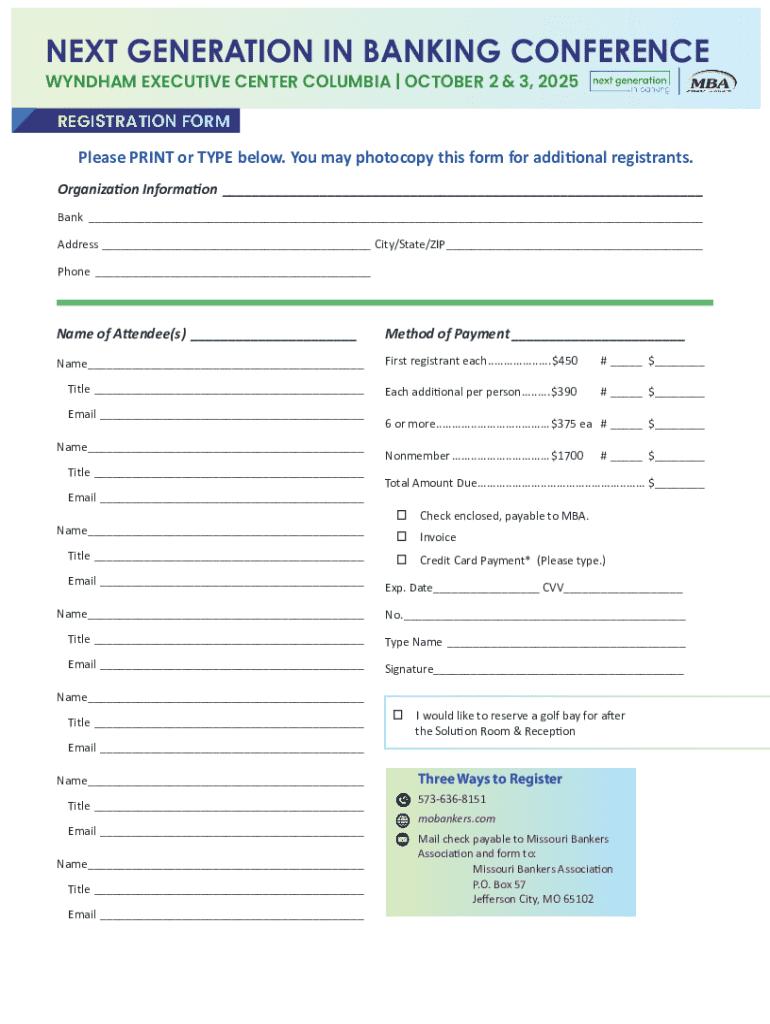

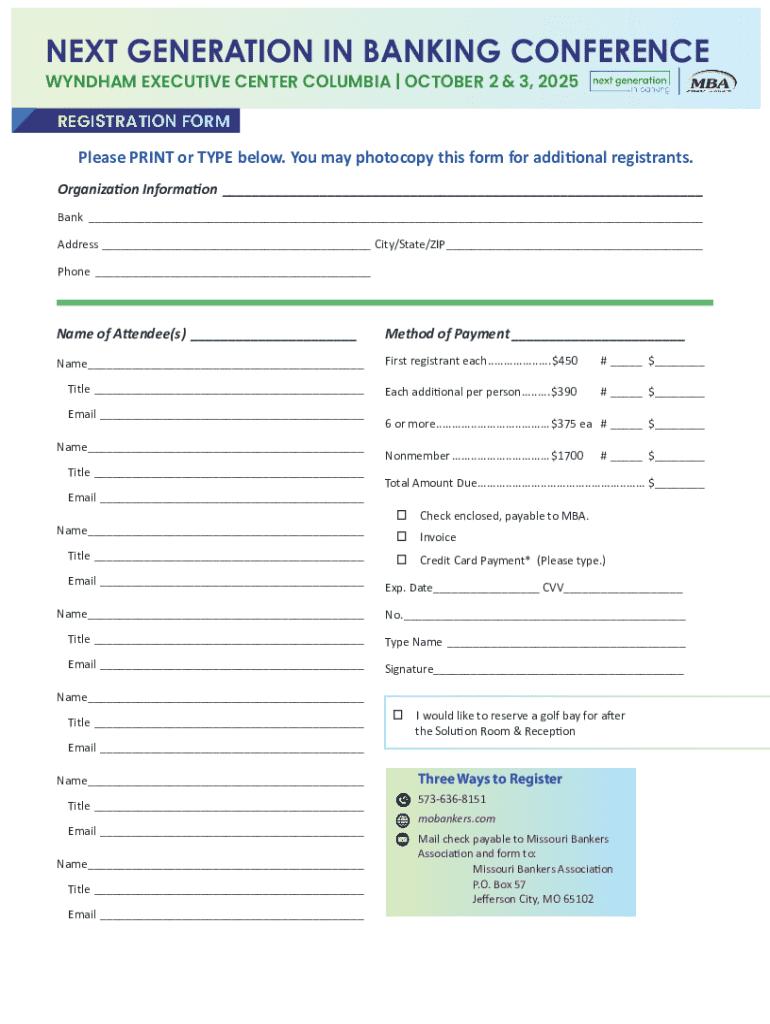

Get the free Next Generation in Banking

Get, Create, Make and Sign next generation in banking

How to edit next generation in banking online

Uncompromising security for your PDF editing and eSignature needs

Next generation in banking form

Understanding the next generation in banking

Next generation banking indicates a significant shift in how financial services are offered and consumed. This transformation is characterized by the integration of advanced technologies like AI, blockchain, and mobile platforms that create more personalized, efficient, and user-friendly banking experiences.

Key features of this transformation include enhanced security measures, improved customer service through automation, and a broader range of financial products presented in an easily accessible manner. The importance of digital transformation, therefore, cannot be understated; it's crucial for banks looking to remain competitive in an increasingly tech-savvy marketplace.

Core innovations driving next generation banking

Several core innovations are propelling the next generation in banking form, heavily influencing how consumers interact with their financial institutions. These innovations are not just trends but are reshaping the fundamental operations of banks worldwide.

Digital banking platforms

Digital banking platforms offer seamless user experiences across a variety of devices, making banking accessible from anywhere at any time. These platforms integrate various services — from checking accounts to loan applications — into a single interface, thus eliminating the need for customers to navigate multiple sites or apps.

AI and machine learning applications

AI and machine learning enhance the personalization of financial services, providing recommendations based on customer behavior. Automatic customer service solutions powered by AI resolve queries efficiently, while machine learning algorithms can detect fraudulent activities by analyzing transaction patterns in real-time.

Blockchain and cryptocurrency

Blockchain technology plays a significant role in enhancing transaction speed and security, providing a decentralized, transparent ledger that reduces fraud. The evolving landscape of digital currencies allows for quicker payments and lower costs, increasing adoption among users seeking streamlined financial transactions.

Customer-centric approaches in next generation banking

A customer-centric approach is essential for banks looking to thrive in the next generation of banking. This requires continual engagement with customers to understand their needs and preferences deeply.

Enhancing the customer experience

User feedback is invaluable in product design, helping banks craft services that genuinely resonate with their customers. Tools and technologies designed for improved onboarding processes, such as interactive guides and video tutorials, ensure users can navigate banking services effectively and confidently.

Omnichannel interactions

To provide consistent experiences across platforms, it's critical to strategize for omnichannel engagement. Mobile banking is particularly vital, as it fuels greater customer interaction, allowing users to manage their finances seamlessly through their smartphones.

Regulatory considerations and compliance

Navigating the regulatory landscape is complex for next generation banks, especially with ongoing advancements in technology. Understanding regulations affecting banking operations is essential for compliance while fostering innovation.

Adapting to compliance requirements involves investing in data protection solutions that safeguard customer information. With heightened scrutiny on data practices, banks must prioritize privacy as a fundamental aspect of their digital services.

Unlocking new business models

To stay competitive, banks are exploring innovative business models, notably subscription-based banking services. By transitioning from traditional fee structures to subscription models, banks can offer predictable billing, which enhances consumer satisfaction and fosters loyalty.

Partnering with FinTechs

Collaborations with FinTech companies can greatly enhance service offerings and widen market reach. Successful partnerships often involve leveraging FinTech solutions for efficient payment processing or customer verification, providing a win-win scenario for both parties involved.

Evolving role of traditional banks

Traditional banks face the challenge of adapting to remain relevant in this dynamic environment. By leveraging existing customer bases and introducing new services, they can capitalize on their established trustworthiness while integrating modern solutions.

Balancing legacy operations with innovative practices is vital. Banks must emphasize digital solutions without alienating customers who prefer traditional services, ensuring a comprehensive approach that embraces both worlds.

Tools and resources for effective banking management

To effectively manage the next generation in banking form, it's essential to integrate reliable tools. Document management solutions are key, with electronic signatures and document management negating the need for paper transactions.

Document management solutions

Using platforms like pdfFiller helps streamline this process. With capabilities to edit, sign, and collaborate on essential documents, banks can ensure compliance and enhance customer satisfaction. Specific forms such as loan applications, account management documents, and investment requests can all be managed efficiently within this digital framework.

Interactive tools for better decision making

Data analytics tools are invaluable, providing strategic insights into customer behavior and preferences. This intelligence allows banks to map customer journeys and dial into their evolving needs, fostering an environment of continuous improvement in service design.

Future trends in banking

Looking to the decade ahead, several emerging technologies are likely to impact banking significantly. Blockchain advancements, AI-driven analytics, and further automation of customer services promise to reshape how financial services are delivered.

Banks must remain agile and ready to adapt to future changes in consumer behaviors and expectations. This adaptability will require not only technological investments but also a commitment to continuous learning and innovation.

Redefining success metrics

As banks evolve, traditional success metrics must also be reevaluated. Emphasizing customer satisfaction and engagement as primary performance indicators is crucial to assess the effectiveness of next generation banking initiatives.

Utilizing data-driven insights will enable banks to analyze how well they meet customer needs and make necessary adjustments to their offerings, ultimately driving growth and retention.

Preparing for the next generation in banking

To effectively prepare for the next generation in banking form, individuals and teams must have a roadmap that includes thorough training and development programs. Understanding the technological landscape and customer needs will be foundational in this endeavor.

Creating a culture of innovation within banking institutions will encourage the exploration of new ideas and practices, leading to improved service delivery and operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send next generation in banking to be eSigned by others?

How do I make changes in next generation in banking?

Can I create an electronic signature for signing my next generation in banking in Gmail?

What is next generation in banking?

Who is required to file next generation in banking?

How to fill out next generation in banking?

What is the purpose of next generation in banking?

What information must be reported on next generation in banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.