Get the free Empower 457 Plan

Get, Create, Make and Sign empower 457 plan

Editing empower 457 plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out empower 457 plan

How to fill out empower 457 plan

Who needs empower 457 plan?

Empower 457 Plan Form: A Comprehensive Guide

Understanding the 457 plan overview

A 457 plan is a type of retirement savings plan available to state and local government employees and some non-profit organizations. The purpose of this plan is to help employees save for retirement through tax-deferred contributions. There are two main types of 457 plans: governmental and non-governmental. Governmental 457 plans are offered by state and local governments and are generally considered to have more favorable tax treatment compared to non-governmental plans, which are usually offered by non-profit organizations.

Participating in a 457 plan provides several benefits, including significant tax advantages. Contributions made to the plan are deducted from your taxable income, allowing your savings to grow tax-deferred until withdrawal. Additionally, there are generous contribution limits, which for 2023 are set at $22,500, with an additional catch-up contribution option for those aged 50 and over. Unlike some other retirement plans, a 457 plan also allows for loans and withdrawals, giving participants access to their funds if needed.

The importance of the Empower 457 plan form

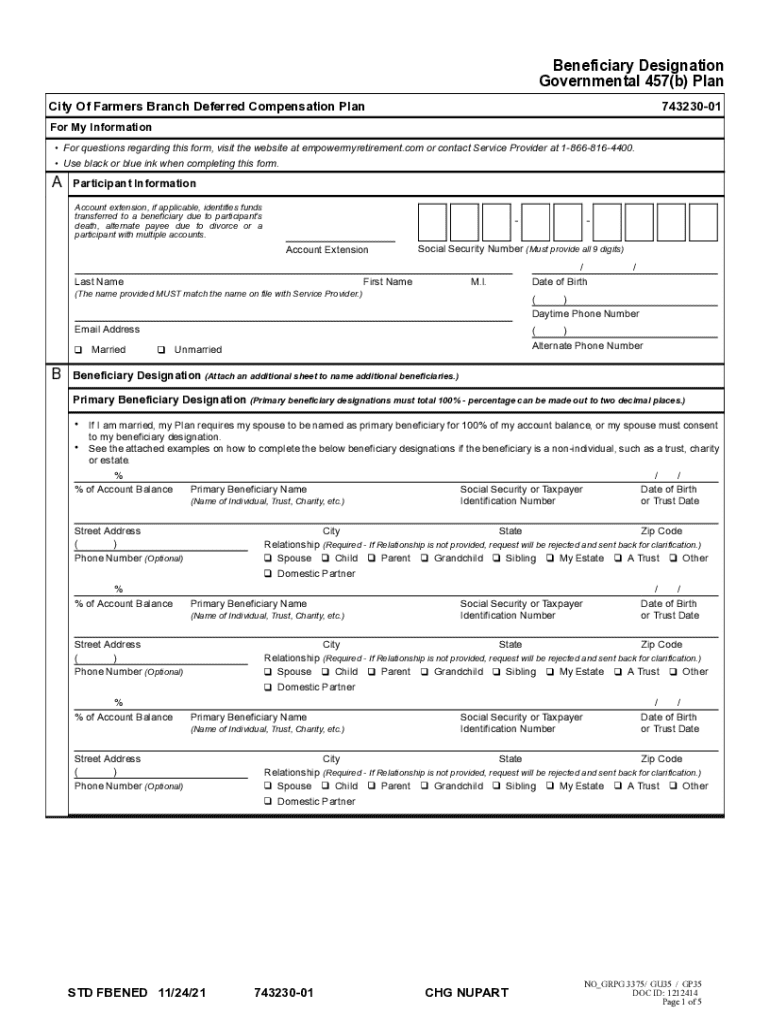

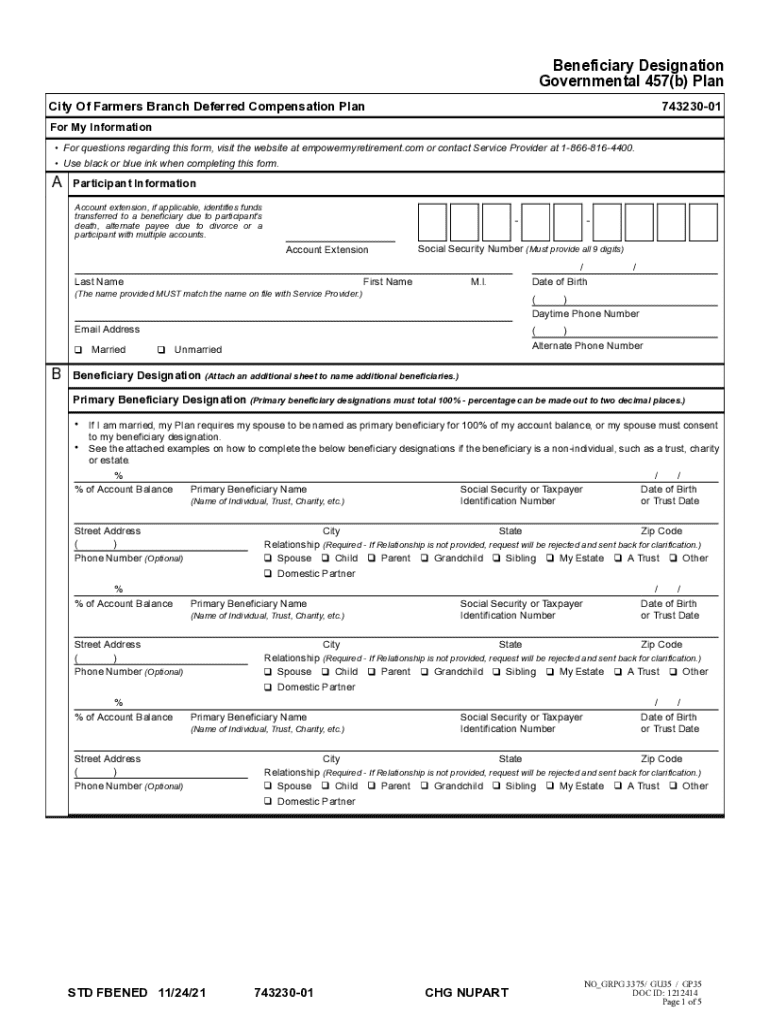

The Empower 457 plan form is crucial for anyone wishing to enroll in this retirement savings plan. This form serves as the formal application to initiate your 457 plan, and it collects necessary information that is vital for plan management. Accurate completion of the Empower 457 plan form ensures that your enrollment goes smoothly and that your contributions are correctly processed.

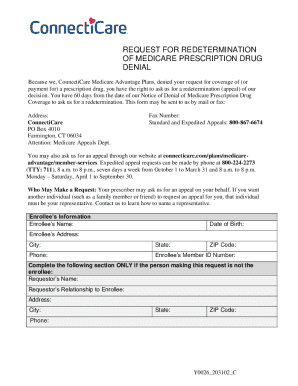

You will need to use the Empower 457 plan form under various circumstances: during your initial enrollment in the plan, when you want to modify your current contribution amounts, or when you're updating your beneficiary designations. Keeping this form updated is important to manage your retirement savings effectively and ensure that your loved ones are taken care of in the event of your untimely passing.

Detailed guide to filling out the Empower 457 plan form

Filling out the Empower 457 plan form can seem daunting, but following these step-by-step instructions will simplify the process. Start by gathering the required information you'll need to complete the form, which includes your personal details such as your name, address, and social security number, along with your employment details, including your employer's name and your job position.

Editing and managing your Empower 457 plan form

After completing the Empower 457 plan form, managing and editing it might be necessary from time to time. This is where pdfFiller comes into play as an effective tool for handling your documentation needs. Using the pdfFiller platform allows users to access and edit forms conveniently from anywhere. You can easily make adjustments to your Empower 457 plan form, add text, insert images, and make necessary changes to your signature.

With pdfFiller’s collaborative features, you can share your form with team members or financial advisors for review or input. Furthermore, cloud storage options enable you to save your document securely and access it at any time, streamlining your personal document management process.

FAQs: Common questions about the Empower 457 plan form

Many prospective enrollees have questions regarding the Empower 457 plan form. For instance, what happens if you make a mistake while filling out the form? Most forms allow for corrections to be made but it’s best to consult your plan administrator for specific guidance. You might also wonder how often you can update your 457 plan information; typically, updates can be made annually or as necessary when life circumstances change.

Troubleshooting – Common issues you might encounter

Navigating the Empower 457 plan form and its submission process may lead to occasional hurdles. Common issues often include problems with electronic signatures or difficulties in submitting the form online. These issues can create unnecessary stress, but it’s important to remain proactive. Familiarize yourself with the troubleshooting sections of your plan or reach out to support services for guidance.

If you encounter problems with electronic signatures, ensure that your signature complies with the digital requirements. Should you have issues submitting the form, checking internet connectivity or browser compatibility may resolve some problems. Always keep the contact details for customer support handy for immediate assistance in case situations arise.

Conclusion: Maximizing your 457 plan experience

The Empower 457 plan form is not just a piece of paperwork; it is an integral part of your retirement planning strategy. Efficiently managing this form and understanding its importance can significantly enhance your journey towards a secure financial future. Leveraging tools like pdfFiller can allow for seamless document management, from filling out forms to maintaining accuracy and compliance.

Being informed about how to complete and manage your Empower 457 plan form, along with regularly updating it when necessary, empowers you to make the most of your benefits while keeping alignments with your financial goals.

Next steps: What to do after submitting your form

Once you've submitted your Empower 457 plan form, tracking your application status is vital. Many providers offer online access where you can monitor your account and confirm that your contributions are being processed as expected. Setting reminders for future updates or changes to your plan can help you stay proactive and ensure your retirement savings remain aligned with your evolving financial situation.

Schedule periodic reviews of your beneficiaries, contributions, and financial goals to effectively manage your retirement strategy and safeguard your financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send empower 457 plan to be eSigned by others?

Where do I find empower 457 plan?

Can I create an electronic signature for signing my empower 457 plan in Gmail?

What is empower 457 plan?

Who is required to file empower 457 plan?

How to fill out empower 457 plan?

What is the purpose of empower 457 plan?

What information must be reported on empower 457 plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.