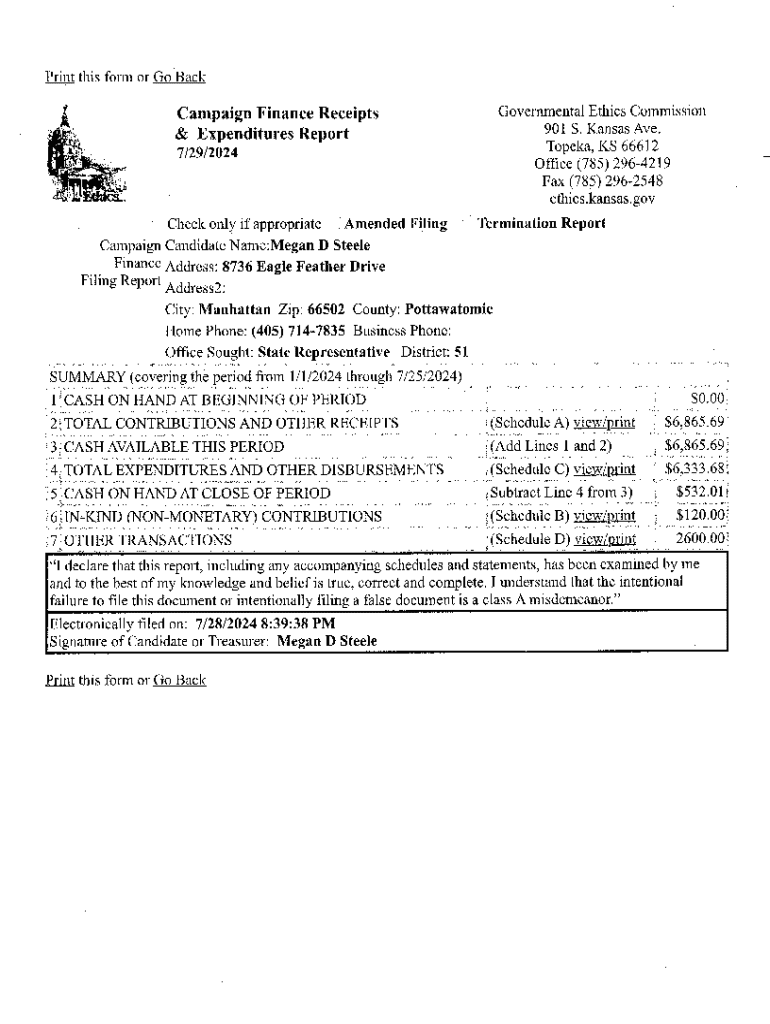

Get the free 71 OTHER TRANSACTIONS

Get, Create, Make and Sign 71 oformr transactions

How to edit 71 oformr transactions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 71 oformr transactions

How to fill out 71 oformr transactions

Who needs 71 oformr transactions?

71 Oformr Transactions Form - A Comprehensive Guide

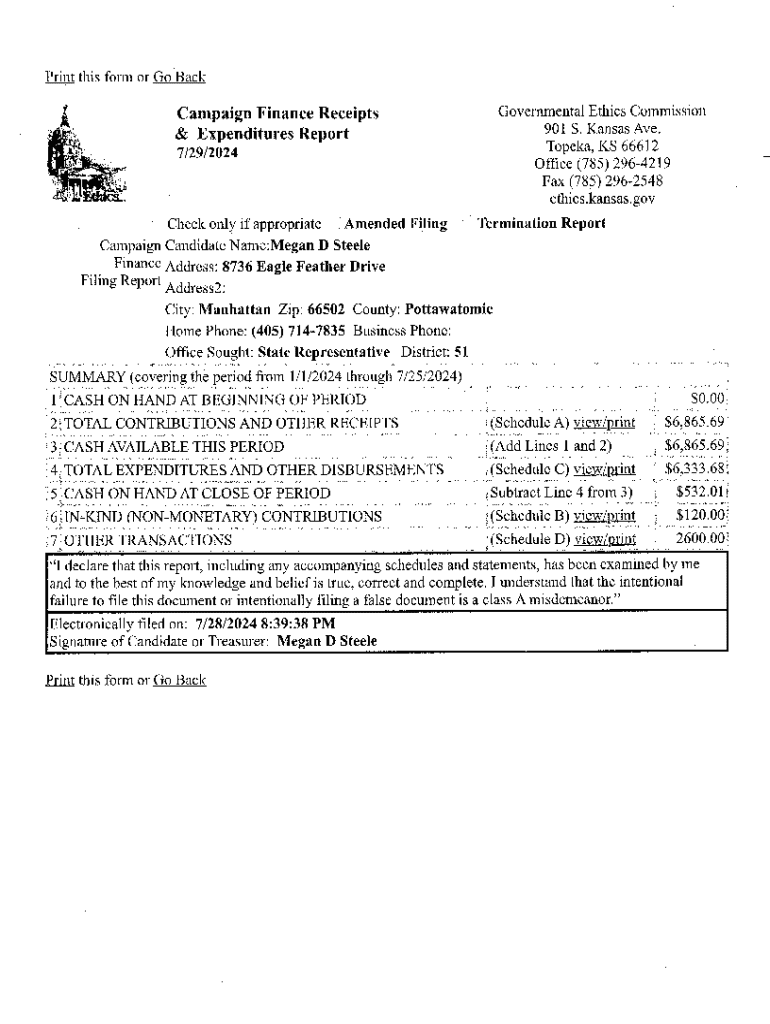

Understanding the 71 Oformr Transactions Form

The 71 Oformr Transactions Form is an essential document used in various transactions to ensure proper record-keeping and compliance in financial dealings. This form serves as a formal request, authorization, or notification which can range from personal transactions to business operations. Its main purpose is to provide a standardized way of documenting specifics related to the transaction, creating a clear trail that can be referenced in the future.

Having the right documentation is paramount, especially when dealing with significant amounts of money or sensitive information. The importance of the 71 Oformr Transactions Form cannot be overstated, as it can prevent disputes and misunderstandings, ensuring all parties are on the same page.

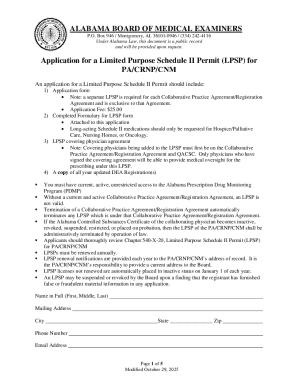

Who Needs the 71 Oformr Transactions Form

The target users of the 71 Oformr Transactions Form are diverse, including individuals, businesses, and teams. Individuals may need this form for personal financial transactions, such as loan applications or property purchases. Businesses utilize it for transactions involving larger sums or when compliance with regulatory standards is necessary.

Teams working on projects may also find this form beneficial for tracking transactions related to budgets, expenses, and resource allocation. By employing this form, users ensure that important financial events are accurately documented and retrievable.

Key features of the 71 Oformr Transactions Form

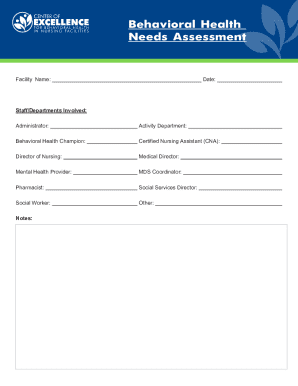

The 71 Oformr Transactions Form is structured with several essential components that need to be filled accurately. Each section is designed to gather critical details that collectively describe the nature and specifics of the transaction. In addition to basic identification information, the form will typically require details about the transaction type, amount, currency, and involved parties.

Required fields may include dates, contact information, and additional details that could assist in clarifying the transaction's purpose. Accuracy is crucial because any errors or inconsistencies may lead to complications or delays in processing.

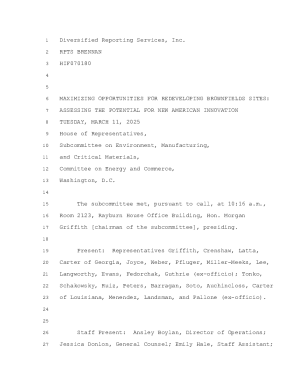

Common use cases for the 71 Oformr Transactions Form

This form can be used in various scenarios, including but not limited to, real estate transactions, financial transactions between individuals and businesses, and inter-departmental budgeting within companies. For example, if two parties are entering into a sale, the 71 Oformr Transactions Form can summarize all terms and expectations, providing a legally binding reference if necessary.

Step-by-step guide to filling out the 71 Oformr Transactions Form

Before filling out the 71 Oformr Transactions Form, it's crucial to prepare by gathering all necessary documents and information. This may include identification cards, transaction details, and any other supporting documentation that could be relevant.

Detailed instructions for each section

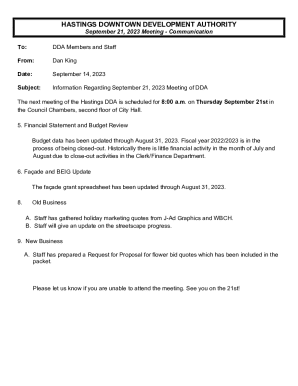

Section 1: Basic information

In this section, you will need to input personal or business details. This should include your name, address, and contact information. For businesses, include the company name, registration number, and contact details. Ensure accuracy, as discrepancies can lead to processing issues.

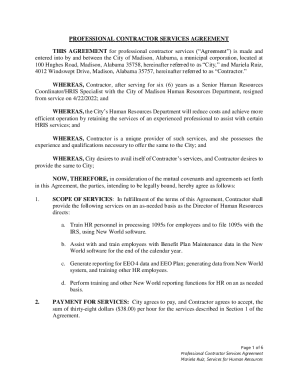

Section 2: Transaction details

This part specifies the nature of the transaction and the total amount involved. You must provide a clear description and ensure that required documentation, such as invoices or contracts, accompanies the form. Including adequate proof can expedite the review process.

Section 3: Signatures and authorizations

The signatures needed depend on the transaction type and the involved parties. Make sure all necessary individuals sign the form. If you are using pdfFiller, digital signature options make it easier to sign documents securely without the need for physical copies.

Common mistakes to avoid

Editing and managing your 71 Oformr Transactions Form

Once you’ve filled out the form, you may want to make edits to ensure clarity and accuracy. Utilizing pdfFiller's editing tools can simplify this process. The platform allows users to edit a PDF version of the form easily, ensuring that any last-minute changes can be made without a hassle.

One of the primary advantages of this cloud-based platform is the ability to collaborate with others. You can invite team members to review the form, which provides an efficient way to streamline approvals or make necessary modifications.

Collaboration features

pdfFiller’s commenting and communication tools also enhance collaboration by allowing team members to leave feedback and discuss edits directly within the document. This minimizes the back-and-forth emails, making the review process smoother and more integrated.

eSigning the 71 Oformr Transactions Form

With the advent of electronic signatures, signing your 71 Oformr Transactions Form has never been easier. Electronic signatures are now a legally accepted form of authorization in many jurisdictions, including most areas in the United States. Utilizing eSignatures not only saves time but also enhances security measures when properly executed.

pdfFiller's eSigning features come with robust security protocols to protect your signature and ensure the integrity of the document. By keeping your data encrypted, pdfFiller ensures that sensitive information remains confidential throughout the signing process.

Step-by-step eSigning process

To add signatures using pdfFiller, simply upload your filled-out 71 Oformr Transactions Form onto the platform, click on the 'eSign' button, and follow the prompts to add signatures. The simple interface makes it easy to manage signature requests and track follow-ups, ensuring that you can monitor who has signed and who still needs to do so.

Frequently asked questions (FAQs)

General queries about the 71 Oformr Transactions Form

Users often wonder what to do if their 71 Oformr Transactions Form gets rejected. In such cases, it is vital to review the rejection reasons carefully. Address any issues highlighted and resubmit the form with the necessary amendments. Additionally, maintaining records of your submission can help with any future references.

Another common question is about how to update or amend a submitted form. If changes are needed after submission, it’s typically advisable to contact the receiving institution or party to understand their procedures for handling amendments.

Technical support and troubleshooting

Users might encounter various technical issues while filling out the 71 Oformr Transactions Form. Common problems include difficulties with file uploads or issues related to digital signatures. pdfFiller provides customer support to assist with troubleshooting these errors, ensuring that users can complete their forms without unnecessary delay.

Additional tips for successful submission

Ensuring compliance with regulations

When preparing to submit the 71 Oformr Transactions Form, it’s crucial to ensure compliance with all applicable regulations. Each sector may have different requirements; understanding these can save time and avoid problems later. For example, certain financial transactions require adherence to specific laws to protect the parties involved.

Reviewing local laws and guidelines can offer guidance in successfully completing the document and navigating any legal implications.

Best practices for document management

Once your 71 Oformr Transactions Form is completed, organizing and storing it properly is equally important. Using pdfFiller’s document management capabilities allows you to easily categorize and store completed forms for future reference. Maintaining organized records can help in audits or any future financial disputes, ensuring everything is easily accessible when needed.

Conclusion and next steps

In summary, understanding how to fill out and submit the 71 Oformr Transactions Form effectively is crucial for achieving seamless transactions and maintaining proper documentation. Prepare thoroughly, ensure accuracy, and take advantage of digital tools from pdfFiller to make the process as efficient as possible.

Utilizing pdfFiller's resources enhances your experience, providing you with tools to edit, sign, and manage your documents from any location, reinforcing the ease and efficiency these digital solutions provide.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 71 oformr transactions directly from Gmail?

Where do I find 71 oformr transactions?

Can I edit 71 oformr transactions on an Android device?

What is 71 oformr transactions?

Who is required to file 71 oformr transactions?

How to fill out 71 oformr transactions?

What is the purpose of 71 oformr transactions?

What information must be reported on 71 oformr transactions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.