Get the free Wv state Tax Dept, 1001 Lee St E, Charleston, WV 25301, US

Get, Create, Make and Sign wv state tax dept

Editing wv state tax dept online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wv state tax dept

How to fill out wv state tax dept

Who needs wv state tax dept?

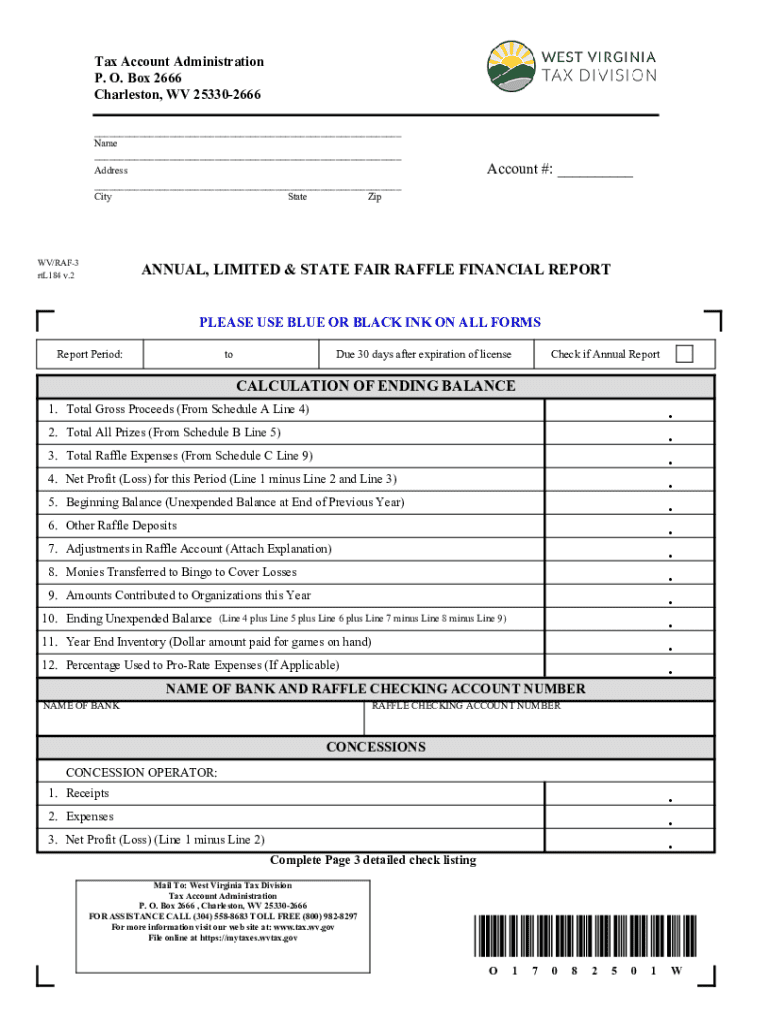

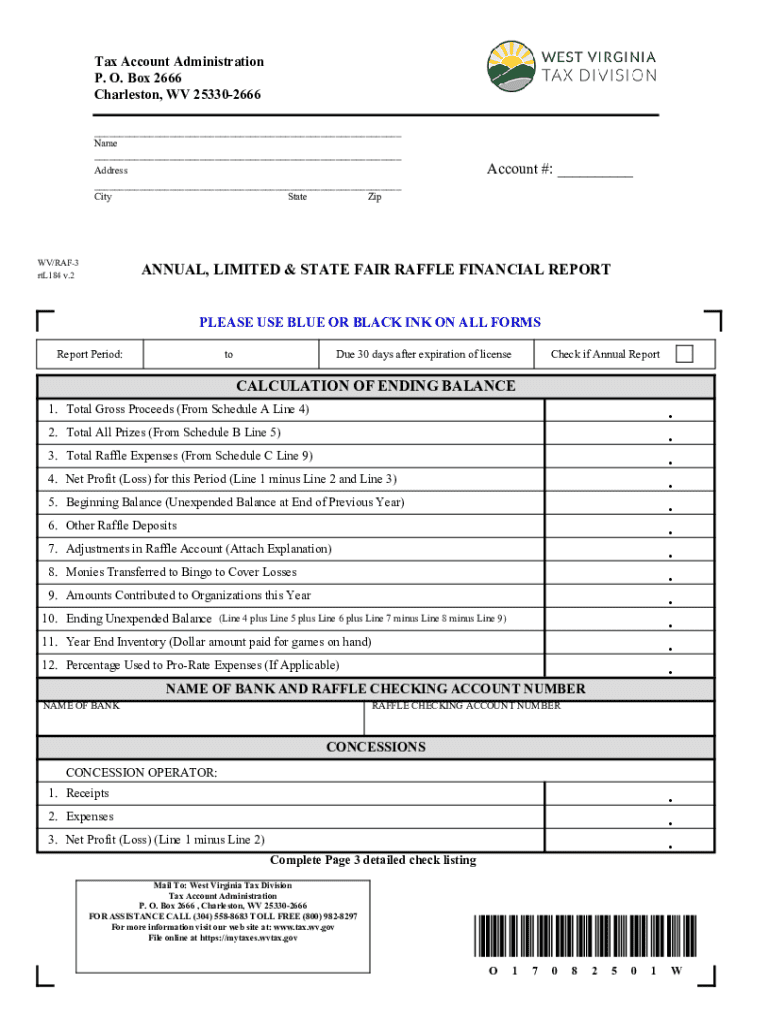

A Comprehensive Guide to West Virginia State Tax Department Forms

Understanding the West Virginia State Tax Department forms

Navigating the intricacies of taxes can be daunting, especially when it comes to understanding the various forms required by the West Virginia State Tax Department. These forms play a critical role in accurately reporting income, calculating taxes owed, and ensuring compliance with state regulations.

The importance of these forms cannot be overstated; failure to complete them correctly can lead to penalties and delays in processing. In West Virginia, tax forms are categorized primarily into three types: income tax forms, business tax forms, and property tax forms.

Identifying key forms for individual tax filers

For individual taxpayers in West Virginia, knowing which forms to utilize is essential. The most common forms for personal income tax are the West Virginia Personal Income Tax Return forms, primarily the WV-IT-140 and WV-IT-140PC. Each of these forms serves specific purposes depending on the income levels and applicable deductions.

Furthermore, individuals may also need to consider local tax forms, which vary by municipality. This can affect the total tax liability based on where the taxpayer resides. It is vital to include all commonly required attachments and schedules, such as federal tax returns and additional schedules, to ensure the completion of the forms is thorough.

Detailed instructions for filling out West Virginia tax forms

Completing the West Virginia income tax return can be simplified by following a systematic approach. Begin by gathering all necessary information, including your identification details, income statements, and any deductions you intend to claim.

Next, accurately fill out the personal information sections, ensuring that names, addresses, and Social Security numbers are correctly entered. After that, focus on calculating your total income, applicable deductions, and tax credits. It's essential to double-check calculations as errors can lead to significant issues.

To minimize common mistakes, consider the following best practices: utilize tax preparation software, verify all entered data, and take advantage of interactive tax calculators that can help clarify your calculations easily.

Electronic filing and signature options

eFiling your WV state tax forms can significantly enhance the efficiency and accuracy of the submission process. With platforms like pdfFiller, users can enjoy an array of benefits, including immediate submission confirmations and reduced processing times.

To eSign your WV state tax forms using pdfFiller, follow these straightforward steps: After completing your forms, navigate to the electronic signature option. Here, you can choose to type, draw, or upload your signature, making the process flexible and user-friendly.

Submitting your West Virginia tax forms

When it comes to submitting your West Virginia tax forms, you have two main options: eFiling, which is encouraged due to its speed, or traditional mail-in submissions. If you choose to eFile, ensure your internet connection is stable to avoid interruptions.

Deadlines for tax submissions are crucial to follow. Typically, individual income tax returns are due by April 15th. Familiarizing yourself with these deadlines can prevent complications or interest charges on late submissions.

After submission, tracking your submission status is important. This can usually be done through the West Virginia State Tax Department’s website, where you can find insights on when your forms were processed and if any additional information is required.

Editing and managing your tax forms with pdfFiller

pdfFiller makes it easy for users to access and edit completed tax forms anytime and anywhere. This flexibility is especially beneficial for individuals who may need to revise their submissions or collaborate with others.

With pdfFiller’s extensive set of features for form management, users can make alterations, add notes, and share documents for review. This capability is particularly useful when working alongside financial advisors or family members during tax preparation.

Troubleshooting common issues with WV tax forms

Encountering issues with your West Virginia tax forms is not uncommon. Common errors include incorrectly entered personal information, which can cause delays in processing. It's vital to double-check names, addresses, and other identifying information on your forms.

Additionally, miscalculations on tax forms can result in overpayment or underpayment scenarios, leading to future complications. If errors are uncovered during the submission process, promptly address and amend them to ensure compliance.

Staying updated on tax law changes in West Virginia

Tax laws can significantly impact how you complete your West Virginia state tax forms. Staying informed about changes is crucial for compliance and optimizing your tax situation. Various resources are available for ongoing tax updates, including newsletters from the West Virginia State Tax Department and dedicated tax blogs.

Understanding the importance of keeping informed will not only aid in tax filing but also enhance financial understanding over time. pdfFiller can further aid in this journey by providing tools that are updated according to the latest changes in tax laws.

Additional support for West Virginia tax filers

For direct assistance, contacting the West Virginia State Tax Department can provide clarity on any tax-related questions or form submissions. They offer a variety of support channels, including phone lines and online resources designed to assist filers.

In addition, pdfFiller offers personalized assistance tailored to your tax document needs. Utilizing these support systems can aid in ensuring a smooth tax filing experience and help address any uncertainties regarding tax forms and submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wv state tax dept to be eSigned by others?

Where do I find wv state tax dept?

Can I edit wv state tax dept on an iOS device?

What is wv state tax dept?

Who is required to file wv state tax dept?

How to fill out wv state tax dept?

What is the purpose of wv state tax dept?

What information must be reported on wv state tax dept?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.