Get the free Chapter 11 ) AMERICAN TIRE DISTRIBUTORS, INC., et

Get, Create, Make and Sign chapter 11 american tire

How to edit chapter 11 american tire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 11 american tire

How to fill out chapter 11 american tire

Who needs chapter 11 american tire?

Chapter 11 American Tire Form: A Comprehensive Guide

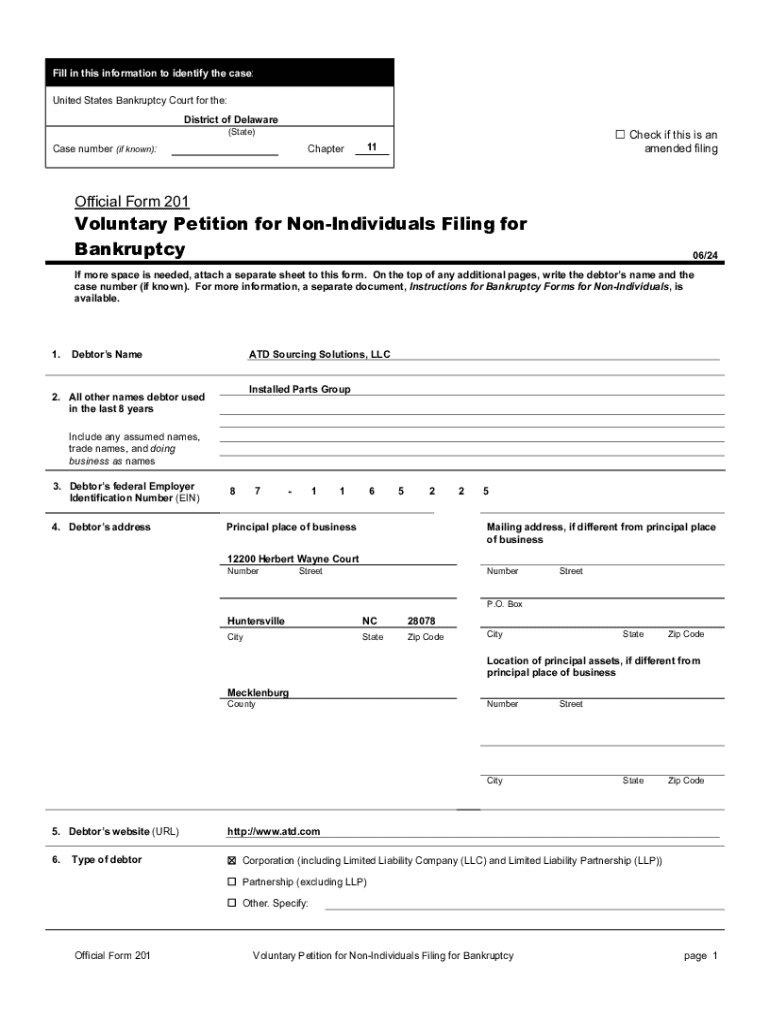

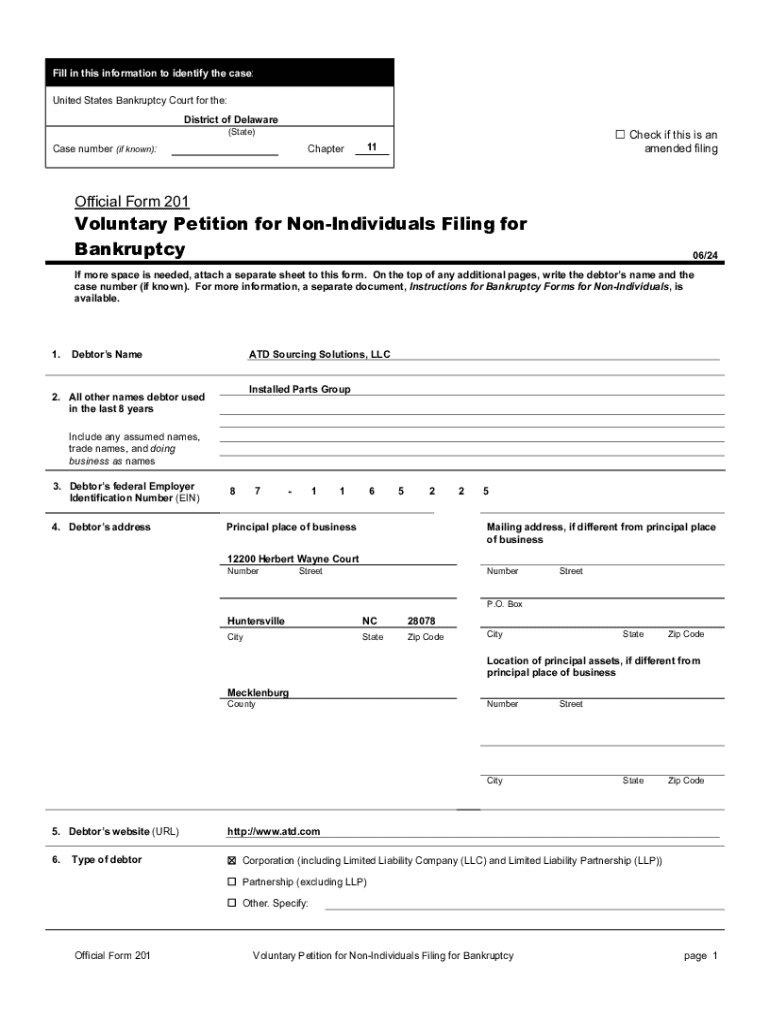

Overview of Chapter 11 American Tire Form

Chapter 11 bankruptcy, a provision in the United States Bankruptcy Code, allows struggling businesses to reorganize their debts while continuing operations. This process facilitates a path toward financial rehabilitation, enabling entities to pay creditors over time while trying to return to profitability. The Chapter 11 American Tire Form is an essential document utilized in these proceedings, serving as a formal declaration by the debtor that outlines significant financial information and strategic plans.

Understanding the Chapter 11 American Tire Form

The Chapter 11 American Tire Form is crucial in bankruptcy filings as it captures vital information about the debtor's current financial situation and operations. Key components include the debtor’s name and address, a comprehensive description of the business activities, as well as detailed financial statements including income statements, balance sheets, and obligations to creditors. It plays a pivotal role in ensuring that all stakeholders have a clear understanding of the debtor's financial status.

Accurate and complete information on the American Tire Form is paramount. As discrepancies can lead to delays or even rejection of the filing, it’s essential for the debtor to dedicate sufficient time to collect and confirm all information before submission.

Preparing to fill out the American Tire Form

Before filling out the American Tire Form, it’s crucial to gather all necessary documentation. This may include a comprehensive list of all creditors along with any claim amounts owed, and financial statements like income and cash flow statements, and balance sheets. Having these documents ready not only makes the filing process smoother but also ensures accuracy in disclosures.

Additionally, a checklist for essential supporting documents should be maintained to verify that all required materials are complete before proceeding with the form submission. Responsible document management at this stage will pay dividends in the long run.

Step-by-step instructions for filing the Chapter 11 American Tire Form

Filing the Chapter 11 American Tire Form can seem daunting, but by following this step-by-step approach, you can simplify the process significantly. First, gather all necessary financial information, ensuring you have up-to-date records concerning income, expenses, assets, and liabilities.

Next, complete the identification section with the debtor's name, address, and relevant business information. Proceed to detail your business operations thoroughly, as this provides context for the financial data being submitted. Then, outline all debts and liabilities, clearly categorizing each obligation and ensuring there are no overlooked amounts.

Finally, once the form is accurately completed, submit the signed form through the required channels. Keep in mind the distinction between electronic filing versus paper submissions, as each has its implications for processing time and record keeping.

Interactive tools to assist with the form

Utilizing interactive tools when filling out the Chapter 11 American Tire Form can dramatically enhance the efficiency and accuracy of your filing process. PDF editing features available on platforms like pdfFiller allow you to fill the form digitally, making it easier to edit and adjust any information quickly.

Additionally, eSignature options ensure that signing documents securely can be done digitally, streamlining the submission process. Collaboration tools also facilitate input from team members or advisors, ensuring that the right expertise is leveraged when filling out this complex form.

Common mistakes and how to avoid them

When preparing your Chapter 11 American Tire Form, it’s easy to overlook crucial details that can lead to complications. Common mistakes include incomplete financial disclosures, mischaracterization of debt types, and discrepancies between documents provided. Each of these can hinder your filing process or raise red flags for scrutiny from the court.

To avoid these pitfalls, meticulous review of all forms and documents is critical. Tips for review include cross-referencing details with financial records, consulting legal advisors for clarity on legal jargon, and conducting a final double-check before submission to catch any missed items.

Specialized considerations for different business types

Different business structures may affect the way the Chapter 11 American Tire Form is filled out. Corporations, for example, will often require more detailed disclosures compared to LLCs due to enhanced regulatory scrutiny and different implications regarding personal guarantees. Small businesses might encounter unique circumstances that necessitate varying approaches to debt management and operational strategies.

Understanding these distinctions is vital. For larger enterprises, comprehensive financial modeling may be needed to showcase projections post-filing, while smaller entities might focus on more immediate cash flow concerns. Each type of business may require tailored strategies in their bankruptcy approach.

Legal considerations surrounding the American Tire Form

Filing the Chapter 11 American Tire Form comes with a number of legal obligations. Accuracy is not just encouraged; it’s essential, as the ramifications of fraudulent filings can result in severe penalties. Legal obligations include not only fully disclosing your financial state but also adhering to the deadlines established for filing proofs of claim and responding to creditor notices.

Businesses can face audits or inquiries from the court if the information submitted appears inconsistent or suspicious. Understanding these legal stipulations is crucial for a smooth bankruptcy process, and consulting with bankruptcy attorneys can illuminate best practices for compliance.

Best practices post-submission of the American Tire Form

Once the American Tire Form is submitted, maintaining diligent documentation and tracking procedures is fundamental. Businesses should emphasize the importance of keeping well-organized records of all submitted forms and correspondence post-filing. This is not only ethical but required for transparency throughout the bankruptcy process.

Engaging legal or financial advisors for ongoing support can provide valuable insights into navigating the post-filing environment. This support can be crucial for complying with court mandates and understanding the next steps in the reorganization process.

Frequently asked questions about the American Tire Form

During the bankruptcy process, many debtors have queries bringing clarity to their situations. A common concern is what to do if the form is rejected. In such cases, it’s critical to understand the reasons for rejection, address those issues promptly, and submit an amended form within the designated time frame. Another frequent query involves the effects of Chapter 11 filings on creditors; most creditors will have to regroup and adjust their expectations based on the court-approved reorganization plan.

Moreover, many debtors seek clarity on what to expect next in the bankruptcy process. Understanding timelines, approval procedures, and communication expectations with the bankruptcy court can alleviate anxiety surrounding the transition period.

Conclusion: Navigating the Chapter 11 process with confidence

Mastering the Chapter 11 American Tire Form is an essential step toward reclaiming financial stability for businesses in distress. By understanding the intricacies of the form and employing resources like pdfFiller for seamless document management, you empower yourself to navigate the complexities of bankruptcy proceedings effectively. Using the tools and strategies outlined in this guide, you can approach the Chapter 11 process with confidence, ensuring that every detail is addressed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chapter 11 american tire straight from my smartphone?

How do I fill out the chapter 11 american tire form on my smartphone?

How do I complete chapter 11 american tire on an Android device?

What is chapter 11 american tire?

Who is required to file chapter 11 american tire?

How to fill out chapter 11 american tire?

What is the purpose of chapter 11 american tire?

What information must be reported on chapter 11 american tire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.