Get the free Choose an RBC Royal Bank mortgage solution for your ...

Get, Create, Make and Sign choose an rbc royal

How to edit choose an rbc royal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out choose an rbc royal

How to fill out choose an rbc royal

Who needs choose an rbc royal?

Choose an RBC Royal Form: A Complete Guide to Your Banking Needs

Understanding RBC Royal Forms

RBC Royal Forms are essential documents used for a variety of banking and financial purposes. These forms facilitate smooth transactions, whether you're opening a personal account or applying for a business loan. Their significance lies in streamlining processes and ensuring that all necessary information is captured accurately. For residents and businesses leveraging RBC's wide array of financial services, understanding how to choose an RBC Royal Form effectively can significantly enhance your banking experience.

In a world where financial literacy is crucial, particularly concerning loans, investments, and business operations, RBC Royal Forms serve as a valuable tool. They not only cater to individual needs but also offer tailored options for business clients, simplifying compliance with various regulatory requirements. Mastering these forms is a fundamental step toward successful banking navigation.

Types of RBC Royal Forms available

RBC provides an extensive range of Royal Forms catering to different financial situations. Understanding these forms can help individuals and businesses choose the appropriate documentation for their needs. Common categories of RBC Royal Forms include:

Each form category comes with unique characteristics designed specifically for that type of transaction, ensuring that all necessary details are captured efficiently.

Selecting the right RBC Royal Form

Choosing the right RBC Royal Form can initially seem daunting, but several factors can simplify this decision. The first consideration should be the type of transaction you intend to carry out. Are you opening a personal account, starting a business, or applying for a loan? Each scenario warrants different forms.

Furthermore, distinguishing between personal and business account requirements is crucial. Personal accounts might focus on basic identification and income verification, while business accounts may require a detailed master client agreement. Specifically, if you're aiming for advisory services related to business financing, you'll need the appropriate forms tailored for those needs.

To aid in your selection, follow this step-by-step guide:

Detailed insights on popular RBC Royal Forms

Each RBC Royal Form is designed for specific uses, making it important to understand their nuances. For instance, personal account setup forms generally require basic personal information and identification proofs. In contrast, business account setup procedures will often request detailed business plans and financial projections to evaluate account applications.

The loan and mortgage application process adds another layer of complexity. These forms demand comprehensive details about your financial situation, such as income, existing debts, and intended loan amounts, to assess your eligibility accurately. Lastly, investment form submissions will require precise information regarding the investment products you wish to utilize and how they align with your financial goals.

It’s essential to recognize the key differences between these forms. For example, personal account forms focus on individual data while business forms require details pertinent to business activities, such as international trade and payments management. Understanding these variations ensures you use the correct form for your needs.

Interactive tools for filling out RBC Royal Forms

pdfFiller offers a suite of interactive tools that simplify the process of filling out RBC Royal Forms. With features such as form editing capabilities, users can make necessary adjustments directly on their documents without hassle. Collaboration tools also allow teams to work together efficiently, ensuring that everyone involved in the form completion can seamlessly contribute.

eSign capabilities further enhance usability by allowing users to sign forms electronically. This is particularly advantageous for businesses needing swift approvals without the delay of physical signatures. Understanding how to use these tools effectively can save time and mitigate errors during the form-filling process.

Step-by-step guide to filling out RBC Royal Forms

Filling out an RBC Royal Form involves several crucial steps to ensure accuracy. Start by gathering all necessary personal or business information you might need. This includes identification documents, proof of income, and any specific details related to services you're applying for, like agricultural loans or business chequing account features.

Once you've prepared your information, begin filling out the form, paying close attention to each field. Failure to provide complete information may lead to delays. Common mistakes to avoid include leaving fields incomplete, misrepresenting information, or misunderstanding the requirements of the form. Take your time to review all entries for accuracy before submission.

Editing and customizing RBC Royal Forms

With pdfFiller, users can edit existing RBC Royal Forms easily. This means you aren't constrained to using a static document; instead, you can modify forms to fit specific needs or correct any mistakes. Customization is especially beneficial for businesses, allowing the creation of tailored service materials and forms to suit various advisory services.

Once you've made your edits, consider saving your customized forms for future use. pdfFiller offers multiple sharing options, enabling efficient document management and collaborative opportunities. This feature proves invaluable when sending forms to solicitors or team members for further input.

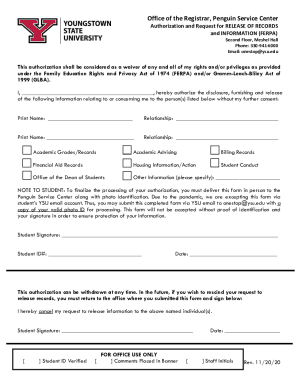

Signing RBC Royal Forms

Understanding eSigning is crucial for modern banking transactions. eSigned documents carry the same legal weight as their handwritten counterparts, making them a viable option for personal and business purposes. To sign a form using pdfFiller, follow a simple series of steps: select your document, apply your signature digitally, and save the changes.

To ensure your document is legally binding, familiarize yourself with the requirements surrounding eSignatures in your jurisdiction. This step is particularly vital for business documents that may require adherence to various legal frameworks.

Managing and storing your RBC Royal Forms

Effective document management is essential for handling completed RBC Royal Forms. Best practices include maintaining an organized filing system—digitally in pdfFiller, for instance— to simplify access when needed. Keep completed forms secured, ensuring sensitive personal or business information is protected.

Utilizing pdfFiller's storage capabilities allows users to categorize documents effectively, which is crucial for businesses managing a range of forms, from business account overviews to loan applications. A well-organized system soars in efficiency and reduces stress when retrieving necessary documents.

Frequently asked questions (FAQs) about RBC Royal Forms

Understanding RBC Royal Forms can lead to many inquiries. Common questions revolve around the specific information needed to complete forms or how to correct errors found post-submission. Experts recommend comprehensive research or seeking advice from financial professionals when navigating complexities related to loans, investments, or business operational documentation.

Furthermore, consulting with a solicitor during major applications can provide clarity on required service materials and compliance regulations, particularly for business clients handling intricate financing or tax purposes.

What's new in RBC Royal Forms

Staying informed about the latest updates to RBC Royal Forms is essential for maximizing their utility. Recent enhancements often include procedural changes or new features that can simplify form completion and processing. For instance, any recent updates regarding agriculture loans or changes in business account requirements should be closely monitored.

Always keep an eye on key dates or deadlines associated with these forms, ensuring that you remain compliant and avoid missed opportunities in business ventures or personal investments.

Legal terms and conditions related to RBC Forms

When using RBC Royal Forms, understanding the associated legal terms and conditions is vital. Each form may come with specific requirements regarding compliance, ensuring that you align with regulatory standards, especially in business environments. Consulting service materials provided by RBC can offer valuable insights into adhering to these regulations.

To guarantee your compliance when using these forms, familiarize yourself with the legal landscape surrounding financial transactions. Effective management of legal documents, along with sound advice from professionals, will serve to safeguard your interests during financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit choose an rbc royal on a smartphone?

Can I edit choose an rbc royal on an iOS device?

How do I fill out choose an rbc royal on an Android device?

What is choose an rbc royal?

Who is required to file choose an rbc royal?

How to fill out choose an rbc royal?

What is the purpose of choose an rbc royal?

What information must be reported on choose an rbc royal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.