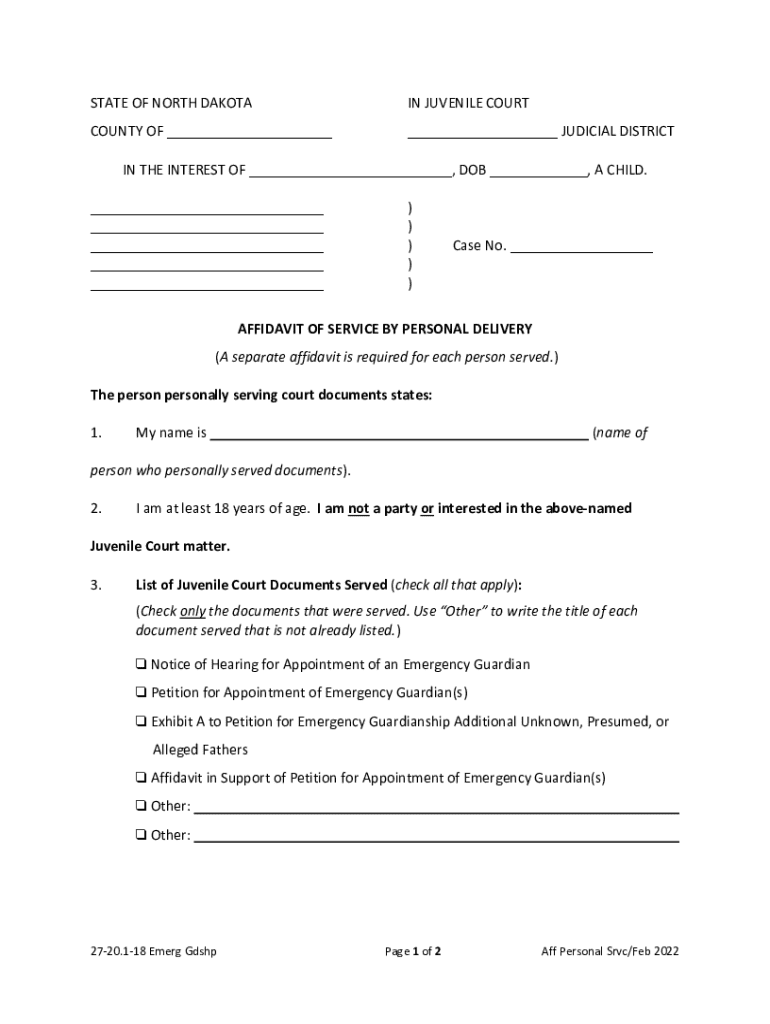

Get the free IN INTEREST OF R. H262 N.W.2d 719N.D.Judgment

Get, Create, Make and Sign in interest of r

How to edit in interest of r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in interest of r

How to fill out in interest of r

Who needs in interest of r?

How-to Guide for Filling Out, Editing, Signing, and Managing the R Form

Understanding the R Form: Key Insights

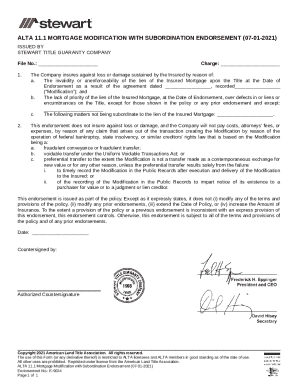

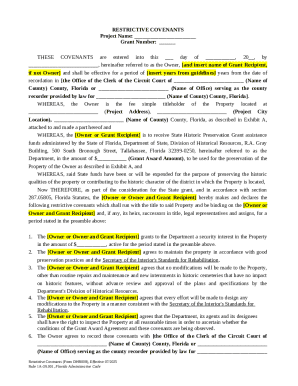

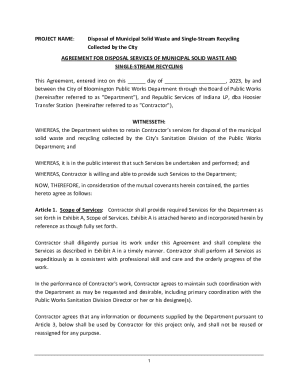

The R Form is a critical component in managing various financial and tax-related documents. Often associated with interest income or investments, this form collects vital information necessary for accurate reporting and compliance. Understanding the intricacies of the R Form can significantly enhance your document management efficiency.

For individuals and teams alike, utilizing the R Form correctly is essential. It serves not just as a tax form but as a conduit for financial transparency and confidence, ensuring that everyone involved has access to crucial interests related to cash accounts.

Step-by-Step Guide to Completing the R Form

Filling out the R Form can seem daunting, but breaking it down into manageable steps can ease the process. Here’s a comprehensive approach to ensuring your R Form is filled out accurately and efficiently.

Gathering necessary information

To start, gather all necessary documents required to fill out the R Form. These may include financial statements, previous tax filings, and any documents related to interest income or investments. Aim to have all information on hand to streamline the process.

Common sources for obtaining this information include bank statements, financial institutions, and accounting software. Make sure that the details collected are accurate to avoid complications later. Consider setting up a checklist to ensure completeness.

Filling out the R Form

When you start filling out the R Form, take it section by section to avoid confusion. The initial section will typically require personal information, including your name and social security number. Following that, you’ll need to complete sections regarding financial details like interest income and any relevant deductions or credits.

Don’t forget the additional remarks or notes section. It’s a space where you can provide explanations for any outstanding details. Common pitfalls include leaving sections blank or miscalculating figures, so ensure to double-check your entries for correctness.

Reviewing your R Form for accuracy

Once you have completed the R Form, it’s crucial to review it meticulously. Establishing a checklist to verify the information can be beneficial. Double-check figures against your collected documents to ensure consistency.

Pay specific attention to math errors that could lead to discrepancies in tax reporting or financial assessments. Look for common errors, such as transposing numbers or omitting required fields, to enhance accuracy before submission.

Editing and customizing the R Form

Using pdfFiller’s editing tools makes editing the R Form simple and efficient. The platform offers a range of text editing features that allow you to amend sections quickly. For additional clarity, you can add annotations or comments to provide more context as needed.

In some cases, you may need to reorder sections for better flow or user understanding. pdfFiller provides straightforward techniques to drag and drop sections, ensuring that your final document is clear and easy to navigate.

How to sign the R Form electronically

In today’s digital world, electronic signatures are increasingly vital for streamlining document processing. The eSigning process on pdfFiller is straightforward. Navigate to the signature option, where you can insert your eSignature easily, ensuring the document is both legally binding and secure.

It’s important to adhere to best practices when collecting signatures from other parties. Always inform signers about the document’s purpose and ensure they understand the implications of their agreement to maintain transparency and confidence in the process.

Managing and storing your R Form

Once your R Form is complete and signed, securing it becomes paramount. Options for cloud storage are numerous, and pdfFiller provides robust management tools for safely saving and organizing your document. This not only protects the integrity of your form but also facilitates easy access whenever necessary.

Organizing your documents in structured folders can significantly improve efficiency. Implementing a tagging and categorizing system will simplify retrieval, ensuring that you can always find the R Form when required.

Common issues and troubleshooting tips

Like any document, users may encounter common problems with the R Form. If you lose the form, it’s essential to create a backup and know the steps to recover necessary details from your source documents.

Additionally, if discrepancies arise in the information provided, it’s important to have a methodical approach to resolving them. Using your checklist to confirm original sources can streamline this process and enhance accuracy.

Best practices for handling the R Form

To ensure compliance and accuracy when handling the R Form, establish a routine for regular maintenance of your documents. Keeping records up to date will save future headaches and improve overall document management.

For teams using pdfFiller collaboratively, developing strategies for collective input and reviews can enhance the effectiveness of R Form processing. Frequent discussions around any updates or changes in financial reporting can improve understanding and accuracy across the team.

Leveraging interactive tools on pdfFiller

Engaging with pdfFiller’s interactive features can significantly aid in managing the R Form. The platform provides templates specifically designed for the R Form, streamlining the entire creation process.

Examples of use cases illustrate the value of these tools. Individuals and teams can customize forms for specific needs, enhancing efficiency and allowing for a more tailored approach to document management.

Conclusion: Making the most out of your R Form experience

The R Form is more than just a document; it’s a vital tool for financial reporting and personal record-keeping. By following this guide, you can take full advantage of the functionalities available through pdfFiller, ensuring that your document management is seamless and efficient.

Looking ahead, consider implementing ongoing improvements in your document management processes using the features available in pdfFiller. Embrace new technologies and strategies to continuously refine how you handle forms, leading to enhanced productivity and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in interest of r for eSignature?

How do I edit in interest of r in Chrome?

How do I complete in interest of r on an Android device?

What is in interest of r?

Who is required to file in interest of r?

How to fill out in interest of r?

What is the purpose of in interest of r?

What information must be reported on in interest of r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.