Get the free Claim Payment Inquiry Resolution Process Guide

Get, Create, Make and Sign claim payment inquiry resolution

Editing claim payment inquiry resolution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim payment inquiry resolution

How to fill out claim payment inquiry resolution

Who needs claim payment inquiry resolution?

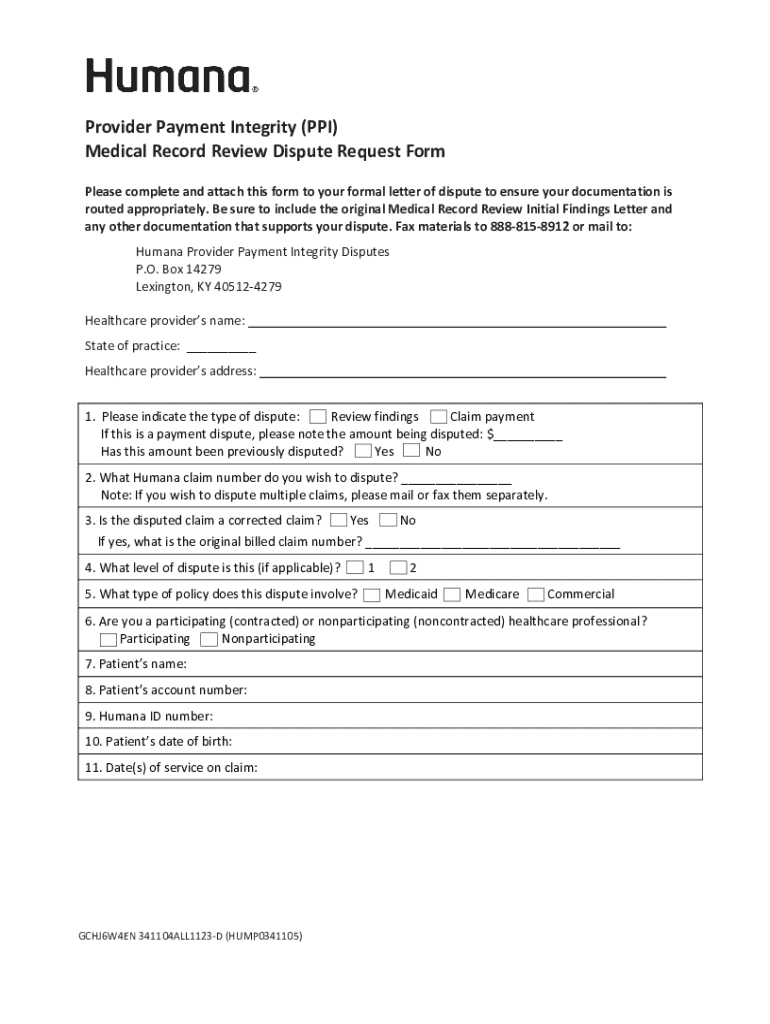

Claim Payment Inquiry Resolution Form: Comprehensive Guide

Understanding claim payment inquiry resolutions

A claim payment inquiry typically arises when there are uncertainties or disputes regarding payments made by insurance companies or other financial institutions. This inquiry serves to clarify the status of a claim, helping individuals or businesses understand why a payment may be delayed, denied, or lower than expected.

Common scenarios requiring inquiries include late payments without explanation, discrepancies in payment amounts, or claims that have been unjustly denied. The importance of timely resolution cannot be understated as delayed payments can have significant repercussions for both individuals and businesses. This could mean extended financial strain, lost opportunities, or adverse effects on business operations.

Preparing for your claim payment inquiry

Preparation is key when it comes to a successful claim payment inquiry. Gather all essential documentation related to your claim. This includes the original claims filed, correspondence with the insurance company, payment notifications, and policy documents. Organizing this paperwork can save time and effort during the inquiry process.

When establishing your case to include in the claim payment inquiry resolution form, be concise but thorough. Clearly articulate your understanding of the claim process, the specific issues at hand, and refer to your documentation clearly. Effective communication strategies include keeping your language direct and using bullet points to highlight key facts.

How to complete the claim payment inquiry resolution form

Completing your claim payment inquiry resolution form does not have to be a daunting task. Begin with the personal information section, ensuring accuracy while providing your name, contact number, and policy number, as any discrepancies can lead to further delays.

Moving on to the claim details section, provide the specifics: what the claim is for, the amount expected, and the payment received if any. In the supporting evidence portion, reference each document you have gathered that backs your claim. Be organized and systematic, as this will expedite the resolution process.

Be mindful of common mistakes, such as omitting critical information or failing to maintain a consistent narrative across sections. Utilize available features on pdfFiller that streamline the form-filling process, including auto-fill options, collaboration tools, and document management solutions.

Submitting your inquiry form

Once your claim payment inquiry resolution form is complete, the next step is submission. You can submit your form online through the pdfFiller platform for immediate processing, or use alternative methods like email or traditional mail. Make sure to keep copies of everything you send.

Confirmation of submission is crucial for tracking the status of your inquiry. With pdfFiller, you can easily check on your submission status, ensuring peace of mind as you await feedback. Timelines for feedback can vary, but maintaining a proactive approach ensures you stay informed.

Monitoring your claim payment inquiry status

After submission, it’s essential to know what to expect. The claims processing timeline typically involves a review period, during which the reviewing authority may contact you for clarification or additional documentation. Common stages in the inquiry process can include initial acknowledgment, thorough investigation, and final resolution.

Follow-up strategies are integral to staying updated on your inquiry’s status. Typically, it’s advisable to wait for a set timeframe before following up,—usually between one to two weeks. When doing so, contact the claims department directly using established communication lines for a succinct and straightforward inquiry.

Handling potential disputes and appeals

Disputes may arise during the claim resolution process, often stemming from misunderstandings or disagreements regarding payment amounts or claims validity. Understanding what constitutes a dispute is essential for addressing issues effectively. Knowing how to escalate disputes through the proper channels can ensure that your concerns are formally acknowledged.

Filing an appeal may be necessary if you are unsatisfied with the outcome of your inquiry. Follow a clear step-by-step guide to gather your documents, articulate your reasons for the appeal, and submit it timely. Document your case thoroughly, maintaining records of communication and any decisions made.

Payment integrity and resolution strategies

Ensuring integrity in claim processes is paramount for both insurers and policyholders. It's essential to adhere to principles of payment integrity to minimize discrepancies. Familiarize yourself with the compliance requirements that govern claims processing to ensure your claims are handled efficiently.

For effective resolution strategies, negotiating or resolving disputes amicably is often the best course of action. Approach discussions with a clear understanding of your rights, and document all conversations and agreements. This documentation serves a dual purpose: it strengthens your case and aids in future claim processes.

Case studies and real-world examples

Successful claim payments often hinge on effective usage of tools like pdfFiller. Numerous users have reported favorable outcomes after diligently following submission protocols and utilizing the platform's features for document management. Their testimonials underscore the benefits of having a centralized platform for claim submissions.

However, there are pitfalls to avoid as well. Common mistakes range from incomplete documentation to miscommunication with the claims department. Learning from the experiences of others can provide valuable insights on how to navigate the resolution process effectively.

Enhancing your document management skills

Leveraging pdfFiller's features can revolutionize your approach to document management. Advanced editing options provide you with the ability to make real-time changes, while collaboration tools simplify team submissions. eSigning functionality enhances security and streamlines the signing process, ensuring that your documents are always ready for submission.

To maintain best practices for future claim submissions, develop proactive document organization techniques. Templates can be particularly effective for recurring inquiries, allowing you to streamline your submissions while ensuring that you include all necessary information right from the start.

Conclusion and next steps after resolution

After your inquiry is resolved, engage with any further claim-related actions as necessary. Maintain a transparent record of all communications and outcomes for future reference. Whether or not further action is needed, being well-organized can significantly ease the stress of future inquiries.

Ultimately, the claim payment inquiry resolution process should empower users to navigate their financial dealings with confidence, armed with the tools and knowledge necessary for success. Embrace the capabilities of pdfFiller, and make document management an effortless part of your experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete claim payment inquiry resolution online?

How do I edit claim payment inquiry resolution in Chrome?

Can I create an eSignature for the claim payment inquiry resolution in Gmail?

What is claim payment inquiry resolution?

Who is required to file claim payment inquiry resolution?

How to fill out claim payment inquiry resolution?

What is the purpose of claim payment inquiry resolution?

What information must be reported on claim payment inquiry resolution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.