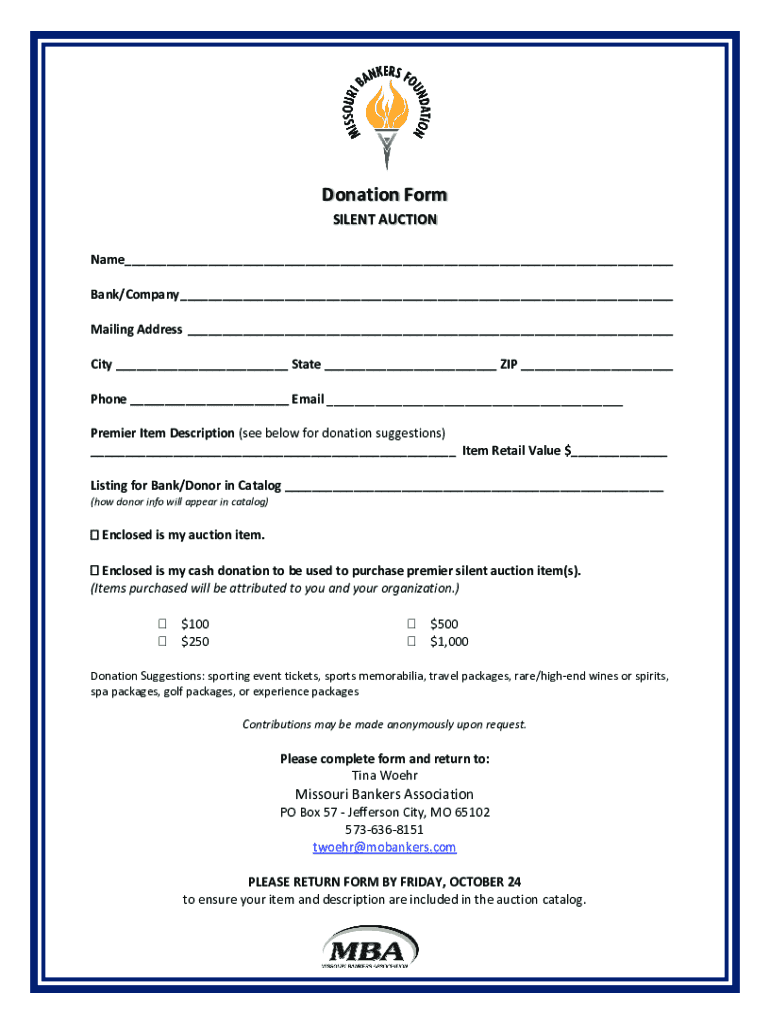

Get the free Bank/Company

Get, Create, Make and Sign bankcompany

How to edit bankcompany online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bankcompany

How to fill out bankcompany

Who needs bankcompany?

Your Comprehensive Guide to the Bank Company Form

Understanding the Bank Company Form

The bank company form is a critical document that companies and organizations must complete to establish or manage their banking services. Essentially, it serves as a formal request for banking institutions to recognize a company’s financial operations and grant access to various banking services, including account openings, loans, and transactions. The purpose of the bank company form extends beyond simple identification; it encapsulates vital information that ensures smooth operational functionality and compliance with regulatory requirements.

Accurate completion of the bank company form is paramount. Incomplete or incorrect entries can lead to transaction failures, legal repercussions, and even financial losses. For example, if an authorized signatory's name is misspelled, it may result in delays or denied access to essential services. Consequently, companies are advised to treat this form with utmost diligence as it plays a foundational role in their banking relationships.

Common uses of the bank company form vary widely. From startups needing an operating account to established firms changing bank affiliations, this document is pivotal. Additionally, it is frequently utilized during audits, compliance reviews, and for setting up merchant accounts, which highlights its versatile nature within the financial landscape.

Key components of the bank company form

The bank company form is structured into several essential sections that collect different types of information. Firstly, the company information section captures the basic details of the business, including its registered name, address, phone number, and business identifier. This data ensures that banks can accurately verify the company's legitimacy and track its financial activities.

The second significant segment is the bank information, where the specific banking institution's name, address, and contact numbers are documented. This is critical for establishing clear communication channels between the bank and the business. Following that comes the account details section, where the type of account being requested and specific requirements such as initial deposit amounts are listed. Lastly, the authorized signatories section identifies individuals authorized to conduct transactions on behalf of the company, underscoring the importance of trust and verification in banking relationships.

Step-by-step guide to filling out the bank company form

Filling out the bank company form can seem daunting, but breaking it down into manageable steps can simplify the process significantly. The first step is to gather all required information, including the company’s legal documents, tax identification number, and any previous banking details if applicable. Having everything organized not only saves time but also minimizes the chance of errors.

In the second step, you need to complete the company information section with accuracy. Ensure that the company's legal name is spelled correctly and that all other details match the registered documents. A common mistake here is the omission of an essential piece of information, which can delay processing. It's crucial to cross-check and verify entries before proceeding.

The third step involves filling in the bank information. Identify the branch of the bank where you wish to establish an account and include its correct name and address. This information can typically be found on the bank’s official website or through direct communication with the bank. Verification is essential to avoid future complications.

Step four focuses on specifying account details, where different account types, such as checking or savings accounts, come into play. Understanding the distinctions between these account types can help in selecting the best fit for your company’s needs. For instance, businesses involved in frequent transactions may prefer a checking account, while those saving for future needs might opt for a savings account.

Next is the designation of authorized signatories. Select individuals with the legal authority and responsibility to conduct banking transactions on behalf of the company. This can include company executives or financial officers. Proper authorization is not just a mere procedural formality; it underscores the integrity of the financial process and safeguards against unauthorized transactions.

Finally, in step six, you should review and finalize your form. A thorough proofreading checklist can assist in confirming that all entries are correct. Pay close attention to clarity and legibility, as well-written forms expedite processing and minimize friction with banking institutions.

Utilizing interactive tools for enhanced experience

In an age where efficiency is paramount, leveraging interactive tools like pdfFiller can drastically enhance the experience of working with the bank company form. With pdfFiller’s document editing capabilities, users can easily fill out, sign, and share their completed forms without the hassle of printing or scanning. This not only streamlines the process but also ensures that you have access to your documents from any location.

To edit a form on pdfFiller, simply upload the document, and use the easy-to-navigate editing tools to fill in your information. Signing documents has never been simpler; you can electronically sign your forms without needing to be physically present. Furthermore, pdfFiller supports sharing options, allowing users to send the completed bank company form directly to relevant parties via email or download it in multiple formats. The utility of this cloud-based solution in document management is immense, ensuring you never misplace critical forms again.

Common challenges and solutions

Filling out a bank company form is not without challenges. One common issue is identifying frequent errors such as incorrect company names, missing signatures, or inaccurate account details that can lead to unnecessary delays. Tips to mitigate these challenges include double-checking entries, ensuring all required fields are completed, and consulting with a colleague for an additional layer of review.

Should you encounter obstacles in the process, contacting bank support can prove invaluable. Many banks offer helplines or online chat services dedicated to answering questions regarding form completion. Additionally, keeping abreast of relevant notification requirements during the application process can reduce uncertainty and add to your confidence.

Managing your completed bank company form

Once you’ve finalized your bank company form, managing it effectively becomes paramount. Storing and accessing completed forms safely in the cloud ensures that you have retrievable copies whenever needed. This method offers several benefits, including easy retrieval, enhanced collaboration, and robust backup options. Cloud technologies provide security features that protect sensitive information from unauthorized access, adding a layer of safety to your document management.

Best practices for collaborating with team members include using shared folders in cloud storage environments like pdfFiller. This allows multiple authorized users to access, review, and edit documents collectively, promoting an efficient workflow and reducing confusion over document versions. Such collaborative efforts can significantly streamline financial operations, ensuring everyone is on the same page concerning banking activities.

FAQ about the bank company form

Questions often arise about the submission and compliance aspects of the bank company form. One common inquiry is regarding the timeline for processing. Typically, banking institutions will inform applicants about the status of their submissions within a few business days; however, more complex requests may take longer. Companies should factor in this lead time when managing their banking needs.

Additionally, firms might seek clarification on tax and legal implications when utilizing the bank company form. It’s essential to consult with financial or legal advisors who understand local regulations. This ensures that the organization abides by stipulated laws and avoids any complications that could impair operational stability in the long term.

Feedback and support

User feedback plays a vital role in enhancing the experience of utilizing the bank company form. If you've used the form through pdfFiller, your insights can help improve functionalities and address gaps. Engaging with customer support is equally important, as responsive support teams can assist with technical issues or onboarding new users to the document management system.

User testimonials

Real-life experiences highlight the efficiency of using the bank company form. Many users report quick processing and approval through pdfFiller, enabling them to establish accounts rapidly without the traditional lag associated with paperwork. These success stories not only reinforce the value of digital solutions but also illustrate how modern businesses can streamline their operations and enhance collaboration amongst team members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit bankcompany online?

How do I make edits in bankcompany without leaving Chrome?

Can I edit bankcompany on an Android device?

What is bankcompany?

Who is required to file bankcompany?

How to fill out bankcompany?

What is the purpose of bankcompany?

What information must be reported on bankcompany?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.