Get the free NEFT/RTGS/Bank transfer details for payments

Get, Create, Make and Sign neftrtgsbank transfer details for

How to edit neftrtgsbank transfer details for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out neftrtgsbank transfer details for

How to fill out neftrtgsbank transfer details for

Who needs neftrtgsbank transfer details for?

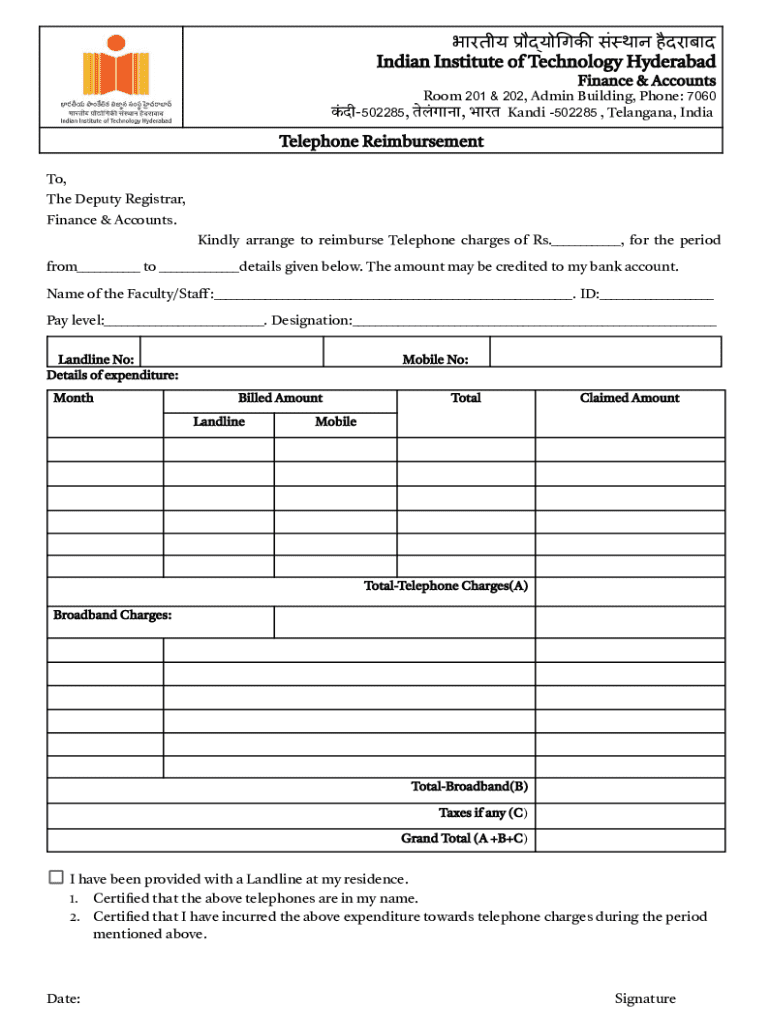

NEFT/RTGS Bank Transfer Details for Form

Understanding NEFT and RTGS transfers

NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) are two essential electronic payment systems used in India. Both services facilitate the transfer of money from one bank to another, but they serve different purposes. NEFT is primarily used for bulk payments and transactions of lower value, typically processed in batches, while RTGS is designed for high-value, time-sensitive transactions where real-time processing is critical.

The choice between NEFT and RTGS often depends on the urgency and amount of the transaction. For example, NEFT is suitable for everyday payments, such as paying utility bills or making small donations, while RTGS is generally utilized for large corporate payouts, property transactions, or urgent fund transfers.

Key differences between NEFT and RTGS

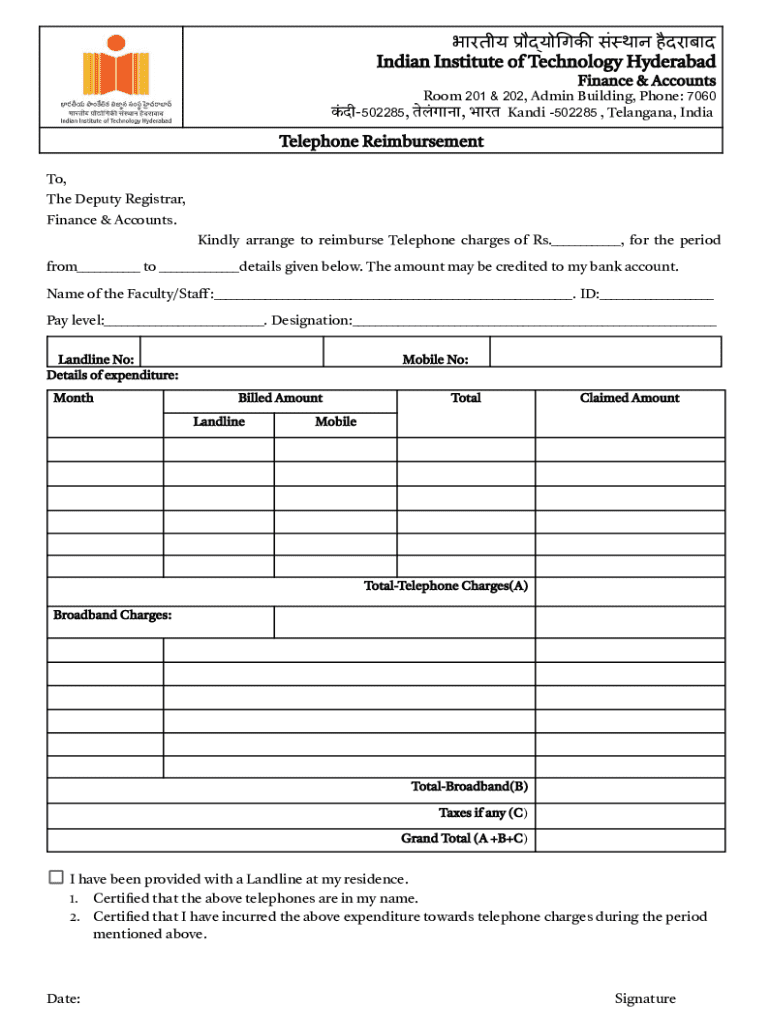

Overview of the NEFT/RTGS form

The NEFT/RTGS form plays a crucial role in facilitating seamless transactions. This form collects necessary details to ensure the accurate transfer of funds between banks. Filling it out correctly is vital, as any discrepancies can lead to delays or failed transactions.

Transactions requiring the NEFT/RTGS form include personal remittances, payment for goods and services, and transfers between accounts at different banks. Each transaction type will require specific information to be accurately entered in the form, ensuring funds reach the correct recipient without issues.

Step-by-step instructions to obtain the NEFT/RTGS form

Acquiring the NEFT/RTGS form is quite simple and can typically be done through various methods.

Step 1: Accessing the form online

Most banks provide the NEFT/RTGS form online via their official websites. Typically, you can navigate to the 'Forms & Applications' section or use their search function to find the specific forms needed. Here are links to popular banks' forms:

Step 2: Alternative methods to obtain the form

If you prefer a more hands-on approach, you can also obtain the NEFT/RTGS form by visiting a local bank branch. Bank tellers can provide you with physical copies of the required forms. Additionally, you can call your bank's customer service and request the form to be emailed or mailed to you.

Filling out the NEFT/RTGS form

Once you have the NEFT/RTGS form, it's crucial to fill it out correctly. Here's a step-by-step guide.

Step 3: Providing personal information

Begin by entering the necessary details for the sender. This information typically includes your name, address, and bank account number. Ensure your account number is accurate, as it’s essential for the transaction’s success.

Step 4: Inputting beneficiary details

Next, provide the necessary beneficiary details. This includes the beneficiary's name, account number, and IFSC code. The IFSC code is vital for ensuring the funds are transferred to the correct bank branch. A wrong IFSC can lead to delays or misdirected transfers.

Step 5: Detailing transaction information

After entering the beneficiary details, specify the transaction information. Include the amount to be transferred, which should align with your purpose of transfer. Clearly state the reason for the transaction, as this helps in record-keeping. You may also need to note the date and time, especially if the transfer is urgent.

Step 6: Additional sections in the form

Lastly, check for any additional sections in the form that may require your input, such as notes or specific instructions for the transaction. Don’t forget to sign the form, as many banks require a physical signature to verify the authenticity of the transaction.

Common mistakes to avoid when filling the form

While filling out the NEFT/RTGS form, caution is advised to prevent errors that could hinder the transaction. One common mistake is providing missing or incorrect information. Always double-check the beneficiary details, primarily the name and IFSC code, as even a small error could result in significant issues.

Additionally, some banks might have specific requirements not outlined in a generic form. Ensure you recognize these particularities, as they may vary from one bank to another, thus affecting the manner in which you fill out and submit the form.

Frequently asked questions about NEFT/RTGS transfers

Understanding the ins and outs of NEFT and RTGS transactions can help you navigate any issues with ease.

Resources for tracking NEFT/RTGS transactions

Tracking your NEFT or RTGS transaction is straightforward, and banks provide several channels for this.

How to track your transfer using the UTR number

Each NEFT and RTGS transaction generates a unique UTR (Unique Transaction Reference) number. You can use this number to monitor the transaction's status through your bank's online platform or mobile application.

Bank apps and online portals for tracking

Most banks today have user-friendly mobile apps and online portals where you can easily check the status of your transactions using the UTR number. This feature enhances transparency and helps keep you informed about your money transfer.

Contacting your bank for assistance

If you're unable to track your transaction online or have specific concerns, don’t hesitate to contact your bank’s customer service. They can provide real-time assistance and clarity regarding your transaction.

Utilizing pdfFiller for your NEFT/RTGS needs

Navigating the NEFT and RTGS processes is made easier with the help of pdfFiller. This innovative cloud-based platform allows users to effortlessly edit, fill, and sign the NEFT/RTGS form online.

With pdfFiller, you can collaborate with your team in real-time, ensuring everyone is on the same page before a transaction is executed. This eliminates miscommunication and enhances the efficiency of your transactions.

Additionally, pdfFiller’s cloud-based document management means you can access your forms anytime, anywhere, making it an ideal solution for individuals and teams that rely on comprehensive and flexible document creation tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the neftrtgsbank transfer details for in Chrome?

How do I fill out the neftrtgsbank transfer details for form on my smartphone?

How do I complete neftrtgsbank transfer details for on an iOS device?

What is neftrtgsbank transfer details for?

Who is required to file neftrtgsbank transfer details for?

How to fill out neftrtgsbank transfer details for?

What is the purpose of neftrtgsbank transfer details for?

What information must be reported on neftrtgsbank transfer details for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.