Get the free Part D Enrollment and Disenrollment Guidance ...

Get, Create, Make and Sign part d enrollment and

Editing part d enrollment and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part d enrollment and

How to fill out part d enrollment and

Who needs part d enrollment and?

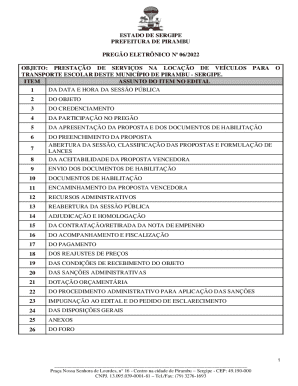

A Comprehensive Guide to Medicare Part Enrollment and Form

Understanding Part : An overview

Medicare Part D is a federal program that provides prescription drug coverage to eligible Medicare beneficiaries. Established as part of the Medicare Modernization Act of 2003, Part D aims to enhance access to affordable medications vital for managing health conditions. This coverage is crucial for individuals with chronic conditions, as it helps manage out-of-pocket costs associated with necessary medications.

The importance of prescription drug coverage cannot be overstated. With the rising costs of medications, having insurance that covers drug expenses can significantly improve health outcomes and financial stability. Without this coverage, many people might struggle to afford the medications they need, leading to poor health results and unnecessary hospitalizations.

Eligibility for Part D enrollment generally extends to anyone enrolled in Medicare. This includes individuals aged 65 and older, and younger people with disabilities. It's essential to understand that while Medicare promotes access to drugs, it does carry certain conditions and requires timely enrollment to avoid penalties.

The basics of Medicare Part

Medicare Part D plans come in two primary types: Standalone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with Drug Coverage (MAPDs). PDPs are separate plans that provide coverage exclusively for prescription drugs. In contrast, MAPDs combine Medicare coverage for hospital and doctor visits with prescription drug benefits, making them an appealing option for many.

When considering Part D, it’s important to familiarize yourself with key terms. Premiums refer to the monthly fees you pay for the plan, while deductibles are the amounts you must spend out-of-pocket before your coverage kicks in. Co-pays are fixed rates paid for specific services, and out-of-pocket costs are the total you pay for covered services in a year before reaching the plan's limit.

How Part enrollment works

Understanding how Part D enrollment works is essential for making informed decisions about your healthcare options. Enrollment periods are crucial, and they consist of several distinct phases. The Initial Enrollment Period occurs when you first become eligible for Medicare. It's a seven-month timeframe starting three months before your 65th birthday and concluding three months after.

After the initial phase, the Annual Election Period allows beneficiaries to enroll or change plans. This period runs from October 15 to December 7 each year, allowing ample time to reassess needs and select appropriate coverage. Special Enrollment Periods may be available for those who have experienced significant life changes, such as moving or losing other health coverage.

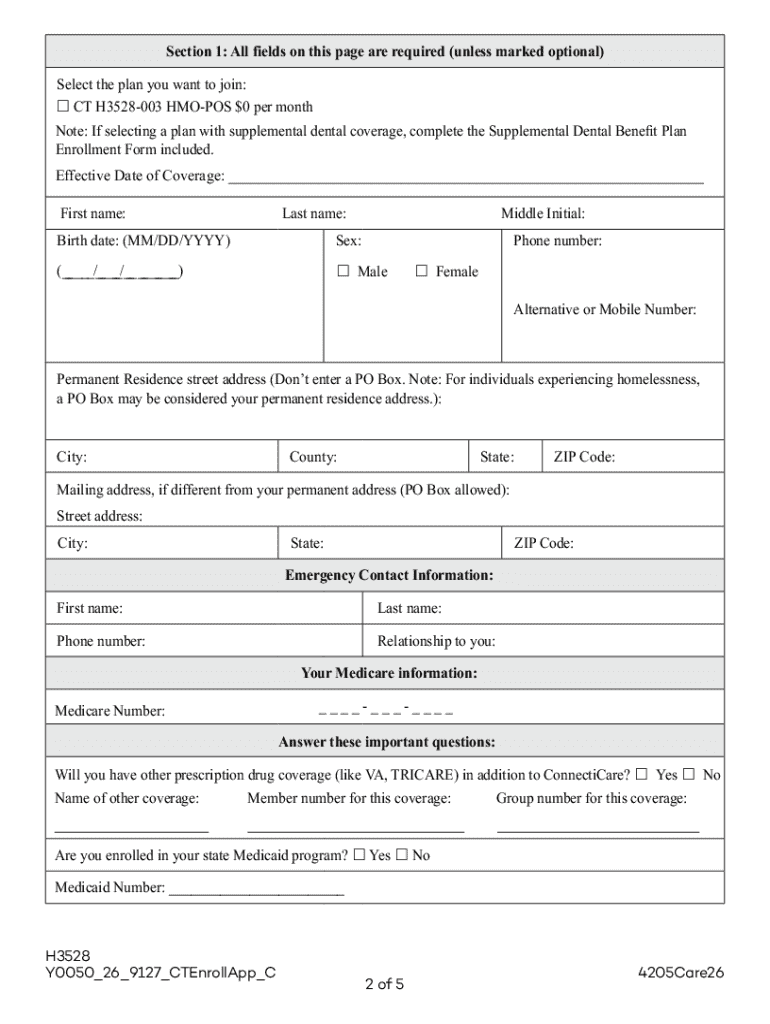

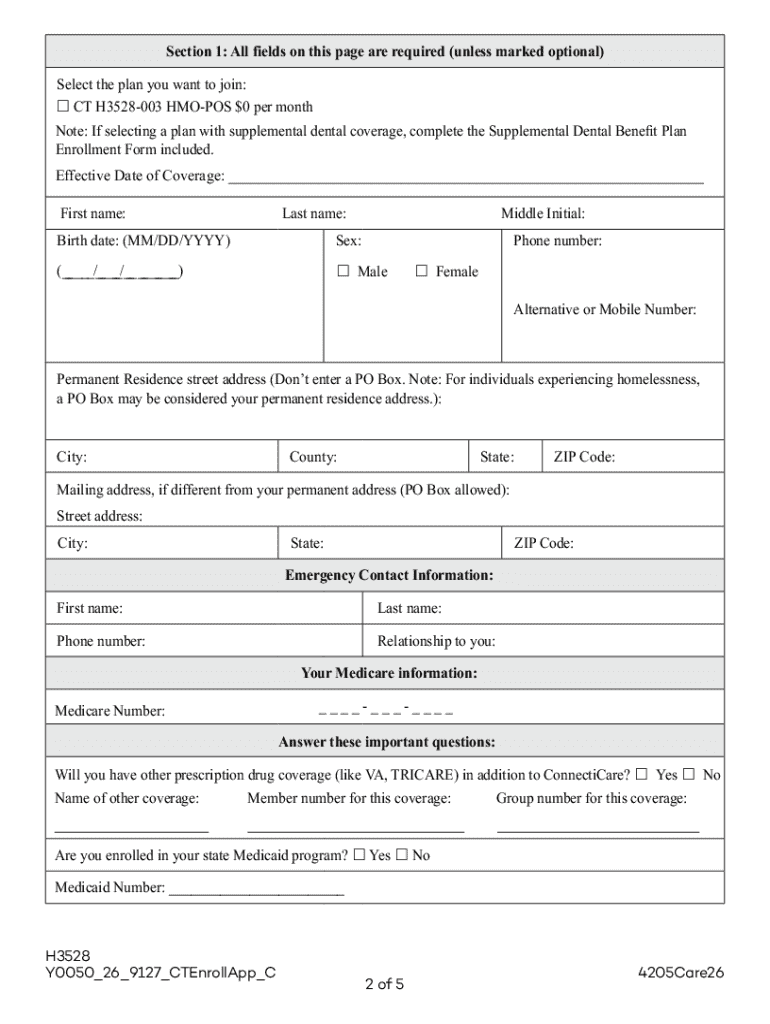

To enroll, you'll need specific documents, including your Medicare card and valid identification. In some cases, if you are eligible for additional assistance or have a low income, proof of income may also be required.

Steps to enroll in a Medicare Part plan

Enrolling in a Medicare Part D plan involves several steps that ensure you choose the right coverage. Step 1 is to assess your prescription needs. Create a comprehensive list of medications you currently take, including dosages and frequencies. This information is crucial for evaluating available plans that cover your necessary medications.

Step 2 involves researching available plans. With a myriad of plans available, it’s essential to compare options based on coverage, premiums, and deductibles. Look into the formulary for each plan, a critical component that outlines which drugs are covered, their tiers, and associated costs. Make sure the medications you need are included in the formulary to avoid unexpected out-of-pocket expenses.

Step 3 consists of filling out the enrollment form. You can find the form on the Centers for Medicare & Medicaid Services website or through your chosen insurance company. Pay close attention while filling out each section to ensure all information is accurate. Step 4 is submitting your application, which you can do online, through the mail, or in person, depending on your preference. Finally, Step 5 is confirming your enrollment. Follow up to verify your enrollment status and learn what to expect as you begin your coverage.

Managing your Part plan

Successfully managing your Part D plan involves understanding how to use your coverage effectively. Begin by finding in-network pharmacies that accept your plan, as this will help you maximize savings. Also, familiarize yourself with your plan’s benefits. Knowing how to access discounts and verifying your medication costs can prevent unexpected bills at the pharmacy.

Additionally, keeping track of changes to your circumstances is vital. If your medications change or your financial situation alters, you may need to adjust your plan. For example, if you move, you should reassess your options in your new area, as different plans may be available. Regularly review your plan annually during the Election Period to ensure it continues to meet your needs.

Common questions about Part enrollment

Navigating Medicare Part D enrollment can lead to many questions. For instance, what should you do if you miss the enrollment period? In such cases, you may have to wait for the next enrollment period or qualify for a Special Enrollment Period if you meet specific criteria. It's also important to know how to appeal a coverage decision or denial, which typically involves submitting a written request to your plan's appeal department.

For any unresolved issues or inquiries, having key contacts for assistance can prove beneficial. You can reach out to your plan’s customer service or consult the official Medicare website for more resources and support. Ensuring that you stay informed and proactive about your enrollment is key to avoiding potential pitfalls.

Interactive tools and calculators

In today’s digital age, utilizing interactive tools and calculators can simplify the complexity of managing Part D plans. These tools often allow users to estimate costs associated with their prescription needs, providing clarity on potential expenses. Additionally, drug coverage comparison tools help users view various plans side by side to assess differences and determine the best fit for their healthcare requirements.

These interactive components can often be accessed on reliable platforms such as pdfFiller. They enable users to fill out, edit, and manage forms seamlessly, ensuring you have everything you need at your fingertips.

Final thoughts on managing your prescription coverage

Remaining informed about your Part D options holds significant benefits. It's crucial to stay updated on any changes to your plan, new medications, and evolving healthcare needs. Regular reviews can save money and ensure your coverage remains adequate. By leveraging document management solutions like pdfFiller, you can easily handle the paperwork associated with your Part D enrollment, editing documents or signing forms as necessary.

Utilizing these tools fosters an organized approach to managing your prescription coverage, empowering you to focus on your health while minimizing stress associated with documentation.

Troubleshooting enrollment issues

Encountering issues during your Part D enrollment is not uncommon, but many problems can be resolved easily. Common mistakes often include incorrect personal details or failing to include required documents. Double-checking your form before submission can mitigate these errors. If discrepancies arise, immediate contact with customer service may clarify misunderstandings and facilitate corrections.

For further assistance, the Medicare support line offers guidance and solutions to common enrollment challenges. Keeping this contact information handy can expedite issue resolution and ensure your coverage remains intact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit part d enrollment and from Google Drive?

Can I sign the part d enrollment and electronically in Chrome?

How do I fill out part d enrollment and using my mobile device?

What is part d enrollment?

Who is required to file part d enrollment?

How to fill out part d enrollment?

What is the purpose of part d enrollment?

What information must be reported on part d enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.