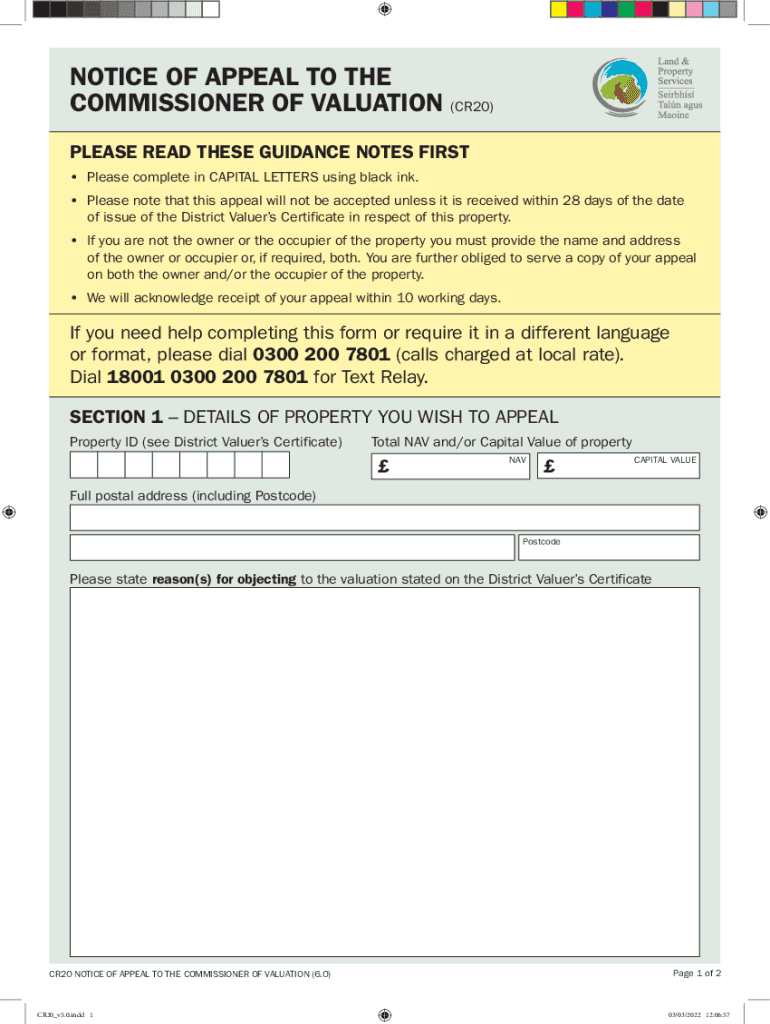

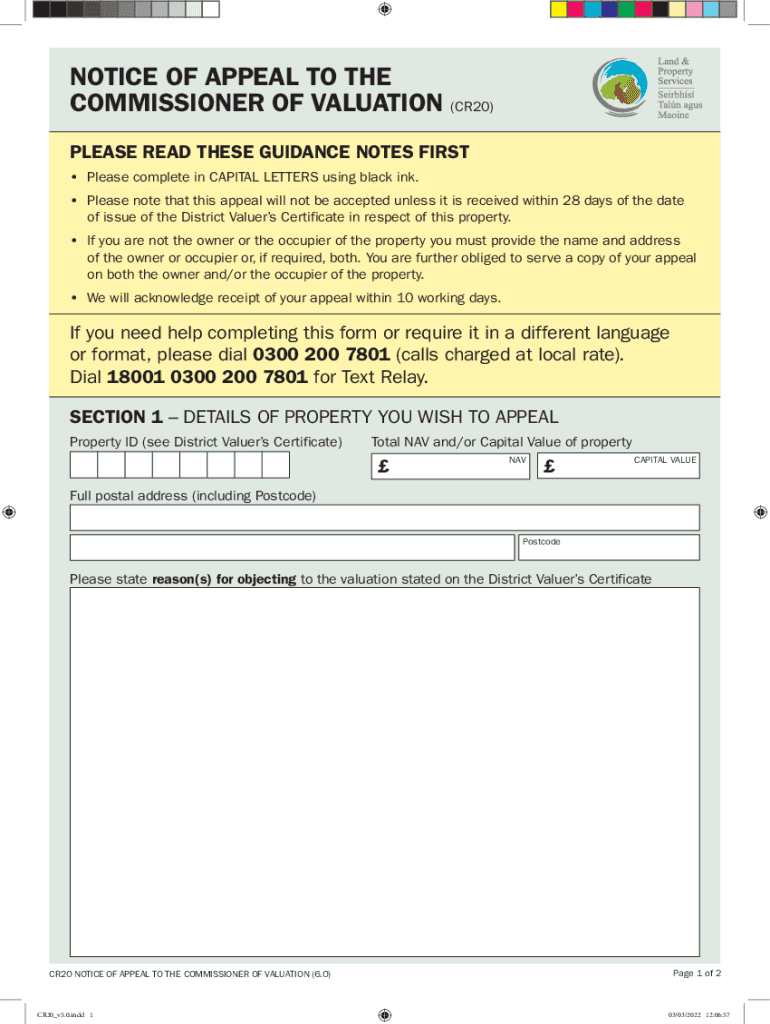

Understanding the valuation appeal form CR20

The valuation appeal form CR20 is a crucial document used in the context of property taxation and valuation disputes. This form allows taxpayers to officially contest the assessed value of their property as determined by government authorities. The need for filing a CR20 typically arises when property owners believe that the valuation they received does not accurately reflect the property's fair market value.

The primary purpose of the CR20 form is to provide a structured and systematic approach for individuals and entities to present their arguments against the valuation carried out by the local authorities. Understanding this form is essential for ensuring that your appeal is processed without unnecessary delays.

Who should use the valuation appeal form CR20?

The CR20 form is intended for a diverse group of stakeholders, including individual homeowners, commercial property owners, and real estate professionals. If you have recently received a valuation notice from a government department and believe the assessment is incorrect or unjust, this form is your formal route to challenge that decision.

Common scenarios necessitating the filing of a valuation appeal include instances where a property's assessment dramatically increases without any significant upgrades or market changes, discrepancies in property classification, or when similar properties in the area have lower valuations. Understanding whether you fit into one of these categories can save you time and effort in addressing the valuation.

Overview of the appeal process

Filing an appeal using the CR20 form involves several structured steps. First, you should gather necessary documents, including prior valuation notices, property tax bills, and any relevant evidence that supports your claim, such as recent sales data for comparable properties. Once equipped with this information, you can proceed to complete the CR20 form.

It’s crucial to pay attention to important deadlines throughout the process, as submitting your appeal late may render it invalid. Ensure you are aware of the timeline for appeal submission, usually provided in the valuation notice you received.

Preparing to fill out the valuation appeal form CR20

Before you begin filling out the CR20 form, it's essential to collect pertinent information. This should include specific details about your property, like its address, current valuation figures, and any identifiable characteristics or issues that may affect its value. Additionally, legal documentation that verifies your ownership or interest in the property should be ready at hand.

To assist in this process, utilizing tools like pdfFiller can simplify document creation and management. This platform allows users to create, edit, and save documents from anywhere, fostering a seamless appeal-filing experience.

Detailed guide to filling out the valuation appeal form CR20

When you approach the CR20 form, you'll find it divided into various sections that require specific information. Here’s a breakdown of the key sections you need to complete:

Accuracy is paramount, so avoid common pitfalls such as leaving sections blank or using vague descriptions. If you're unsure about any part of the form, don’t hesitate to seek clarification or assistance from valuation authorities or online resources.

Editing and reviewing your valuation appeal form CR20

Once you've completed the CR20 form, it's critical to review it thoroughly to ensure accuracy. Utilizing tools like pdfFiller’s eSign and collaboration features can streamline this process by allowing multiple stakeholders to provide input and sign off on the document before submission.

Implementing best practices for revision — such as ensuring clarity and uniformity in your language, and making sure all necessary attachments are included — will fortify your appeal. Consider multiple drafts to hone your argument and rectify any inconsistencies.

Submitting the valuation appeal form CR20

There are typically several methods for submitting your CR20 appeal form. Many jurisdictions now offer an online submission option through relevant portals, which is often preferable for its speed and ease of tracking. However, if required, ensure you understand how to handle paper submissions, including precisely how to format and which addresses to send them to.

After submitting your appeal, you should confirm receipt with the valuation authority. Keeping a record of your submission method and any confirmation received can help you track the status of your appeal more efficiently.

Important considerations after submission

Once your CR20 form has been submitted, several things to expect should be on your radar. Normally, you can expect a response within a specified timeframe, typically communicated in the acknowledgement of your appeal. The appeal can either result in an adjustment of your property valuation, a request for additional information, or potentially a hearing.

Preparing for follow-up interactions is equally vital. This may include gathering further documentation for hearings or clarifying any queries the authorities may have regarding your submitted appeal.

Common questions about the valuation appeal form CR20

Individuals may encounter various issues while filling out or submitting the CR20 form. Some frequently asked questions include concerns about the specific documentation required, deadlines for submission, and how to address denied appeals. It's important to refer to governmental resources or consult a legal professional for guidance.

Additionally, trouble with online submissions can be alleviated by ensuring your digital documents are formatted correctly and by checking for system updates from the government website.

Connecting with support and resources

For additional help, various resources are available to property owners. Connecting directly with valuation authorities can provide clarity on your specific situation. Websites for local government departments often have a wealth of information regarding the appeal process.

Moreover, utilizing pdfFiller’s customer support can enhance your experience with the document management process, ensuring you have the necessary tools at your disposal. It's beneficial to leverage links to supporting documents related to property valuation appeals to empower your case.

Feedback and improvement

Encouraging feedback is essential for improving not only individual experiences but also the overall appeal process. This input can come from both experiences shared by other users and responses from government departments regarding their handling of appeals.

If you've recently navigated the valuation appeal form CR20, consider sharing insights or issues faced. This will help refine the system and ensure that it becomes more accessible for future users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my valuation appeal form cr20 directly from Gmail?

How do I edit valuation appeal form cr20 online?

How do I make edits in valuation appeal form cr20 without leaving Chrome?

What is valuation appeal form cr20?

Who is required to file valuation appeal form cr20?

How to fill out valuation appeal form cr20?

What is the purpose of valuation appeal form cr20?

What information must be reported on valuation appeal form cr20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.