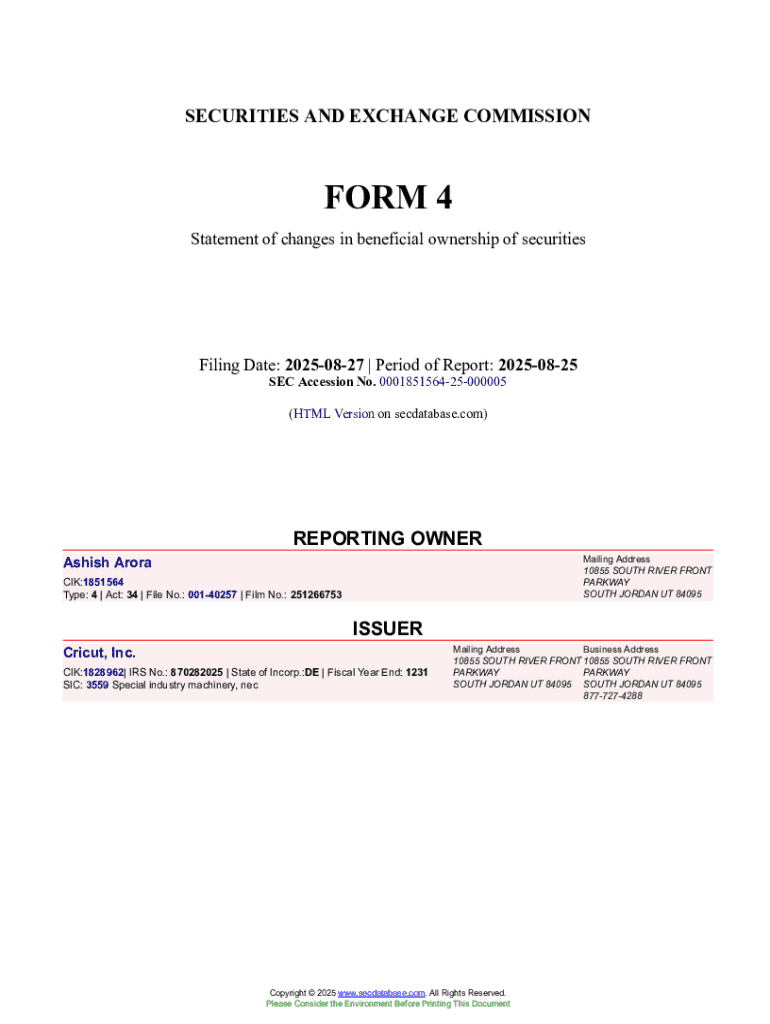

Get the free Ashish Arora Form 4 Filed 2025-08-27. Accession Number

Get, Create, Make and Sign ashish arora form 4

Editing ashish arora form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ashish arora form 4

How to fill out ashish arora form 4

Who needs ashish arora form 4?

Understanding the Ashish Arora Form 4 Form: A Comprehensive Guide

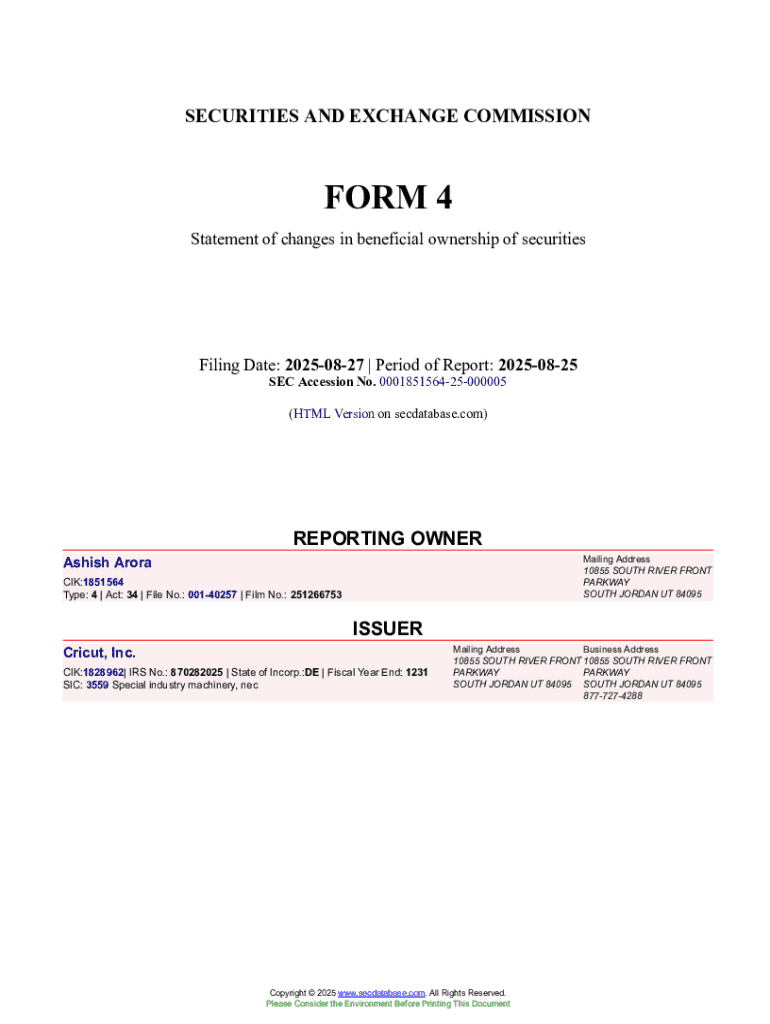

Understanding Form 4: An overview

Form 4 serves as a crucial regulatory filing method mandated by the U.S. Securities and Exchange Commission (SEC). This form is primarily used by insiders, such as officers, directors, and significant shareholders, to disclose their transactions in the company's securities. The primary purpose of Form 4 is to promote transparency and maintain the integrity of the financial markets by revealing the activities of individuals with access to potentially sensitive information.

Ashish Arora is recognized as a significant figure in the corporate world due to his contributions as a leader and innovator. His filings of Form 4 are noteworthy not only for regulatory compliance but also for how they inform stakeholders about his insider transactions, which can indicate confidence or caution regarding the company's performance. Understanding the context of Arora’s transactions can empower investors to make informed decisions.

The Form 4 filings are crucial for investors and stakeholders as they reflect the activities of insiders. Transparency that accompanies these filings enhances market credibility. When insiders buy shares, it typically signals they believe the company's future performance is strong, while a sale could indicate the opposite. Thus, Form 4 serves as a significant tool for investor evaluation and decision-making.

Key components of Form 4

Form 4 consists of several essential elements that facilitate the reporting process. Understanding these components is critical for accurate filing. The first element is the identification of reporting owners, who are the individuals required to file the form. This includes their names, titles, and reasons for the transactions being reported.

Another crucial component is the detailed description of transactions involving the company's securities. This section describes the nature of the transactions, such as purchases, sales, or exchanges, and includes important data like the date of the transaction, the amount involved, and the price per share. Signatures are also necessary, solidifying the commitment of the reporting owner to the accuracy of the information. Understanding terms like 'insider transactions,' 'reporting owners,' and differences between effective date and filing date can make navigating Form 4 easier.

Detailed steps for filling out and submitting Form 4

Filling out Form 4 requires diligence and attention to detail. The initial step involves gathering all required information, including the personal details of the reporting owner, such as their name, address, and title within the company. Additionally, transaction details must be collected — specifying what securities are being transacted, the amount, and the price at which the transaction is occurring.

Each section of Form 4 can be completed methodically. Start with the reporting owner’s information, followed by the nature and details of the transaction. If a transaction involves complex elements like options or derivatives, those must be carefully described to ensure compliance. Following completion, you must file the form electronically through the SEC's EDGAR system, where e-filing offers benefits such as faster processing times and easier tracking of submissions.

Common mistakes and how to avoid them

While filling out the Ashish Arora Form 4, many individuals make recurring mistakes that can lead to compliance issues. Common errors include providing incomplete information, missing filing deadlines, or categorizing transactions incorrectly. Such mistakes can result in penalties or reputational harm, making it crucial for filers to be diligent.

To mitigate these risks, double-check all entries before submission, ensuring that every field is filled appropriately. Professional advice should not be overlooked; experienced financial advisors can provide insight or help clarify any doubts about complex transactions or recent regulatory changes.

Tools and resources for managing Form 4 filings

Managing Form 4 filings can be streamlined with the right tools. Platforms like pdfFiller provide users with interactive tools that allow for easy editing and eSigning of Form 4 documents. Using templates can save time and enhance accuracy, ensuring that all necessary information is provided.

In addition, accessing historical filing data related to Ashish Arora can offer critical insights into trends and transaction behaviors. Being able to track and analyze past Form 4 filings can provide context for how insider purchases or sales have influenced market perceptions.

Understanding the impact of Form 4 on market perception

The information disclosed in Form 4 plays a vital role in shaping investor decisions. For instance, when insiders like Ashish Arora engage in significant transactions, it can signal their confidence or concerns regarding the company’s future, thus influencing stock prices. Investors typically follow these disclosures closely and may adjust their strategies based on this information.

Case studies of notable Form 4 filings by Ashish Arora can demonstrate the tangible market effects that occur following these disclosures. Analyzing how these transactions correlate with stock price movements provides investors with a nuanced understanding of insider trading actions' potential implications.

FAQs on Form 4 filings

Filing Form 4 raises common questions that every director, officer, or significant shareholder should understand. First, Form 4 is required to be filed within two business days of a transaction occurring, making it critical to maintain accurate records of transactions. Failure to file on time can lead to penalties from the SEC.

Some individuals may wonder if there are associated fees with filing Form 4. In most cases, filing is free through the SEC’s EDGAR system, giving filers an economy-efficient way to comply with regulations. Ultimately, familiarizing oneself with the requirements and processes can help ensure seamless compliance.

Additional support for Form 4 filing

For those who require further assistance with Form 4 filings, reaching out to regulatory bodies can provide clarification on specific concerns or compliance issues. The SEC offers resources and contacts to guide individuals through complex filing processes.

Additionally, seeking professional help, such as from compliance experts or lawyers specializing in securities law, can aid in navigating the intricacies of Form 4. Such professionals can ensure that all filings are compliant and timely, thus safeguarding against potential penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ashish arora form 4 online?

How do I fill out the ashish arora form 4 form on my smartphone?

How do I complete ashish arora form 4 on an iOS device?

What is ashish arora form 4?

Who is required to file ashish arora form 4?

How to fill out ashish arora form 4?

What is the purpose of ashish arora form 4?

What information must be reported on ashish arora form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.