Get the Income Eligibility Guidelines for Free and Reduced-price ...

Get, Create, Make and Sign income eligibility guidelines for

How to edit income eligibility guidelines for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income eligibility guidelines for

How to fill out income eligibility guidelines for

Who needs income eligibility guidelines for?

Income Eligibility Guidelines for Form: A Comprehensive Guide

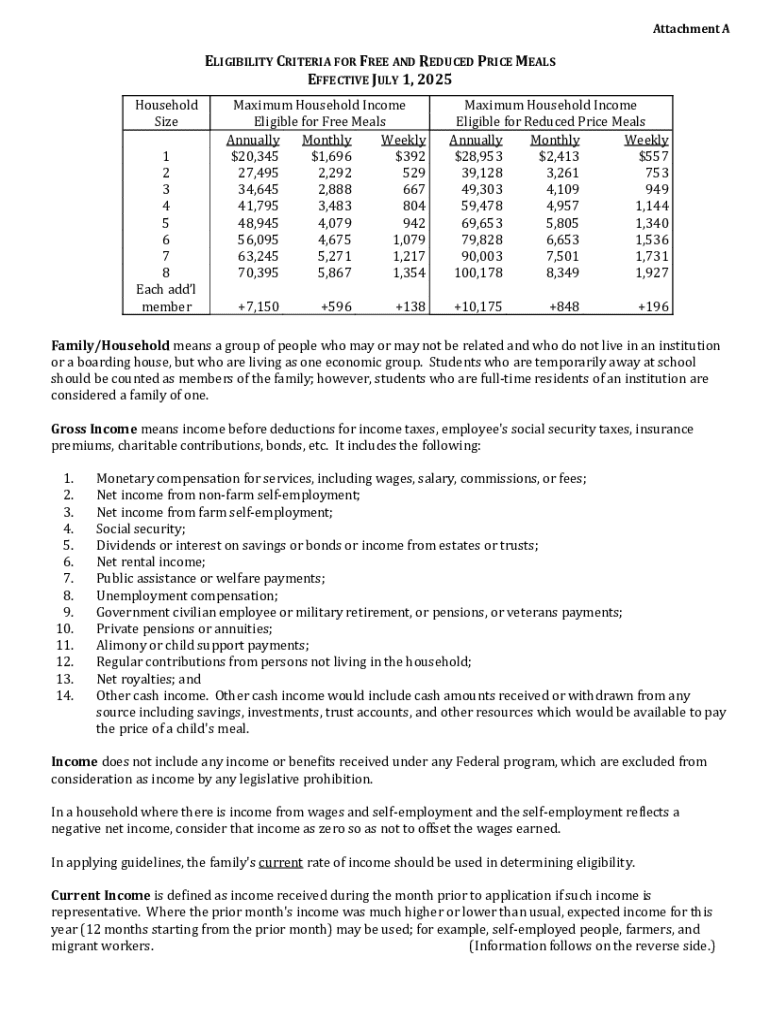

Overview of income eligibility guidelines

Income eligibility guidelines serve as crucial benchmarks for determining whether individuals or families qualify for various assistance programs. These guidelines help establish income thresholds that dictate access to benefits such as food assistance, healthcare, and housing support. For forms like the WIC (Women, Infants, and Children) Program or subsidized housing applications, understanding these guidelines is essential for eligible applicants aiming to receive critical support.

The purpose of these guidelines is not only to create fairness in allocating government resources, but also to ensure that aid reaches those who need it most. They are formulated based on national and sometimes state-specific standards, taking into account factors such as poverty levels, family size, and local economic conditions.

Understanding eligibility criteria

Income eligibility criteria are typically based on specific thresholds that categorize households into various income levels. These categories often include low-income, very low-income, and moderate-income brackets. To determine where a family falls, it is essential to break down the household's annual income and compare it against the established guidelines.

Sources of income considered may include wages, salaries, self-employment income, unemployment benefits, social security, and child support, among others. Each program may have its own criteria on what qualifies as income, making it vital for applicants to understand these nuances.

Key factors affecting eligibility include family size and the regional differences in the cost of living. For example, a family of four living in a high-cost area like Atlanta, Georgia may have a higher income threshold for eligibility than a similar family residing in a rural part of the state. These considerations ensure that the guidelines reflect the socio-economic realities faced by applicants.

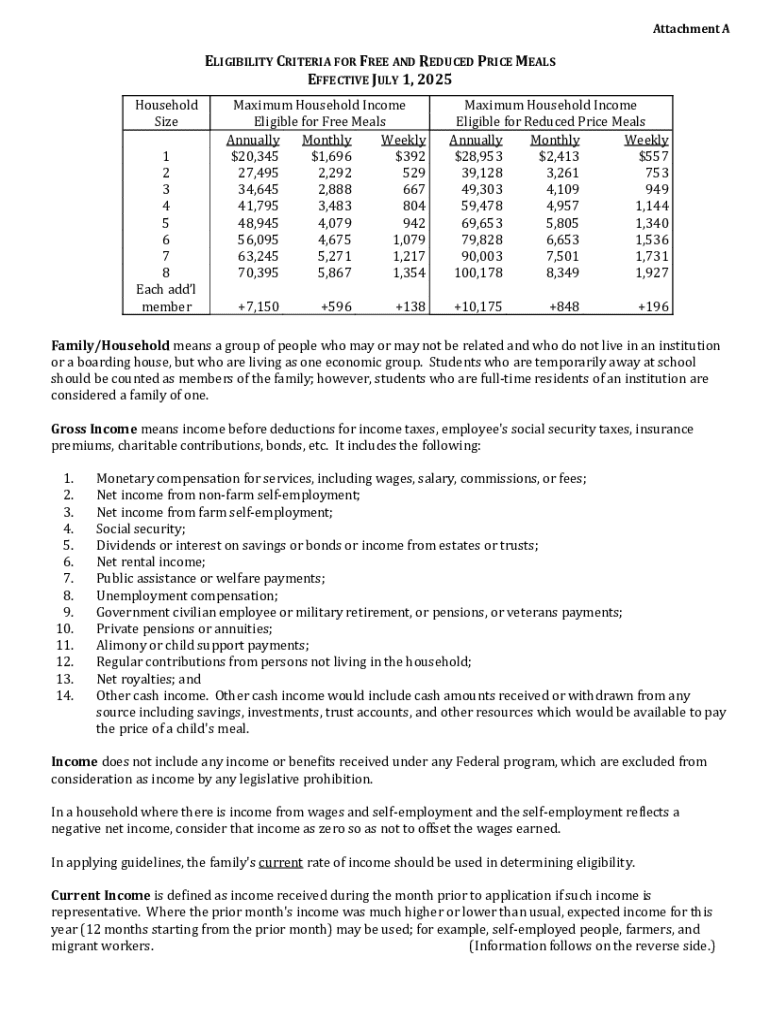

Detailed income guideline tables

The income eligibility guidelines for [current fiscal period] are typically published by government agencies, and they can often be found on state websites or government websites. Here’s a snapshot of what these guidelines may look like, presented in a simplified table format for clarity:

Interpreting these tables involves matching your household size with the respective income threshold. If your income is at or below this level, you may qualify for assistance. However, it is crucial to refer to official updates, as these figures can change annually based on economic conditions.

How to determine your eligibility

Determining your eligibility is a multi-step process that requires careful consideration of your financial situation and household composition. Follow this step-by-step guide to assess where you stand:

For instance, a single mother of three earning $28,000 annually would compare her income against the threshold for a four-person household. If her income is below the guideline, she may qualify for certain benefits.

Completing the application form

After determining your eligibility, the next step is completing the application form correctly. This typically requires providing personal details such as your name, address, and household size. Be prepared to report your income exhaustively, ensuring all sources are documented.

Common mistakes to avoid when filling out the application include omitting information, providing incorrect figures, and neglecting to include all members of your household. Double-check your entries and consider using additional tools to help manage the application process effectively.

Before submitting, be mindful of instructions specific to each form. For instance, WIC applications might also require proof of residency or documentation of children's ages, emphasizing the need for thorough and accurate information.

Resources for further assistance

Many local support and assistance programs provide guidance throughout the eligibility application process. Resources such as community health centers, food banks, and government websites offer valuable information tailored to your region, including the state of Georgia.

With the right resources and support, navigating the eligibility process can become significantly easier. Ensure to reach out with any specific questions or concerns you may have.

Using pdfFiller for form management

pdfFiller stands out as an ideal solution for managing your income eligibility forms with ease and efficiency. The platform offers a user-friendly interface that allows you to edit, sign, and collaborate on documents from a single, cloud-based solution.

Benefits include secure cloud storage for your documents, allowing you access from anywhere, and interactive tools that facilitate real-time collaboration among team members. You can also leverage features like live editing to make necessary adjustments seamlessly.

Whether you're managing multiple applications or working as part of a team on various assistance forms, pdfFiller enhances your ability to keep documents organized and up to date. This ensures that your applications are accurately filled, signed, and returned promptly.

Frequently asked questions (FAQs)

Understanding the intricacies of income eligibility guidelines can raise several questions. Here are some common queries individuals and families often have:

If you have additional questions, consider reaching out to local support services or utilizing resources available on government websites for further assistance.

Testimonials and success stories

Many individuals and families have successfully navigated the income eligibility process thanks to accessible guidelines and supportive programs. For instance, a Georgia-based family who applied for WIC benefits shared their experience of learning about eligibility through local clinics, helping them secure vital nutrition assistance for their children.

Success stories like these highlight the importance of making income eligibility guidelines easier to understand and apply. Access to the right resources can significantly impact lives by ensuring that families receive the benefits they deserve, fostering healthier communities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send income eligibility guidelines for for eSignature?

How do I edit income eligibility guidelines for on an iOS device?

How do I complete income eligibility guidelines for on an iOS device?

What is income eligibility guidelines for?

Who is required to file income eligibility guidelines for?

How to fill out income eligibility guidelines for?

What is the purpose of income eligibility guidelines for?

What information must be reported on income eligibility guidelines for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.