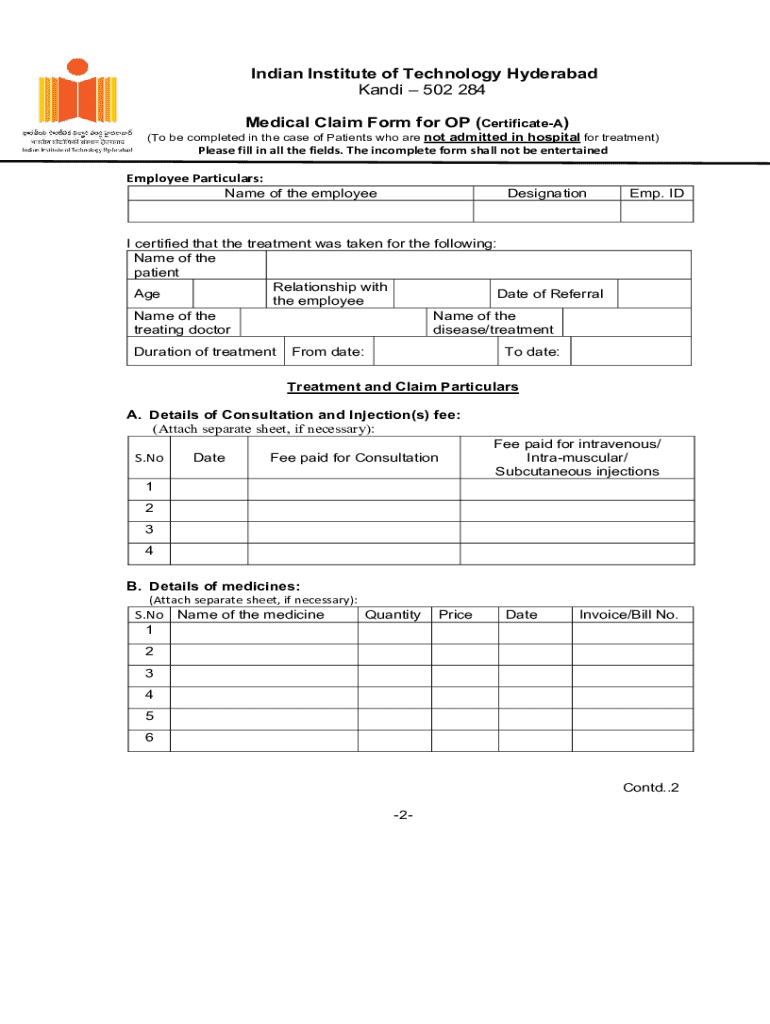

Get the free Medical Reimbursement claim forms for Outpatient treatment

Get, Create, Make and Sign medical reimbursement claim forms

How to edit medical reimbursement claim forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out medical reimbursement claim forms

How to fill out medical reimbursement claim forms

Who needs medical reimbursement claim forms?

Understanding Medical Reimbursement Claim Forms: A Comprehensive Guide

Overview of medical reimbursement claim forms

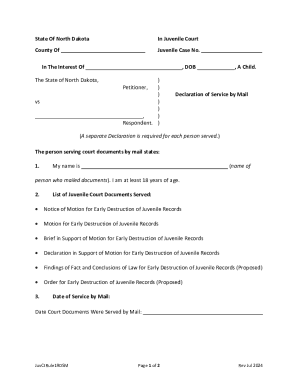

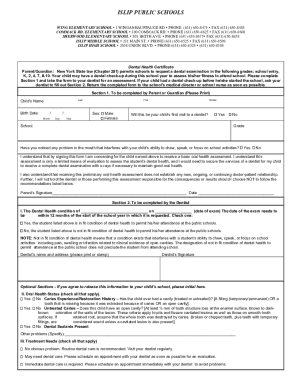

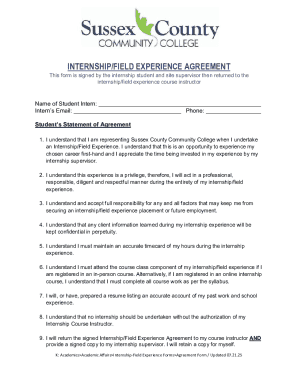

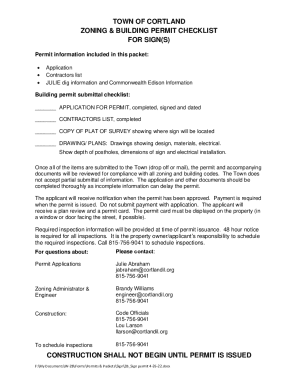

Medical reimbursement claim forms are essential documents designed to facilitate the process of reimbursement for healthcare expenses incurred by insured individuals. Their primary purpose is to provide health insurance companies with the necessary information to assess and process claims based on services rendered. Accuracy in submitting these forms is crucial; even minor errors can lead to delays or denials in claims processing.

Understanding the various types of medical reimbursement claims is equally important. These often include direct medical claims for services rendered, such as doctor's visits, procedures, and diagnostic tests. Each of these claims requires specific information and documentation tailored to the services provided, emphasizing the importance of a thorough and careful approach in filling out medical reimbursement claim forms.

Key components of medical reimbursement claim forms

A medical reimbursement claim form typically contains several crucial components that collectively ensure the smooth processing of your claim. One of the primary elements is the Direct Medical Reimbursement Form. This document serves as the foundation of your claim, consolidating all relevant information needed by the insurer to evaluate and reimburse for healthcare services.

Subscriber information

Subscriber information is vital; it identifies the individual who holds the insurance policy. Essential details include the full name of the subscriber, their ID number, and the group number if applicable. Accurate data is critical, as any discrepancies can delay your claim. Insurers rely on this information to match the claim with the correct policy details.

Patient information

Patient information must also be accurately represented. This includes the patient's name, date of birth, and their relationship to the subscriber. Common mistakes in this section often lead to delays in processing and can create complications in reimbursement. Having this information precise from the outset is pivotal in ensuring a seamless claims process.

Payer information

The payer is usually an insurance provider responsible for the reimbursement. Including accurate payer information is essential, as these entities handle the processing of claims. Necessary details such as policy details and contact information about the insurance provider should never be overlooked either. This not only streamlines communication but also ensures that your claims are assessed promptly.

Essential attachments and documentation

For a medical reimbursement claim to be processed efficiently, several attachments and pieces of documentation are required. One common attachment is the Explanation of Benefits (EOB), which outlines the services provided, amounts billed, and any payments made by the insurer. The EOB serves not only as a record of transaction but also helps in clarifying what remains to be reimbursed. Obtaining your EOB typically involves accessing it through your insurer's online portal.

Submission type

Claims can be submitted through various channels: by mail, fax, or electronically. Each method has its advantages and best practices. For example, electronic submission may expedite the process, while mail submissions can provide a paper trail for record-keeping. It’s best to familiarize yourself with your insurer's preferred claim submission methods to avoid misunderstandings.

Provider information

Moreover, your claim should also include details about the healthcare provider who rendered services. This encompasses the provider's name, their National Provider Identifier (NPI) number, and specialty. Providing accurate provider information is vital for ensuring that your claims are effectively processed and that reimbursements are delivered timely. Missing or incorrect details might hinder the processing of claims, resulting in further delays.

Detailed submission process

Filling out a medical reimbursement claim form might seem daunting initially, but following a structured approach can simplify the task. Begin with the Subscriber Information, ensuring all details are filled out accurately. Next, include the Patient and Payer details comprehensively. It's essential to double-check these sections before proceeding to the next steps.

Additionally, be mindful of any secondary attachments you may need to provide, as these often bolster your claim's integrity. Common mistakes to avoid include submitting incomplete forms, not signing the document, or neglecting to attach necessary documentation, all of which can lead to delays. Once submitted, be aware that claim processing timelines can vary; typically, expect a waiting period of two to four weeks for most insurance claims.

Managing your claim post-submission

After you have submitted your claim, managing its status becomes paramount. Tracking your claim's progress involves reaching out to your insurer and utilizing their claim tracking tools available online. Understanding the claims denial and appeals process is crucial as well; should your claim be denied or underpaid, knowing how to correctly file an appeal is essential. This is where keeping meticulous records comes into play.

Using pdfFiller for efficient document management

pdfFiller offers a streamlined solution for managing medical reimbursement claim forms. Through this cloud-based platform, users can effortlessly edit PDFs, electronic sign documents, and collaborate with team members or healthcare providers. The ease of file sharing and version control allows for seamless communication throughout the claims process. By employing pdfFiller's tools, users can handle multiple claims effectively, enabling better documentation management.

Special considerations for specific situations

Navigating the claims process can become particularly complex in specific scenarios, such as seeking reimbursement for services rendered by out-of-network providers. Many insurance policies impose greater restrictions and may require additional documentation in these cases. It’s essential to check your health plan details regarding out-of-network claims to understand what's permissible.

Understanding the steps to take if your claim is denied or underpaid is equally important. Typically, you will need to provide additional documentation or clarification to have your claim reconsidered. For dependent care claims, consider that specific adjustments might also be necessary, particularly in documenting the relationship between the subscriber and the dependent.

Frequently asked questions (FAQs)

One common inquiry is regarding the typical turnaround time for claim reimbursements, which usually ranges from two to four weeks depending on the insurer. Additionally, many may wonder if multiple claims can be submitted simultaneously. Most insurers allow simultaneous submissions, but it’s best to verify with your specific provider.

Moreover, if individuals lose their claim form or any supporting documents, it’s imperative to recompile the necessary documentation quickly and notify their insurer of the situation. The use of digital tools like pdfFiller can significantly mitigate such issues, providing users with easy access to stored claim forms and documentation.

Tips and best practices for successful claims

To enhance the likelihood of successful reimbursement claims, ensuring completeness is critical. Double-checking all fields on the medical reimbursement claim forms prevents errors that can cause delays. Organizing your supporting documentation for easy reference can also save valuable time during the claims process. Beyond this, utilizing pdfFiller's tools can maximize efficiency as it provides functionalities to edit, sign, and manage documentation in one convenient platform.

Finally, remaining informed about submission types, tracking claims, and understanding the appeals process will equip you with the knowledge necessary for navigating the reimbursement landscape effectively. By adhering to these best practices and leveraging tools like pdfFiller, you empower yourself to take control over your medical reimbursement claims with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my medical reimbursement claim forms in Gmail?

How can I fill out medical reimbursement claim forms on an iOS device?

How do I fill out medical reimbursement claim forms on an Android device?

What is medical reimbursement claim forms?

Who is required to file medical reimbursement claim forms?

How to fill out medical reimbursement claim forms?

What is the purpose of medical reimbursement claim forms?

What information must be reported on medical reimbursement claim forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.