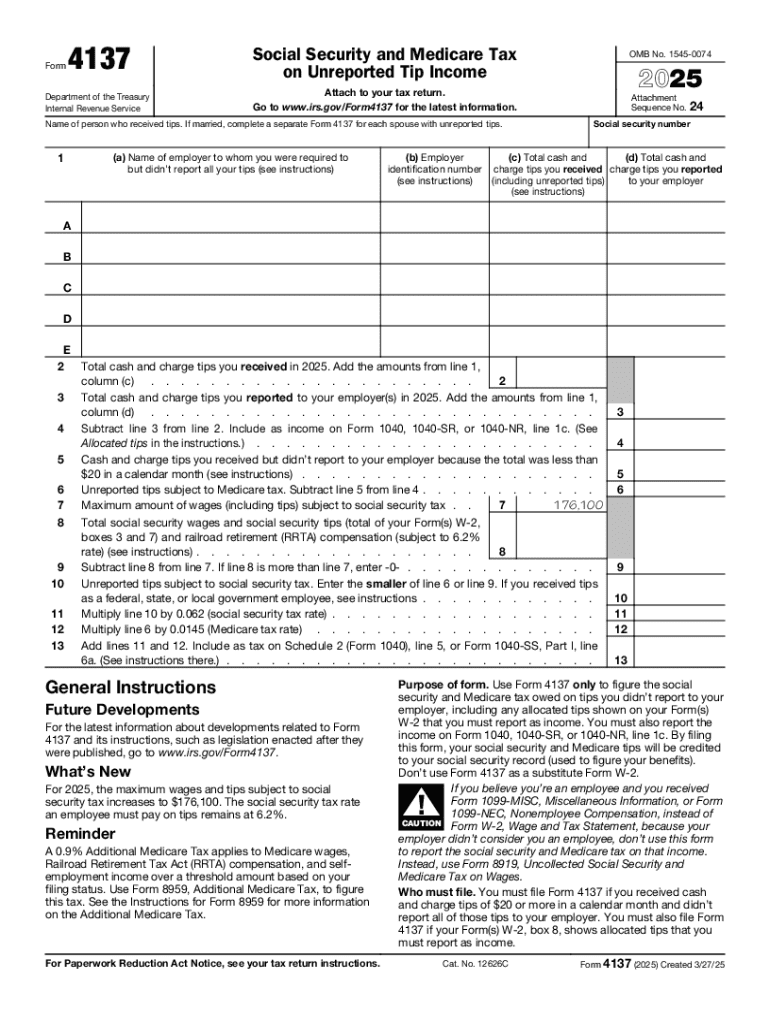

IRS 4137 2025-2026 free printable template

Get, Create, Make and Sign IRS 4137

Editing IRS 4137 online

Uncompromising security for your PDF editing and eSignature needs

IRS 4137 Form Versions

How to fill out IRS 4137

How to fill out 2025 form 4137

Who needs 2025 form 4137?

2025 Form 4137 Guide: Everything You Need to Know

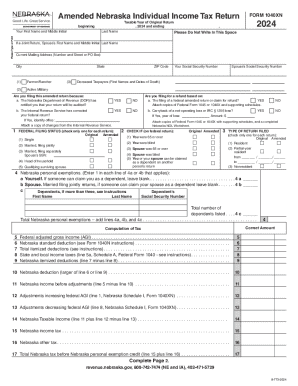

Overview of the 2025 Form 4137

Form 4137 is a crucial document for individuals in jobs that receive tips, often referred to as service jobs. This IRS form serves the purpose of reporting unreported tips, ensuring that employees pay their fair share of taxes on all income, including tip money, received throughout the year. For the 2025 tax year, understanding how to fill out and submit Form 4137 is especially important due to ongoing government efforts to ensure compliance on income from tips.

Understanding IRS Form 4137 in 2025

IRS Form 4137 specifically addresses the issue of unreported tips. Employees in the service industry, such as waitstaff, bartenders, and taxi drivers, frequently receive tips as part of their wages. This form allows them to report any tip income that wasn’t reported to their employers, ensuring correct tax withholding and compliance with tax obligations.

In 2025, several updates to tax regulations influence how Form 4137 is utilized. For instance, with changes made to standard tax deductions and brackets, employees must be even more diligent in reporting all income. Enhanced IRS scrutiny regarding tip reporting may also lead to audits focusing on accurate representation of total income, compelling employees to be precise with their submissions.

Significance of filing Form 4137

Filing Form 4137 is not merely a suggestion; it is a legal obligation for employees who receive tips. By accurately reporting these amounts, you ensure compliance with tax laws, minimizing the risk of facing penalties or interest charges for underreporting income. Additionally, timely filing helps maintain the integrity of your income records, which can prove beneficial for future credit applications or financial assessments.

Common misconceptions surround the nature of tip reporting and Form 4137. Many people believe that if tips are not reported to employers, they do not need to be reported on taxes. This is incorrect; regardless of employer practices, all tip income must be accurately documented to avoid legal issues.

When to file Form 4137

In 2025, specific deadlines for filing Form 4137 are essential to remember. Generally, the form must be filed by the annual tax return deadline, falling on April 15 for most individuals. However, if you receive tips that you have not reported to your employer, prompt filing is advised to avoid complications with the IRS.

Immediate filing may be required if you’ve accumulated a significant amount of unreported earnings during the year. For example, if your tip income reaches or exceeds $20 per month and it has not been recorded, you must submit Form 4137 for that particular tax year.

How to fill out Form 4137

Filling out Form 4137 can be straightforward if approached methodically. Start with the identification section by entering your name, address, and taxpayer identification number. Subsequent sections require details about your tip income, so it is beneficial to maintain logs of tip amounts throughout the year to ensure accuracy.

Specific steps include: 1. **Gather your records**: Make sure you have a comprehensive record of your tip income. This can include daily logs of tips received. 2. **Complete the identification section**: Fill out personal information, ensuring all details are correct. 3. **Detail your tip income**: Use actual amounts received over the relevant tax year. 4. **Calculate your total**: Sum all reported tips to arrive at the total amount accurately.

To avoid common pitfalls, ensure to double-check your figures and keep your data organized. Errors can lead to IRS inquiries, so precision is key.

Interactive tools, including those offered by pdfFiller, can significantly simplify the completion of Form 4137. These tools allow users to fill in, edit, and sign the document conveniently.

Managing Form 4137 post-submission

After submitting Form 4137, tracking your submission status is vital. Keep a copy of your form and any associated documentation for your records. Establish a record-keeping system—this could be digital or physical, whichever you find more manageable. It’s advisable to retain copies for at least three years, as this is the duration the IRS may review your submitted information.

Record-keeping includes filing documents in an organized fashion, labeling folders by tax year or category, and using digital storage solutions for easy access. This ensures that in case of any IRS inquiries or requests, you are well-prepared.

Collaborating with teams on Form 4137

For teams handling multiple tip-reporting employees, collaboration on Form 4137 can streamline the process. Organizing group training sessions to raise awareness about the form’s significance and filing requirements is a proactive step. Encouraging open communication about tip reporting can clarify expectations and encourage accurate submissions.

Utilizing pdfFiller’s collaboration features allows teams to work on Form 4137 together seamlessly. Shared access to documents ensures everyone is on the same page regarding the tips earned, making the filing process more efficient and less error-prone.

Troubleshooting and support

Filling out Form 4137 can result in challenges and questions, especially for first-timers. Common errors include miscalculating tip amounts or leaving sections blank, which can lead to processing delays or IRS inquiries. To address challenges, keep your records organized and refer to IRS guidelines as you complete the form.

For assistance, numerous resources are available. The IRS website provides comprehensive guidelines on completing Form 4137, and local tax professionals can offer personalized support. Additionally, pdfFiller offers customer support to troubleshoot any issues through their platform.

Future considerations

Looking ahead, tax regulations continue to evolve, and so does Form 4137. Potential changes might include adjustments to reporting thresholds or documentation requirements. Awareness of these possible changes is vital for employees who rely on tips for income.

Staying informed about tax regulations impacting Form 4137 can be achieved through regular consultation with tax professionals and subscribing to IRS updates. Engaging with community forums can also provide insights on new developments and best practices regarding tip reporting and income taxation.

People Also Ask about

What happens if you don't report some of your income?

Should I put unreported tips on my taxes?

What happens if you don't report your tips as a server?

How much income can you not report?

Do you have to report earnings less than 600?

Should I report unreported tips on taxes?

How much income can go unreported?

What is 4137?

What happens if I don't report all my tips?

What happens if income is not reported to IRS?

What form is unreported tip income?

What happens if you don't report your tips?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 4137 from Google Drive?

How do I edit IRS 4137 in Chrome?

How do I complete IRS 4137 on an iOS device?

What is 2025 form 4137?

Who is required to file 2025 form 4137?

How to fill out 2025 form 4137?

What is the purpose of 2025 form 4137?

What information must be reported on 2025 form 4137?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.