Get the free Jio BlackRock Flexi Cap Fund to Open Today, Sep 23

Get, Create, Make and Sign jio blackrock flexi cap

Editing jio blackrock flexi cap online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jio blackrock flexi cap

How to fill out jio blackrock flexi cap

Who needs jio blackrock flexi cap?

Jio Blackrock Flexi Cap Form: A Comprehensive Guide for Investors

Overview of Jio Blackrock Flexi Cap Fund

The Jio Blackrock Flexi Cap Fund is a dynamic investment option designed to provide investors with exposure to a diverse range of equity securities. This type of fund is classified as a flexi cap fund, which means it has the flexibility to invest across large-cap, mid-cap, and small-cap stocks. The primary purpose of this fund is to maximize capital appreciation while also managing risks through diversified investments.

Key features of flexi cap funds include the ability to actively adjust the composition of the portfolio based on market conditions and opportunities. This adaptability allows fund managers to take advantage of growth potential across different market segments. Additionally, Jio Blackrock is partnered with BlackRock, a globally recognized investment management firm, providing investors with top-tier management expertise and insights.

Investing in the Jio Blackrock Flexi Cap Fund is advantageous for individuals seeking a balanced approach to equity investment, understanding the associated risks while aiming for capital growth.

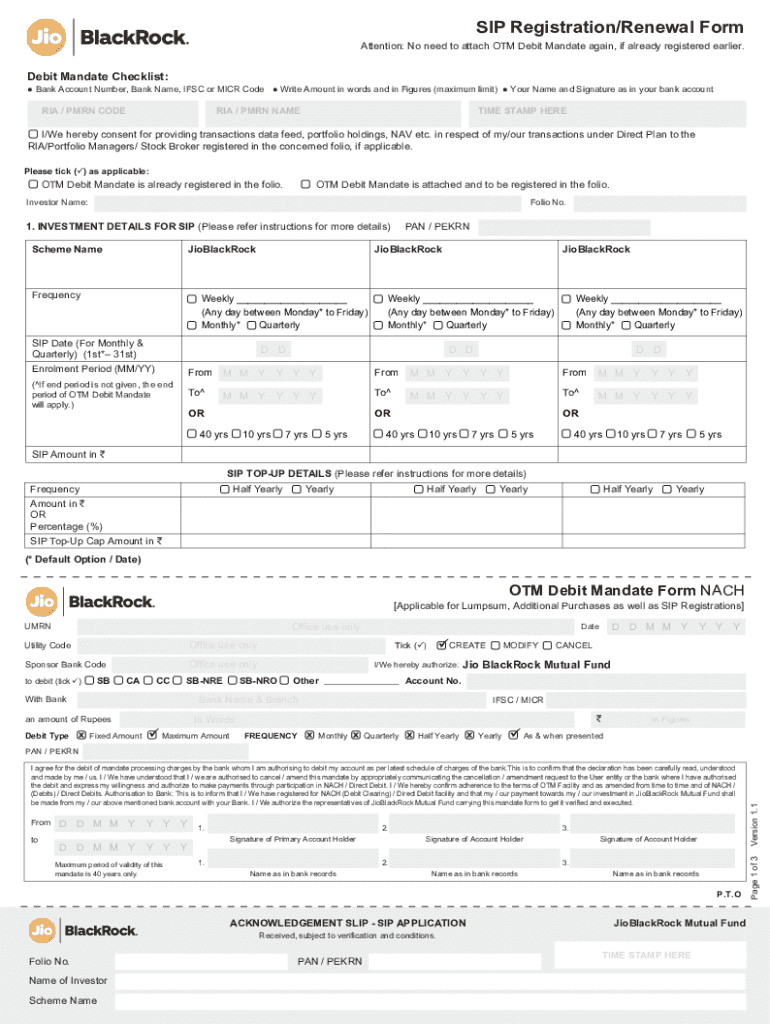

Understanding the Jio Blackrock Flexi Cap Form

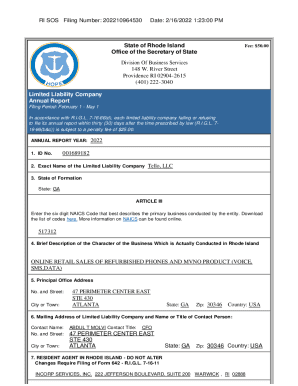

The Jio Blackrock Flexi Cap Form is an essential document for investors looking to participate in this fund. The primary purpose of the form is to gather necessary information from investors, allowing them to make their investment efficiently. It serves as a contract between the investor and the fund, ensuring that all necessary details are properly recorded.

Key components of the form include sections for personal information, investment amount, and bank details. The personal information section collects basic identification data, while the investment amount section specifies how much you intend to invest. The bank details section is critical as it ensures that funds can be transferred securely and correctly.

Providing accurate information in the Jio Blackrock Flexi Cap Form is vital to avoid delays or errors in processing your investment. Any discrepancies can lead to complications in fund allocation, affecting your potential returns.

Step-by-step guide to filling out the Jio Blackrock Flexi Cap Form

Filling out the Jio Blackrock Flexi Cap Form may seem daunting at first, but following a structured approach can simplify the process. Here’s a step-by-step guide to help you through.

Each of these steps is crucial in ensuring that your investment process is seamless, allowing you to focus on your financial growth.

Interactive tools for managing your investment

Managing your investment in the Jio Blackrock Flexi Cap Fund can be enhanced through various interactive tools, especially through platforms like pdfFiller. Tools for document editing and management can streamline your investment journey significantly.

Utilizing pdfFiller’s capabilities allows you to easily edit your submitted forms, sign documents, and collaborate with team members. Furthermore, maintaining spreadsheets for tracking your investment can help visualize your returns over time, adjusting your financial strategies as needed.

By leveraging these tools, you will be in a better position to manage your investments effectively, ensuring you meet your financial goals with confidence.

Common mistakes to avoid when filling out the form

While completing the Jio Blackrock Flexi Cap Form, it's easy to make simple mistakes that can lead to delays in processing or issues with your investment. Being aware of these common pitfalls can help you avoid them.

By being mindful of these common mistakes, you will streamline the submission process and enhance the likelihood of a successful investment experience.

Managing and modifying your investment post-submission

After submitting your Jio Blackrock Flexi Cap Form, managing your investment requires an understanding of how to modify your information, track performance, and further educate yourself on the fund.

To update your investment information, reach out to your fund manager or the customer service department to initiate any changes. Options for tracking fund performance typically include regular updates via your online investment account and access to detailed fund reports.

By staying engaged with your investment, you can better adapt to market changes and make informed decisions that align with your financial objectives.

Tax implications and considerations

Investing in the Jio Blackrock Flexi Cap Fund also comes with tax implications that every investor should be aware of. Understanding long-term versus short-term capital gains can significantly affect the net returns from your investments.

Long-term capital gains (LTCG) apply to assets held for over a year, typically enjoying a lower tax rate of 12.5%. In contrast, short-term capital gains are subjected to your regular income tax slab, which can be significantly higher. It’s important to calculate these taxable amounts appropriately, as taxes can eat into your returns.

Knowledge of these tax considerations is essential for making well-informed investment choices that maximize after-tax returns.

Comparing Jio Blackrock Flexi Cap Fund with competitors

When considering an investment in the Jio Blackrock Flexi Cap Fund, it's prudent to compare it with other similar funds on the market. Understanding the key differentiators can aid your investment decision.

Key comparisons typically include performance rankings, expense ratios, and the quality of fund management. Jio Blackrock has demonstrated consistent performance in various market conditions compared to many competitors, primarily due to its expert management and strategic asset allocation.

Highlighting the strengths of Jio Blackrock reinforces its value proposition among flexi cap funds, making it a compelling choice for potential investors.

Frequently asked questions (FAQ)

As with any investment, questions often arise regarding the submission process for the Jio Blackrock Flexi Cap Form. The following FAQs address common concerns prospective investors may have.

By addressing these questions, investors can feel more confident in their approach to filling out the Jio Blackrock Flexi Cap Form and managing their investments.

Final thoughts on investing in Jio Blackrock Flexi Cap Funds

The Jio Blackrock Flexi Cap Fund presents compelling benefits for investors seeking balanced exposure to the equities market. Recapping some key advantages, the fund’s structure allows for both diversified asset allocation and expert management, making it a strong contender among investment options.

As you embark on your investment journey, consider the factors discussed in this guide. Engaging with your investments through active management and seeking continuous education is vital for making informed decisions. The Jio Blackrock Flexi Cap Fund is not only about capital appreciation but also about aligning investment strategies with personal financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get jio blackrock flexi cap?

How do I fill out the jio blackrock flexi cap form on my smartphone?

How do I fill out jio blackrock flexi cap on an Android device?

What is jio blackrock flexi cap?

Who is required to file jio blackrock flexi cap?

How to fill out jio blackrock flexi cap?

What is the purpose of jio blackrock flexi cap?

What information must be reported on jio blackrock flexi cap?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.