Get the free Form 5500 Reporting Information - Retirement

Get, Create, Make and Sign form 5500 reporting information

Editing form 5500 reporting information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500 reporting information

How to fill out form 5500 reporting information

Who needs form 5500 reporting information?

Form 5500 Reporting Information Form - How-to Guide

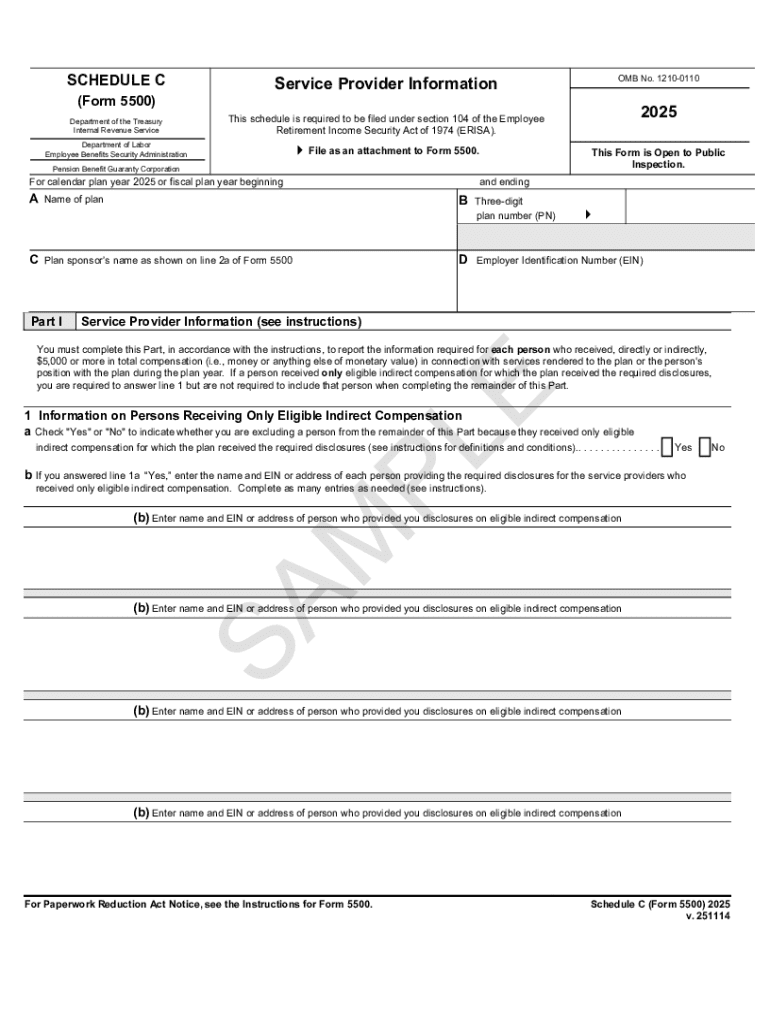

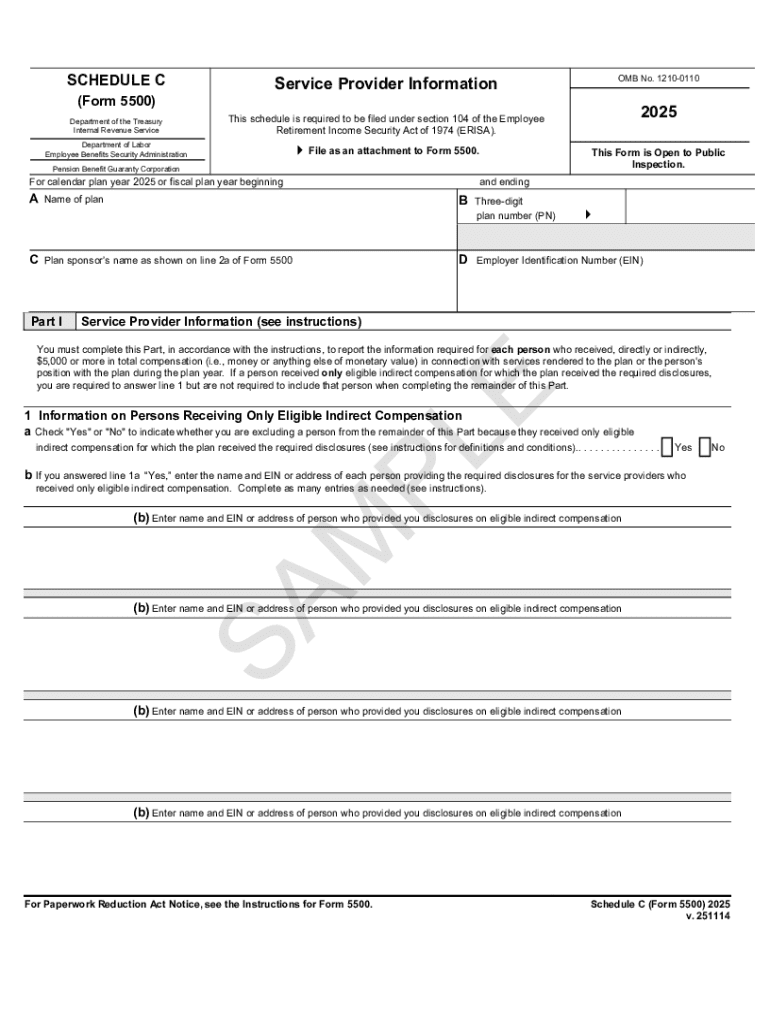

Understanding Form 5500

Form 5500 serves as a crucial filing document required by the U.S. Department of Labor (DOL) for employee benefit plans. It is designed to provide the government with essential information about a plan's financial condition and operations. This comprehensive reporting is vital for ensuring compliance with the Employee Retirement Income Security Act (ERISA) and helps protect the interests of plan participants.

Every employee benefit plan is required to submit Form 5500 to maintain transparency and uphold regulatory standards. By keeping track of various plans, the DOL ensures that the rights of employees are safeguarded, thereby fostering an environment of trust and accountability.

Types of plans required to file Form 5500

Two main types of employee benefit plans need to file Form 5500: retirement plans and health and welfare plans. Retirement plans include defined benefit plans, defined contribution plans, and multi-employer plans, ensuring that participants have access to adequate funds upon retirement.

On the other hand, health and welfare plans encompass a range of benefits such as medical, dental, and disability insurance. Plans that fall into these categories must comply with specific filing requirements, ensuring that both employees and employers maintain awareness of the plan's status.

Filing requirements for Form 5500

Organizations that sponsor employee benefit plans are required to file Form 5500 if they have more than 100 participants. Understanding who must file is essential for compliance and avoiding penalties. Employers with plans covering fewer than 100 participants may file the simpler Form 5500-SF (Short Form).

The submission deadlines for Form 5500 are typically the last day of the seventh month after the end of the plan year. If this date falls on a weekend or holiday, the deadline extends to the next business day. Filing can be done either electronically or on paper, though electronic filing is highly recommended due to its convenience and efficiency.

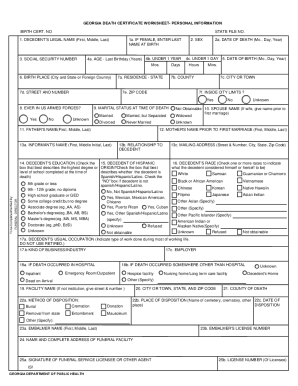

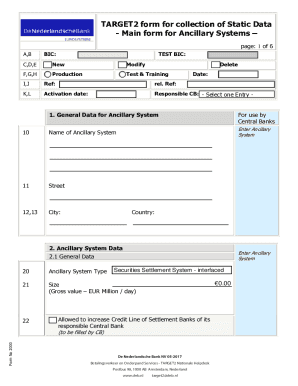

Components of Form 5500

Form 5500 contains multiple sections, each serving a specific purpose. These sections include plan information, financial details, and compliance questions. Each component is crucial as it helps ensure that the information provided is complete and accurate.

Additionally, schedules and attachments accompany Form 5500, depending on the type of plan you are reporting on. For instance, if your plan includes more complex features, such as investment options, you may be required to provide additional schedules to clarify these details.

Step-by-step guide to completing Form 5500

Before initiating the completion of Form 5500, it is essential to gather all necessary documents, such as plan documents and financial statements. Utilizing tools and resources can significantly ease the preparation process and ensure that nothing is overlooked.

When filling out the form, it is important to leverage platforms like pdfFiller, which offers an interactive walkthrough of the filing process. This application simplifies the navigation of various sections, allowing you to complete each part methodically and reduce the chance of errors.

Managing and submitting your Form 5500

Before you submit Form 5500, it's crucial to conduct a review process. This involves checking against the checklist of specific requirements mentioned in the form. Best practices suggest that an extra set of eyes from a colleague can help catch any unnoticed inaccuracies.

Once submitted, you will receive a confirmation from the DOL, indicating that your form has been accepted for processing. It’s essential to track your filing status through the DOL's website to ensure that all necessary actions are completed.

Special considerations for unique circumstances

In instances where changes must be made after the initial filing of Form 5500, amending the form is necessary. A well-defined process exists that allows organizations to make corrections while ensuring compliance with DOL regulations.

Moreover, if submissions are unexpectedly delayed, organizations can request an extension for filing. However, late submissions may incur penalties, so understanding the guidelines surrounding late filings is imperative for compliance.

Resources and tools for effective Form 5500 management

Utilizing pdfFiller’s features can streamline the entire Form 5500 management process. This platform allows for cloud-based document management, ensuring that all team members can access and edit documents seamlessly, regardless of location.

In addition to pdfFiller, seeking additional support from professional services or community forums can greatly enhance your understanding of the filing requirements. Accessing reliable resources ensures that your organization remains compliant and well-informed.

Staying informed: updates and changes to Form 5500

Keeping abreast of recent changes in regulations surrounding Form 5500 is essential for compliance. The DOL regularly updates requirements that affect various types of plans. Staying informed allows organizations to adapt their filings accordingly and ensure that they meet all necessary standards.

To receive updates on Form 5500, organizations can subscribe to notifications from the DOL or visit the official website regularly. This proactive approach will help in timely adaptations to any new changes.

Frequently asked questions (FAQs)

Many individuals and teams have questions about Form 5500, from basic definitions to specific filing requirements. Addressing these common queries can help demystify the process and provide actionable insight for successful submissions.

Expert tips from seasoned professionals can further ease the filing challenges associated with Form 5500. Gathering these insights can bolster your organization’s compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5500 reporting information for eSignature?

How can I fill out form 5500 reporting information on an iOS device?

How do I fill out form 5500 reporting information on an Android device?

What is form 5500 reporting information?

Who is required to file form 5500 reporting information?

How to fill out form 5500 reporting information?

What is the purpose of form 5500 reporting information?

What information must be reported on form 5500 reporting information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.