Get the free Central Bank of India Recruitment: Office Assistant & FLCC

Get, Create, Make and Sign central bank of india

Editing central bank of india online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central bank of india

How to fill out central bank of india

Who needs central bank of india?

Central Bank of India Form - A Comprehensive How-to Guide

Overview of Central Bank of India forms

Central Bank of India forms play a vital role in facilitating a multitude of banking operations. Understanding these forms and their specific purposes is essential for both individuals and teams engaging with banking services. These forms not only streamline processes such as account openings and loan applications but also improve communication between customers and the bank.

The types of forms offered by the Central Bank of India can be categorized into several main types, including account opening forms, loan applications, deposit forms, and other relevant templates. Each type serves as a gateway to essential financial services, which makes familiarity with them crucial for anyone looking to optimize their banking experience.

Understanding the purpose and need for each form

Reviewing account opening forms is critical because they require specific personal and financial details. Users must ensure they have accurate information to avoid delays or rejections. Typically, these forms may ask for the applicant's identification, address proof, and source of income. Potential mistakes to avoid include missing signatures and providing incorrect details, which can lead to unnecessary complications.

Loan application forms require precise information, as inaccuracies might decline the application. It's advisable to prepare a checklist of required documents, such as proof of income, identification, and purpose of the loan. Each document should be accurately reflected in the application to ensure compliance with lending criteria. Likewise, deposit forms come in various types, such as fixed deposits or recurring deposits, and it's essential to understand the distinctions when filling them out.

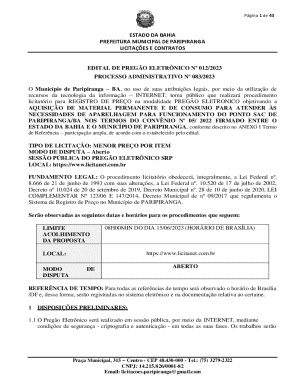

Accessing Central Bank of India forms

Finding official Central Bank of India forms is straightforward with a bit of guidance. The Central Bank of India website has a dedicated section for customer resources where all relevant forms can be accessed. Users simply need to navigate to the appropriate section, often categorized under services or customer support, to locate the forms they need.

In addition to the website, some third-party hosting platforms also make these forms available. It is essential to ensure that any external source is reputable to avoid misinformation. Most forms can be downloaded in PDF format, which is standard, but alternative formats may also be available to enhance accessibility for all users.

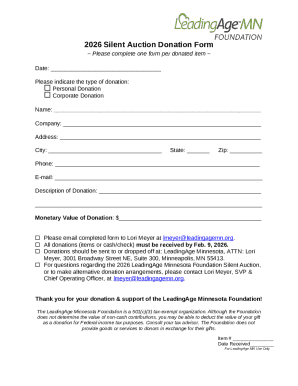

Step-by-step guide to filling out Central Bank of India forms

Before filling out any Central Bank of India form, it's crucial to prepare all relevant information. This includes gathering personal details like full name, address, and identification numbers, along with financial information critical for applications such as income sources and existing loan obligations. Additional supporting documents, such as property documents for a loan application or identity proofs for an account opening, should also be organized beforehand.

Here are helpful instructions for completing each major form. For the account opening form, start by filling in your personal details accurately, ensuring that each field is correctly interpreted. In the case of loan applications, pay special attention to sections requiring employment details and the purpose of the loan. Lastly, filling deposit forms necessitates precision, especially when indicating multiple transaction amounts or types of deposits.

Editing and signing Central Bank of India forms

Editing forms before submission is critical to ensure both accuracy and clarity. Mistakes can lead to delays or the rejection of requests. Using tools like pdfFiller, users can easily edit PDF forms without hassle. The process involves uploading the PDF, making necessary alterations, and adding annotations where required.

Once the editing phase is concluded, signing forms becomes the next step. The legal validity of electronic signatures is well-recognized, and pdfFiller provides options for users to eSign their forms digitally. The steps typically involve choosing a signing option, following prompts to add your signature, and completing the process quickly and securely.

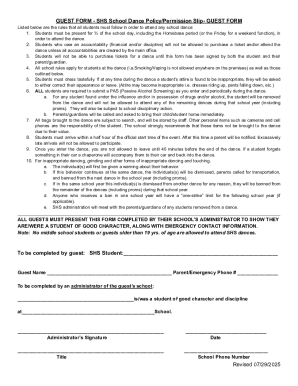

Managing your completed forms

Once your forms are completed and submitted, effective management is essential. Storing these documents securely while ensuring easy access is critical for future reference. Cloud-based storage solutions offer a safe environment for keeping important forms, with platforms such as pdfFiller providing organized storage facilities that include categorization features for streamlined management.

Collaboration among team members can enhance efficiency in managing forms. Using pdfFiller's collaboration tools, users can share documents for review, making it easy to include input from different stakeholders. This is particularly useful in environments where multiple approvals are necessary for processes such as loan applications.

Troubleshooting common issues with forms

Common errors encountered when filling out forms can usually be tackled with a proactive approach. Missing or incorrectly filled sections can lead to processing delays. It is crucial to double-check every detail before submission, ensuring all required fields are completed and accurate.

When issues arise, reaching out to Central Bank of India for assistance is straightforward. The bank typically provides clear channels for customer support, whether through phone, online chat, or email. Knowing when to seek help is just as important, especially if complications persist.

Utilizing pdfFiller for ongoing document management

In today’s rapidly evolving digital landscape, using a cloud-based document solution like pdfFiller offers numerous advantages. The ability to integrate with various tools and platforms allows for streamlined workflows, enabling users to tackle form management more effectively than ever before. Moreover, pdfFiller enhances workflow efficiency with its user-friendly features, ensuring that you can focus on more critical tasks.

With capabilities for editing, signing, and collaborating, pdfFiller positions itself as an indispensable resource for individuals and teams engaged in frequent banking transactions or legal documentation. Whether applying for a loan or setting up a new account with Central Bank of India, having a reliable document management platform makes all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my central bank of india in Gmail?

How do I make changes in central bank of india?

How do I edit central bank of india in Chrome?

What is central bank of india?

Who is required to file central bank of india?

How to fill out central bank of india?

What is the purpose of central bank of india?

What information must be reported on central bank of india?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.