Get the free Utah Uniform Application Fiscal Year 2026/2027 Combined ...

Get, Create, Make and Sign utah uniform application fiscal

Editing utah uniform application fiscal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah uniform application fiscal

How to fill out utah uniform application fiscal

Who needs utah uniform application fiscal?

Comprehensive Guide to the Utah Uniform Application Fiscal Form

Understanding the Utah Uniform Application Fiscal Form

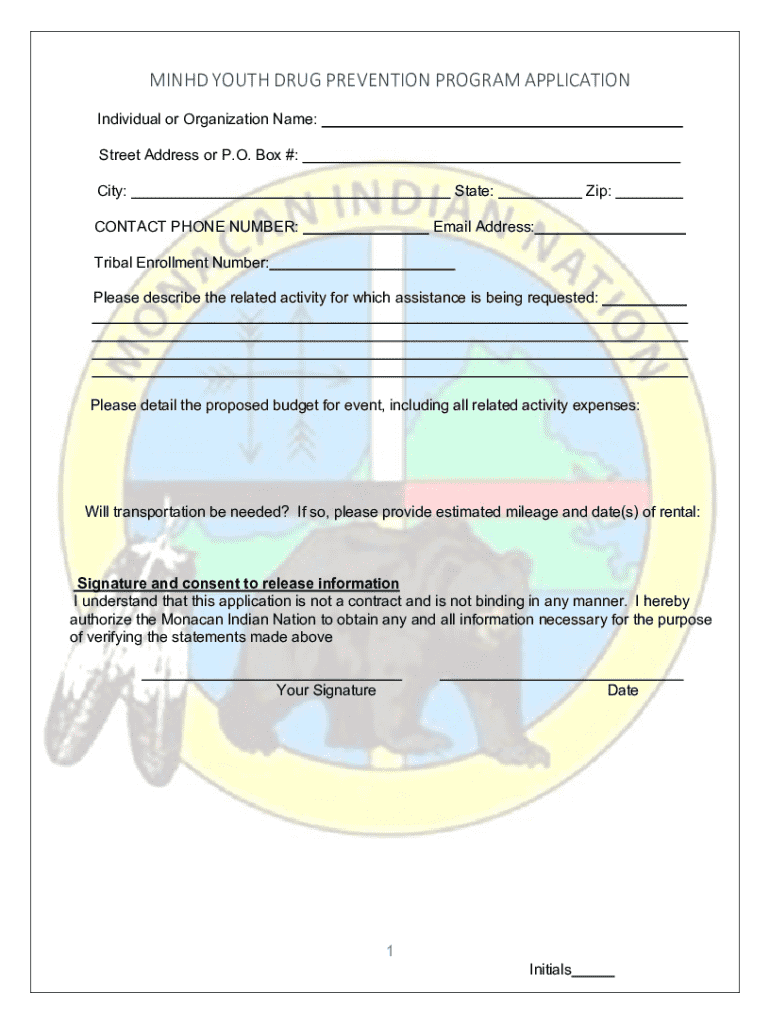

The Utah Uniform Application Fiscal Form is a crucial document used primarily by individuals and organizations to streamline various financial applications in the state of Utah. Its importance cannot be understated as it serves as a standardized vehicle for presenting financial information, ensuring transparency, compliance, and efficiency in processing requests. Whether you are applying for grants, loans, or other funding opportunities, accurately completing this form is vital for meeting state regulations and securing financial assistance.

The key uses of this form include its application in grant proposals, loan applications, and other fiscal arrangements where detailed financial data is essential. Organizations leveraging this form must provide a comprehensive view of their financial health, project budgets, and funding needs, making it indispensable for fiscal assessment by funding authorities in Utah.

Eligibility and requirements for submission

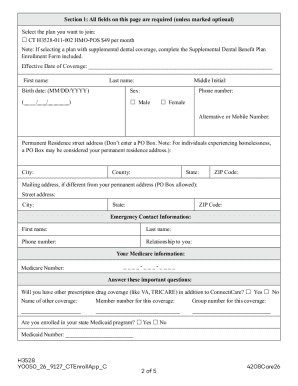

Understanding who needs to fill out the Utah Uniform Application Fiscal Form is critical for ensuring proper compliance. Generally, this form is required for any organization or individual that is seeking funding or assistance through state-sponsored programs. This includes non-profits, educational institutions, businesses, and governmental entities that plan to apply for grants or financial support from state agencies.

Necessary prerequisites include a variety of documents and detailed information that must be gathered prior to form completion. Applicants must assemble financial statements, project budgets, and any other documentation that showcases their fiscal status. It's also important to have previous tax documents on hand, as they may be necessary for verification purposes.

Step-by-step instructions for completing the Utah Uniform Application Fiscal Form

Step 1: Gathering information

Before filling out the Utah Uniform Application Fiscal Form, it's crucial to gather all relevant financial information. This includes your organization's total income, expenditure details, and any grants or loans currently in effect. Furthermore, tips for collecting supporting documentation include creating a checklist of all necessary documents, organizing them chronologically, and ensuring that all figures are backed up with appropriate paperwork.

Step 2: Accessing the form

Accessing the Utah Uniform Application Fiscal Form is straightforward. You can obtain the form online through official state websites or directly from portals such as pdfFiller, which also offers additional features for managing your document. Users typically have the option to download or print the document, providing flexibility based on preference.

Step 3: Filling out the form

When it comes to completing the form, it's essential to meticulously fill out each section. Start with personal information, including the applicant's name and contact details. Then, move on to the financial data section, where comprehensive and accurate figures are vital to the assessment of your application. Follow this with the declaration and certifications section, making sure to include all necessary acknowledgments.

Best practices for ensuring accuracy and comprehensiveness include double-checking entries and referencing gathered documentation to confirm figures. Providing clear, concise data reduces the likelihood of application delays or rejections.

Step 4: Reviewing your submission

The review stage is arguably one of the most important aspects before submitting your Utah Uniform Application Fiscal Form. Taking the time to revise your entries can help identify common mistakes, such as incorrect data or missing information. It's advisable to have a second set of eyes review the form to catch errors you might have overlooked.

Interactive tools for completing the form

Using pdfFiller’s editing capabilities can significantly enhance your experience in managing the Utah Uniform Application Fiscal Form. You can easily upload, edit, and manage your document all from the convenience of a cloud-based platform, which mitigates the hassle of traditional form handling. The platform also provides e-signature options, enabling you to sign the form digitally, which is both quick and secure.

Collaboration features offered by pdfFiller allow for seamless sharing with team members for input and review. You no longer need to print out copies or send emails back and forth; collaboration can happen in real-time, streamlining the entire process.

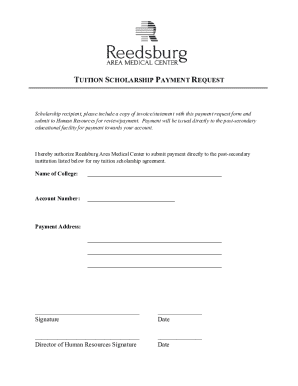

Submitting the form

Submitting the Utah Uniform Application Fiscal Form can be done through various pathways. If you choose to submit online, follow best practices by ensuring your documents are complete, formatted correctly, and that you receive confirmation of submission. Keeping copies of all documents submitted is key in case you need to verify details later.

Alternatively, if you opt for mail submission, ensure you follow the listed address precisely. For submissions in Salt Lake City, for instance, remember to include appropriate addresses like those at 581 President's Circle, Room 159, Salt Lake City, 84112. Also, be aware of submission deadlines; understanding the timing helps prevent missing out on critical funding opportunities.

Post-submission actions

After submitting the Utah Uniform Application Fiscal Form, applicants should know what to expect. Normally, there’s a waiting period during which you may be contacted regarding your application status. Expect follow-up communications from the authorities, as they may require further information or clarification regarding your submission.

In cases where modifications are necessary or you wish to retract your submission, knowing the proper channels and protocols is essential. It’s advisable to maintain records of your application interaction, so you can address any subsequent inquiries promptly and effectively.

Common questions about the Utah Uniform Application Fiscal Form

When navigating the complexities of the Utah Uniform Application Fiscal Form, you may encounter questions. Some of the most frequently asked questions include how to handle form rejections or what steps to take if additional information is requested after your initial submission. Understanding these processes ahead of time can help streamline your experience.

Helpful tips from experienced users indicate the importance of reaching out to financial advisors or experts who can provide insights based on their own experiences. Networking with individuals who have gone through the process can offer perspective and practical strategies to improve your submission's success rate.

Best practices for document management

Maintaining accurate records is fundamental after submitting the Utah Uniform Application Fiscal Form. Keeping copies of your submission and any accompanying documents in an organized manner contributes to seamless document management. Ensure all records are digitally backed up and categorized for easy access in the future.

Leveraging pdfFiller’s features allows for long-term document access and management, ensuring that you are never left scrambling for important information when you need it. Strategies for organizing financial documents efficiently include creating folders specifically for each funding application and regularly updating them with new correspondence or documentation as needed.

Resources for further assistance

For additional information about the Utah Uniform Application Fiscal Form, refer to official Utah government websites, which provide authoritative resources and updates about funding opportunities and submission processes. Engaging with these resources can offer useful data about new legislation or changes in requirements that may impact your application.

Furthermore, connect with professional services and organizations that specialize in financial applications. They can provide further guidance and assistance to ensure your application meets all necessary standards and requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the utah uniform application fiscal electronically in Chrome?

Can I create an electronic signature for signing my utah uniform application fiscal in Gmail?

How do I complete utah uniform application fiscal on an Android device?

What is utah uniform application fiscal?

Who is required to file utah uniform application fiscal?

How to fill out utah uniform application fiscal?

What is the purpose of utah uniform application fiscal?

What information must be reported on utah uniform application fiscal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.