Get the free Home Mortgage Disclosure Act Flashcards

Get, Create, Make and Sign home mortgage disclosure act

How to edit home mortgage disclosure act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home mortgage disclosure act

How to fill out home mortgage disclosure act

Who needs home mortgage disclosure act?

Understanding the Home Mortgage Disclosure Act Form: A Comprehensive Guide

Understanding the Home Mortgage Disclosure Act (HMDA)

The Home Mortgage Disclosure Act (HMDA) was enacted to provide transparency in the lending process by ensuring that lenders disclose certain information about mortgage applications. Its primary purpose is to promote fair lending and ensure that financial institutions serve the housing needs of their communities.

For consumers, HMDA data can help in understanding lending patterns within their communities, thereby facilitating informed decisions while applying for mortgages. Lenders benefit from HMDA as it helps them identify potential biases in their lending practices, ensuring compliance with fair lending laws.

The Home Mortgage Disclosure Act form explained

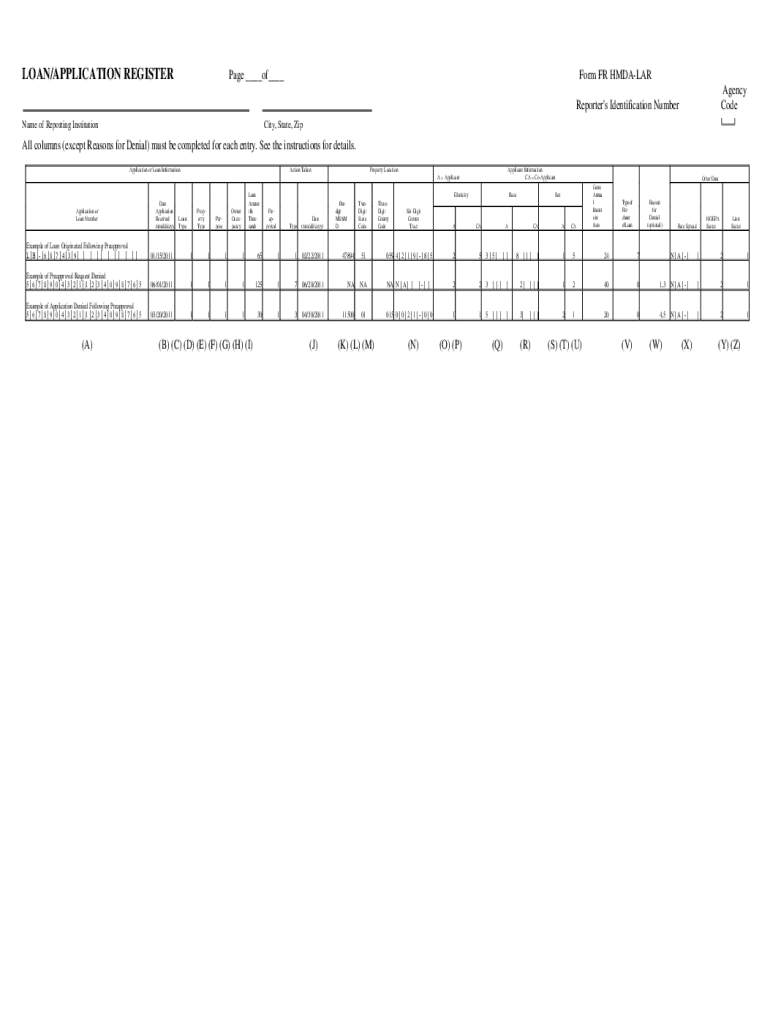

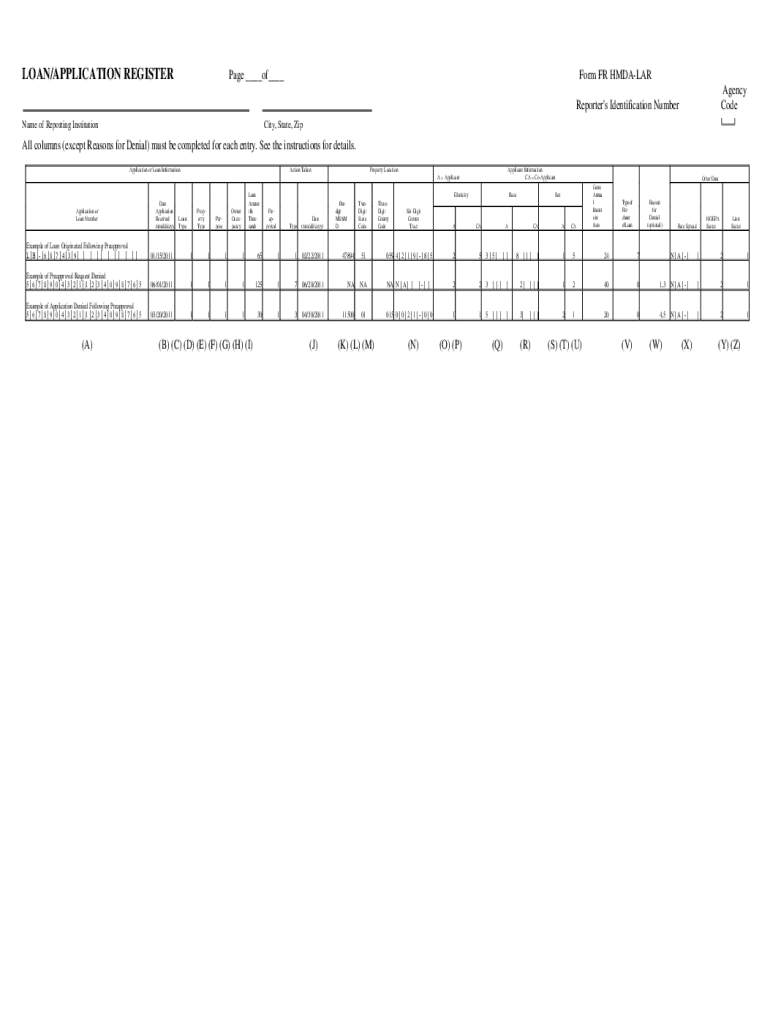

The HMDA form is a standardized document that lenders must fill out when they process mortgage applications. This form collects essential data that regulators analyze to ensure compliance with lending laws. Financial institutions that meet specific thresholds regarding the number of loans issued are typically required to complete the HMDA form.

The information collected through the HMDA form helps assess lending patterns and informs policymakers about mortgage applications. This data includes not only details about the loans—such as the loan type and amounts—but also applicant demographics and geographical data to ensure equal access to credit across all communities.

Filling out the HMDA form

Completing the HMDA form may seem daunting, but with proper preparation, it becomes manageable. Begin by gathering necessary documentation like loan applications, applicant demographics, and geographical data. A clear and organized approach will help ensure each section of the HMDA form is filled out accurately.

The HMDA form consists of several sections. Each section has specific data requirements, so take your time to review what is needed. Pay close attention to detail, ensuring that the information matches your documentation. This diligence will help avoid common errors that could lead to compliance issues.

Common mistakes to avoid

One of the most common mistakes when filling out the HMDA form is providing incomplete information. Ensure all required fields are filled, as leaving something blank may trigger compliance issues. Misinterpretation of data requirements can also pose a problem; be sure to understand what information is needed for each category.

Also, be cautious of date formats and specific terminology. Employing uniform language and formats can prevent confusion and ensure accuracy. When in doubt, consult HMDA guidelines or resources available through platforms like pdfFiller to clarify any uncertainties.

Tools for managing your HMDA form

Utilizing tools like pdfFiller can streamline the process of filling out HMDA forms. This platform allows users to edit, sign, and collaborate seamlessly on PDF documents. Its cloud-based capabilities mean you can manage your forms anywhere, making it particularly convenient for teams working together on compliance projects.

Features like electronic signatures and document editing allow for a more efficient workflow. With these digital tools, there's no need to print and scan documents, saving you time and reducing the risk of errors during manual handling.

Submission process for the HMDA form

Submitting your HMDA form is crucial for compliance and must be done correctly. Electronic submission is the preferred method, allowing for instant processing. Detailed instructions are typically provided by regulatory authorities on the submission portal. Ensure that you follow these guidelines carefully to avoid any delays.

Alternately, some lenders may have the option to submit forms by mail or other methods. If so, adhere strictly to the provided timelines and instructions for alternative submissions. Always keep a record of your submission, including any confirmation details, to track the status of your submission.

Tracking your submission

Once your HMDA form is submitted, you may wish to confirm its receipt. Most submission portals will provide a confirmation message or receipt, so pay attention to these details after submission. It’s imperative to understand response timelines set by regulatory authorities to manage your expectations regarding any follow-up requirements.

In case you do not hear back within the expected timelines, follow up with the appropriate regulatory office to ensure your submission was received and processed. This proactive approach ensures that you remain compliant and aware of any follow-up actions necessary.

Implications of HMDA data

Investing in proper compliance with the HMDA form prevents discriminatory lending and promotes fair practices across the mortgage market. HMDA data is deeply influential as it informs policymakers regarding lending patterns and helps anticipate housing needs within various communities. Understanding how this data is used is integral to grasping the larger picture of mortgage dynamics in the U.S.

Official bodies utilize HMDA reports to monitor trends over time, ensuring that lending is equitable. By analyzing HMDA trends, stakeholders—including consumers—can advocate for better access to credit in underserved communities, thus enhancing broader economic stability.

Updates and changes to HMDA regulations

HMDA regulations have undergone significant revisions to enhance transparency and effectiveness. Understanding these changes is crucial for lenders and borrowers alike, as they affect reporting requirements and compliance obligations. For example, adjustments to the data fields collected can influence how lenders assess and document applicant information.

These evolving regulations highlight the importance of staying informed about potential changes in compliance requirements. Maintaining awareness through resources, such as pdfFiller's guidance, ensures that both lenders and consumers can navigate the landscape effectively and remain compliant with any new standards.

Future outlook for HMDA compliance

The future of HMDA compliance is likely to involve increased scrutiny and tighter regulations. As data privacy becomes a paramount concern, stakeholders will need to ensure borrower information is handled with care while still meeting disclosure requirements. Ongoing education will play a vital role in keeping lenders informed about new expectations and providing consumers with the knowledge they need to uphold their rights.

By prioritizing transparency and accountability, the mortgage industry can better align itself with the community's needs. Therefore, continuous evolution in HMDA regulations will help ensure that fair lending practices remain at the forefront of the conversation in the housing market.

Frequently asked questions (FAQs) about the HMDA form

General FAQs

Understanding the HMDA form often comes with questions surrounding its purpose and requirements. Common misconceptions include the belief that only certain types of loans require reporting. In reality, any mortgage application from a covered lender is subject to HMDA reporting, which helps build a comprehensive view of loan activity across various demographics.

Another frequent question pertains to what happens if errors are found post-submission. Addressing mistakes promptly is essential, as lenders may need to revise submitted data to correct any inaccuracies, ensuring their compliance standing isn't compromised.

Specific scenarios and applications

When considering unique case examples, individuals may wonder if all applicants need to self-identify their demographic information. While borrowers are encouraged to provide this information, there are options for applicants to decline to answer without impacting their application negatively.

Another scenario involves utilizing the HMDA form for joint applications. Understanding lender policies on joint applications is crucial, as these may vary. It's advisable to check with specific lenders for their practices regarding combined applicant data on the HMDA form.

Getting support and assistance

Navigating the complexities of the HMDA form can be overwhelming, but various resources are available to provide guidance. The Consumer Financial Protection Bureau (CFPB) is an official source that offers comprehensive guidelines and explanations regarding the HMDA form requirements.

Further, utilizing digital platforms like pdfFiller can ease data entry challenges and enhance document management practices. If necessary, consulting with professionals who specialize in regulatory compliance can provide additional assurance regarding your HMDA reporting processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send home mortgage disclosure act for eSignature?

Where do I find home mortgage disclosure act?

How do I make edits in home mortgage disclosure act without leaving Chrome?

What is home mortgage disclosure act?

Who is required to file home mortgage disclosure act?

How to fill out home mortgage disclosure act?

What is the purpose of home mortgage disclosure act?

What information must be reported on home mortgage disclosure act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.