Get the free MARYLAND FORM 502AC 2014 SUBTRACTION FOR CONTRIBUTION OF ARTWORK

Show details

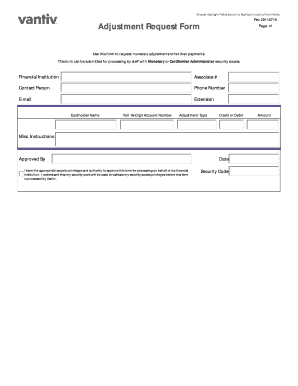

MARYLAND FORM 502AC 2014 SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach to your tax return. Print using blue or black ink only. Your first name and initial Last name Social Security Number Spouses

We are not affiliated with any brand or entity on this form

Instructions and Help about maryland form 502ac 2014

How to edit maryland form 502ac 2014

How to fill out maryland form 502ac 2014

Instructions and Help about maryland form 502ac 2014

How to edit maryland form 502ac 2014

To edit the Maryland Form 502AC 2014, access the form using pdfFiller. Upload the form to the platform, where you can utilize editing tools to make any necessary changes. Save the updated document once your edits are complete, ensuring that all information is accurate and up to date.

How to fill out maryland form 502ac 2014

To fill out Maryland Form 502AC 2014 correctly, follow these steps:

01

Obtain the Maryland Form 502AC 2014 from the official Maryland state website or pdfFiller.

02

Provide your personal information, including your name, address, and Social Security number.

03

Indicate your filing status, which will affect your tax obligations and potential credits.

04

Enter any applicable income and deductions, as this form is used to calculate your tax due.

05

Sign and date the form, acknowledging that the information provided is correct to the best of your knowledge.

Latest updates to maryland form 502ac 2014

Latest updates to maryland form 502ac 2014

As of the last update, there have been no significant changes to Maryland Form 502AC for the tax year 2014. For the most current information, check the Maryland State Comptroller's website regularly to ensure compliance and awareness of any updates.

All You Need to Know About maryland form 502ac 2014

What is maryland form 502ac 2014?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About maryland form 502ac 2014

What is maryland form 502ac 2014?

Maryland Form 502AC 2014 is an official tax form used by Maryland residents to report their income, claim allowances, and communicate their tax information to the state. This document is essential for establishing an individual's tax liability and eligibility for credits or deductions.

What is the purpose of this form?

The purpose of Maryland Form 502AC 2014 is to ensure that residents report all relevant income and tax information accurately to the Maryland state government. This form helps facilitate the calculation of taxes owed or refunds due based on the information provided.

Who needs the form?

Maryland residents who have taxable income or who are claiming tax credits and deductions must fill out the Maryland Form 502AC 2014. This includes individuals who filed Maryland personal income tax returns for 2014.

When am I exempt from filling out this form?

Filers are exempt from completing Maryland Form 502AC 2014 if they do not have any taxable income or if their income falls below the state’s filing threshold. Moreover, those who are not residents of Maryland and do not earn any income within the state are also exempt from this form.

Components of the form

The main components of Maryland Form 502AC 2014 include sections for personal information, filing status, income declarations, deductions, and tax calculation. Each component plays a crucial role in determining the overall tax obligation of the filer.

Due date

The filing deadline for Maryland Form 502AC 2014 typically aligns with the federal tax return deadline, which is usually April 15. However, it is important to confirm the specific due dates for that tax year to avoid any late penalties.

What are the penalties for not issuing the form?

Failure to file Maryland Form 502AC 2014 could result in penalties, including fines and interest on unpaid taxes. Additionally, not filing may lead to the state estimating a tax liability, which could be higher than what the filer would owe if the form were completed accurately.

What information do you need when you file the form?

When filing Maryland Form 502AC 2014, you will need your personal identification details, including your Social Security number, financial records detailing your income from various sources, and information about deductions and credits you are eligible to claim for that tax year.

Is the form accompanied by other forms?

Maryland Form 502AC 2014 may be accompanied by other forms, such as the Maryland Form 502 (the main income tax return) and various schedules for reporting specific income types or calculating credits. Always check the Maryland state guidelines for any required additional documentation.

Where do I send the form?

Once completed, Maryland Form 502AC 2014 should be mailed to the appropriate address specified by the Maryland Comptroller's office. This is usually included in the form instructions or can be found on the state’s official tax website.

See what our users say