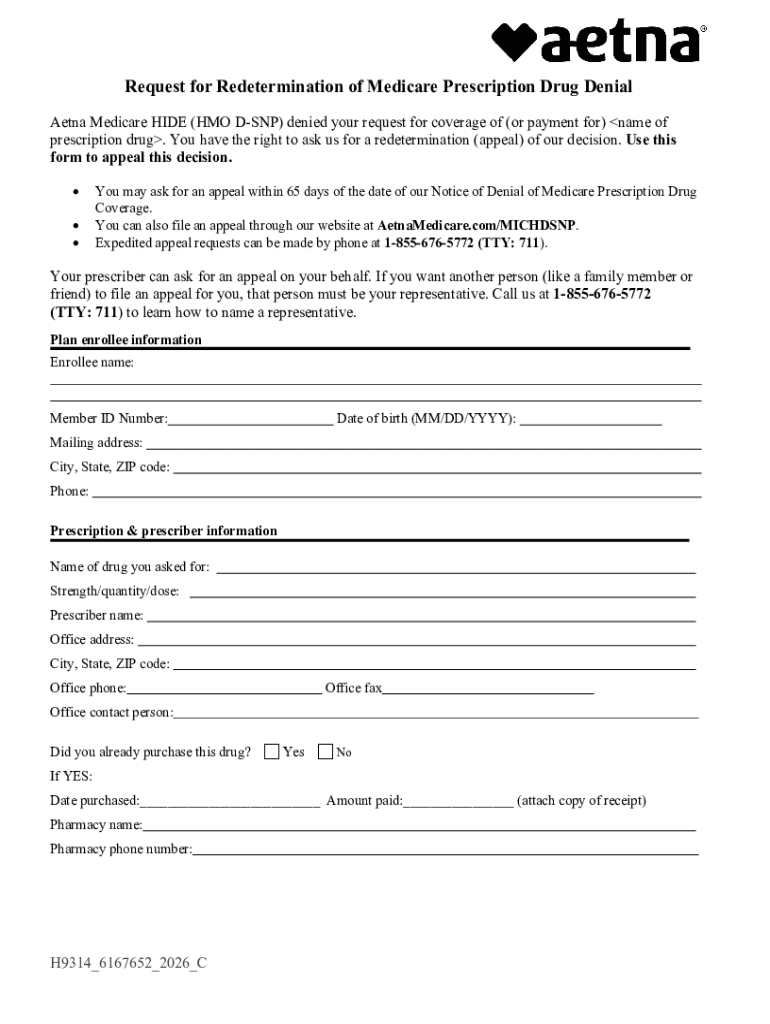

Get the free What to Do If Medicare Denies Coverage for Prescription ...

Get, Create, Make and Sign what to do if

Editing what to do if online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what to do if

How to fill out what to do if

Who needs what to do if?

What to do if form [] is missing or incorrect

Understanding Form []

Form [X] serves as a crucial document that provides essential information necessary for various purposes, such as filing taxes or making informed decisions during financial processes. This form may pertain to multiple sectors, but its primary goal remains consistent: to ensure accuracy and clarity in financial reporting and obligations. The significance of having Form [X] correctly filled out cannot be overstated; it serves as the backbone for your filings and can impact significant financial aspects.

When dealing with tax documents, for instance, Form [X] becomes vital to ensure that your income tax return is accurate, which influences tax calculations and ultimately your financial health. Moreover, an incorrect or missing form can lead to delays, penalties, and a complicated filing process.

Identifying the issue

Recognizing that you may not have received Form [X] is the first step in addressing the problem. Look for specific signs, such as discrepancies in your income reporting, missing details during tax filing season, or reminders from your employer regarding document submissions. Often, individuals identify the missing piece when they attempt to file their income tax return and realize vital components are missing. Common causes for not receiving Form [X] include an oversight by your employer, mailing errors that prevent delivery, or issues with electronic distribution, where forms meant to be sent via email may end up in spam folders or not sent at all.

Immediate steps to take

Once you've confirmed the issue with Form [X], immediate action is necessary. Contacting your employer is often the best first step. Approach your HR or payroll department professionally, and clearly explain the issue with your missing form. A useful strategy is to prepare relevant questions that can help expedite the retrieval process, such as asking if there were any distribution issues or when the forms were initially sent out.

In addition to reaching out directly, checking online resources can also save time. Many employers use payroll systems where employees can log in to access their documentation. This provides not only a quick remedy if the form is available but also a historical record of your documents that may be useful for future reference.

What to do if you didn’t receive Form []

If direct contact with your employer does not yield results, follow these key steps. Begin by documenting all your attempts to retrieve Form [X]. Having a clear record will assist in following up and, if necessary, in escalating the issue to higher management or regulatory bodies. Utilizing electronic copies or accessing online accounts for historical documents is key as well. In instances where you cannot obtain the form, look into options such as using estimates based on prior years or your current income records.

If Form [X] remains unavailable, alternatives might include gathering recent pay stubs or tax documents, which can provide sufficient information for completing your obligations. Developing a solid understanding of your finances will not only aid in filling out necessary forms but prepare you for interactions with tax authorities or financial bodies.

Understanding your rights

Under federal and state regulations, employers bear legal obligations concerning the distribution of important documents such as Form [X]. Ensuring that employees receive these documents in a timely manner is part of their responsibilities, and failure to comply can lead to penalties for the company. If you find yourself unable to resolve the issue directly with your employer, you may need to file a complaint with relevant regulatory agencies. Familiarize yourself with the process for submitting formal complaints to bodies such as the Department of Labor or IRS, and keep records of all communication to support your case.

Filing taxes without Form []

Filing taxes can be a daunting task, particularly when you are faced with a missing Form [X]. However, it is vital to know that you have options available for this situation. Using estimated information related to your income can be a prudent alternative. In the absence of the actual form, gather documentation such as pay stubs or invoices that can provide an accurate estimate of your earnings.

While filing without Form [X] might seem straightforward, be aware of the potential implications. If the IRS or tax authority investigates, having to explain why you did not include the actual document can lead to delays or even penalties. To avoid complications, you might consider submitting a request for an extension during tax season if you believe needing more time will help secure the absent form.

What to do if you receive an incorrect Form []

Upon receiving Form [X] that contains incorrect information, it’s crucial to act quickly to rectify the issue. Contact the issuer promptly to request corrections and provide necessary evidence or documentation to back up your claims. Often, discrepancies arise from basic clerical errors, and most issuers will be willing to correct these with proper communication.

Once the corrections are confirmed, ensure you receive a revised version of Form [X] and resubmit the accurate information promptly. An incorrect form can significantly affect your financial documentation, leading not only to reporting errors but potentially affecting your overall financial standing.

Tracking and managing your forms

Managing financial documents efficiently can ease the process of tracking forms such as Form [X]. Implementing tools provided by pdfFiller for tracking forms and signatures can simplify your documentation process. By utilizing a centralized document management system, you can keep critical forms organized and accessible from anywhere. Properly categorized folders and well-labeled files can prevent future discrepancies.

Aside from using pdfFiller for electronic management, consider developing a routine for monitoring the distribution and status of your forms each tax season. Set reminders for important dates related to the distribution of forms, and regularly check in with your employer or relevant parties to confirm that you are on track.

FAQs about Form []

When navigating issues related to Form [X], common questions often arise. Many individuals wonder what steps to take if their employer does not respond or if they are uncertain about the legalities surrounding unpaid obligations for forms. This section aims to clarify misconceptions about Form [X] and guide you through quick answers to pervasive queries.

Real-world examples

Exploring scenarios where others have faced issues with Form [X] can illuminate the path forward. Consider Jane, who realized her W-2 was missing just days before tax filing day. After confirming with her employer about distribution dates and checking her online portal, she successfully retrieved her form after tracking it down to a mailing error. This interaction highlighted the importance of following up and being proactive.

Another example involves Mark, who received an incorrect tax form that misreported his income. By documenting all communications with his employer, he was able to facilitate a quick correction. These cases underscore the necessity of knowing what to do if Form [X] is missing or incorrect. Understanding the steps you need to take can ease anxiety and provide a clearer pathway for rectifying issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my what to do if directly from Gmail?

How can I modify what to do if without leaving Google Drive?

How do I fill out the what to do if form on my smartphone?

What is what to do if?

Who is required to file what to do if?

How to fill out what to do if?

What is the purpose of what to do if?

What information must be reported on what to do if?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.