Get the free Louisiana Manufacturing Exemption Certificate

Get, Create, Make and Sign louisiana manufacturing exemption certificate

How to edit louisiana manufacturing exemption certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out louisiana manufacturing exemption certificate

How to fill out louisiana manufacturing exemption certificate

Who needs louisiana manufacturing exemption certificate?

Louisiana manufacturing exemption certificate form: A comprehensive guide

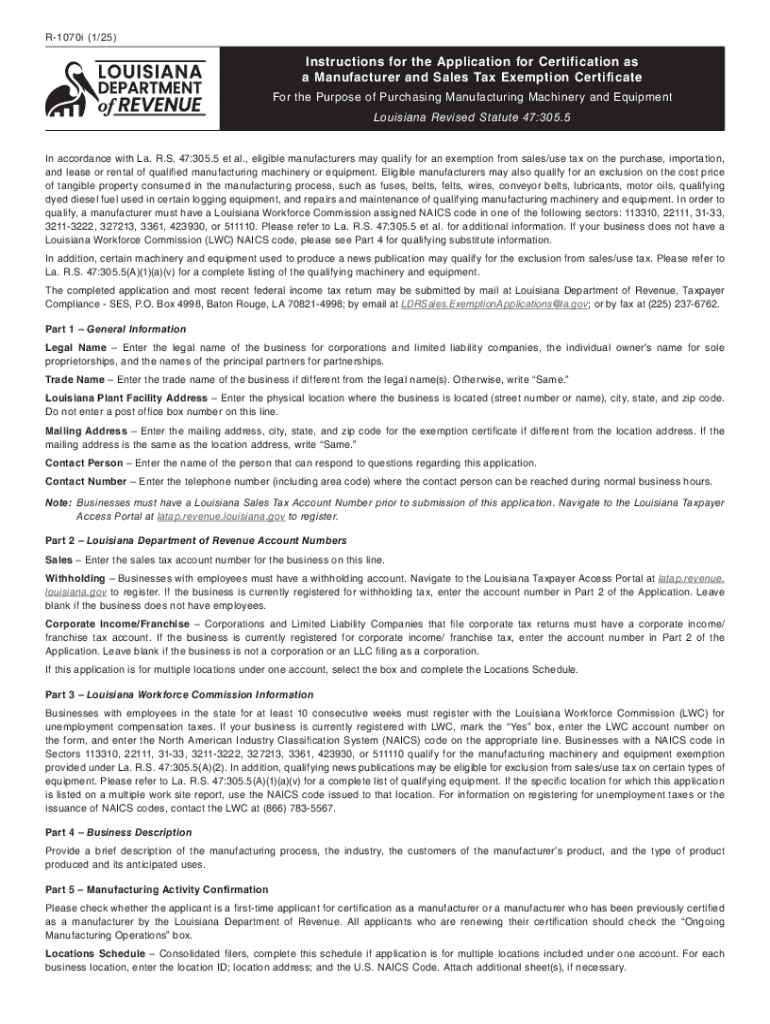

Overview of Louisiana manufacturing exemption certificate

The Louisiana manufacturing exemption certificate is a crucial document that allows qualifying manufacturing businesses in Louisiana to purchase certain goods and services without paying sales tax. This exemption is intended to reduce operational costs and encourage the growth of manufacturing companies in the state.

For manufacturing businesses, obtaining this certificate is vital, as it can significantly lower their sales tax liabilities. This allows companies to allocate more funds toward reinvestment in their operations and workforce, ultimately fostering economic growth. Additionally, this exemption can attract new businesses to Louisiana, which values its manufacturing sector as a fundamental component of its economy.

Types of exemption certificates in Louisiana

Louisiana offers several types of exemption certificates aimed at alleviating financial burdens on various sectors. These exemptions vary based on the nature of purchases and the industries they serve. While certain exemptions may apply broadly, the manufacturing exemption certificate specifically targets businesses involved in production processes.

Qualifying for the manufacturing exemption typically requires satisfying specific criteria determining whether the goods and services purchased are essential for production. It's important for business owners to distinguish between different exemption types, as not every exemption applies to every industry. For instance, the agricultural exemption and the manufacturing exemption differ significantly in their applications and beneficiaries.

Eligibility criteria for Louisiana manufacturing exemption

To be eligible for the Louisiana manufacturing exemption certificate, business owners must ensure their operations fit within specific parameters defined by the state. Primarily, businesses must be engaged in the manufacturing process, which includes the transformation of raw materials into finished products. Typically, industries such as automotive manufacturing, food processing, and textile production qualify for these exemptions.

The necessary documentation to apply includes proof of business registration, tax identification numbers, and sometimes additional evidence demonstrating how your goods or services are integral to manufacturing processes. Entrepreneurs must maintain careful records of their operations and demonstrate compliance with Louisiana tax regulations as part of the eligibility criteria.

Step-by-step guide to completing the Louisiana manufacturing exemption certificate form

Filling out the Louisiana manufacturing exemption certificate form may seem daunting, but following a structured approach simplifies the process. First, access the official form from the Louisiana Department of Revenue website or directly from the pdfFiller platform, where downloadable templates are readily available.

Once you have the form, it's essential to fill in all required information accurately. This generally includes your business name, address, tax ID number, and a description of the items you'll purchase under the exemption. For clarity and compliance, take your time to provide precise details here — inaccuracies can lead to denial or audits.

Finally, submit your completed form through the appropriate channels. This can include online submission or mailing it directly to the Louisiana Department of Revenue. Be mindful of any deadlines specified, as timely submission is crucial for maintaining good standing with tax compliance.

Key considerations when applying for the manufacturing exemption

When applying for the Louisiana manufacturing exemption certificate, there are several key considerations to keep in mind to ensure a smooth process. One common mistake to avoid is submitting incomplete forms — double-check that all sections are filled out completely. Additionally, ensure that the requested documentation accompanies your application.

Understanding compliance requirements is also crucial after submission. Regularly review and update your records to reflect any changes in operations or business structure. Non-compliance can lead to significant consequences, including the requirement to repay sales tax with interest or penalties, emphasizing the importance of ongoing diligence in managing your exemption status.

Managing your Louisiana manufacturing exemption certificate

Once you've obtained your Louisiana manufacturing exemption certificate, managing the document effectively is essential. Start by organizing and securely storing the certificate along with any related documentation. A well-maintained filing system can help streamline audits and facilitate easy access to records when necessary.

Ensure you remain aware of renewal processes or any updates required for your exemption. Keeping informed about changes in tax law or state regulations that may affect your certification is equally important. Prepare for potential audits by having all necessary records organized and accessible to demonstrate tax compliance.

Frequently asked questions (FAQs)

Understanding the nuances of the Louisiana manufacturing exemption certificate can trigger a variety of questions for business owners. A common concern may revolve around the implications of a denied application. If your application is denied, you typically have the option to appeal the decision or rectify any issues noted in the rejection.

It’s also important to understand the applicability of the exemption across state lines. Generally, exemption certificates are state-specific, meaning you cannot utilize the Louisiana exemption certificate in other states without understanding their specific regulations. Typically, the exemption is valid as long as you continuously meet eligibility criteria, but the duration can vary; be sure to check for any renewal requirements.

Real-world examples and case studies

The impact of the Louisiana manufacturing exemption certificate can be observed through real-world examples. Many local businesses have experienced significant financial relief and increased competitiveness as a result of utilizing the exemption. For instance, a textile manufacturer in Baton Rouge reported saving thousands in annual sales tax costs, enabling them to upgrade equipment and hire additional staff.

Moreover, success stories illustrate how proactive management of the exemption can lead to not only financial benefits but also operational enhancements. best practices observed include routine audits of eligibility, staying compliant with documentation, and engaging with tax advisors to navigate complex regulations effectively.

Interactive tools and resources available on pdfFiller

pdfFiller provides a suite of interactive tools and resources for businesses managing their Louisiana manufacturing exemption certificate. Users can easily create, edit, and customize forms, ensuring that all required information is accurately presented. This capability streamlines the paperwork associated with tax compliance.

Additionally, pdfFiller offers eSigning capabilities, allowing users to quickly obtain the necessary signatures electronically, which speeds up the submission process. Teams can collaborate effectively through features designed for document sharing, ensuring all relevant stakeholders have access to essential information when needed.

Conclusion: Empower your business with the Louisiana manufacturing exemption

The Louisiana manufacturing exemption certificate is a powerful tool that can significantly enhance a business's financial standing and operational capabilities. By reducing sales tax burdens, manufacturers can invest more strategically in growth and innovation within their industries.

Leveraging platforms like pdfFiller facilitates document management, ensuring that businesses can efficiently navigate the often complex world of tax compliance. By utilizing these resources effectively, manufacturers in Louisiana can harness the full potential of the exemption certificate, ultimately empowering them to thrive in a competitive landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my louisiana manufacturing exemption certificate directly from Gmail?

Can I create an electronic signature for the louisiana manufacturing exemption certificate in Chrome?

Can I create an eSignature for the louisiana manufacturing exemption certificate in Gmail?

What is louisiana manufacturing exemption certificate?

Who is required to file louisiana manufacturing exemption certificate?

How to fill out louisiana manufacturing exemption certificate?

What is the purpose of louisiana manufacturing exemption certificate?

What information must be reported on louisiana manufacturing exemption certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.