Get the free Income Application

Get, Create, Make and Sign income application

How to edit income application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income application

How to fill out income application

Who needs income application?

Income Application Form: How-to Guide Long-Read

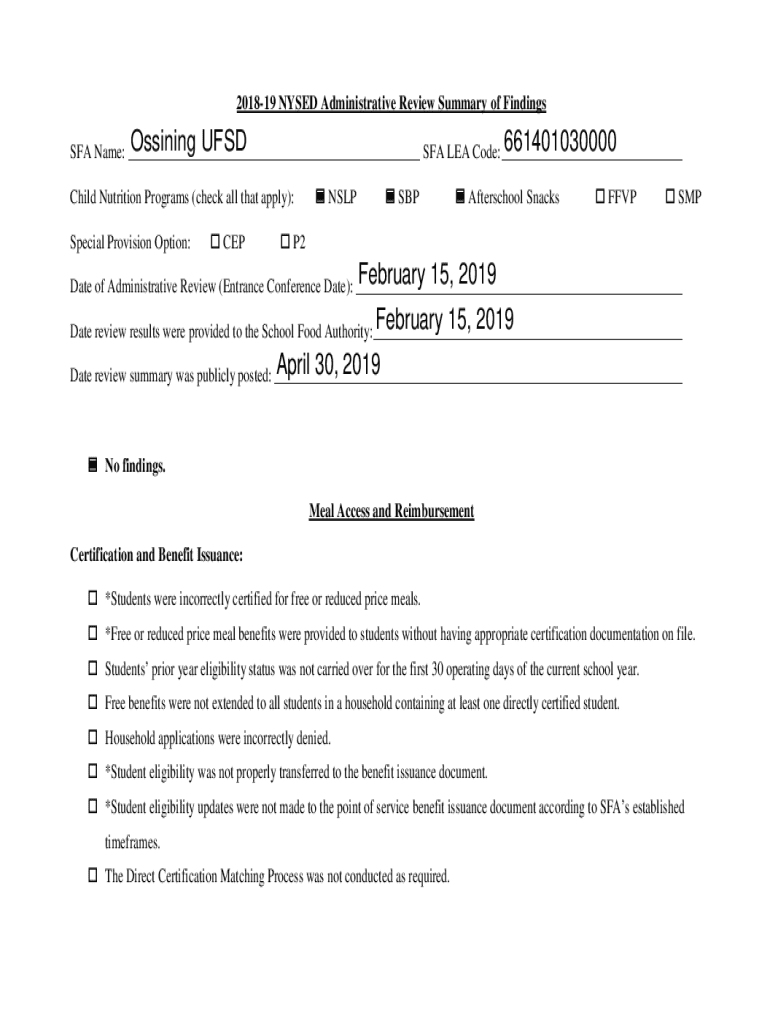

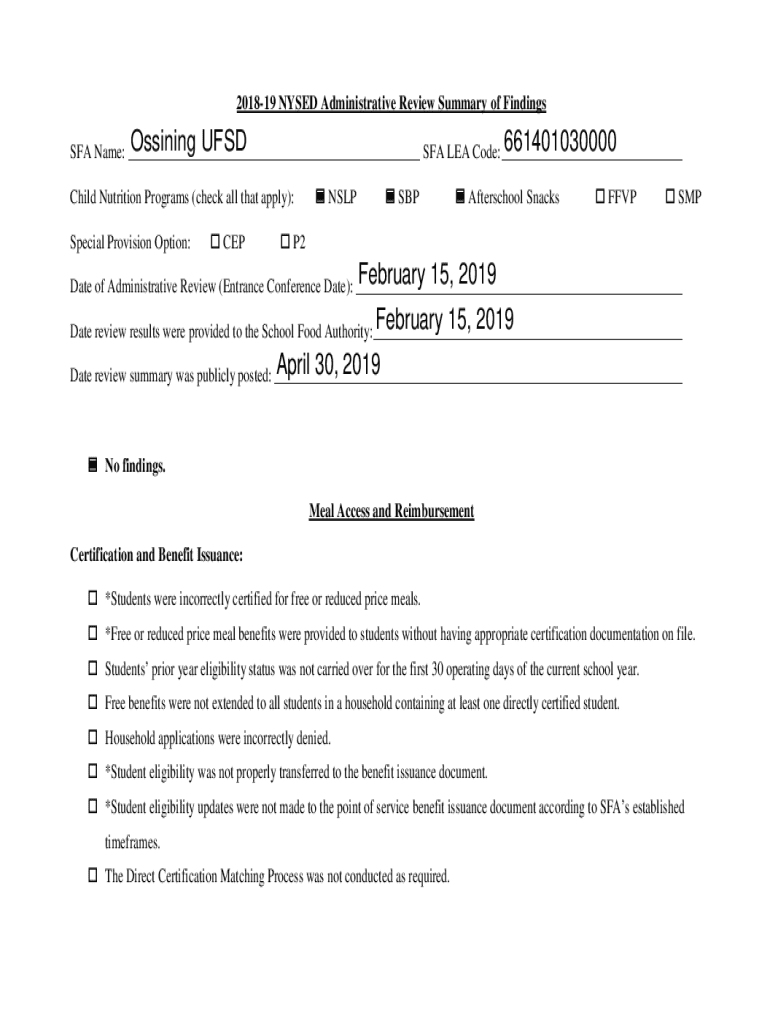

Understanding the income application form

An income application form is a crucial document utilized across various sectors to assess an individual’s financial standing. This form typically compiles all necessary details regarding one’s income sources, financial obligations, and sometimes personal identification information. Each field on the form contributes to a comprehensive view of the applicant's financial health.

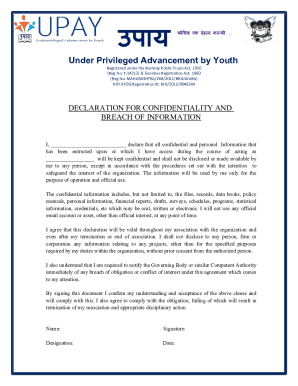

Providing accurate information on an income application form is vital. Misrepresentations or inaccuracies can lead to delays, denials, or even legal consequences. Understanding the nuances of this form not only benefits users but also improves transaction accuracy for employers, landlords, and financial institutions.

Essential components of an income application form

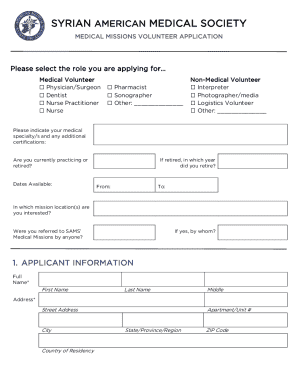

Each income application form contains several essential components, which every applicant must accurately complete. Starting with personal information, applicants must provide basic identity details. This foundation is crucial because it allows the reviewing entity to verify the applicant's identity and associate the financial details with the correct individual.

In the income details section, applicants list all sources of income, including employment positions, freelance work, and any investments. Additionally, detailing other income elements such as bonuses, commissions, and overtime income can yield a fuller picture of financial health. Tax information, including tax identification numbers and previous tax returns, helps ensure that the applicant adheres to required tax laws.

Step-by-step guide to filling out the income application form

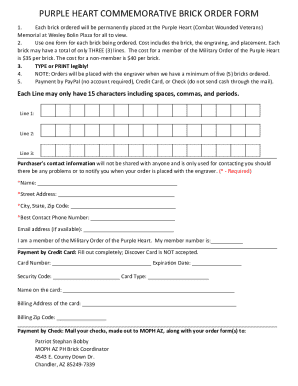

Filling out an income application form can feel overwhelming. However, breaking it down into manageable steps simplifies the process significantly. Start by gathering necessary documentation that supports your income claims. These documents include recent pay stubs, tax returns for verification, and bank statements to highlight savings or investments.

As you complete each section of the form, accurately provide personal details, income sources, and monthly expenses. An essential part of the process is reviewing your entries before submission. Cross-checking for accuracy minimizes errors that could influence the processing of your application.

Tips for a successful income application submission

Every income application submission should be accompanied by a checklist to avoid common pitfalls. Inaccurate reporting of income and missing essential documentation are frequent mistakes that can lead to denials. Improving the credibility of your application may require supplemental documents, such as references from previous landlords, which can support your claims.

Formatting can also elevate your application, presenting a professional image that fosters confidence among reviewers. By utilizing pdfFiller's features for optimizing document presentation, users enhance their applications’ likelihood of approval.

Managing your income application form after submission

After you submit your income application form, managing its status becomes essential. Keeping track of application status helps applicants anticipate potential issues or delays. It’s equally crucial to understand how to make updates efficiently; financial situations can change, necessitating a response to any new circumstances.

Archiving previous applications is facilitated through pdfFiller’s document management tools, which allow users to retrieve past applications easily. This feature eliminates the need for repeated document requests and makes updates swift.

Frequently asked questions about income application forms

Inquiries regarding an income application form often involve how to handle financial changes. If your income fluctuates, it’s vital to report these changes as they occur to ensure compliance with responsibilities to lenders or landlords. Transparency is key for preserving trust in all financial dealings.

Handling multiple income sources can be confusing, but it’s crucial to list all income streams accurately—this may include full-time work, side jobs, or passive income. Any oversights can significantly impact the decision-making process regarding your application.

Leveraging pdfFiller for your income application needs

Using pdfFiller to manage your income application offers significant advantages. The platform provides cloud-based editing and sharing capabilities that streamline the process of completing and submitting forms. Teams benefit from the collaborative nature of pdfFiller, which allows multiple users to contribute to document creation, significantly enhancing efficiency.

Real-life success stories shared by pdfFiller users reveal that easy document access and robust editing features have transformative potentials for application management. Whether you’re a freelancer working on loan applications or managing multiple rental prospects, pdfFiller adapts to simplify your tasks.

Conclusion: Empowering your income applications with pdfFiller

Utilizing pdfFiller for your income application form simplifies and enhances the entire process. By leveraging its features, users can access their documents from anywhere, streamline collaboration with teams, and ensure their submission is polished and accurate. As detailed in the guide, understanding the form’s components and how to effectively manage them is invaluable.

Embracing pdfFiller not only empowers individuals with resources and tools but encourages a proactive approach to financial applications, leading to better outcomes, increased approval rates, and less stress during the application process. Explore the comprehensive features and realize the ease of managing your documents with pdfFiller today!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the income application electronically in Chrome?

How can I edit income application on a smartphone?

Can I edit income application on an iOS device?

What is income application?

Who is required to file income application?

How to fill out income application?

What is the purpose of income application?

What information must be reported on income application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.