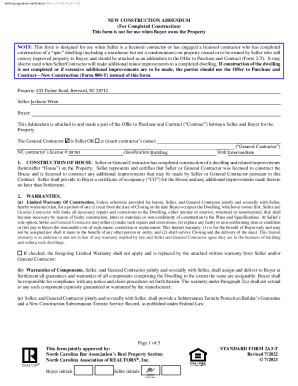

Get the free dbs kyc online

Get, Create, Make and Sign dbs kyc online form

How to edit dbs kyc online form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dbs kyc online form

How to fill out kyc-formpdf - dbs bank

Who needs kyc-formpdf - dbs bank?

Understanding the KYC form for DBS Bank: A comprehensive guide

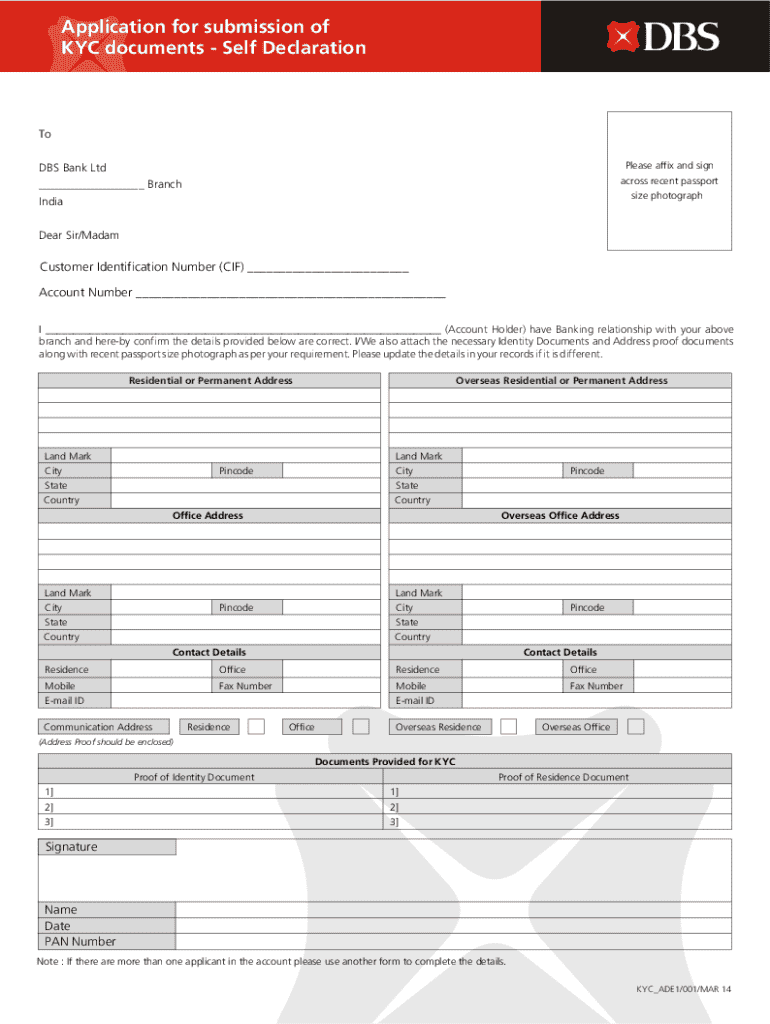

Understanding the KYC form

Know Your Customer (KYC) forms are a crucial part of the onboarding process for banking institutions like DBS Bank. They serve as a tool to verify the identities of clients, ensuring compliance with legal and regulatory standards aimed at combating money laundering, fraud, and other financial crimes. For DBS Bank, a recognized leader in the banking sector, adherence to KYC procedures reflects their commitment to providing the safest banking experience for their clients.

The KYC form is designed to gather essential customer data. DBS Bank emphasizes meticulous compliance with these forms, given their reputation as one of the best banks for corporate responsibility in 2025. Through diligent KYC practices, they not only protect their interests but also foster a secure environment for clients.

Preparing to fill out the KYC form

Before tackling the KYC form for DBS Bank, it's essential to gather all necessary documents to ensure a smooth and effective process. This preparation mitigates the risk of inaccuracies and delays in account setup.

Key documents typically required include valid forms of identification such as a passport or national ID and proof of address, which can be in the form of utility bills or bank statements. In specific situations, additional documentation may be necessary, such as company registration papers for business accounts or tax identification numbers.

To ensure accuracy, take your time filling out the form. Double-check all information before submission, and be mindful of common mistakes such as typographical errors in personal information or incorrect document uploads. These small oversights can lead to significant delays.

How to fill out the KYC form PDF

Filling out the KYC form for DBS Bank using pdfFiller makes the process straightforward and user-friendly. Here’s a step-by-step guide to get started.

First, open the KYC form in pdfFiller. This platform allows for easy editing of PDFs without the need for complicated software installations. Start by entering your personal information accurately to match the identification documents prepared.

While entering information, take advantage of pdfFiller's editing tools if you need to adjust document fields or highlight critical sections of the form. This ensures you emphasize pertinent information during the KYC process.

Editing and customizing your KYC form

pdfFiller provides robust features that allow users to customize the KYC form to meet specific needs. For instance, you can add custom fields if your situation requires additional information not included in the standard form.

Additionally, you can highlight important sections using pdfFiller’s tools. This feature is especially useful when collaborating with team members who may also need to review the KYC form before final submission.

eSigning the KYC form in pdfFiller

The use of electronic signatures in KYC forms has significantly streamlined the verification process while ensuring security and compliance. An eSignature is as binding as a handwritten one in the eyes of the law, particularly facilitated through platforms like pdfFiller.

To eSign your KYC form, you’ll first need to create your unique eSignature within pdfFiller. This step allows you to personalize your signature digitally, adding an extra layer of authenticity to your submission. Once created, you can place your eSignature on the document with a simple click.

Managing your KYC form after submission

After submitting your KYC form to DBS Bank, managing your form and any subsequent updates is vital for compliance and record-keeping. Keep track of your forms within pdfFiller for easy access.

Once submitted, users can access their previous submissions to modify any details as necessary. If there is a need to update your KYC information, follow the streamlined steps provided by the bank to amend your details securely.

Common FAQs about the DBS Bank KYC form

Navigating the KYC process can raise questions. Here are some frequently asked questions surrounding the KYC form for DBS Bank.

Additional resources for KYC compliance

For further guidance on KYC compliance, users can access DBS Bank’s official guidelines, which provide detailed information on the requirements and procedures involved. An understanding of anti-money laundering (AML) regulations is also essential, as these laws often interconnect with KYC practices.

Additionally, best practices for personal data protection should be observed at all times when submitting your KYC information. Ensuring your personal data’s confidentiality helps maintain compliance and enhances trust in financial transactions.

Incorporating pdfFiller for future documents

Utilizing a cloud-based document management solution like pdfFiller offers numerous advantages for both individuals and teams. Its capabilities extend beyond KYC forms, providing users with tools for efficient completion, editing, and collaboration on all types of documents.

Transitioning other essential forms to pdfFiller can enhance productivity and ensure that all documents are secured in one place. The platform supports real-time editing and signing, which significantly streamlines workflows within organizations, making it one of the best document management solutions available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dbs kyc online form for eSignature?

Can I create an electronic signature for signing my dbs kyc online form in Gmail?

How can I edit dbs kyc online form on a smartphone?

What is kyc-formpdf - dbs bank?

Who is required to file kyc-formpdf - dbs bank?

How to fill out kyc-formpdf - dbs bank?

What is the purpose of kyc-formpdf - dbs bank?

What information must be reported on kyc-formpdf - dbs bank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.