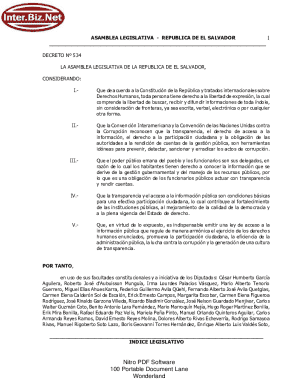

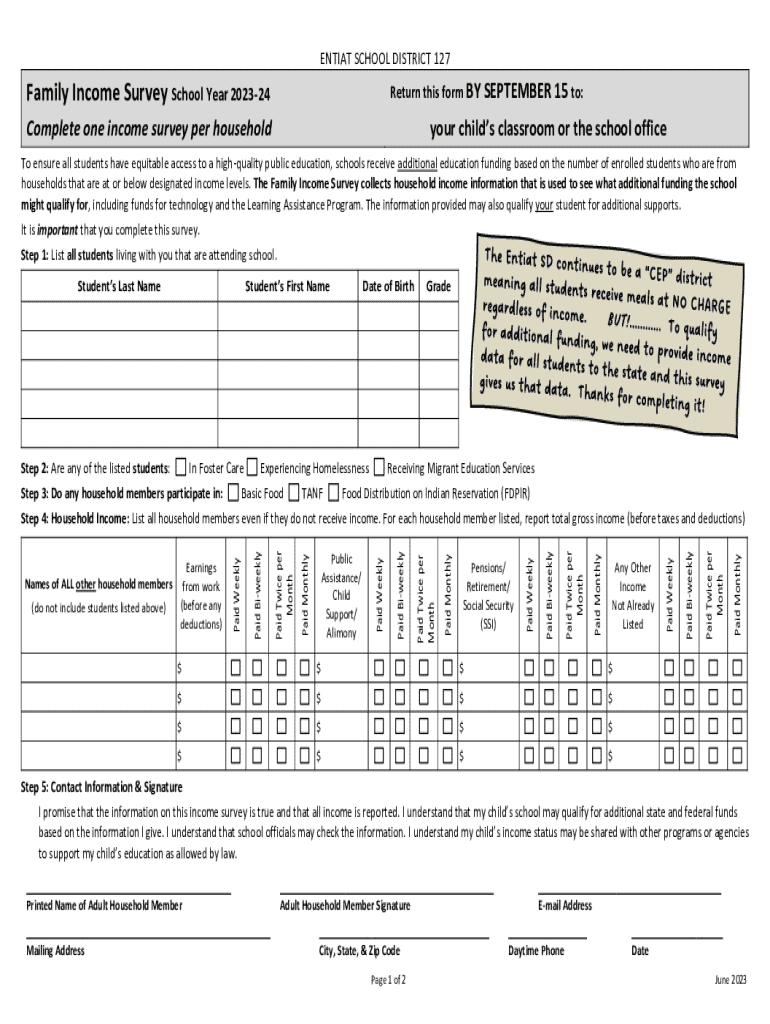

Get the free School Year 2024-2025 Income Eligibility Verification Forms ...

Get, Create, Make and Sign school year 2024-2025 income

How to edit school year 2024-2025 income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out school year 2024-2025 income

How to fill out school year 2024-2025 income

Who needs school year 2024-2025 income?

School year 2 income form: A comprehensive guide

Understanding the importance of the 2 income form

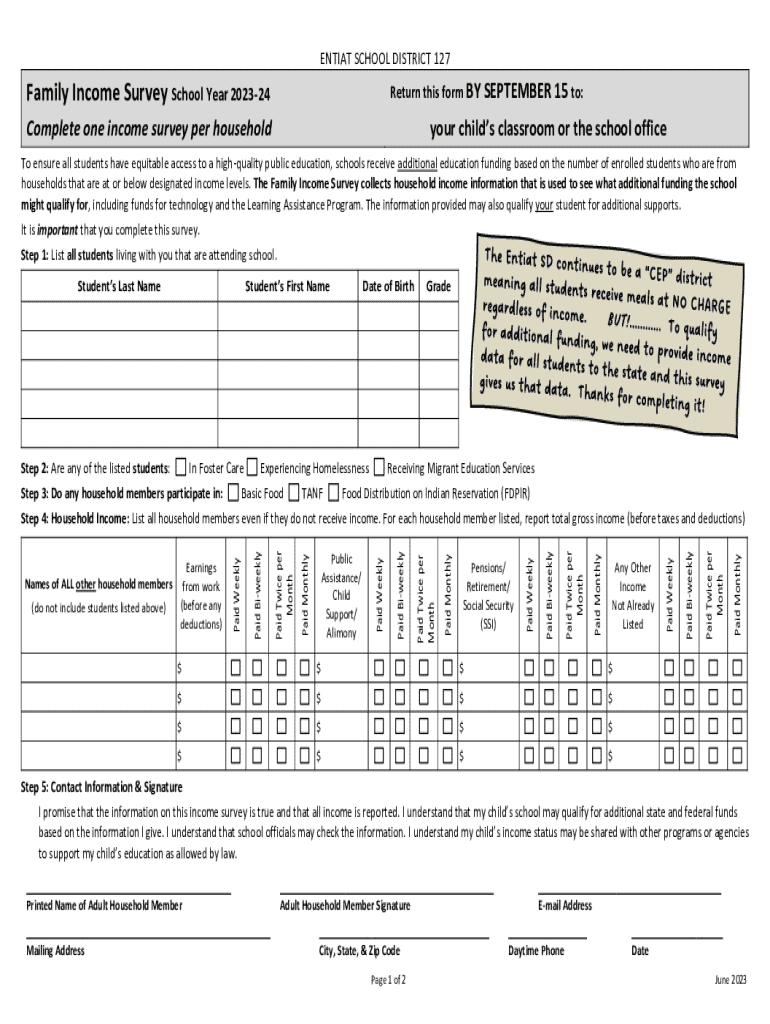

The school year 2 income form plays a crucial role in the financial planning and assistance process for students and families. By accurately completing this form, families can ensure they provide the necessary financial information that schools and financial aid programs need to assess eligibility for financial assistance. Proper documentation on this form helps institutions determine the level of support students may qualify for, which can significantly ease the financial burden of tuition and associated educational expenses.

Moreover, the income form is pivotal not just for determining eligibility for federal aid, but also for state and institutional aid programs that have their own criteria. Missing or inaccurate data can lead to delays, increased costs, or a reduction in aid, directly impacting a student's ability to attend or succeed in their educational journey. Therefore, it is essential to complete the income form with careful attention to detail.

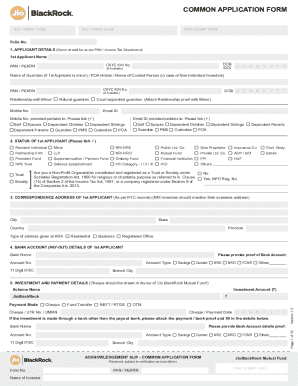

Who needs to complete the income form?

The income form is mandatory for students and families applying for financial aid, whether through federal programs like FAFSA or state-specific assistance. Both dependent and independent students have specific reporting requirements based on their financial situations. Dependent students must include their parent's income, while independent students can report their own income alone. Recognizing whether you fall under the dependent or independent category is crucial for accurately filling out the income form.

For instance, a dependent student is typically one who relies on their parents for financial support. Conversely, an independent student is usually someone who has reached a certain age, is married, or has dependents of their own. Understanding these differences helps in providing the right information, which ultimately influences financial aid assessments.

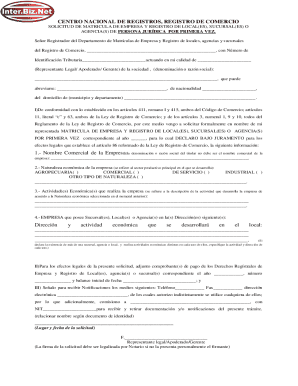

Essential income documentation required

Completing the school year 2 income form requires specific documentation to ensure all reported figures are accurate and verifiable. Commonly required documents include recent W-2 forms, self-employment income statements, and tax returns and transcripts. In particular, recent W-2 forms reflect salaries and wages earned, which are critical in understanding one’s total income.

In addition, self-employed individuals need to submit detailed income records, which might include profit and loss statements. Tax returns are foundational for income assessment, and obtaining certified copies from the IRS is advisable if originals are lost. It is crucial to remember that only original documents are generally accepted unless otherwise specified, so keep your documents organized and accessible for a smooth submission process.

Step-by-step instructions for filling out the income form

Step 1: Gather your financial information

The first step in completing the school year 2 income form is to gather all necessary financial information. Organize your recent W-2 forms, any documents related to self-employment income, and your tax returns. Ensuring you have these documents ready will streamline the filling process and reduce the risk of errors.

Step 2: Complete the income section

When you're prepared to fill out the income section, carefully break down the various types of income you have. You need to report both earned income (wages, salaries) and unearned income (interest, dividends). A common pitfall is inaccuracies caused by not double-checking figures against your documentation, which can lead to delays and questions from aid providers.

Step 3: Review household information

Lastly, a thorough review of household information is vital. Make sure the reported household size is accurate and reflects all income sources. If multiple family members are included in providing support, clearly detail all incomes to give a complete picture of financial need.

Tips for editing and reviewing your income form

Before submitting your school year 2 income form, it’s essential to check for accuracy. Utilize tools like pdfFiller, which can assist in editing and correcting any mistakes. By offering features for easy edits and eSigning, pdfFiller simplifies collaboration, allowing family members or financial advisors to review the form together, ensuring accuracy and completeness.

Adopting best practices such as reviewing the income figures against the original documents and verifying that all entries are legible will significantly minimize errors. Don't hesitate to make use of available resources for help during the editing process.

Submitting the income form: methods and deadlines

When it comes to submission, there are various options available for the school year 2 income form, including online submission and traditional paper forms. Online submission is often faster, but it’s essential to adhere to submission deadlines, as late filings can incur penalties or a reduction in aid availability. Be sure to check and confirm the deadlines set by your school or financial aid program.

Once submitted, you should also confirm that your submission was successful. Most schools provide a tracking system or confirmation email to ensure your application is received and in process.

What to do after submission?

After submitting your school year 2 income form, it enters a verification process that may require documents to verify the reported information. Common verification items include providing additional income documentation or proof of household size. Responding to verification requests quickly and thoroughly is paramount to securing financial aid considerations.

Furthermore, keep an eye on the status of your submission. Tools provided by schools or financial aid organizations can help you monitor application progress and verify that all necessary documentation has been received.

Addressing common issues and challenges

Navigating the completion of the school year 2 income form can lead to frequently encountered issues, such as submission errors. Familiarize yourself with common mistakes—such as entering incomplete or incorrect information—to mitigate potential complications during the review process.

Additionally, if there have been changes in your income since your last tax return, it’s vital to address this on your form. Document any changes and be prepared to explain them, especially if they are significant. Sudden changes in income during the school year can affect your eligibility, so proactive communication with financial aid offices is key.

Resources for additional assistance

If you need help during the process of filling out the school year 2 income form, several resources are available. Financial aid offices in schools are invaluable for personalized guidance, while online resources and support forums can provide additional insights from peers undergoing similar experiences.

Leveraging the capabilities of pdfFiller enhances your document management experience. With efficient eSigning, collaborative tools, and secure storage in the cloud, you can focus on completing your forms without the usual document management stress.

Staying updated on financial aid policies and procedures

Understanding financial aid policies is essential, as they can vary from year to year. Staying informed about potential changes in financial assistance regulations ensures you remain eligible for available funding. Consider subscribing to newsletters or following financial aid websites dedicated to updates on policies.

Using pdfFiller to adapt quickly to new forms and processes can give you a competitive advantage. With automatic updates and easy access to the latest forms, maintaining compliance while staying informed is less burdensome.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit school year 2024-2025 income from Google Drive?

Can I create an electronic signature for signing my school year 2024-2025 income in Gmail?

How do I edit school year 2024-2025 income on an iOS device?

What is school year 2024-2025 income?

Who is required to file school year 2024-2025 income?

How to fill out school year 2024-2025 income?

What is the purpose of school year 2024-2025 income?

What information must be reported on school year 2024-2025 income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.