Get the free Cattle Production Loan Application Form

Get, Create, Make and Sign cattle production loan application

How to edit cattle production loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cattle production loan application

How to fill out cattle production loan application

Who needs cattle production loan application?

Cattle Production Loan Application Form - How-to Guide

Understanding cattle production loans

Cattle production loans serve as crucial financial tools that enable farmers and ranchers to support their cattle operations effectively. These loans are primarily designed to assist in various aspects of cattle farming, from purchasing livestock to funding necessary equipment and operational costs. An understanding of what constitutes a cattle production loan is essential for ensuring that ranchers can capitalize on the funds available to them.

In agriculture, securing sufficient funding is non-negotiable. Cattle production loans play a pivotal role in allowing producers to maintain their operations, especially during challenging seasons or unexpected situations. With the right financing, farmers can scale their businesses, invest in better livestock genetics, or implement advanced farming techniques. This not only enhances productivity but also contributes positively to the agricultural economy.

Overview of the loan application process

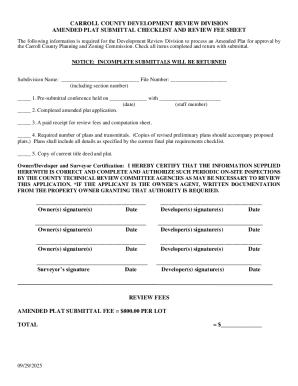

Applying for a cattle production loan involves a detailed process that ranchers must navigate carefully. Familiarity with the key requirements can aid in a smoother application experience. Primarily, it's essential to understand the eligibility criteria set by various lending institutions, which usually include verification of income, credit history, and the overall health of your cattle operation.

Documentation is another critical component of the application process. Standard requirements typically encompass financial statements, tax returns, a business plan, and historical production records. However, applicants often encounter common challenges, such as assembling the necessary documents, accurately representing their financial health, or understanding what lenders are looking for during the evaluation process.

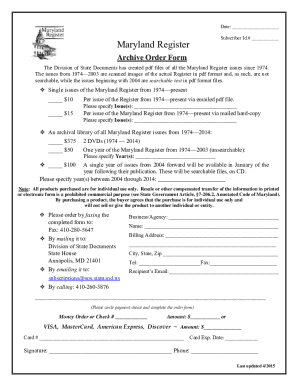

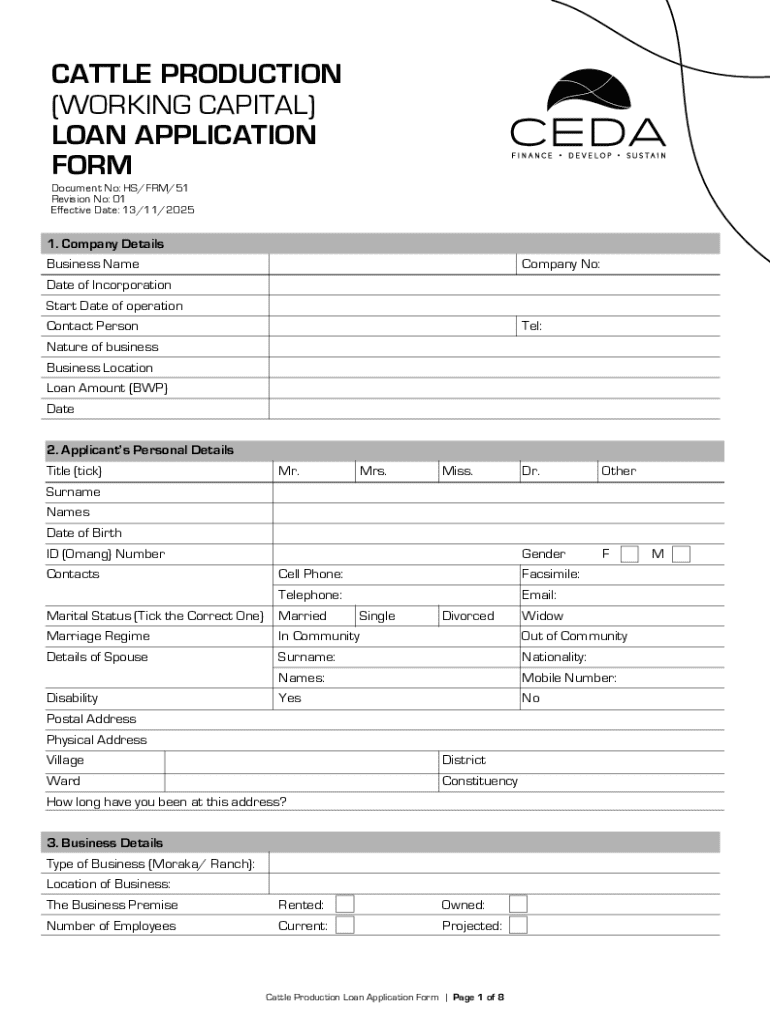

Accessing the cattle production loan application form

Finding the cattle production loan application form is often the first step in accessing vital financing. These forms can typically be found on the official websites of agricultural lenders, banks, or local government offices that provide funding support to farmers. Websites such as pdfFiller can also host these forms digitally, allowing for easier access and completion.

The pdfFiller platform is an excellent resource for streamlining the application process. Its interactive tools make it easy for users to fill out forms, select text, and navigate efficiently through each section of the application. With features that allow for real-time editing, users can ensure their application is tailored to their specific needs.

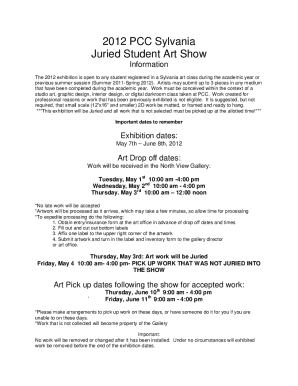

Step-by-step guide to completing the application form

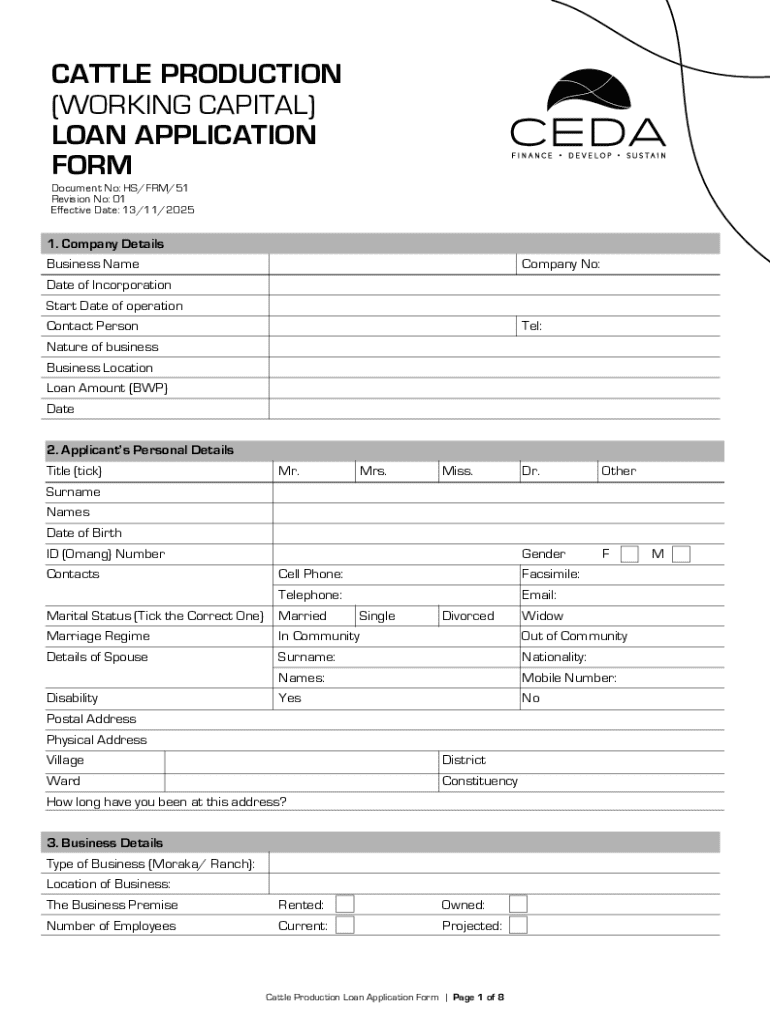

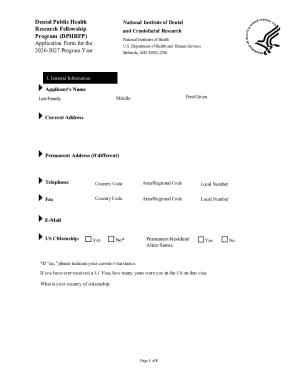

Completing the cattle production loan application form requires careful consideration of its structure. The form typically consists of multiple sections that need focused attention for accuracy. Each section serves a specific purpose, such as gathering personal information, defining the business landscape, and requesting financial details.

To begin with, the personal information section asks for the applicant's name, address, and personal identification details. Following this, the business information section will delve into specifics about the cattle operation, including the business structure and number of years in operation. Financial information is next, requiring an outline of assets, liabilities, and projected income, while the final part specifies the purpose of the loan, detailing how the funds will be allocated.

Editing and customizing your application form

After entering the required information, editing the application form is an essential next step. Using pdfFiller, you can easily make changes to the PDF form if needed. This ensures that any errors can be corrected without starting from scratch, thus saving both time and effort.

The platform also offers eSign features, allowing applicants to quickly add their signature and date electronically. This not only enhances convenience but also speeds up the submission process. Furthermore, if you are collaborating as part of a team, team members can review and provide input on various sections of the application simultaneously, streamlining communication and enhancing the quality of the submission.

Submitting the application

Once your application form is complete and customized to your satisfaction, the next phase is to submit it. This can generally be done through multiple channels, including online submission or mail-in options. Many agricultural lending institutions now favor online submissions as they tend to process applications faster, allowing applicants to receive feedback sooner.

Regardless of your submission method, it’s crucial to follow up on your application status after a reasonable time. This proactive approach demonstrates your engagement and can provide reassurance as you await feedback from lenders.

After submission: what to expect

After submitting a cattle production loan application, it’s essential to be prepared for what comes next. Typically, the timeline for loan approval can range from a few days to several weeks, depending on the lender's internal processes and the complexity of your loan request. During this period, lenders will assess your application thoroughly, considering your credit history, the financial vitality of your operation, and the intended use of the funds.

Understanding the loan terms and conditions is equally vital once you receive approval. Make sure you are fully aware of interest rates, repayment schedules, and any fees associated with the loan. Awareness of these details can aid you in managing your finances effectively and avoiding any pitfalls in your repayment journey.

Managing your loan through pdfFiller

After securing a loan, it's imperative to keep your documentation organized. pdfFiller offers robust document management features, allowing ranchers to store and access all loan-related documents securely in one place. This centralization aids in efficiency, particularly during the tax season or when preparing for annual reviews.

Utilizing the platform’s reminder features can help you stay on top of payments. Setting reminders within pdfFiller ensures that you pay your loan on time, preventing any late fees and maintaining a positive credit history. This proactive approach can significantly influence your long-term financial health and aid in securing future financing.

Cattle loan resources and support

Accessing resources and support tailored for farmers can also enhance the likelihood of successful loan acquisition and management. Numerous assistance tools exist, both online and through local service centers, that provide guidance tailored to cattle ranchers and farmers. These resources can help you understand the intricacies of loan applications and offer tips on improving your financial position.

Building connections with local service centers can also yield personalized support and consultation. Engaging with professionals who can provide insights based on your specific situation is often invaluable. Additionally, leveraging financial management tools can help you maintain a clear understanding of your farm’s fiscal status, while market research resources can equip you with information about pricing trends and demand for cattle.

Related financial considerations for cattle producers

Beyond the cattle production loan application form, several financial considerations offer depths of insight into managing agricultural financing. Understanding interest rates and payment structures is crucial. Ranchers must grasp how fluctuating interest rates can impact loan viability and overall profitability. A responsible approach to loan payments can significantly influence credit ratings, ultimately affecting future financing options.

Additional funding options for cattle producers exist, such as grants and subsidies that various governmental and nonprofit organizations provide. These can offer valuable financial support without the burden of repayment. Exploring alternative loan programs can also be beneficial, particularly those designed for specific agricultural needs or seasonal operations. By analyzing all available options, ranchers can align their financial strategy with their production goals effectively.

Staying informed: updates in agricultural financing

The agricultural financing landscape is continuously evolving, influenced by changes in governmental policies and market dynamics. Staying informed about emerging trends in cattle production loans can significantly enhance a rancher's ability to make sound financial decisions. Engaging in webinars, industry conferences, and financial workshops can provide valuable insights into the latest developments.

Resourceful websites often offer newsletters and articles that keep ranchers abreast of shifts in agricultural financing. Additionally, participating in local agricultural associations can facilitate networking opportunities with other producers and financial experts while fostering a sense of community and support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in cattle production loan application without leaving Chrome?

How can I edit cattle production loan application on a smartphone?

How do I edit cattle production loan application on an Android device?

What is cattle production loan application?

Who is required to file cattle production loan application?

How to fill out cattle production loan application?

What is the purpose of cattle production loan application?

What information must be reported on cattle production loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.