Get the free Two Wheeler Loan - Wet Signature Card - Axis Bank

Get, Create, Make and Sign two wheeler loan

How to edit two wheeler loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out two wheeler loan

How to fill out two wheeler loan

Who needs two wheeler loan?

A comprehensive guide to the two wheeler loan form

Understanding two wheeler loans

A two wheeler loan is a financial product designed to help individuals purchase motorcycles or scooters. With the rising need for personal transportation, these loans have gained significance in today’s market. Generally, two wheeler loans come in two main forms: secured loans, where the vehicle acts as collateral, and unsecured loans, which do not require collateral but may have higher interest rates.

The importance of two wheeler loans today cannot be overstated, especially in urban areas where public transport may not be reliable. Owning a two wheeler not only enhances personal mobility but can also lead to financial savings in the long run, reducing the need for frequent taxi rides or public transport fares.

Key features and benefits of two wheeler loans

Two wheeler loans offer several features that make them appealing options for borrowers. One of the most significant advantages is flexible repayment options, allowing customers to choose terms that best fit their financial situation. Moreover, many lenders provide competitive interest rates, making it affordable to finance a new bike or scooter.

Quick loan approval processes are another perk, with several lenders allowing online applications that can yield approvals within hours. Two wheeler loans are also accessible to a broad range of borrowers, making them suitable for students, working professionals, and even retirees. Beyond financing, lenders often include additional perks like insurance plans or maintenance packages.

Financial planning with two wheeler loans

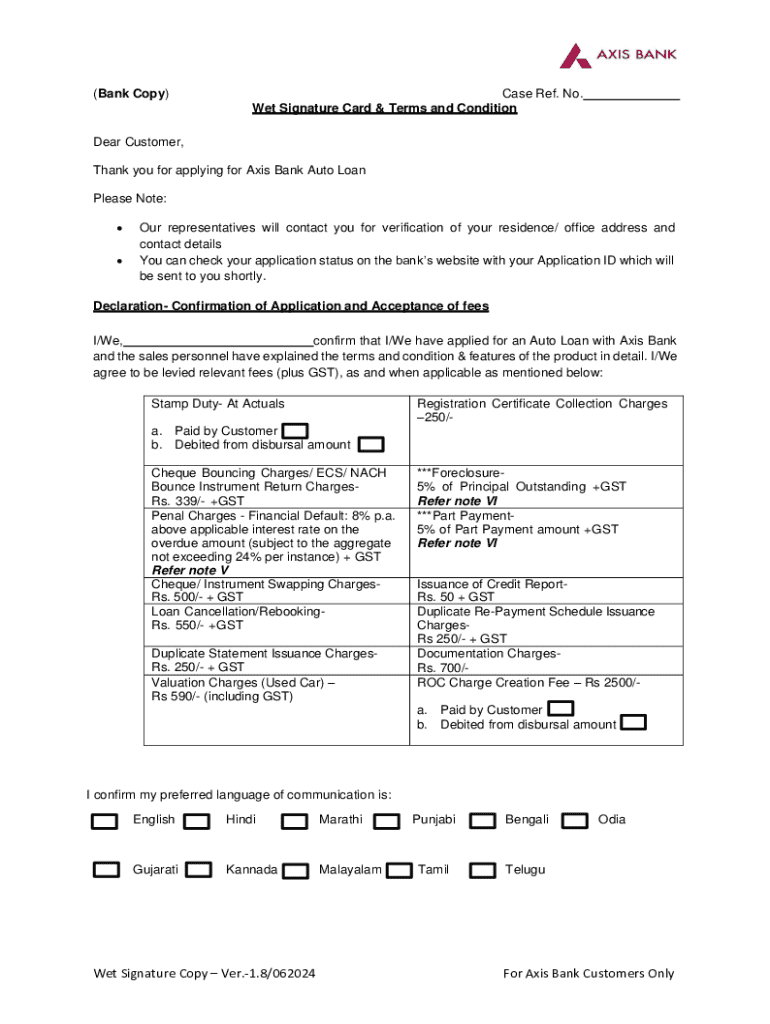

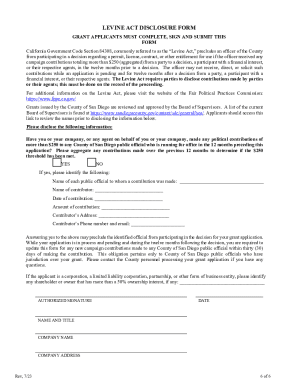

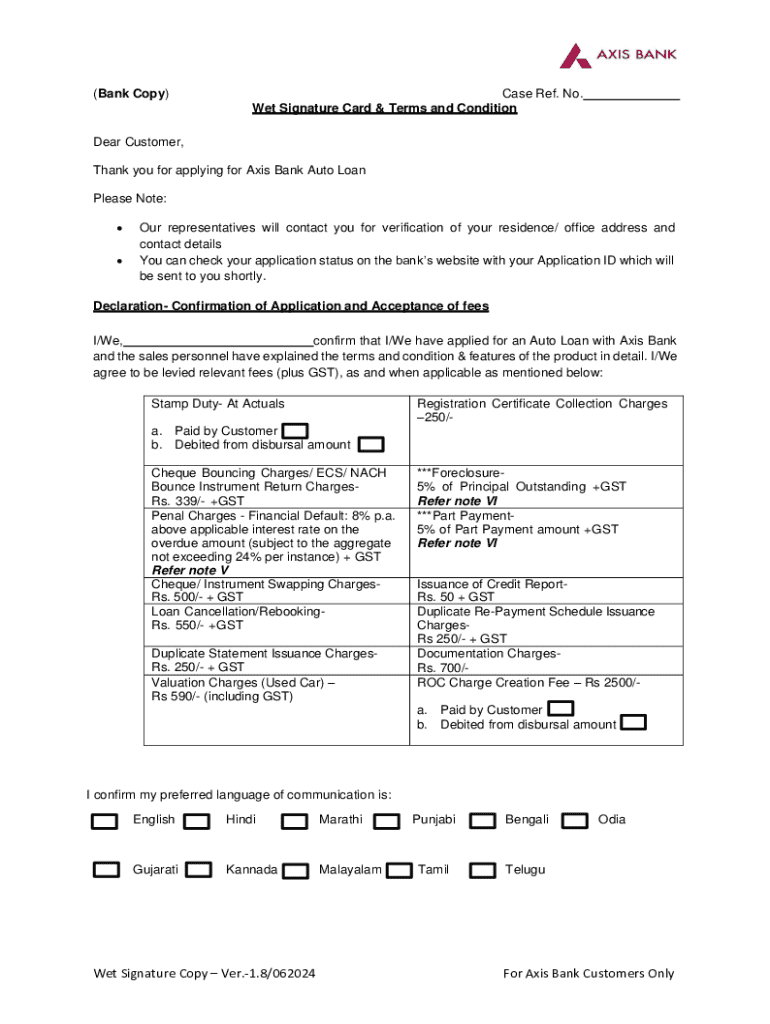

When considering a two wheeler loan, it is crucial to be aware of the various charges and fees associated with these products. Common fees include processing charges, which can range from 1% to 3% of the loan amount. Additionally, borrowers should be aware of pre-closure charges, which apply if you decide to pay off your loan early, and late payment penalties that accrue when EMIs are not paid on time.

Utilizing a two wheeler loan EMI calculator is an excellent way to manage your financial planning. This tool helps estimate the monthly installments based on the loan amount, the interest rate, and the tenure. By inputting different variables, borrowers can discover what fits their budget best.

Eligibility criteria for two wheeler loans

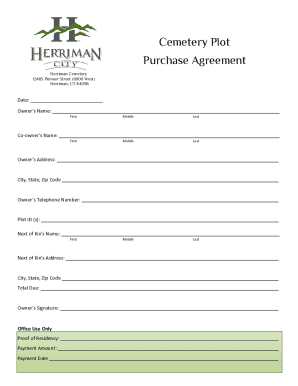

To apply for a two wheeler loan, applicants must meet specific eligibility criteria. Basic requirements typically include an age limit (usually between 18-65 years) and a minimum income threshold that varies by lender. Prospective borrowers should also be mindful of employment status, as formal employment generally increases loan approval chances. A good credit score is crucial since it reflects repayment capability.

Additionally, understanding the loan amount you can borrow and the tenure you qualify for is beneficial. Different lenders have varied limits based on income and credit score, which should be evaluated before applying.

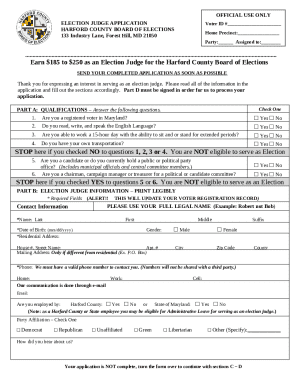

Documents required to apply for a two wheeler loan

When applying for a two wheeler loan, documentation plays a crucial role. Applicants are generally required to provide personal identification documents such as an Aadhar card, passport, or voter ID. Income proof is also necessary and may include recent salary slips, bank statements, or tax returns, depending on employment status.

Address proof can typically be established through utility bills or rental agreements. It's also worth noting that specific documentation requirements can vary significantly based on the lender's policies, so it's always best to check directly with the financial institution.

Step-by-step guide on how to apply for a two wheeler loan

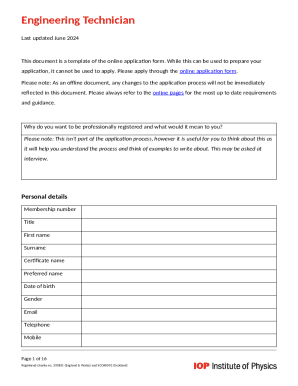

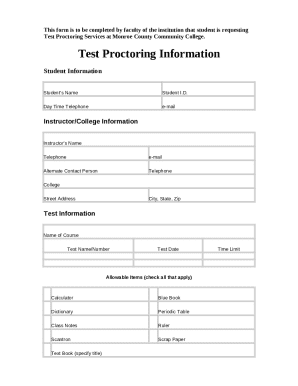

Applying for a two wheeler loan involves a few systematic steps. First, prepare your application by gathering all necessary documentation and reviewing eligibility criteria. Being organized can speed up the process significantly.

Next, fill out the loan application form. This form typically requires information about personal details, employment, and the asked loan amount. Understanding each section of the form is essential to avoid common mistakes. After completing the application, borrowers can choose between online or offline submission methods. Online applications are often processed more quickly, usually resulting in approval within a few business days.

Finally, track your loan status through the lender's application tracking system. This step is important to determine if any additional information is needed and to ensure timely communication regarding approval or delays.

Managing your two wheeler loan efficiently

Once you have secured a two wheeler loan, managing it efficiently should be a priority. Strategies for effective loan management include ensuring timely EMI payments to avoid penalties and maintaining a clear understanding of your loan statement to track payment schedules and outstanding amounts. Keeping organized records can drastically simplify this process.

In case of payment difficulties, borrowers should proactively communicate with their lenders. Many institutions offer restructuring options or flexible repayment plans tailored for challenging situations. Utilizing pdfFiller for document management can make paperwork easier, enabling you to edit, e-sign, and collaborate on documents seamlessly.

Frequently asked questions about two wheeler loans

As borrowers navigate the two wheeler loan landscape, they often have questions and concerns. Common misconceptions may arise regarding interest rates and eligibility. Many prospective borrowers wonder if they will qualify for loans, even with average credit scores, while others concern themselves about hidden fees or costs.

It's essential to clarify that most lenders are upfront about their terms, and borrowers can always ask questions during the application process. Educating yourself about these topics can help ease uncertainties associated with financing a two wheeler.

Conclusion: Empowering your journey with two wheeler loans

Understanding the intricacies of the two wheeler loan form can greatly enhance your financial journey. Being informed about features, benefits, eligibility, and documentation will empower you to make confident financing decisions. This allows you to choose a loan that best suits your needs.

Utilizing tools like pdfFiller can streamline your application process, ensuring documents are easy to manage and sign. Embracing financial knowledge and effective document management can transform your loan experience, turning it into an opportunity rather than a burden.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete two wheeler loan online?

How do I fill out two wheeler loan using my mobile device?

How do I edit two wheeler loan on an iOS device?

What is two wheeler loan?

Who is required to file two wheeler loan?

How to fill out two wheeler loan?

What is the purpose of two wheeler loan?

What information must be reported on two wheeler loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.