Get the free 10-6: Reimbursement requests - Division of Finance - Utah.gov

Get, Create, Make and Sign 10-6 reimbursement requests

Editing 10-6 reimbursement requests online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-6 reimbursement requests

How to fill out 10-6 reimbursement requests

Who needs 10-6 reimbursement requests?

Mastering the 10-6 Reimbursement Requests Form: A Comprehensive Guide

Understanding the 10-6 reimbursement requests form

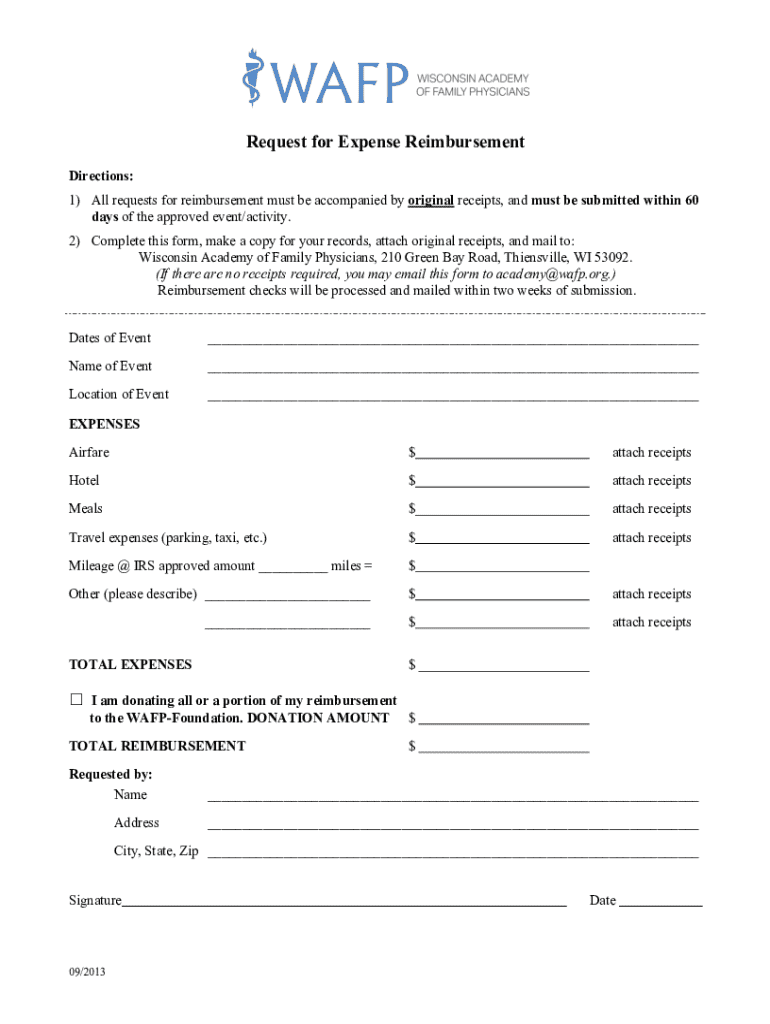

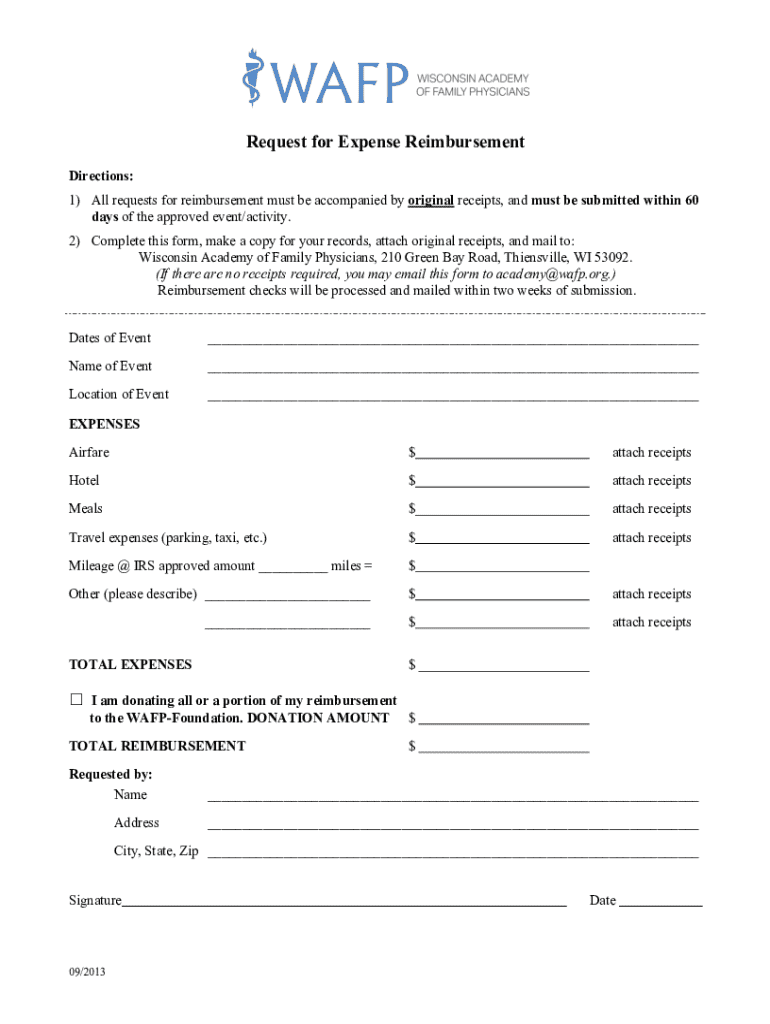

The 10-6 reimbursement requests form serves as an essential document for employees seeking to recover out-of-pocket expenses incurred while conducting business on behalf of their organization. This form is not just a piece of paperwork; it is a formal acknowledgment from the company regarding its commitment to cover legitimate business-related costs. Filing a reimbursement request through the 10-6 form helps in official record-keeping, allowing for a structured approach to financial management.

Utilizing the 10-6 reimbursement form streamlines the process of reclaiming expenses, thus enhancing employee satisfaction. Its structured format ensures that each request is detailed and clear, facilitating faster approval processes. Moreover, using this specific form aligns with the internal policies of the organization, thereby providing a sense of security for employees that their claims will be handled properly.

Types of reimbursement requests

Reimbursement requests can cover a plethora of expenses incurred during business operations. Among the most prevalent types are travel expenses, office supplies, and meals and entertainment. Each category comes with its own set of guidelines and limits, ensuring a fair and consistent approach to reimbursements across the organization.

Identifying eligible versus ineligible expenses is crucial. Eligible expenses typically include transportation costs, lodging, necessary office supplies, and meals related to business meetings. Conversely, ineligible expenses could encompass personal costs, unapproved entertainment, and overstated mileage claims. Clarity in these distinctions helps prevent confusion and promotes transparency within the reimbursement process.

Step-by-step guide to completing the 10-6 reimbursement form

Completing the 10-6 reimbursement form requires careful attention to detail. Follow these steps for a successful submission. First, gather necessary information such as personal and business details, ensuring that you provide accurate and up-to-date information. Maintaining accurate records simplifies the process, enabling quicker reimbursements and reducing the likelihood of errors.

Next, itemize your expenses. Providing a clear, detailed breakdown of costs aids in the validation of your request. Include dates, amounts, and descriptions of each expense. Accuracy in documentation cannot be overstated; always cross-reference your listed expenses against your supporting documents to ensure compliance.

Once your expenses are listed, it's crucial to attach supporting documents. These usually involve receipts and other proofs of expenses, such as invoices or tickets. Adhering to guidelines for what constitutes sufficient documentation helps enforce company policy and can expedite processing.

Finally, review and validate your request before submission. Take the time to proofread your form to catch any potential errors that could lead to delays or rejections. Common pitfalls include incorrect amounts and incomplete documentation, so diligence during this stage is paramount.

Submission process for the 10-6 form

The submission of the 10-6 reimbursement requests form has been simplified through digital platforms. Access the form online through pdfFiller, where you can fill out, edit, and sign your document digitally. This method ensures that the form is always up-to-date, reducing the chances of using outdated versions.

For digital submission, follow the instructions provided on the pdfFiller platform. You can easily submit your completed form with just a few clicks. If your organization accepts alternative methods, such as direct email or postal service, ensure that you follow internal protocols carefully. Being aware of the expected timeline for processing requests can also help set realistic expectations for when you might see your reimbursement.

Compliance and policy guidelines

Adhering to compliance and policy guidelines while submitting reimbursement requests is vital for both employees and employers. Each organization has specific policies in place governing what can be reimbursed, and these often include adherence to IRS regulations which dictate the treatment of business expenses. Familiarizing yourself with these policies can minimize the risk of delays or denials.

Moreover, internal review procedures are often established to ensure that every reimbursement request is scrutinized for compliance with company guidelines. This not only protects company resources but also ensures fairness in how expenses are treated across the board.

Handling common challenges with reimbursement requests

Despite best efforts, challenges can arise during the reimbursement process. One common issue is the lack of proof of expenses, which can result in significant delays. If you find yourself missing receipts, consider employing alternative strategies such as obtaining a receipt affidavit, indicating our expenses through a detailed personal account of the incident.

Another concern is the possibility of rejections and needing to resubmit claims. Understanding common reasons for denial—such as missing documentation or unrealistic expense claims—can help you proactively avoid these pitfalls. If you do encounter a denied reimbursement request, it's important to know that there generally is an appeal process. Be ready to gather and provide additional information as required.

Lastly, regularly follow up on the status of your reimbursement to ensure you remain informed about its progress. Creating a habit of checking back can alleviate anxiety and keep communication open with the responsible departments.

Utilizing pdfFiller for simplified reimbursement management

pdfFiller stands out in simplifying the reimbursement management process through its cloud-based platform. Users can effortlessly edit and share the 10-6 reimbursement requests form, promoting collaboration among team members. This feature is particularly valuable in larger organizations where multiple submissions from different employees need to be managed simultaneously.

The platform also offers eSigning capabilities, making it easier than ever to finalize reimbursement requests quickly. In addition to eSigning, pdfFiller provides collaborative tools that enable users to discuss and amend requests in real-time, fostering efficient communication. Case studies indicate that organizations employing pdfFiller have experienced significant improvements in their reimbursement management processes.

Conclusion and next steps

Efficient document management plays a vital role in successful reimbursement requests. Utilizing the 10-6 reimbursement requests form in conjunction with the capabilities of pdfFiller can streamline this process significantly. By embracing digital solutions, employees can save time, reduce stress, and improve their overall experience with expense reclamation.

Additionally, pdfFiller offers various tools for document handling that can enhance workplace productivity. As you navigate the complexities of reimbursement requests, consider integrating these digital solutions into your workflow for an even smoother experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 10-6 reimbursement requests without leaving Google Drive?

How can I get 10-6 reimbursement requests?

Can I create an electronic signature for the 10-6 reimbursement requests in Chrome?

What is 10-6 reimbursement requests?

Who is required to file 10-6 reimbursement requests?

How to fill out 10-6 reimbursement requests?

What is the purpose of 10-6 reimbursement requests?

What information must be reported on 10-6 reimbursement requests?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.