Get the free Federal Work-StudyFinancial Aid Office at Sonoma State ...

Get, Create, Make and Sign federal work-studyfinancial aid office

Editing federal work-studyfinancial aid office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal work-studyfinancial aid office

How to fill out federal work-studyfinancial aid office

Who needs federal work-studyfinancial aid office?

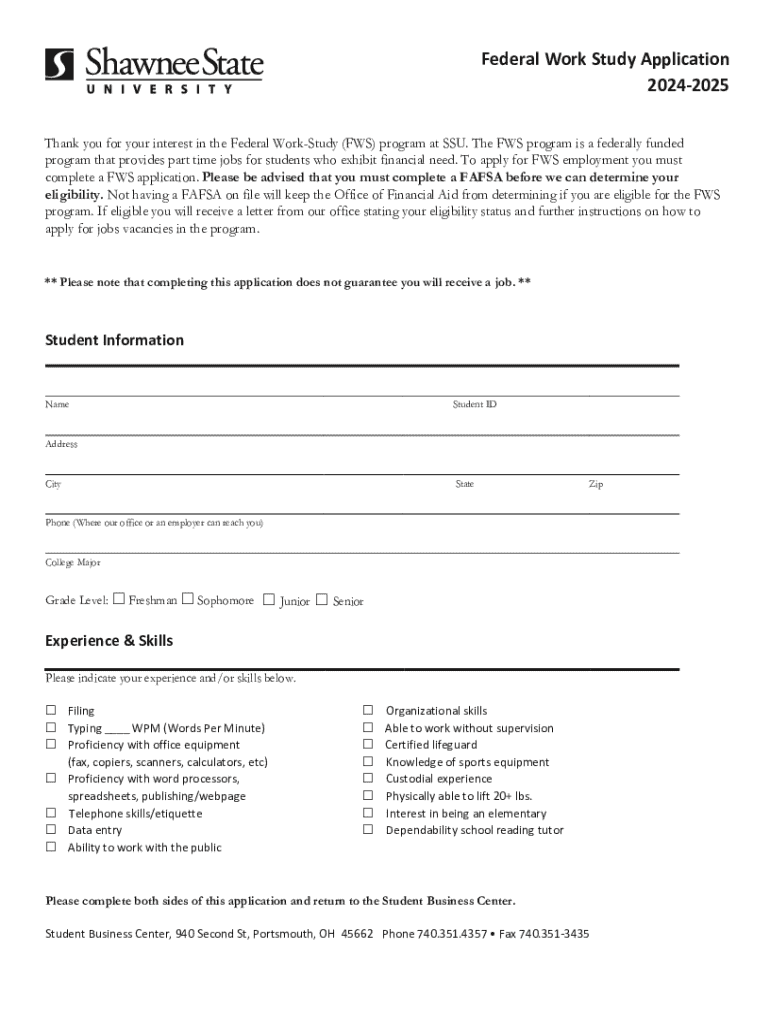

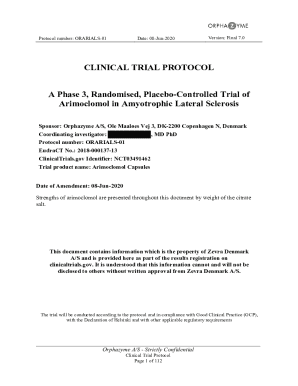

Understanding the Federal Work-Study Financial Aid Office Form

Understanding federal work-study

Federal Work-Study (FWS) is a unique financial aid program in the United States that offers part-time jobs to students with financial need, allowing them to earn money to pay for education expenses. This program not only helps alleviate the burden of tuition costs but also provides students with valuable work experience in their field of study. The aim is to promote access to higher education while fostering a sense of responsibility and work ethic.

Key benefits of participating in FWS include flexible work hours that can adapt to class schedules, the opportunity to earn income without incurring additional student debt, and networking that often leads to career opportunities post-graduation. Additionally, students involved in work-study are often employed at educational institutions, which can enrich their academic experience and provide relevant job training.

The financial aid office plays a critical role in this process, guiding students through eligibility assessments, application procedures, and ensuring they understand their financial packages. They are the primary resource for any questions regarding the FWS program and assist students in managing their work-study positions effectively.

Eligibility criteria for federal work-study

To qualify for federal work-study positions, students must meet general eligibility requirements. These generally include maintaining citizenship and residency status, being enrolled at least half-time in an eligible program, and adhering to specific course load requirements. Each institution may have different stipulations, so consulting with the financial aid office is essential for tailored eligibility.

Financial need is another substantial criterion determining eligibility. It is typically assessed through the Free Application for Federal Student Aid (FAFSA) form. The FAFSA evaluates the student's expected family contribution (EFC), which helps institutions gauge the financial need. If the calculated need exceeds the tuition and fees, students may be eligible for work-study funds.

Graduate students may have distinct eligibility from undergraduates. Financial aid offices will provide details on specific programs available to them. Additionally, students with disabilities may have access to tailored work-study opportunities and should inquire about any special programs designed to support their educational needs.

Navigating the financial aid office

The financial aid office is a student’s best ally when it comes to understanding the federal work-study financial aid office form. Financial aid advisors are trained professionals who assist students in navigating the complexities of financial aid, including understanding grants, scholarships, and work-study options. They provide extensive support in refining how students complete the necessary forms.

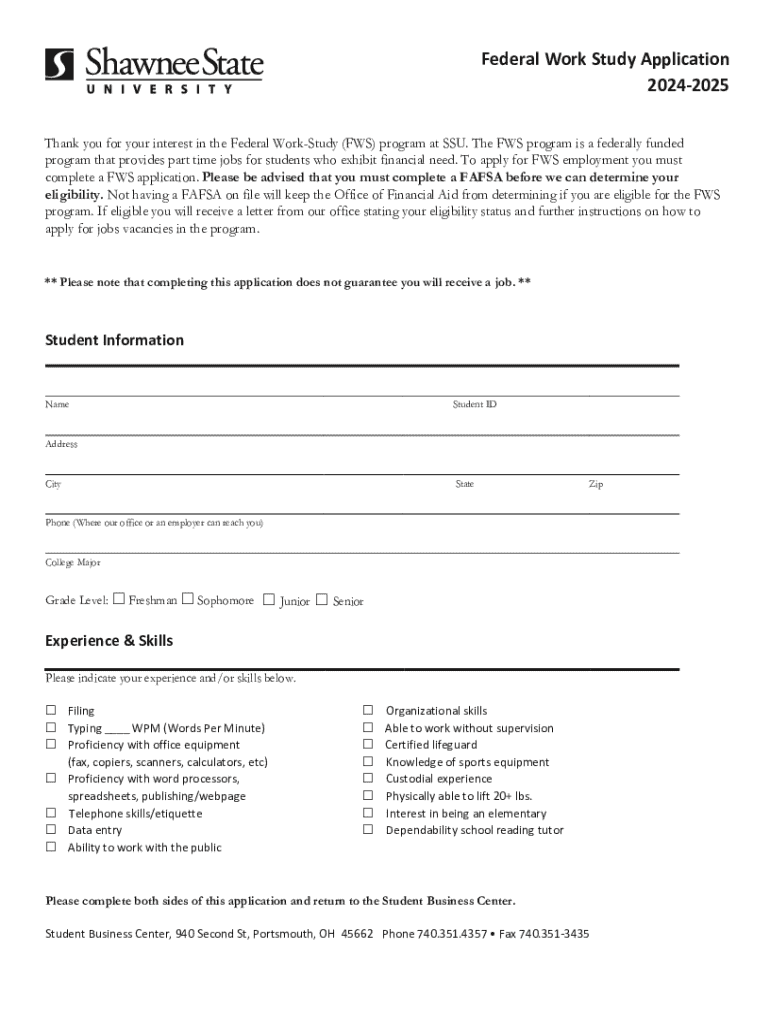

Students should prepare a list of required documents before visiting the office. Common documentation includes income verification forms, tax returns, and academic transcripts. An essential component of the FWS application process is the federal work-study financial aid office form, which requests personal information, financial status, and academic details. Understanding how to accurately fill out this form can significantly enhance a student's chance of receiving aid.

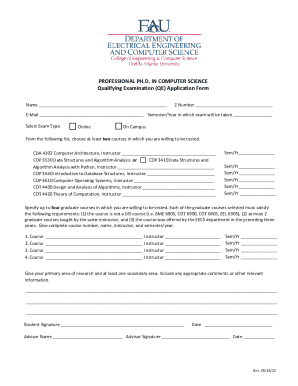

Completing the federal work-study form

Completing the federal work-study financial aid office form accurately is crucial to secure funding. Start by providing personal information such as your name, address, social security number, and school identification number. Next, detail your financial information, including income sources and amounts, which help the financial aid office evaluate your eligibility.

When filling out the program of study section, ensure you detail your major and current enrollment status. Each part of the form is significant because it builds the complete picture of your financial landscape. Pay close attention to instructions provided by your financial aid office to avoid common mistakes, such as leaving sections blank or not providing sufficient financial verification.

Common mistakes include not providing all required information and failing to double-check for errors. To effectively submit the form, be mindful of deadlines provided by your financial aid office, and remember that you can submit your application in various ways – online, via mail, or in person.

Managing your federal work-study award

After receiving confirmation of your award, understanding the components of your award letter is essential. The letter typically breaks down the total amount awarded, the hours you are expected to work per week, and any specific job roles assigned. Depending on the institution, you may have the option to accept or decline your work-study offer based on individual circumstances.

Finding employment can be one of the most exciting aspects of the FWS program. Many institutions prioritize on-campus opportunities, allowing students to work in departments relevant to their studies, enhancing their college experience. Additionally, external off-campus jobs may be available for those who seek further employment opportunities. It’s essential to utilize resources offered by the financial aid office for job-searching tools and listings related to work-study positions.

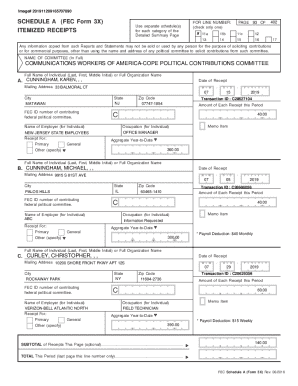

Getting paid: the financial process

Federal Work-Study participants receive payment for the hours worked, typically on a bi-weekly basis, based on the institution's payroll schedule. Understanding this pay frequency is crucial for budgeting and managing expenses throughout the semester. Students can usually opt for direct deposit, which streamlines the payment process, or receive traditional checks, depending on the institution's policies.

Earnings from work-study positions are considered taxable income, so students should be mindful of their earnings in relation to tax implications. Budgeting these paychecks effectively can alleviate financial stress and help manage living expenses throughout college. Establishing a budget that allocates funds towards tuition, books, and personal expenses will promote financial discipline and aid in academic success.

Additional employment considerations

Balancing work-study commitments with academic responsibilities requires careful planning. Students should prioritize their schedule to ensure that work hours do not interfere with their studies. Engaging in work-study does not only provide financial support but also incentivizes better time management and organizational skills that benefit academic success.

Exploring other part-time job opportunities can also be appealing, especially for those seeking to maximize their earnings. However, students must be cautious regarding the legal limitations on working hours for FWS participants; true flexibility means ensuring work does not detract from academic performance. Open conversations with advisors can further aid in finding a balance between work and study.

Frequently asked questions

Many questions arise regarding the federal work-study financial aid office form, primarily regarding eligibility and application procedures. Common queries include how to resolve issues if one does not qualify for federal work-study, what alternative financial aid options are available, and how to appropriately react if problems arise with received funds.

The best approach to addressing potential conflicts with financial aid is to reach out to the financial aid office directly. They can provide personalized assistance, guide you on altering your aid package, or help resolve any discrepancies in your work-study award. Seeking their advice fosters prompt resolution of any problems, paving the way for a more successful academic experience.

Utilizing pdfFiller for document management

Utilizing pdfFiller for managing the federal work-study financial aid office form can simplify the application process considerably. The platform provides an easily navigable interface for editing, signing, and managing documents online. Students can upload their work-study forms directly to pdfFiller and make needed changes without hassle.

To help complete the federal work-study form effectively, pdfFiller allows collaboration between students and their advisors. By sharing the document through the platform, advisors can provide immediate feedback and assistance, ensuring that the submission is as accurate as possible before it reaches the financial aid office.

Leveraging a cloud-based document solution like pdfFiller not only enhances accessibility but also ensures the privacy and security of sensitive financial information, offering peace of mind in the often-stressful process of securing federal work-study opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find federal work-studyfinancial aid office?

Can I sign the federal work-studyfinancial aid office electronically in Chrome?

How can I fill out federal work-studyfinancial aid office on an iOS device?

What is federal work-study financial aid office?

Who is required to file federal work-study financial aid office?

How to fill out federal work-study financial aid office?

What is the purpose of federal work-study financial aid office?

What information must be reported on federal work-study financial aid office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.