Get the free SAMPLE AHF LOAN AGREEMENT

Get, Create, Make and Sign sample ahf loan agreement

How to edit sample ahf loan agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sample ahf loan agreement

How to fill out sample ahf loan agreement

Who needs sample ahf loan agreement?

Sample AHF Loan Agreement Form: A Comprehensive Guide

Overview of the AHF loan agreement

An AHF loan agreement, short for Affordable Housing Fund loan agreement, serves as a legal document between a borrower and lender aimed at facilitating the development of affordable housing. These agreements are crucial in promoting accessible housing for low to moderate-income families, often supported by governmental or non-profit organizations. Understanding the nuances of AHF loan agreements is vital for stakeholders in the housing market, ensuring they can effectively leverage financial resources for housing development.

This document not only formalizes the terms of the loan but also outlines the responsibilities of each party involved. It provides clarity and protection, ensuring that funds are used appropriately while also setting the standards for repayment and compliance with local regulations. As such, drafting and reviewing an AHF loan agreement necessitate careful attention to detail to safeguard all parties' interests.

Key components of an AHF loan agreement

A comprehensive AHF loan agreement contains several key components that define the relationship between the borrower and lender. Understanding these components is essential for both parties to navigate the agreement successfully. Each component serves to outline the terms clearly, ensuring there’s a mutual understanding of expectations.

Sample language for AHF loan agreement

Crafting an AHF loan agreement involves using precise language that clearly conveys the intent of both parties. Sample clauses can serve as templates to ensure that critical components are addressed appropriately. Below are common clauses found in AHF loan agreements.

Additionally, it is prudent to incorporate language that allows for amendments to the agreement, ensuring flexibility for changes in circumstances or project scope.

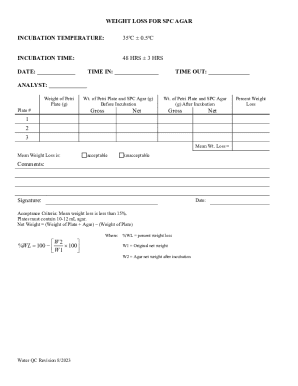

Filling out the AHF loan agreement form

Completing the AHF loan agreement form can be daunting, but following a structured approach ensures accuracy and completeness. Each section of the form must be filled out thoroughly, avoiding common pitfalls that could lead to misunderstandings or legal issues later.

It's also advisable to review the completed form for any inaccuracies or omissions before submission. Common mistakes like misspelling names or neglecting to provide necessary documentation can cause delays or complications.

Utilizing pdfFiller's interactive tools can enhance the form completion process. Features such as editing options, e-signing capabilities, and sharing functionality streamline the process considerably, allowing for seamless collaboration among team members.

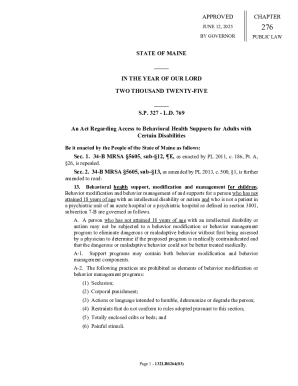

Legal considerations in the AHF loan agreement

When drafting and signing an AHF loan agreement, it's imperative to consider the legal framework surrounding housing finance. This includes compliance with local and state laws which govern the lending process as well as specific regulations that pertain to the Affordable Housing Fund.

Managing and storing your AHF loan agreement

Once the AHF loan agreement is signed, proper management and storage are essential to maintaining clarity over the terms and ensuring compliance. Best practices dictate that you keep digital records organized, which can significantly ease future referencing.

Having organized and secure management protocols will streamline document retrieval during audits or when making compliance checks, providing peace of mind to all stakeholders involved.

FAQs on AHF loan agreements

Navigating the realm of AHF loan agreements churns up numerous questions, particularly for first-time borrowers or novice developers. Understanding these common queries can demystify the process and guide informed decision-making.

Addressing these frequently asked questions allows borrowers to gain a clearer insight into managing their loans efficiently, diminishing confusion or anxiety surrounding the agreement process.

Collaborating on the AHF loan agreement process

Collaboration plays a significant role in the AHF loan agreement process, especially for teams working on larger housing development projects. Leveraging tools that promote teamwork enhances efficiency and effectiveness throughout the agreement lifecycle.

Everyone involved can have access to the same version of the agreement, ensuring coherent communication and reducing the chances of misinterpretation.

Next steps after completing the AHF loan agreement

After the AHF loan agreement is signed, stakeholders should promptly engage in the next steps to kick off the project appropriately. This involves a series of actions to ensure that the funds are disbursed and that compliance is monitored throughout the loan's duration.

Diligently following through on these steps will promote a smoothflow of resources and accountability, ultimately ensuring the project's success and compliance with the terms set forth in the AHF loan agreement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample ahf loan agreement for eSignature?

How can I get sample ahf loan agreement?

How do I make edits in sample ahf loan agreement without leaving Chrome?

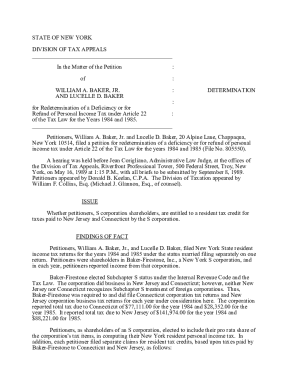

What is sample ahf loan agreement?

Who is required to file sample ahf loan agreement?

How to fill out sample ahf loan agreement?

What is the purpose of sample ahf loan agreement?

What information must be reported on sample ahf loan agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.