Get the free / 6400 W

Get, Create, Make and Sign 6400 w

Editing 6400 w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 6400 w

How to fill out 6400 w

Who needs 6400 w?

Your Comprehensive Guide to the 6400 W Form

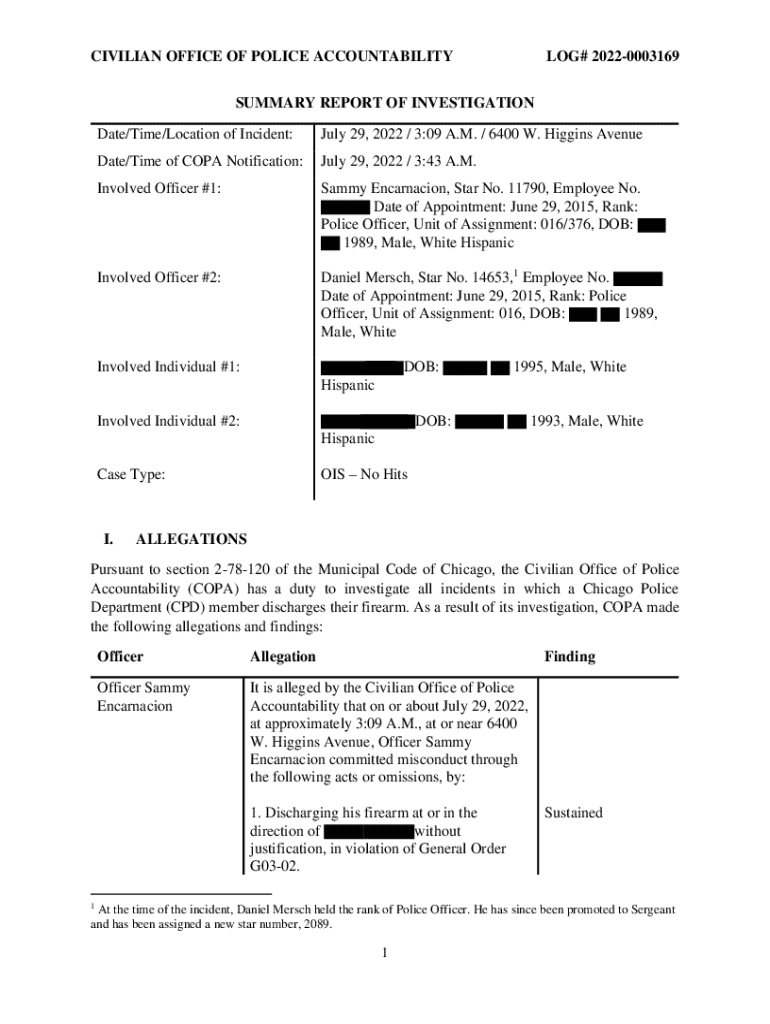

Understanding the 6400 W form

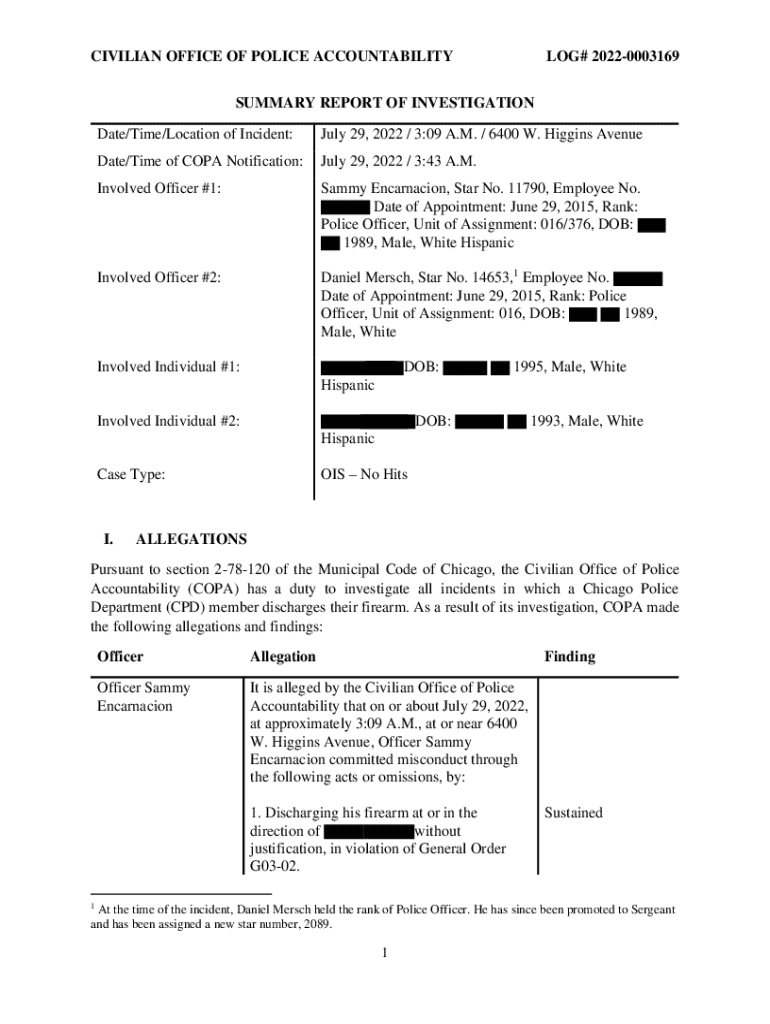

The 6400 W form is a crucial document often required in specific financial or governmental contexts. It serves to collect and report information that is necessary for compliance with tax and regulatory mandates. Individuals and organizations use the 6400 W form to accurately convey their financial standing or activities to relevant authorities, ensuring they stay within statutory guidelines.

Understanding the importance of the 6400 W form extends beyond mere compliance; it plays a significant role in risk management and financial transparency. By keeping accurate records through this form, users can avoid potential penalties or discrepancies during audits.

Who needs to use the 6400 W form?

The 6400 W form is primarily aimed at individuals, businesses, and organizations involved in specific financial transactions or reporting requirements. Common target audiences include:

Specific scenarios include applying for grants, filing taxes, or reporting large transactions, where the accurate documentation provided by the 6400 W form is essential.

Detailed breakdown of the 6400 W form

The 6400 W form consists of several key components that users must complete for it to be valid. Each section serves a unique purpose and helps in the comprehensive collection of data relevant to financial reporting.

Understanding the required fields is vital. Users should pay particular attention to mandatory sections and ensure that optional fields, while not compulsory, are filled out where appropriate for enhanced clarity.

Common terms and definitions

To navigate the 6400 W form effectively, familiarity with associated terminology can significantly reduce confusion. A glossary can be particularly helpful to define common terms such as:

Step-by-step guide to filling out the 6400 W form

Before diving into the completion of the 6400 W form, preparation is key. Gathering the necessary documents and information ahead of time can streamline the process.

Guided walkthrough of each section

Here’s a detailed walkthrough of how to fill out each section of the 6400 W form:

Common mistakes to avoid include incorrect Social Security Numbers, miscalculating financial figures, and forgetting to sign the form, as such errors can lead to processing complications.

Editing and managing your 6400 W form

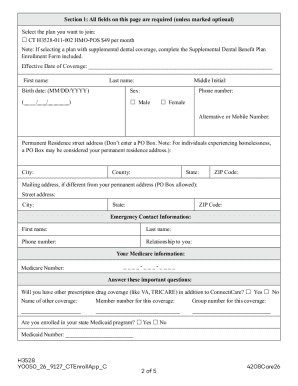

Once you have completed the 6400 W form, ensuring its accuracy is crucial. pdfFiller offers a range of features designed to simplify editing and managing your document.

Using pdfFiller, you can upload your filled 6400 W form and make necessary edits easily.

Collaboration features

Collaboration can be essential for teams handling the 6400 W form collectively. pdfFiller provides functions to streamline collaboration:

Signing and submitting the 6400 W form

Additionally, pdfFiller supports multiple eSignature options to facilitate the signing of your 6400 W form effortlessly.

Once signed, you have multiple options for submission— online, via mail, or in person— depending on the requirements associated with the 6400 W form. Be vigilant about deadlines, as submissions past these may incur penalties or delays in processing.

Frequently asked questions (FAQs) about the 6400 W form

Engaging with the 6400 W form can present challenges. Here are some common questions and their solutions:

Addressing these questions can facilitate a smoother experience when dealing with the 6400 W form.

Additional insights and tools

For further assistance, various resources are available that can enhance your understanding of the 6400 W form. These include:

Interactive tools or calculators may also be provided by pdfFiller to assist users in determining their reporting requirements accurately.

Conclusion

Managing the 6400 W form accurately is essential for compliance and financial clarity. Utilizing pdfFiller’s innovative document management tools, users can simplify filling, editing, and submitting the 6400 W form while ensuring all necessary requirements are met.

The advantages of pdfFiller extend beyond simple form handling, offering users a comprehensive, cloud-based solution for streamlined document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 6400 w for eSignature?

Can I sign the 6400 w electronically in Chrome?

How do I complete 6400 w on an Android device?

What is 6400 w?

Who is required to file 6400 w?

How to fill out 6400 w?

What is the purpose of 6400 w?

What information must be reported on 6400 w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.