Get the free CVT 2021 IRS 990 Public Disclosure

Get, Create, Make and Sign cvt 2021 irs 990

Editing cvt 2021 irs 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cvt 2021 irs 990

How to fill out cvt 2021 irs 990

Who needs cvt 2021 irs 990?

A Comprehensive Guide to the CVT 2021 IRS 990 Form

Understanding the CVT 2021 IRS 990 Form

The CVT 2021 IRS 990 Form is an essential document for nonprofits in the United States. This form offers insight into an organization’s financial activities and ensures compliance with IRS regulations. Form 990 is significantly important as it provides the IRS, donors, and the public with a detailed understanding of how nonprofits operate and utilize their funds.

Introduced changes in the CVT 2021 version include updated reporting requirements and enhanced transparency measures. These revisions aim to give stakeholders a clearer view into the organization's financial health, governance practices, and mission-driven activities.

Key components of the CVT 2021 IRS 990 form

The CVT 2021 IRS 990 form consists of several critical sections that provide a comprehensive picture of a nonprofit's operations. Understanding these components is vital for accurate completion and can ensure that your organization remains compliant with IRS requirements.

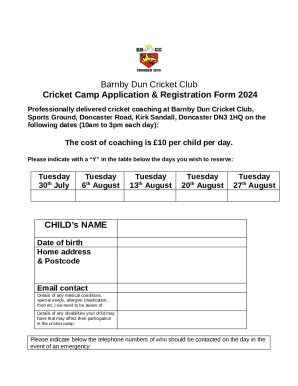

Filling out the CVT 2021 IRS 990 form

Filling out the CVT 2021 IRS 990 form requires careful attention to detail. Start by gathering all necessary documents, including financial records, donor lists, and board meeting minutes. Ensuring you have credible financial documentation strengthens your form's integrity.

Consider using software tools that streamline data compilation and integration. These resources can help minimize errors, ultimately enhancing the organization’s financial reporting.

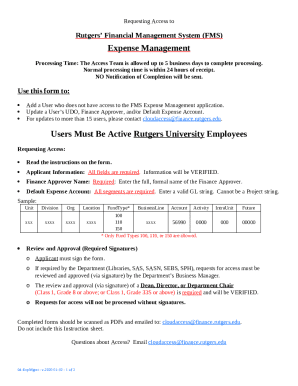

Interactive tools for completing the CVT 2021 IRS 990 form

Utilizing technology can drastically streamline the process of filling out the CVT 2021 IRS 990 Form. Platforms like pdfFiller provide intuitive features for completing PDFs, allowing users to edit, sign, and collaborate directly on their forms.

The eSignature capability expedites the approval process, reducing time delays. Moreover, collaboration tools enable teams to provide input collectively, ensuring that all voices are heard and that the form reflects accurate and comprehensive organizational data.

Strategies for managing the CVT 2021 IRS 990 form

Efficient document management is crucial for nonprofits, especially when handling forms like the CVT 2021 IRS 990. Establishing a system for tracking and archiving completed forms ensures that your organization remains compliant with IRS requirements and can access historical data when needed.

Implement best practices for storing completed forms, such as organizing files by year and type, and maintaining both digital and physical copies when necessary. Ensure that access to these files is restricted to key personnel to protect sensitive information.

Understanding IRS regulations and deadlines

Nonprofits must be aware of critical filing deadlines associated with the CVT 2021 IRS 990 form. Generally, the IRS mandates that organizations with a fiscal year-end of December 31 submit their completed forms by May 15 of the following year.

Organizations failing to file on time can face substantial penalties. If your organization anticipates needing more time, filing for an extension ahead of the due date is paramount. Regardless of extensions, staying current with IRS updates ensures compliance and mitigates risks.

Consequences of incorrectly filling out the CVT 2021 IRS 990 form

Filling out the CVT 2021 IRS 990 form incorrectly can lead to severe consequences for nonprofits. Errors can result in fines, denial of tax-exempt status, or increased scrutiny from the IRS. Accurate reporting is not simply a regulatory obligation; it is essential to preserving the integrity and trustworthiness of your organization.

Organizations have a responsibility to report financial activities truthfully, as misleading information can damage reputations and affect donor relationships. Therefore, a meticulous approach to completing this form is not only necessary but crucial for long-term viability.

Enhancing organizational transparency through the CVT 2021 IRS 990 form

The CVT 2021 IRS 990 form operates as a powerful tool for enhancing transparency and building trust among stakeholders. By providing a detailed account of a nonprofit’s financial health and operational strategies, organizations can foster stronger relationships with donors, board members, and the community.

Utilizing the data reported on the form allows organizations to communicate their impact effectively. Highlighting success stories and significant contributions showcases accomplishments and contextualizes the results reported, creating a compelling narrative for stakeholders.

Support and resources for completing the CVT 2021 IRS 990 form

Navigating the intricacies of the CVT 2021 IRS 990 form can be challenging; however, resources are available. Professional services specializing in tax forms assist nonprofits in achieving precise and compliant submissions. Utilizing community resources, workshops, and even online tutorials can enhance knowledge and improve your organization’s filing process.

pdfFiller offers exemplary customer support and tutorial resources, ensuring that users can access help as they complete their forms. Whether opting for professional assistance or a DIY approach, leveraging available support enhances completion accuracy and compliance.

Making the most of your CVT 2021 IRS 990 reports

Once your CVT 2021 IRS 990 form is completed and submitted, analyzing the data becomes vital for organizational growth. The report highlights financial patterns, revenue sources, and areas requiring improvement. By interpreting this information, nonprofits can strategize for future operations and enhance their overall impact.

Utilizing insights drawn from the IRS 990 form aids in refining organizational goals and objectives, ensuring they align with the mission. As nonprofits review their reports, they should consider their performance in relation to stated goals, further solidifying their role in the community and enhancing the impact they make.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cvt 2021 irs 990 for eSignature?

How do I edit cvt 2021 irs 990 online?

How do I complete cvt 2021 irs 990 on an Android device?

What is cvt 2021 irs 990?

Who is required to file cvt 2021 irs 990?

How to fill out cvt 2021 irs 990?

What is the purpose of cvt 2021 irs 990?

What information must be reported on cvt 2021 irs 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.