Get the free STR-Tax-Information-Form.pdf - City Of Manzanita - ci manzanita or

Get, Create, Make and Sign str-tax-information-formpdf - city of

Editing str-tax-information-formpdf - city of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out str-tax-information-formpdf - city of

How to fill out str-tax-information-formpdf - city of

Who needs str-tax-information-formpdf - city of?

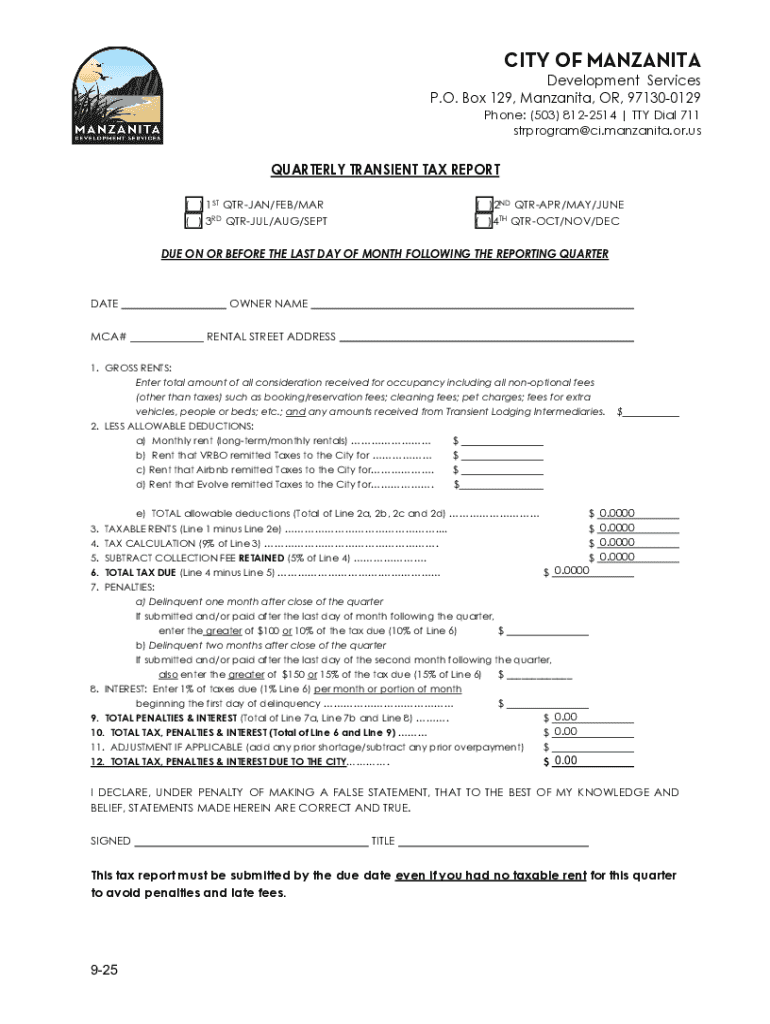

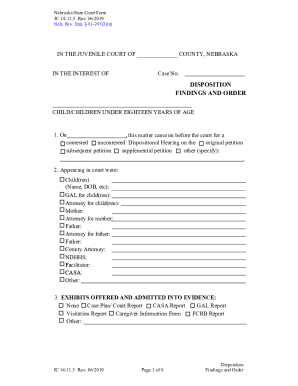

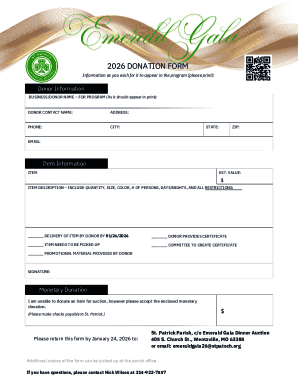

Tax Information Form PDF - City of Form

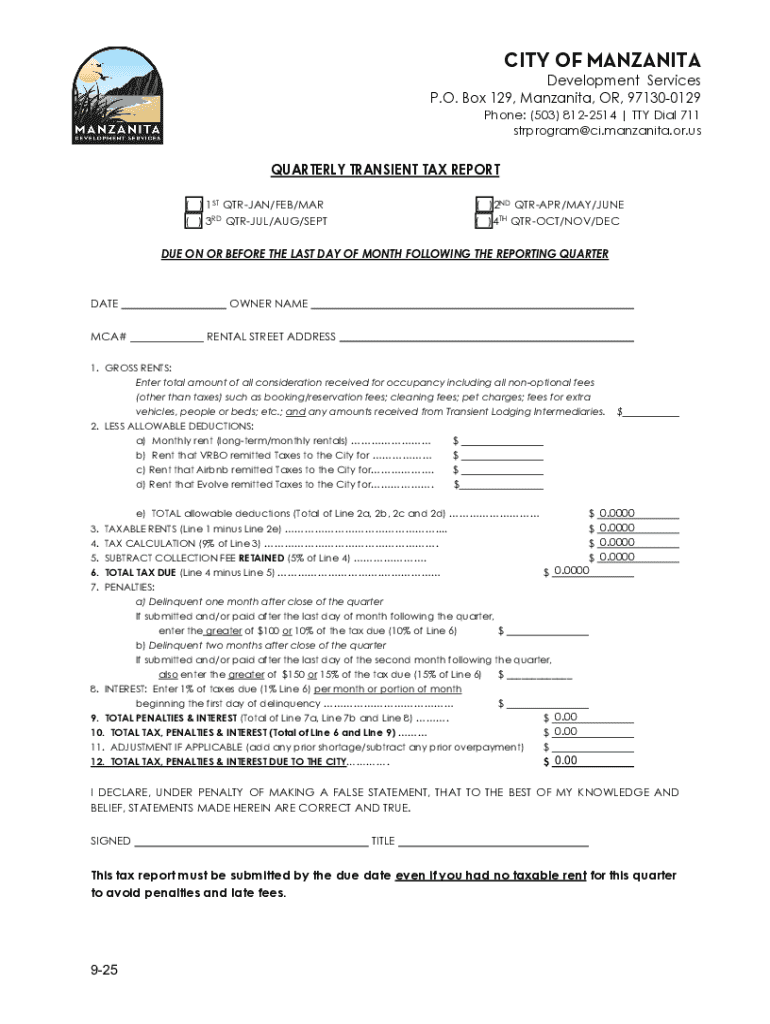

Understanding the Tax Information Form

A Tax Information Form serves as a critical document for both individuals and businesses, encapsulating necessary details required for accurate tax consideration and compliance. These forms are instrumental in reporting income, claiming deductions, and ensuring transparency within the taxpayers' obligations.

Completing the form correctly can significantly impact tax owed or refunded, making it paramount for stakeholders to prioritize accuracy and timeliness when filing.

Who needs to complete the Tax Information Form?

The necessity of completing the Tax Information Form arises from various scenarios. Individuals employed within the city or those receiving taxable income from the city are generally required to submit this form. Additionally, businesses operating within the jurisdiction must also comply to maintain good standing and ensure their tax obligations are accurately recorded.

Thus, anyone engaged in economic activities tied to the City of Form must ensure they accurately complete their forms, aligning with regulatory practices to avoid potential penalties.

Accessing the Tax Information Form

The Tax Information Form can be readily accessed through the official City of Form website. Users can find direct links to download the PDF version of the form, ensuring they are using the most current file available, essential for compliance.

Staying updated on the correct version of the form is crucial, as the city often releases new versions based on changing tax regulations and requirements.

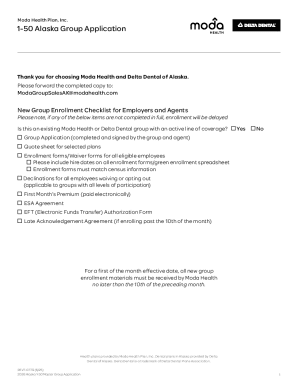

Steps to complete the Tax Information Form

Beginning the process demands adequate preparation of necessary documents. Collect income statements, identification, and residency proofs that substantiate your claims. Organizing these documents expedites the completion process and minimizes confusion during submission.

Filling the form involves following a step-by-step approach. Start with personal information, outline your income sources, and detail possible deductions. Using interactive tools available on pdfFiller can simplify this, ensuring efficiency and accuracy as you progress through each section.

Common mistakes stem primarily from incorrect data entry or misunderstanding tax regulations. It is crucial to double-check all entries to secure the correct treatment of your form.

Editing and managing the Tax Information Form

Editing tools from pdfFiller provide users the advantage to amend entries easily. Whether correcting a typo or updating income data, these features allow seamless adjustments without starting over. Users can save the form in varying formats or revise as necessary to ensure their submissions are top-notch.

eSigning the form through pdfFiller enhances the security and expediency of your submission. Logically, eSignatures hold legal weight; thus, it is vital to confirm their validity as per the local regulations governing electronic signatures.

After completing your form, save and store it securely. Choosing pdfFiller streamlines this process, allowing users to maintain organized files and accessible forms that can be retrieved as needed.

Submitting the Tax Information Form

Understanding your submission options is vital for timely processing. Online submissions are often quicker, but ensure that you follow the guidelines established by the City of Form. Alternatively, physical mailing of the completed form is also an option, requiring attention to detail in accurately addressing envelopes to avoid delays.

Staying aware of deadlines is crucial. Missing these can result in penalties or financial implications. Be sure to check the city’s official website for any crucial dates tied to your tax submissions.

Tracking and managing your tax submission

Confirming that your form reached the appropriate department is an essential step in your filing process. Utilize the city’s online verification tools, or contact the local tax office to confirm your submission status, ensuring your paperwork is processed without hitches.

Post-submission issues can arise, such as discrepancies in reported income or missed deductions. It's prudent to be proactive and address these issues quickly by seeking guidance from the tax office or relevant professionals.

Frequently asked questions

Many taxpayers harbor common concerns about the Tax Information Form, ranging from filing procedures to submission confirmations. Addressing these queries directly represents a step towards ensuring compliance and alleviating potential stress associated with tax season.

Finding additional help is vital for ensuring your tax submissions are correct. Local tax offices provide personalized support to those in need of clarity regarding their filings or obligations. pdfFiller also offers customer support geared towards document management challenges.

Leveraging pdfFiller for future tax seasons

Utilizing pdfFiller for Tax Information Forms not only streamlines your current tax efforts but also sets a solid foundation for future transactions. The cloud-based functionality assures that your documents are always at your fingertips, paving the way for a more organized and productive tax season ahead.

Organizing this year’s documents can set the ground for a seamless next year, allowing for efficient tax filing practices. pdfFiller enhances your experience by integrating continuous learnings and adaptability towards changing tax requirements, ensuring you’re always prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify str-tax-information-formpdf - city of without leaving Google Drive?

How can I send str-tax-information-formpdf - city of for eSignature?

Can I edit str-tax-information-formpdf - city of on an iOS device?

What is str-tax-information-formpdf - city of?

Who is required to file str-tax-information-formpdf - city of?

How to fill out str-tax-information-formpdf - city of?

What is the purpose of str-tax-information-formpdf - city of?

What information must be reported on str-tax-information-formpdf - city of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.