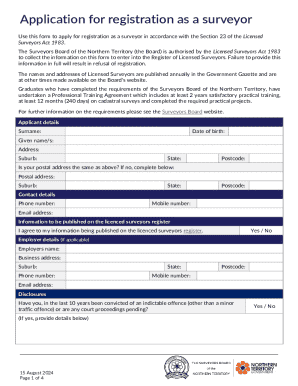

IRS 8936 - Schedule A 2025-2026 free printable template

Get, Create, Make and Sign IRS 8936 - Schedule A

Editing IRS 8936 - Schedule A online

Uncompromising security for your PDF editing and eSignature needs

How to fill out IRS 8936 - Schedule A

How to fill out instructions for form 8936

Who needs instructions for form 8936?

Instructions for Form 8936: Claiming Your Electric Vehicle Tax Credit

Table of Contents

1. Overview of Form 8936 2. Eligibility Criteria for Claiming the Credit 3. Step-by-Step Instructions on Completing Form 8936 4. Specific Instructions for Each Section of Form 8936 5. Video Walkthroughs for Visual Guidance 6. Frequently Asked Questions regarding Form 8936 7. Where to Submit Form 8936 8. Related Tax Articles and Resources

Overview of Form 8936

Form 8936 is a vital document for taxpayers who wish to claim tax credits for qualified plug-in electric drive motor vehicles (PHEVs). By filing this form, you can receive a tax credit worth up to $7,500, significantly reducing your overall tax liability. This guide will provide comprehensive instructions for completing Form 8936, ensuring you maximize your tax benefits and follow the necessary IRS guidelines.

Accurate completion of Form 8936 is essential. This form is typically filed with your annual tax return using either IRS Form 1040 or IRS Form 1040NR. Ensuring that you meet all eligibility requirements can streamline your filing process and prevent delays or audits.

Eligibility criteria for claiming the credit

To qualify for the tax credit, your vehicle must meet several specific criteria. First, it must be a qualified plug-in electric drive motor vehicle (PHEV)—any vehicle that draws propulsion energy from a rechargeable battery and has at least four wheels. Additionally, it must have a gross vehicle weight rating (GVWR) of less than 14,000 pounds and be used primarily in the United States.

Income limitations play a crucial role in eligibility as well. Taxpayers whose modified adjusted gross income exceeds $250,000 for single filers or $500,000 for joint filers may face reduced eligibility. Furthermore, taxpayers must have enough tax liability to utilize the credit fully, as the credit is non-refundable.

Step-by-step instructions on completing Form 8936

Section 1: Basic Information

Start by entering your personal details, including name, address, and Social Security number, in Section 1. Ensure that the tax year corresponds to the year in which you purchased the vehicle. This information is critical for processing your credit accurately.

Section 2: Vehicle Information

In Section 2, you must provide specific details about your vehicle. This includes the make, model, and year. The Vehicle Identification Number (VIN) is also essential. If you're unsure where to find your VIN, it's generally located on the driver's side dashboard or on the driver-side door frame.

Section 3: Credit Calculation

Section 3 involves calculating the eligible credit amount. Depending on your vehicle type, the credit can vary vastly. Refer to the IRS guidelines to determine your appropriate credit based on the vehicle's specifications. It's crucial to use accurate details to ensure you receive the correct credit amount.

Section 4: Additional Information

Finally, complete Section 4 by reporting any other tax credits or deductions related to electric vehicles if applicable. This section ensures you capture all tax benefits appropriately.

Specific instructions for each section of Form 8936

Detailed guidance for Section 1 requires you to provide accurate personal information. Ensure that your Social Security number is correct and matches your IRS records to avoid processing issues.

In Section 2, it's vital to double-check the vehicle information you enter. An incorrect VIN can lead to delays in processing. If your vehicle qualifies for a credit, listing the right manufacturer certification is essential.

When filling out Section 3, knowing the amount of tax credit for your fuel cell motor vehicle or other PHEVs can help you maximize benefits. To accurately interpret this section, reference the IRS information specific to your vehicle type.

Interpreting the instructions for Section 4 is crucial for taxpayers who may qualify for other tax incentives. Consolidate all credits to maximize your refunds.

Video walkthroughs for visual guidance

For individuals who prefer visual instruction, several online resources offer step-by-step video tutorials on how to complete Form 8936. These walkthroughs simplify the process, demonstrating precisely how to fill in each section, making it user-friendly.

Users of these video resources have often commented on their effectiveness, stating that they significantly reduce confusion surrounding the filing process.

Frequently asked questions regarding Form 8936

Many taxpayers may wonder about the nuances of eligibility and filing. For instance, questions often arise about lifetime limits on credits. It's essential to clarify that only one credit can be claimed per vehicle and that these credits do not carry over.

Misconceptions about tax credits for electric vehicles can lead to confusion. One common misunderstanding is that all electric vehicles are eligible for credits, which isn't true. As discussed earlier, they must meet specific qualifications.

Where to submit Form 8936

Once completed, Form 8936 should be submitted with your annual tax return. You can file electronically, which is recommended for faster processing times, or by mailing a paper return to the IRS. Make sure to retain copies for your records as well.

Understanding the processing times can also help manage expectations. Generally, e-filed returns tend to be processed faster, often within 21 days, compared to paper submissions, which can take longer.

Related tax articles and resources

For further reading on electric vehicle incentives, consider exploring additional articles that discuss various energy-related tax credits, including those for solar energy. Resources for other forms and documentation for tax filing are also beneficial, providing broader insights into tax benefits available to taxpayers.

Utilizing these associated resources can help ensure you're fully informed about all credits available, ensuring you make the most out of your tax situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 8936 - Schedule A online?

How do I fill out IRS 8936 - Schedule A using my mobile device?

How can I fill out IRS 8936 - Schedule A on an iOS device?

What is instructions for form 8936?

Who is required to file instructions for form 8936?

How to fill out instructions for form 8936?

What is the purpose of instructions for form 8936?

What information must be reported on instructions for form 8936?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.