Get the free Single Employer Groups

Get, Create, Make and Sign single employer groups

Editing single employer groups online

Uncompromising security for your PDF editing and eSignature needs

How to fill out single employer groups

How to fill out single employer groups

Who needs single employer groups?

Single Employer Groups Form - How-to Guide Long-read

Understanding the Single Employer Groups Form

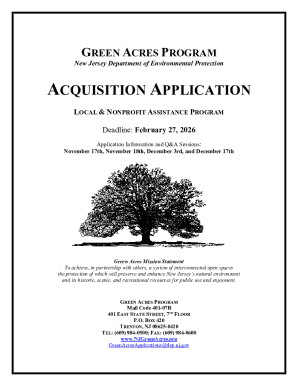

A single employer group typically refers to a group health insurance plan that is offered by one employer, designed to provide benefits to its employees. This grouping allows employers to tailor their health insurance offerings to the unique needs of their workforce, emphasizing both employee satisfaction and compliance with health coverage mandates.

The importance of a single employer group in employee benefits cannot be overstated. It helps employers streamline their benefits administration process, ensuring that a comprehensive benefits package is available to all eligible employees while managing costs effectively.

Purpose of the Single Employer Groups Form

The Single Employer Groups Form serves as a foundational document in benefits administration. It formalizes the agreement between the employee and employer regarding health benefits and outlines key information required for regulatory compliance.

In the context of healthcare regulations, this form helps employers adhere to the Affordable Care Act (ACA) requirements and other legal obligations, safeguarding both the organization and its employees.

Key components of the Single Employer Groups Form

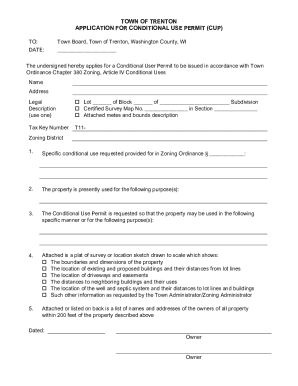

Understanding the structure of the Single Employer Groups Form is crucial for accurate completion. Typically, the form includes various sections such as employer information, employee eligibility criteria, benefit choices, and authorizations.

Each section plays a critical role in ensuring clarity and accuracy. For instance, employer information provides essential contact details, while eligibility criteria define who within the organization can avail of the offered benefits.

Terminology: Key Definitions

Familiarity with terminology is essential when completing the Single Employer Groups Form. Definitions of terms such as 'eligible employee,' 'plan enrollment,' and 'premium contribution' directly influence how the form is filled.

Misunderstanding these terms can lead to errors in completion, potentially impacting the compliance and effectiveness of the overall employee benefits strategy.

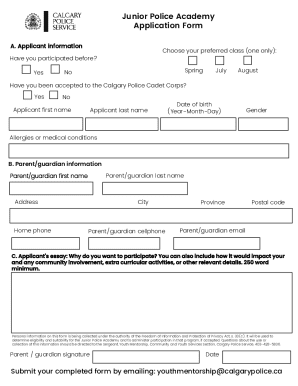

Step-by-step guide to completing the Single Employer Groups Form

Completing the Single Employer Groups Form involves careful preparation and attention to detail. The first step is gathering the necessary information and documentation.

Gathering required information

Before starting the form, it’s advisable to collect the following documents and information:

Detailed instructions for each section

Section 1: Employer Information

Fill out all pertinent employer details, ensuring accuracy to maintain compliance with regulations.

Section 2: Employee Eligibility Criteria

Define criteria for employee eligibility, taking into account employment status and tenure.

Section 3: Benefit Choices and Options

Choose appropriate plans and coverage options that align with the employee demographic.

Section 4: Signatures and Authorizations

Acquire necessary signatures to validate the form, which can typically involve multiple stakeholders.

Tips for accurate and compliant form submission

Ensure compliance by reviewing the form multiple times before submission. Common mistakes include leaving sections blank, incorrect data entry, and failing to secure necessary signatures. Taking the time to double-check enhances the likelihood of acceptance on the first submission.

Editing and managing your Single Employer Groups Form

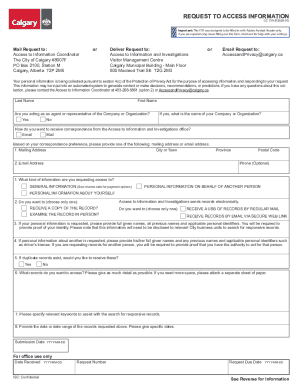

After completing the initial draft of your Single Employer Groups Form, utilizing pdfFiller can notably ease the process of document management and editing.

Utilizing pdfFiller for document editing

pdfFiller provides a range of tools that simplify editing PDF documents. Users can edit text, images, and even fields directly in the document without the need for separate software.

eSigning and collaboration features

The eSigning feature within pdfFiller ensures that obtaining signatures is simple and fast. Team members can sign documents from anywhere on any device, seamlessly integrating into the workflow.

Collaboration is also made easier through pdfFiller’s sharing options, where team members can review documents together, providing feedback or making further adjustments.

Troubleshooting common issues

Despite best efforts, forms can be rejected by authorities for various reasons. Identifying the cause is essential for re-submission.

Addressing form rejections

Common causes for rejection include inaccuracies in the form data and missing signatures. To ensure successful re-submission, it’s critical to carefully review feedback provided by the authority and address each point flagged.

FAQs about the Single Employer Groups Form

It’s common to have questions about the Single Employer Groups Form, particularly concerning eligibility or benefit options. Keep an organized FAQ section, addressing these inquiries based on common challenges faced by users.

Real-life application and case studies

The practical application of the Single Employer Groups Form can significantly impact organizations. From large corporations to small businesses, having a well-structured benefits plan can lead to improved employee retention and satisfaction.

Success stories and testimonials

Consider the story of a tech startup that utilized the Single Employer Groups Form to create a customized benefits package tailored to their young, dynamic workforce. The result was an increase in employee retention by over 25% within the first year.

Illustrative scenarios for better understanding

For example, a manufacturing company that incorporated a family health plan in their single employer group benefits experienced an uptick in productivity and morale, highlighting how strategic choices in the form can yield measurable benefits.

Conclusion and next steps

Navigating the intricacies of the Single Employer Groups Form is essential for any organization aiming to provide comprehensive health benefits. By understanding the form and efficiently managing it through tools like pdfFiller, employers can foster a positive corporate atmosphere.

Resources for further learning

Engaging with authoritative resources on employer group benefits can further equip organizations for success. Websites and publications that focus on workplace benefits are excellent starting points.

How to stay updated on regulatory changes

Employers should establish a routine to regularly check for regulatory updates that might affect the Single Employer Groups Form or its accompanying obligations. Subscribing to newsletters, attending workshops, and participating in community forums can help maintain awareness and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify single employer groups without leaving Google Drive?

How do I edit single employer groups in Chrome?

Can I create an eSignature for the single employer groups in Gmail?

What is single employer groups?

Who is required to file single employer groups?

How to fill out single employer groups?

What is the purpose of single employer groups?

What information must be reported on single employer groups?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.