Get the free For the Fiscal Year Ended September 30, 2025

Get, Create, Make and Sign for form fiscal year

Editing for form fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form fiscal year

How to fill out for form fiscal year

Who needs for form fiscal year?

Comprehensive Guide to the Fiscal Year Form

Understanding the fiscal year form

The fiscal year form serves as a critical document for businesses, facilitating financial reporting and compliance with tax regulations. It captures essential financial data from a specified fiscal year, allowing organizations to summarize their financial performance. Understanding the fiscal year form is essential to any business, as it acts as a foundational component of financial management and transparency.

Accurate documentation is vital for effective financial planning and analysis. Improperly completed forms can lead to discrepancies that affect a business’s tax responsibilities. Businesses must ensure they record all necessary details accurately, avoiding costly errors that could trigger audits or penalties. Common applications of the fiscal year form include reporting income to the government, facilitating tax calculations, and establishing a framework for internal financial reviews.

Key components of the fiscal year form

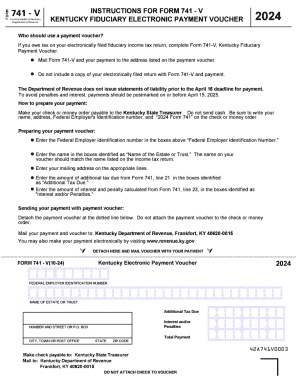

The fiscal year form contains several key components that businesses must complete accurately to ensure compliance. Required information fields typically include entity specifics such as the business name, address, and contact information. A crucial aspect is detailing the duration of the fiscal year, which can vary significantly among organizations depending on their operational needs.

Additionally, financial metrics need to be reported, such as total revenue, net profit, and various tax liabilities like ad valorem tax or insurance premium tax. Often, attachments accompany the fiscal year form, including supporting documents like financial statements or previous tax filings that substantiate the numbers reported. These documents are essential for validating the reported figures and providing a comprehensive view of the business's financial health.

Step-by-step guide to completing the fiscal year form

Completing the fiscal year form requires diligence and attention to detail. The first essential step is preparing your financial information. This involves organizing your financial statements and gathering necessary supporting documents, including ledger accounts and previous filings that provide a historical context for your current year’s performance.

Filling out the form necessitates that users pay meticulous attention to each field. Every section typically guides the user through specific data entries, such as income details, tax categories like sales tax and use tax, and other essential financial figures. Avoiding common mistakes is critical here. Double-check figures and ensure that all information corresponds with the collected documents.

Once you complete the form, a thorough review process is necessary to ensure accuracy. Creating a checklist featuring key areas to double-check is advisable. This may include verifying totals, percentages of sales tax collected, and ensuring that figures correlate with appendices and financial statements to identify any discrepancies before submission.

Editing and modifying your fiscal year form

Modifications to a submitted fiscal year form can occur due to various reasons such as oversight or changes in financial circumstances. If adjustments are necessary, first determine the required changes and gather any documentation that supports the amendments. Depending on the submission method, the process for making changes may vary.

For electronic submissions, users often have the option to amend their submission through an online portal. Resubmission may involve additional steps such as notifying the governing agency of your correction and may require re-evaluating previous tax liabilities. Common scenarios for amendments include corrections in reported income metrics or adjustments due to overlooked tax liabilities like utility services or reemployment taxes.

eSigning and submitting your fiscal year form

In today's digital age, the eSigning process provides a quick and secure method for affirming your fiscal year form. Utilizing eSignature capabilities allows for immediate action and streamlines the submission process significantly. Choosing to submit online through a verified platform minimizes delays that could arise from traditional physical mail systems.

When deciding on submission options, users can weigh the benefits of online submissions against physical mail. For instance, online submissions can often provide instant confirmation of receipt, which is immensely beneficial for tracking submission status. Keeping meticulous records of your submission can aid in future references or inquiries. Ensure that you note the submission date and confirmation codes if applicable.

Managing fiscal year documentation efficiently

Efficient management of fiscal year documentation is crucial for maintaining compliance and organizational efficiency. Effective methods include organizing financial records in a systematic manner that allows for easy retrieval during audits or reviews. Utilizing detailed labeling systems for folders can further enhance access and efficiency.

Leveraging pdfFiller’s tools specifically designed for document management can greatly simplify this process. The cloud-based access feature enables users to collaborate on documents from different locations, enhancing teamwork and ensuring that everyone involved has the latest version of forms like the fiscal year form. Incorporating best practices for long-term record-keeping will also help mitigate loss and ensure ongoing compliance with potential future tax changes, such as variations in documentary stamp tax.

Troubleshooting common issues with fiscal year forms

Encountering challenges with fiscal year forms can be a source of stress for businesses. Some common issues include form rejections due to incorrect information or discrepancies in submitted data. Businesses often find themselves needing to correct and resubmit their forms. Understanding the reasons behind rejections often helps prevent future issues.

In case of further complications, resources such as official help lines or user community forums can provide valuable support. Engaging with these platforms may result in quicker resolutions, as users share solutions for similar issues encountered.

Frequently asked questions (FAQs) about the fiscal year form

As businesses navigate the complexities of their fiscal year filings, several questions frequently arise. For instance, many wonder what the consequences are if they miss the fiscal year filing deadline. Late submissions can lead to penalties, including surcharges that can impact overall financial standing.

Another common inquiry is about eSigning the fiscal year form in the context of partnerships. Typically, eSigning is permissible, but it’s essential to confirm that all partners consent to electronic submissions. Furthermore, questions often arise about how the fiscal year impacts tax responsibilities; the chosen fiscal period can significantly influence tax calculations and reporting requirements.

Important dates and deadlines for fiscal year submission

Awareness of key dates and deadlines is essential for successful fiscal year submissions. Annual filing deadlines can vary, with many jurisdictions requiring submissions within specific time frames following the fiscal year’s conclusion. Late filings may result in penalties, so understanding regional requirements is crucial.

Ending the fiscal year usually necessitates an immediate evaluation of financial health, prompting the business to prepare reports and conduct audits to meet the filing deadlines. Knowing these dates in advance can allow for better resource management and ensure timely compliance, especially for taxes like the personal property tax and program contributions tax credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the for form fiscal year in Gmail?

How do I fill out for form fiscal year using my mobile device?

How do I complete for form fiscal year on an iOS device?

What is for form fiscal year?

Who is required to file for form fiscal year?

How to fill out for form fiscal year?

What is the purpose of for form fiscal year?

What information must be reported on for form fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.