Get the free Property Tax Exemption of Nonprofit Organizations in West ...

Get, Create, Make and Sign property tax exemption of

Editing property tax exemption of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax exemption of

How to fill out property tax exemption of

Who needs property tax exemption of?

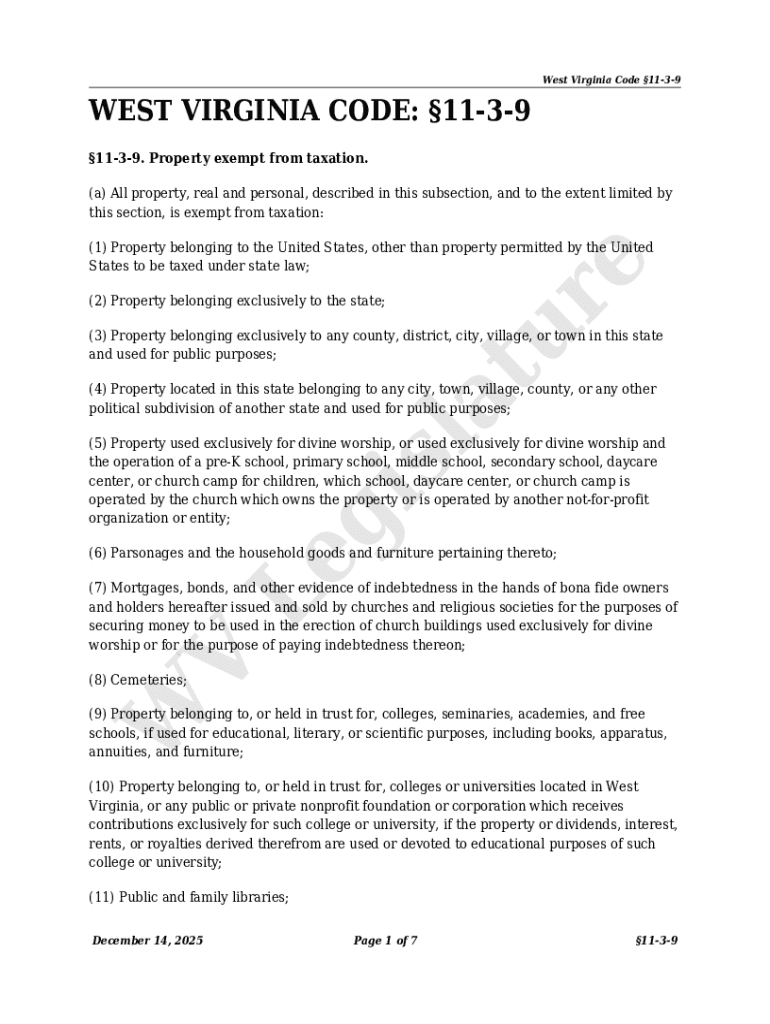

Understanding Property Tax Exemption of Form

Understanding property tax exemptions

A property tax exemption refers to a reduction in the amount of property tax owed by an individual or organization. This financial benefit can significantly lessen the property tax burden, making it an essential avenue of relief for homeowners and various entities. Property tax exemptions can alleviate financial strain, foster community development, and incentivize home ownership, leading to healthier economies.

The significance of property tax exemptions goes beyond immediate savings. By reducing tax obligations, these exemptions empower homeowners to reinvest their savings into home improvements, education, and other growth opportunities, ultimately benefiting the community at large.

Types of property tax exemptions

Various types of property tax exemptions exist to cater to the unique situations of different homeowners and organizations. Understanding these exemptions helps individuals determine their eligibility and the potential benefits available.

The property tax exemption form: an overview

Filing for a property tax exemption involves completing a designated form, which serves as the formal request for tax relief. The property tax exemption form is crucial for initiating the process of receiving reductions in property taxes.

The form requires specific information that is vital for the tax authority to process the application accurately. This includes ownership details, property identification, and the type of exemption being requested.

Step-by-step guide to filling out the property tax exemption form

Completing the property tax exemption form is a straightforward process if you follow a systematic approach. Here’s a detailed guide to help homeowners and organizations navigate through the required steps.

Managing your property tax exemption application

Once your application for the property tax exemption is submitted, keeping track of its status is necessary. Most tax authorities allow you to verify if your exemption is in process, ensuring you remain informed.

Interactive tools for property tax exemption management

In today's digital age, managing forms can be cumbersome; however, platforms like pdfFiller offer robust tools to enhance the efficiency of managing your property tax exemption requests.

Getting help with your property tax exemption

Navigating the intricacies of property tax exemptions can be overwhelming. Fortunately, assistance is available through various channels, both digitally and at local government offices.

Understanding related tax forms

Filing for a property tax exemption is just one part of the larger tax process. Understanding related forms can provide greater clarity and streamline your financial management strategies.

About pdfFiller

Choosing pdfFiller for your property tax exemption needs ensures access to a powerful document management platform. It offers features that enhance user experience and efficiency, from seamless editing to secure electronic signatures.

User testimonials often highlight the time-saving and user-friendly aspects of the platform, making it a preferred choice for individuals and teams working with various documentation.

Connect with pdfFiller

Remaining informed is crucial regarding property tax exemptions and related topics. By joining the pdfFiller community, users can access tips, updates, and insights to help optimize their experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit property tax exemption of from Google Drive?

How can I send property tax exemption of for eSignature?

How do I fill out the property tax exemption of form on my smartphone?

What is property tax exemption of?

Who is required to file property tax exemption of?

How to fill out property tax exemption of?

What is the purpose of property tax exemption of?

What information must be reported on property tax exemption of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.