Get the free Investing in JioBlackRock Liquid Fund? Find out 1-month ...

Get, Create, Make and Sign investing in jioblackrock liquid

Editing investing in jioblackrock liquid online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investing in jioblackrock liquid

How to fill out investing in jioblackrock liquid

Who needs investing in jioblackrock liquid?

Investing in Jioblackrock Liquid Form: A Comprehensive Guide

Understanding jioblackrock liquid form

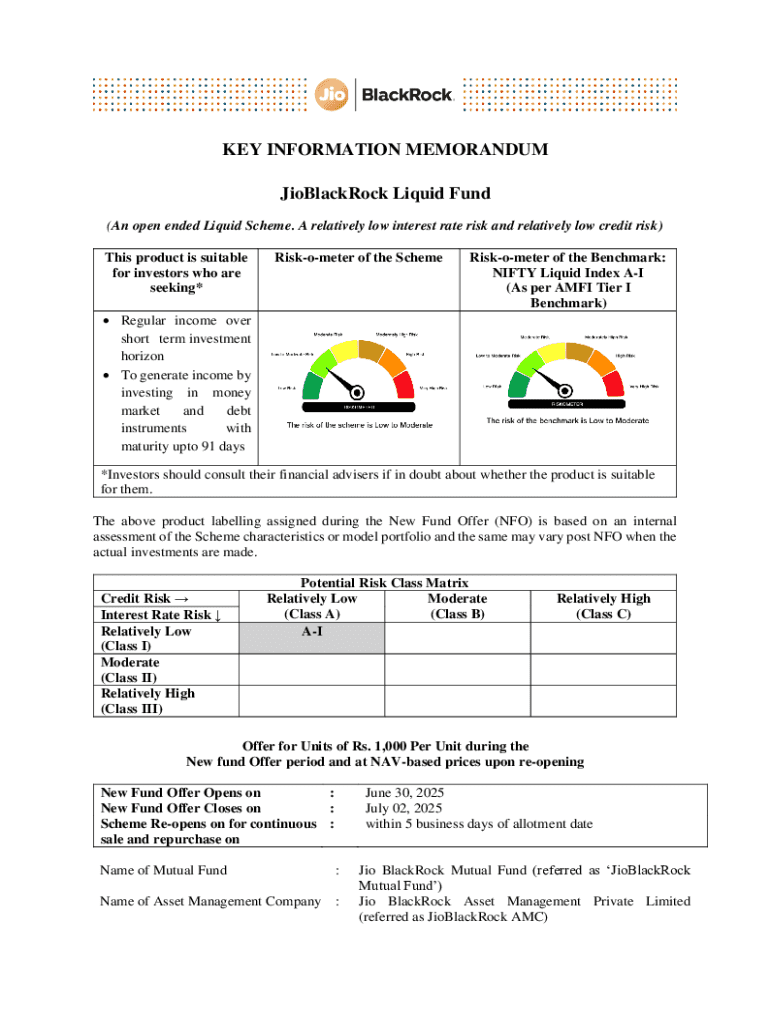

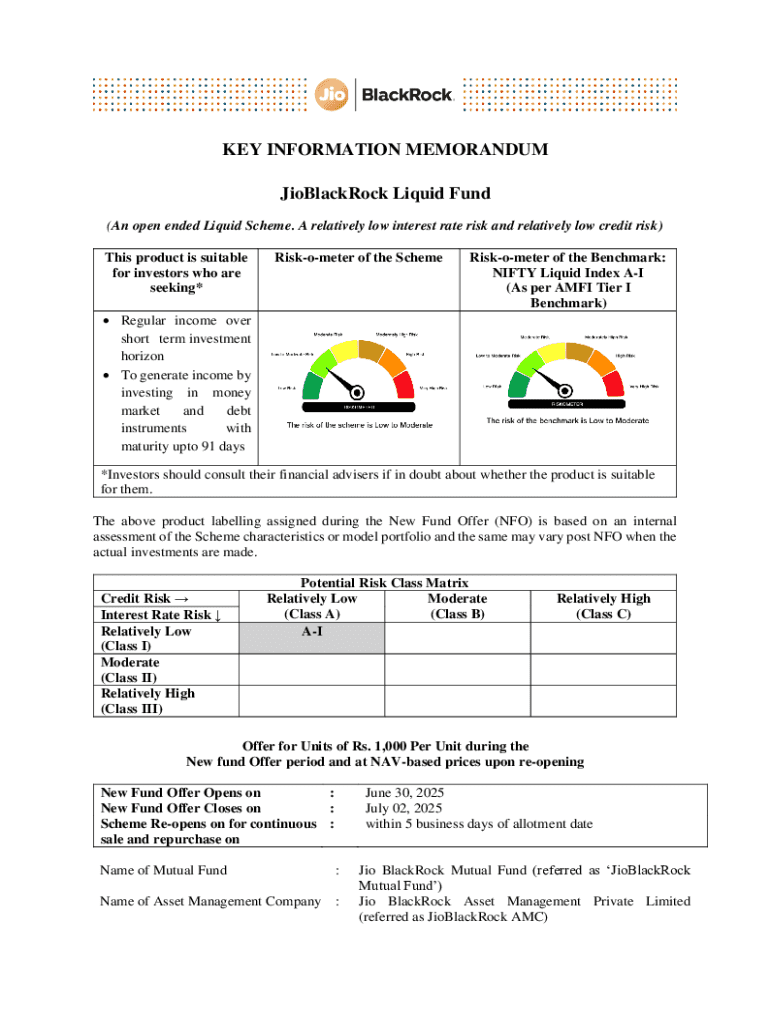

Jioblackrock Liquid Form refers to a specific investment vehicle that combines liquidity and diversification, aimed at providing investors with easier access to the markets. This form of investment is particularly significant as it addresses the needs of both novice and seasoned investors looking to preserve capital while earning returns. Unlike traditional investments, which may lock funds for extended periods, jioblackrock liquid forms allow for more flexibility in managing cash flows.

When comparing jioblackrock liquid form to traditional investment forms like fixed deposits or real estate, the key difference lies in agility and lower entry barriers. Investors can buy and sell in shorter timeframes, making this a strategic choice for those aiming for quick returns or managing cash efficiently.

Key features of jioblackrock liquid form

The jioblackrock liquid form comes with several key features that enhance its attraction for investors. Firstly, liquidity and accessibility play vital roles. As the name suggests, liquid forms enable investors to quickly convert their investments into cash without significant penalties, offering the flexibility to act on new opportunities that arise in the market.

Secondly, diversification opportunities are abundant. By investing in liquid forms, individuals can easily spread their investments across various sectors and asset types. This not only mitigates risks but also enhances potential returns through targeted exposure. Thirdly, low minimum investment amounts makejioblackrock liquid form accessible for investors at different financial levels.

How to start investing in jioblackrock liquid form

Starting your journey in investing in jioblackrock liquid form involves a few critical steps. First, investors should conduct thorough research and establish their financial goals, because understanding what you want to achieve will shape your investment choices. Secondly, it’s essential to determine your risk appetite; knowing how much risk you can tolerate will guide your fund selection and allocation strategy.

Choosing the right platform or brokerage is another important aspect. Users should consider key factors such as fees, user interface, and customer support when doing so. Several platforms cater specifically to jioblackrock investments, ensuring you have the tools and resources needed for successful investment management.

The investment process

Investing in jioblackrock liquid form requires diligent fund selection. It's crucial to evaluate the criteria for choosing an optimal fund, considering aspects such as past performance, management fees, and fund assets to ensure the best fit for your portfolio. Comparing different funds will help in identifying those that align with your investment strategy.

Additionally, knowing how to allocate funds within jioblackrock liquid form is imperative. Suggested strategies can include weightage based on risk tolerance and financial objectives. A balanced portfolio might consist of 60% in high-potential growth sectors, while 40% might be allocated to more stable, diversified investments. This creates a safety net while still allowing for growth.

Managing your investment

Monitoring and managing your jioblackrock investments is crucial for long-term success. Regular performance reviews help identify weak spots or funds underperforming relative to the market. Understanding market movements provides context to your investments and can inform your strategy moving forward.

To aid in tracking investments effectively, various tools exist. For instance, pdfFiller offers interactive resources to create, edit, and manage investment documents. Utilizing such tools can simplify the process of keeping performance charts and investment reports organized.

Evaluating returns and performance

Understanding expected returns from investing in jioblackrock liquid form involves analyzing several key metrics. One such metric is the expense ratio, which includes the total costs associated with managing the fund. Lower expense ratios can lead to higher net returns for investors. Peer comparison analysis can also provide insights into how your selected fund performs compared to others in the same category.

For instance, if you invest in a fund with an expense ratio of 1.5%, whereas the average in the market is 1%, you might be sacrificing a percentage of your returns over time. Hence, thorough evaluation is paramount. Regular monitoring of these benchmarks can facilitate informed decisions that bolster your long-term investment portfolio.

Tax implications of investing in jioblackrock liquid form

Investing in jioblackrock liquid form also brings along certain tax implications that investors must understand. Capital gains tax can apply, dependant on whether the gains are classified as long-term or short-term — determined by the holding period of your investment. As a rule of thumb, long-term capital gains (LTCG) typically face lower taxation than short-term capital gains (STCG).

Strategies for minimizing tax obligations can include holding investments for longer periods to qualify for LTCG rates. Moreover, it’s also essential to understand any exit loads and their potential impacts on your investment returns. Effective planning and awareness of these tax implications can improve overall returns on your investments.

Navigating common challenges

Investors in jioblackrock liquid form might face several challenges, chiefly driven by market volatility and economic factors. It is essential for investors to stay updated on economic indicators that can impact liquidity and investment performance. Understanding how these factors interplay can help mitigate risks associated with sudden market downturns.

Moreover, by avoiding common investment pitfalls like lack of research or emotional decision-making, investors can position themselves for long-term success. Develop a well-thought-out investment strategy and commit to it, adjusting only when warranted by substantial evidence or analytical insights.

Collaborating with financial advisors

While many investors can manage their investments independently, there are times when professional advice can be beneficial. When dealing with more complex financial situations or if you require tailored investment strategies, collaborating with a financial advisor can provide significant advantages.

Selecting the right advisor is crucial; look for professionals experienced in jioblackrock investments who understand your investment objectives. A reputable advisor will not only assist in strategizing but can also offer insights into market trends, helping you navigate the nuances of liquid investing.

The future of jioblackrock liquid form investment

As the investment landscape continues to evolve, the future of jioblackrock liquid form keeps pace with emerging market trends. Investors can anticipate increased transparency and innovative investment vehicles that will enhance the user experience. The next fiscal quarters might see a greater focus on sustainable and ESG-oriented liquid funds, attracting a broader base of socially conscious investors.

Predictions indicate that liquid investment forms will grow in popularity, thanks to their inherent flexibility and responsiveness to market conditions. Investors should be prepared to adapt, understanding that as innovations arise, so too will new opportunities within the jioblackrock liquid domain.

Interactive tools and resources

To further enhance your investment experience in jioblackrock liquid form, utilizing interactive tools can improve decision-making. Investment calculators tailored specifically to jioblackrock can provide estimates on potential returns based on your investment strategy. Moreover, templates for investment tracking through pdfFiller enable users to keep detailed records of their portfolio performance, enhancing clarity over time.

Additionally, workshops and webinars dedicated to jioblackrock liquid investing often equip individuals with practical knowledge and insights from experts, helping to bridge knowledge gaps. Engaging in these sessions can cultivate a deeper understanding and better strategies when venturing into liquid forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send investing in jioblackrock liquid for eSignature?

How do I make changes in investing in jioblackrock liquid?

Can I create an eSignature for the investing in jioblackrock liquid in Gmail?

What is investing in jioblackrock liquid?

Who is required to file investing in jioblackrock liquid?

How to fill out investing in jioblackrock liquid?

What is the purpose of investing in jioblackrock liquid?

What information must be reported on investing in jioblackrock liquid?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.