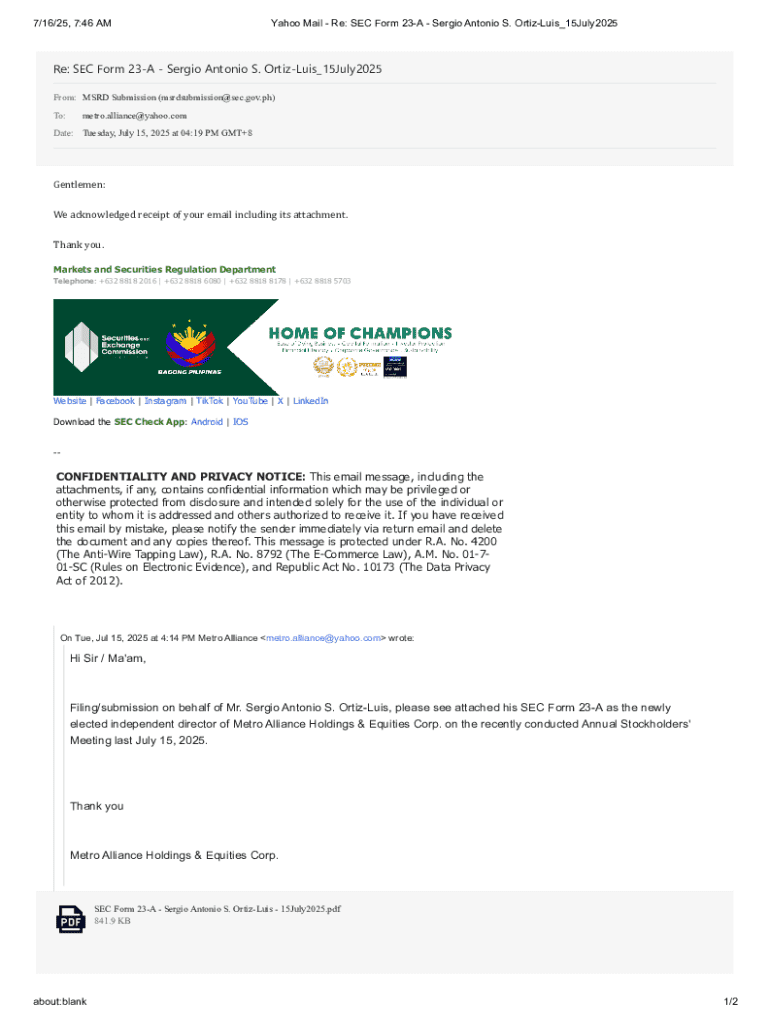

Get the free Re: SEC Form 23-A - Sergio Antonio S. Ortiz-Luis15July2025

Get, Create, Make and Sign re sec form 23-a

Editing re sec form 23-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out re sec form 23-a

How to fill out re sec form 23-a

Who needs re sec form 23-a?

Understanding and Managing RE Sec Form 23-A Form

Understanding RE Sec Form 23-A

The RE Sec Form 23-A is a pivotal document utilized in the realm of regulatory compliance, primarily within the context of real estate securities. This form serves as a notification that outlines the beneficial ownership information relevant to certain securities, ensuring transparency and adherence to regulatory standards. The purpose of the form is to inform relevant stakeholders about any shifts or changes in ownership, thus maintaining the integrity of market operations.

Who needs to file RE Sec Form 23-A?

The obligation to file the RE Sec Form 23-A is primarily placed on individuals directly connected to the securities market. This typically includes corporate officers, directors, and significant shareholders holding a notable percentage of equity. Furthermore, anytime there is a change in beneficial ownership—such as buying, selling, or transferring stocks—these individuals must file the form to report these changes accurately.

There are various scenarios where filing becomes necessary. For example, if a corporate officer acquires shares that push their ownership past certain thresholds, it is imperative to file the RE Sec Form 23-A. Similarly, when shareholders divest key interests, updates via this form are equally critical to ensure that the ownership structure remains clear and transparent.

Detailed breakdown of RE Sec Form 23-A

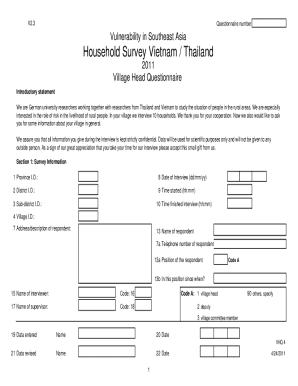

RE Sec Form 23-A comprises several sections, each serving a purpose that contributes to the overall clarity and compliance of the document. The initial section typically requests personal information about the filer, including name, address, and identification details. Following this, the form solicits information regarding the ownership structure, specifying the securities held and other pertinent details.

Conversely, common misconceptions surrounding the RE Sec Form 23-A often lead to confusion. For instance, many assume that the form is solely for new acquisitions; however, it is also essential for reporting divestitures and transfers. Furthermore, terminology used in the document, like 'beneficial ownership,' requires clear understanding to ensure proper filing.

Step-by-step guide to filling out RE Sec Form 23-A

Filling out the RE Sec Form 23-A can initially seem daunting, but breaking it down into manageable steps can simplify the process significantly. Start by gathering all necessary documentation to support your information, including previous filings, transactional records, and personal identification. Preparation is key to ensuring that you don’t overlook critical pieces of information.

Begin filling out the form by first addressing the personal information section. This should include your name, title, company (if applicable), and contact details. Next, proceed to the ownership disclosure section, where you will detail the specific securities held, their quantity, and any relevant transaction dates. Finally, don't forget the certification and signature section where you will confirm the accuracy of the information provided. To enhance accuracy and completeness, consider double-checking numerical data and ensuring that all fields are filled where necessary.

Editing and managing your RE Sec Form 23-A

After submitting your RE Sec Form 23-A, it’s important to manage your filings effectively. If any amendments are needed, it is crucial to understand how to correct these without unnecessary complications. Often, forms can be amended through a straightforward process where previous filings are referenced and corrections are highlighted.

To facilitate ease of use, pdfFiller provides various tools to edit and manage your forms. Keeping accurate records not only aids in compliance but also prepares you for any potential audits. Tools to track changes, manage versions, and get real-time updates on your forms can significantly bolster your regulatory compliance strategy.

eSigning your RE Sec Form 23-A

The electronic signature process is becoming increasingly prevalent, and when it comes to the RE Sec Form 23-A, eSignatures are not only accepted but legally valid. This significantly streamlines workflow and hastens the filing process, eliminating the need for printed documents in many scenarios.

To eSign your form using pdfFiller, simply follow a series of straightforward steps that include uploading your document, clicking on the designated 'eSign' area, and using the platform's tools to create an electronic signature. This not only facilitates faster filing but also maintains compliance with legal standards.

Submitting your RE Sec Form 23-A

Having completed and eSigned your RE Sec Form 23-A, the final step involves submission. There are various methods available, including online submission through regulatory portals, mailing physical copies, or even faxing the document if necessary. Each method carries its own implications concerning speed and tracking.

It is critical to be aware of important deadlines associated with your submission to ensure compliance. For instance, certain regulatory bodies may stipulate a time frame within which the form must be submitted following a change in ownership. Always seek confirmation of successful submission—be it through digital receipts or confirmation emails—to maintain a clean compliance record.

Common FAQs about RE Sec Form 23-A

Navigating the filing process can often raise questions. One common query is: What happens if a filing is late? In many cases, late submissions are subject to penalties, which can vary by jurisdiction. Thus, staying on schedule is essential to avoid unnecessary fines or complications.

Another frequently asked question involves checking the status of your submission. Most regulatory entities provide online platforms where you can verify the status of your filings. Additionally, it’s wise to inquire about what steps to take in case of an audit concerning your RE Sec Form 23-A, including how to prepare documentation supporting your submissions.

Using pdfFiller for RE Sec Form 23-A

pdfFiller offers a robust platform for handling the RE Sec Form 23-A efficiently. With features tailored specifically for regulatory documents, users can navigate forms with ease, ensuring compliance with all necessary requirements. The platform's intuitive design also helps users fill out forms accurately while providing help across different stages of document management.

Moreover, customer testimonials underscore the effectiveness of pdfFiller. Many users have highlighted their success in managing their filings with ease, enhancing their ability to stay compliant while minimizing any potential errors or delays. Utilizing pdfFiller can significantly streamline your experience, making the filing process simple and less overwhelming.

Best practices for filing RE Sec Form 23-A

Establishing best practices for filing the RE Sec Form 23-A can establish a proactive approach to regulatory compliance. A good practice includes regularly reviewing compliance requirements to stay updated on any changes in the filing process. This may involve subscribing to relevant newsletters or resources that provide updates on regulatory guidelines.

Additionally, leveraging collaborative tools within your team can enhance the filing process. This allows for smoother communication and division of responsibilities when multiple parties are involved in signing or filing the document. Incorporating proper document management strategies for future filings will help ensure that you remain compliant moving forward.

Conclusion: Simplifying your RE Sec Form 23-A experience

The accurate filing of the RE Sec Form 23-A is not just a compliance requirement; it is a responsibility that upholds market integrity. With technological advancements such as pdfFiller, users can now navigate the form-filing process with clarity and ease. Streamlining the process through document management tools significantly minimizes potential errors and enhances compliance, thus providing peace of mind.

Emphasizing the importance of this form and leveraging technology can lead to a much more efficient filing experience. As you move forward with your applications, consider adopting pdfFiller as your go-to platform to simplify your document management needs and ensure all your filings meet regulatory standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get re sec form 23-a?

Can I create an electronic signature for signing my re sec form 23-a in Gmail?

How do I fill out re sec form 23-a using my mobile device?

What is re sec form 23-a?

Who is required to file re sec form 23-a?

How to fill out re sec form 23-a?

What is the purpose of re sec form 23-a?

What information must be reported on re sec form 23-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.